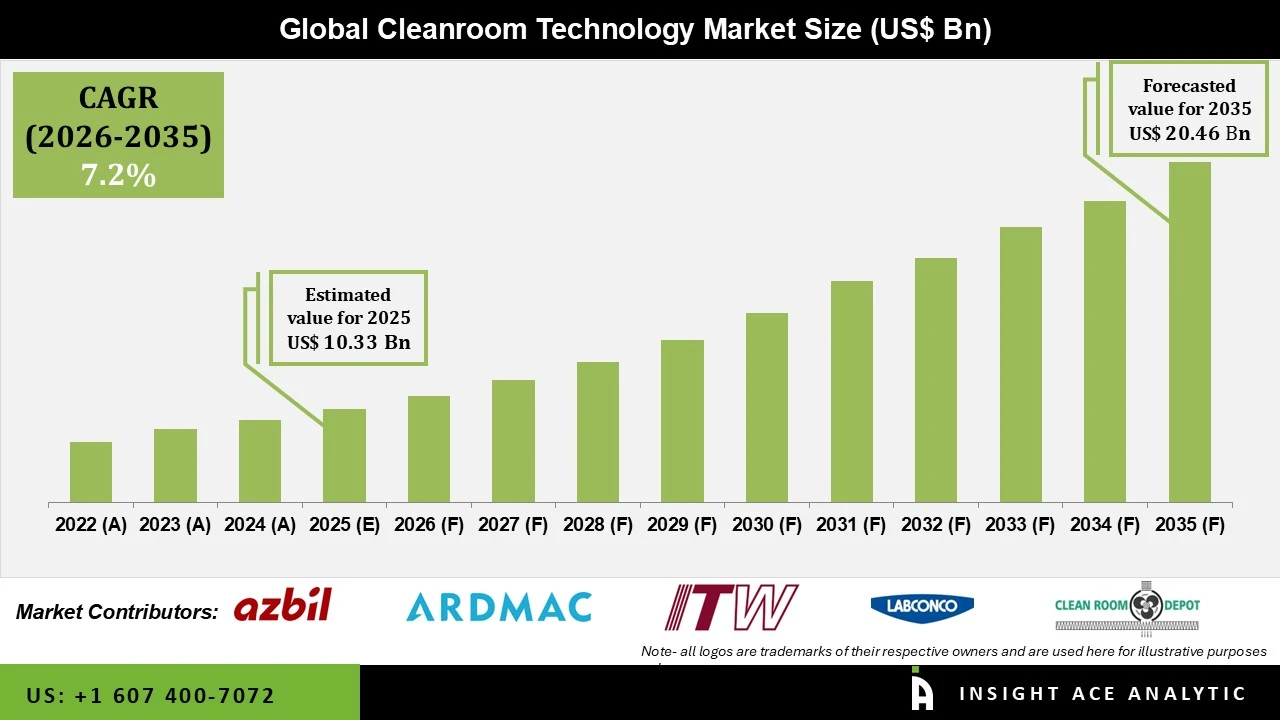

Cleanroom Technology Market Size is valued at USD 10.33 Bn in 2025 and is predicted to reach USD 20.46 Bn by the year 2035 at an 7.2% CAGR during the forecast period for 2026 to 2035.

Cleanroom Technology Market Size, Share & Trends Analysis Distribution by Offering (System, Consumables), Type (Lab, Air Pressure Cleanroom, Modular Cleanroom, Portable Cleanroom), Industry (Medical Devices, Pharmaceuticals, Semiconductor and Electronics) and Segment Forecasts, 2026 to 2035

The cleanroom technology market is growing rapidly due to the rising demand for contamination control across pharmaceutical, biotechnological, electronic, and aerospace industries. A cleanroom is the most controlled environment with the purpose of minimizing the number of airborne particles, microorganisms, and contaminants that could compromise the quality and safety of the final product. Cleanrooms are categorized into cleanliness levels; these vary in strength according to more sensitive applications. For example, in the semiconductor industry, cleanrooms play a vital role in maintaining the integrity of microchips, while in the pharmaceutical industry, they help in producing sterile drugs and vaccines.

This is so because the production processes are becoming very complex, particularly in nanotechnology and electronics miniaturization. All these are environments in which preparation of sterile products is highly important in pharmaceuticals and for biotechnology researches as well as production of semiconductors. With the inception of more precise technologies within industries, companies will make appropriate investments in new innovative clean room designs that opt for improved systems of contamination control and optimizing production efficiency.

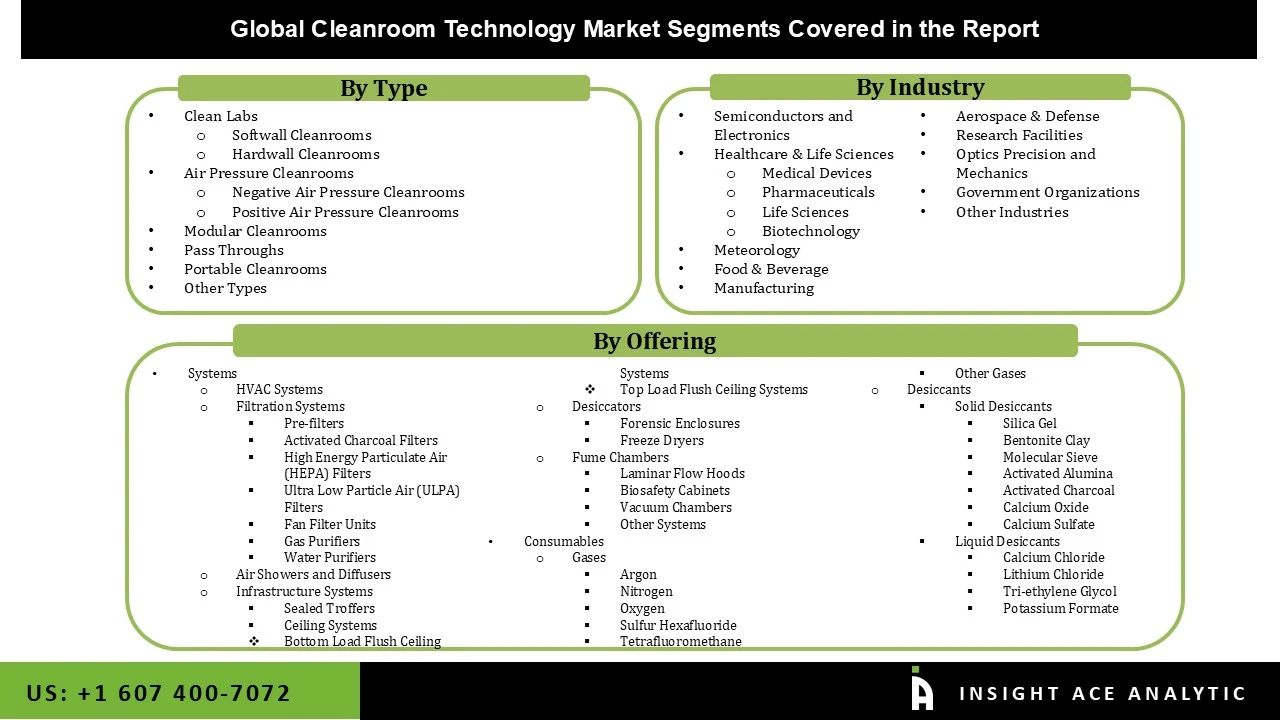

The Cleanroom Technology market is segmented by offering, type, industry. By offering the market is segmented into systems and consumables. Systems are sub segmented into HVAC systems, filtration systems, air showers and diffusers, infrastructure systems, desiccators, fume chambers. Filtration systems is sub segmented into pre-filters, activated charcoal filters, high energy particulate air (HEPA) filters, ultra-low particle air (ULPA) filters, Fan Filter Units, gas purifiers, water purifiers. Infrastructure Systems is sub segmented into sealed troffers, ceiling systems (bottom load flush ceiling systems, top load flush ceiling systems). Desiccators is sub segmented into forensic enclosures, freeze dryers. fume chambers is sub segmented into laminar flow hoods, biosafety cabinets, vacuum chambers, and other systems.

Consumables is sub segmented into gases, desiccants. gases is sub segmented into argon, nitrogen, oxygen, sulfur hexafluoride, tetrafluoromethane, and other gases. Desiccants is sub segmented into solid desiccants (silica gel, bentonite clay, molecular sieve, activated alumina, activated charcoal, calcium oxide, calcium sulfate), liquid desiccants (calcium chloride, lithium chloride, tri-ethylene glycol, potassium formate). Type is segmented into clean labs (softwall cleanrooms, hardwall cleanrooms), air pressure cleanrooms (negative air pressure cleanrooms, positive air pressure cleanrooms), modular cleanrooms, pass throughs, portable cleanrooms, and other types. Industry segmented into semiconductors and electronics, healthcare & life sciences (medical devices, pharmaceuticals, life sciences, biotechnology), meteorology, food & beverage, manufacturing, aerospace & defense, research facilities, optics precision and mechanics, government organizations, other industries

Consumables is one of the significant growth drivers for the cleanroom technology market. This includes examples of glove, wipes, and disinfectants that strongly require contamination control purposes. Large industry-wide market growth is particularly notable in pharma and healthcare industries due to high demand from disposable items. Further growth opportunities for the market can be found in eco-friendly, comfortable, and protective consumables, which fall in line with sustainability trends.

The modular cleanroom segment is booming with the flexibility, rapid installation, and cost-effectiveness of the units. The construction of cleanrooms can easily be assembled and reconfigured as the production necessities change within these industries. Therefore, their quicker setup than traditional cleanrooms limit downtime and accelerates time-to-market, especially in competitive markets like pharmaceuticals and electronic. Modular cleanrooms are also economical, as they require less labor and cause less disruption in operations, thereby making businesses attract to them.

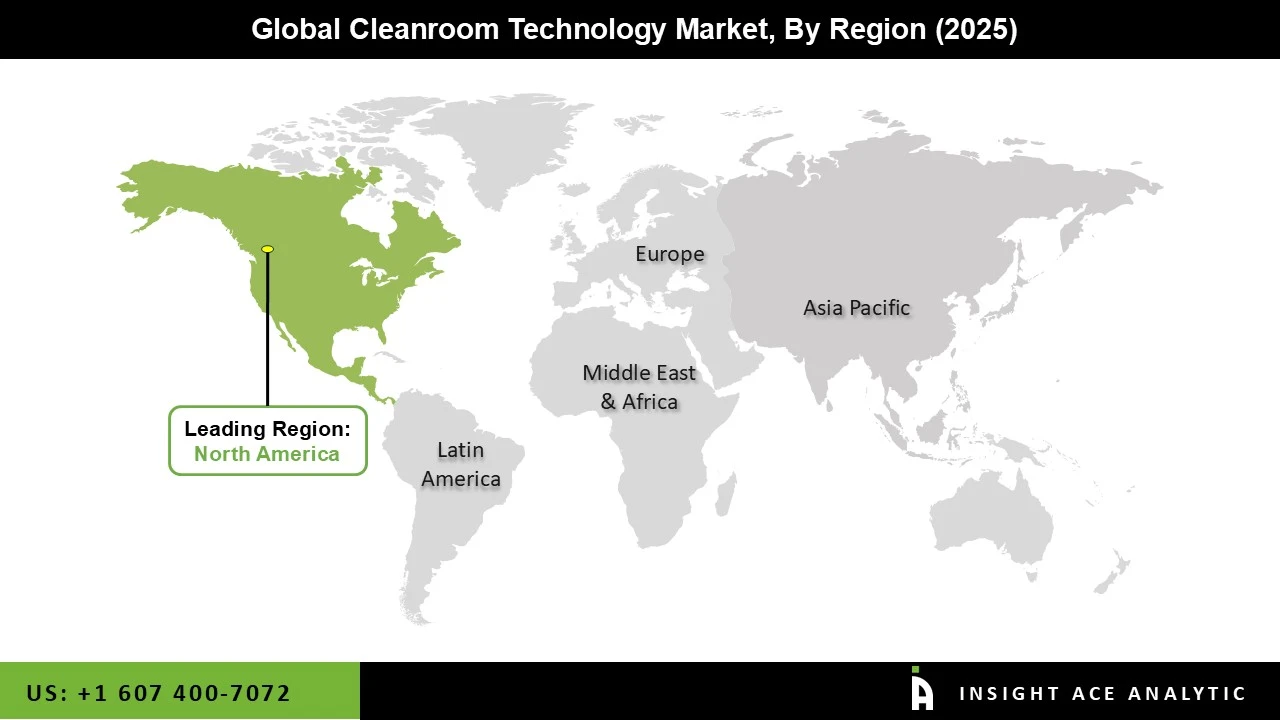

North America dominates the cleanroom technology market. Stringent regulatory requirements driven by bodies such as the FDA and WHO compel companies to invest heavily in more advanced cleanroom solutions for compliance, primarily in pharmaceutical and biotechnology products. Robust sectors of pharmaceuticals and biotech in the region along with an increase in biopharmaceutical and chronic disease research have prompted significant investments in cleanroom facilities by major players, Merck and Pfizer. There is, therefore, leadership of North America in the technological advancements, including automation and energy-saving systems, which increases cleanroom efficiency and attracts further investments.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 10.33 Bn |

| Revenue Forecast In 2035 | USD 20.46 Bn |

| Growth Rate CAGR | CAGR of 7.2% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Offering, Type, Industry and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Azbil Corporation (Japan), Ardmac Ltd. (U.S.), Clean Room Depot, Inc. (U.S.), Labconco Corporation (U.S.), Clean Air Products (U.S.), AES Clean Technology, Inc. (U.S.), Illinois Tool Works Inc. (U.S.), Terra Universal. Inc. (U.S.), Clean Rooms International, Inc. (U.S.), Connect 2 Cleanrooms Ltd. (U.K.), ABTech Inc. (U.S.), Modular Cleanrooms, Inc. (U.S.), BASX Solutions (U.S.), and Exyte Technology GmbH (Germany). |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Cleanroom Technology Market by Offering -

Cleanroom Technology Market by Type -

Cleanroom Technology Market by Industry -

Cleanroom Technology Market by Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.