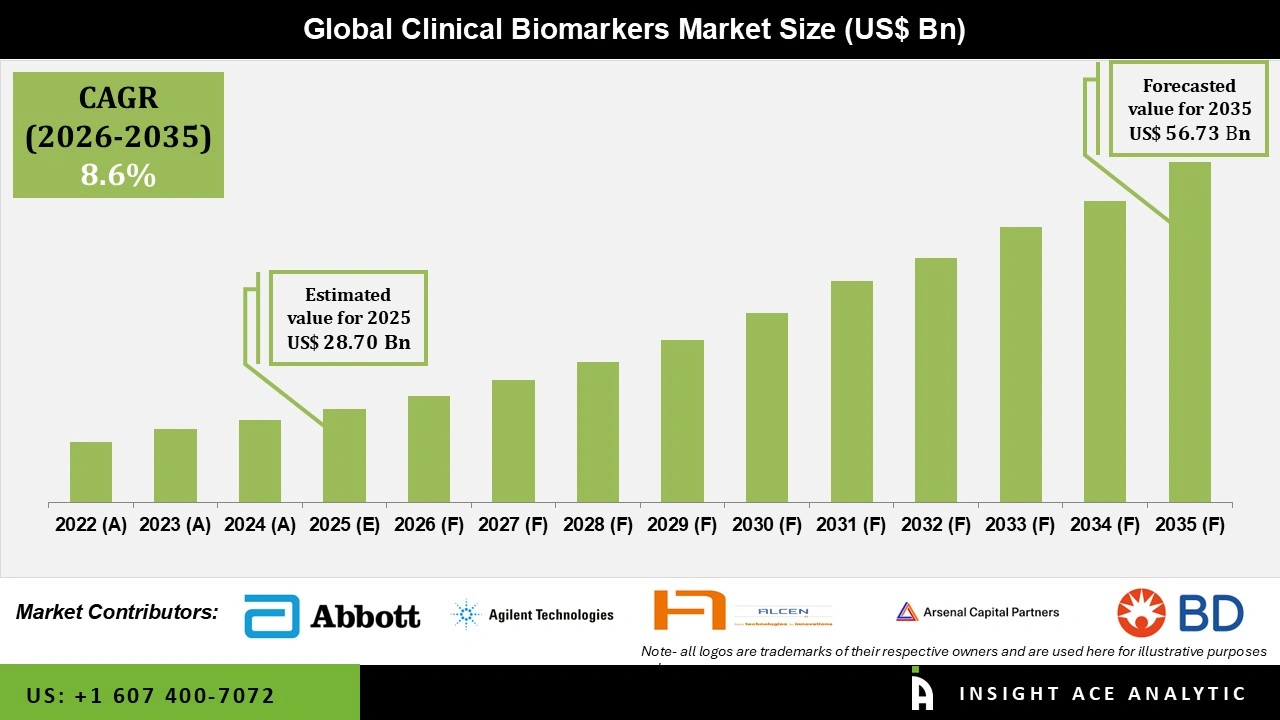

Global Clinical Biomarkers Market Size is valued at USD 28.70 Bn in 2025 and is predicted to reach USD 64.73 Bn by the year 2035 at a 8.6% CAGR during the forecast period for 2026 to 2035.

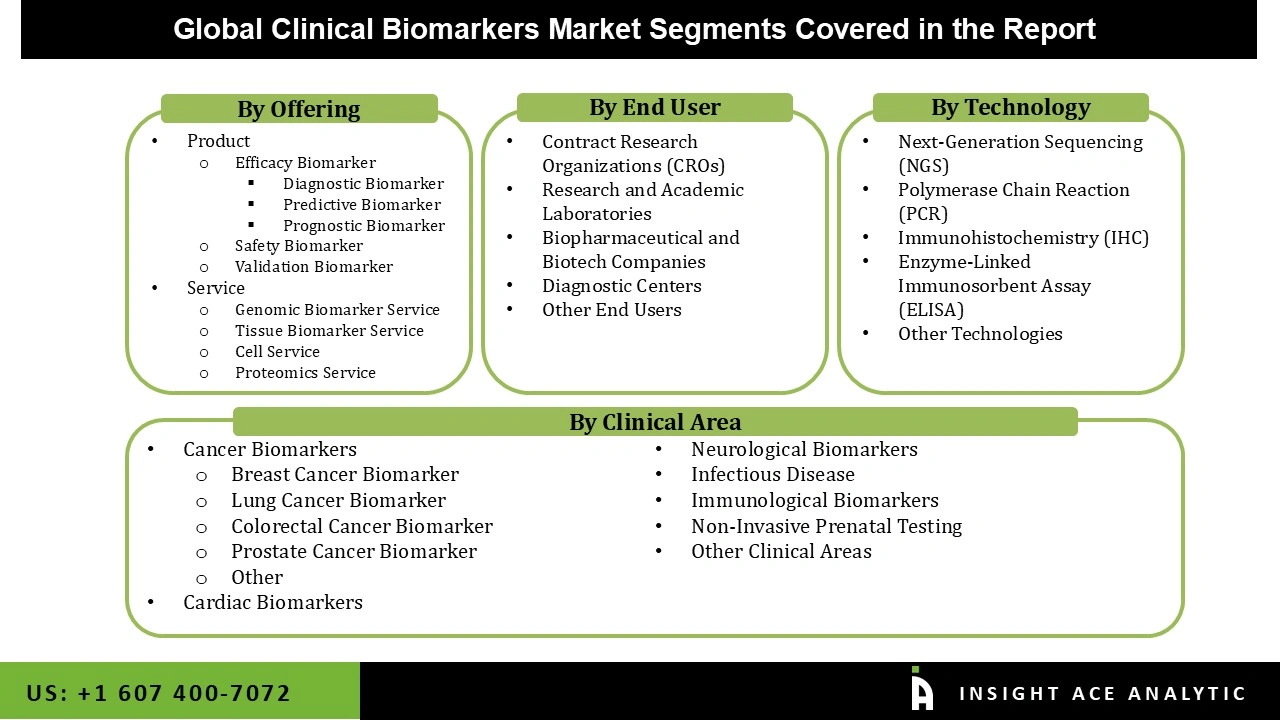

Clinical Biomarkers Market Size, Share & Trends Analysis Report By Offering (Product (Efficacy Biomarker (Diagnostic Biomarker, Predictive Biomarker, Prognostic Biomarker), Safety Biomarker, Validation Biomarker), Service (Genomic Biomarker Service, Tissue Biomarker Service, Cell Service, Proteomics Service), By Clinical Area, By Technology, By End User, By Region, And By Segment Forecasts, 2026 to 2035

Clinical biomarkers are molecular biomarkers that offer novel avenues for studying diseases and identifying potential new therapeutic targets. Clinical biomarkers are finding more and more applications in drug development, disease risk assessment, and other areas, and healthcare companies are investing heavily to keep up with industry demand, fueling market growth. Many different assays and methods are utilized in drug discovery to help develop biomarkers for various diseases. Furthermore, infectious diseases can aid in disease prognostic evaluations, treatment decision-making, and pharmaceutical efficacy tracking.

However, the market growth is hampered by the high-cost criteria for the safety and health of the clinical biomarkers market and the product's inability to prevent fog in environments with dramatic temperature fluctuations or high clinical biomarkers market because the lack of investment and infrastructure is the main thing stopping market companies from investing, one of the main reasons for the high capital demand is the expensive instruments. Thus, the desired level of capital investment differs according to the capabilities and size of the newly constructed laboratory. Despite the enormous untapped potential in the global clinical biomarkers market, the prohibitive entry cost limits the industry's ability to reach new audiences and accelerate its progress.

The clinical biomarkers market is segmented based on offering, clinical area, technology, and end user. According to offerings, the market is segmented into products and services. Product segment comprises Efficacy Biomarker (Diagnostic Biomarker, Predictive Biomarker, Prognostic Biomarker), Safety Biomarker, and Validation Biomarker. The Service segment includes Genomic Biomarker Service, Tissue Biomarker Service, Cell Service, Proteomics Service. By clinical area, the market is segmented into cancer biomarkers, cardiac biomarkers, neurological biomarkers, infectious disease, immunological biomarkers, non-invasive prenatal testing, and other clinical areas. By technology, the market is segmented into next-generation sequencing (NGS), polymerase chain reaction (PCR), immunohistochemistry (IHC), enzyme-linked immunosorbent assay (ELISA), and other technologies. By end user, the market is segmented into contract research organizations (CROs), research and academic laboratories, biopharmaceutical and biotech companies, diagnostic centers, and other end users.

The service clinical biomarkers market is expected to lead with a major global market share. biomarker services help with trial design, execution, and analysis. Diseases can be diagnosed using biomarker testing, which clinical laboratories and diagnostic service providers offer. These services aid in the monitoring and early identification of diseases by facilitating the accurate and dependable detection of biomarkers.

The Next-generation sequencing (NGS) industry makes up the bulk of acrylic acid ester usage because of the advancements in sequencing technology. Nucleotide sequencing (NGS) is a novel and complementary method that enables oncologists to study many cancer genes simultaneously. A patient's tumor tissue that has been surgically removed or biopsied can be utilized for next-generation sequencing, especially in countries like the US, Germany, the UK, China, and India.

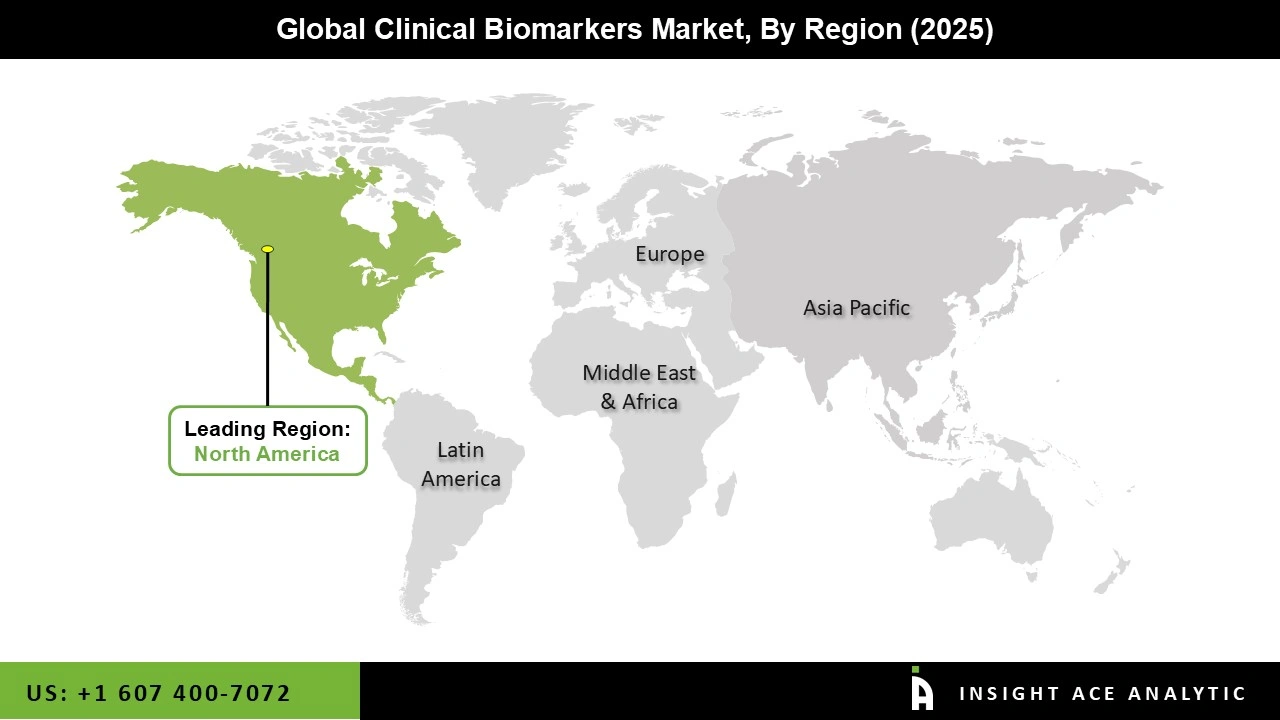

The North American clinical biomarkers market is expected to record the maximum market revenue share in the near future. It can be attributed to the increasing disease burden, new technologies, more informed consumers, encouraging government programs, and better healthcare facilities.

In addition, Asia Pacific is projected to grow rapidly in the global clinical biomarkers market due to the increasing need for top-notch healthcare, the growth of regional research initiatives, and the worldwide burden of cancer.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 28.70 Bn |

| Revenue Forecast In 2035 | USD 64.73 Bn |

| Growth Rate CAGR | CAGR of 8.6% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Offering, Clinical Area, Technology, End User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; Southeast Asia; South Korea |

| Competitive Landscape | F. Hoffmann-La Roche AG, Epigenomics AG, Abbott, Thermo Fisher Scientific Inc, General Electric, Eurofins Scientific, Johnson & Johnson Services, Inc., QIAGEN, Bio-Rad Laboratories, Inc., Siemens Healthineers AG, Merck KGaA, PerkinElmer Inc., Agilent Technologies, Inc., DiaMetra, Others |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.