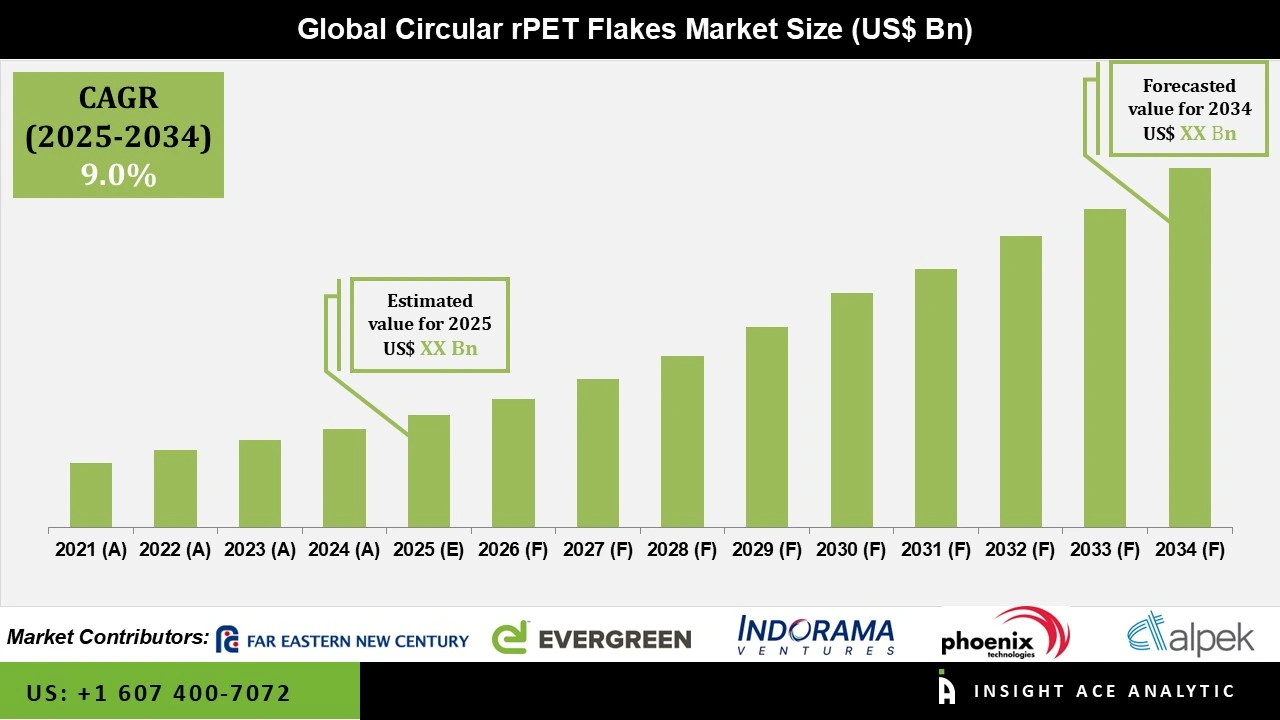

Global Circular rPET Flakes Market is expected to reach grow, with a CAGR of 9.0% during the forecast period of 2025-2034.

Circular rPET (recycled polyethylene terephthalate) flakes are the cornerstone of the modern closed-loop PET recycling ecosystem. Produced by collecting, sorting, washing, and flaking post-consumer bottles, these flakes are decontaminated to food-grade purity and reprocessed into resin, pellets, or sheet that can be used indefinitely without loss of performance. Unlike traditional down-cycled PET that ends up in textiles or carpets, circular rPET enables true bottle-to-bottle, tray-to-tray, and packaging-to-packaging recycling. It meets the world’s strictest food-contact regulations (FDA, EFSA, etc.) and supports brand compliance with escalating recycled-content mandates. As the primary raw material for sustainable packaging, circular rPET flakes are driving one of the most successful and scalable examples of a circular economy in the global plastics industry.

The global circular rPET flakes market is experiencing robust growth driven by binding legislation and corporate sustainability commitments. Breakthrough super-clean mechanical recycling technologies and solid-state polycondensation (SSP) have resolved previous contamination concerns, consistently achieving food-grade purity levels required by regulators. These advancements, combined with investments in sorting and decontamination infrastructure, have unlocked premium applications and accelerated market expansion.

Despite strong tailwinds, the sector faces hurdles in quality consistency, color stability, and supply-chain traceability, particularly for flakes sourced from diverse post-consumer streams. Residual contaminants and variable intrinsic viscosity can limit use in high-end applications. However, ongoing innovations—next-generation optical sorters, AI-enhanced quality control, tracer-based authentication, and scaled chemical recycling—are rapidly addressing these constraints. As collection rates improve and closed-loop systems mature, the circular rPET flakes market is poised for sustained double-digit growth, playing a pivotal role in reducing virgin plastic production and meeting global net-zero packaging goals.

Some of the Key Players in Circular rPET Flakes Market:

The circular rpet flakes market is segmented by product type, by application, by end-use. By product type, the market is segmented into food-grade rpet flakes and non-food-grade rpet flakes. By application, the market is segmented into bottles, containers, textiles, and packaging. By end-use, the market is segmented into cloud-based, food & beverage, automotive, textile, and consumer goods.

The Food-Grade rPET Flakes category led the Circular rPET Flakes market in 2024. This convergence is fueled by technological advancements in decontamination procedures, strict regulatory requirements for beverage packaging, and significant brand promises to use recycled content in food-contact applications are some of the drivers driving this segment's growth. The FDA claims that certified super-clean recycling methods can attain decontamination levels appropriate for direct food contact, allowing for broad use in food containers and beverage bottles.

The largest and fastest-growing Application is individuals, a trend driven by the regulations requiring recycled content in beverage packaging, customer preferences for sustainable products, and established PET bottle collecting infrastructure are some of the factors driving this segment's growth. Established infrastructure for collecting and processing that is tailored for recycling beverage containers is advantageous to bottle applications. The efficient closed-loop systems produced by the bottle-to-bottle recycling paradigm reduce material loss and uphold quality standards.

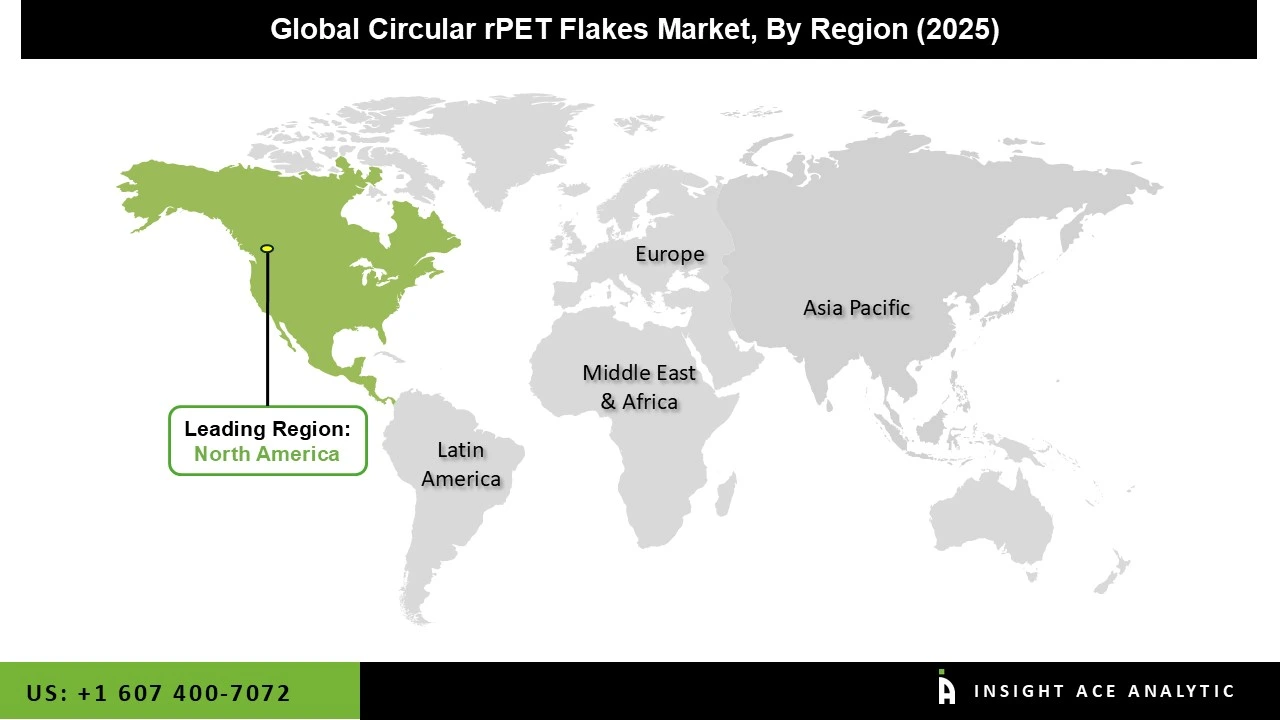

Europe dominated the circular rPET flakes market in 2024 and continues to lead in 2025. The region benefits from the world’s most mature and stringent regulatory framework, including the EU Single-Use Plastics Directive and highly efficient deposit-return systems in countries such as Germany, the Netherlands, Norway, Sweden, and Finland that achieve PET bottle collection rates of 90–98 %. Europe hosts the largest concentration of EFSA-approved, food-grade “super-clean” mechanical recycling plants and is home to pioneering chemical recycling projects (Carbios, CuRe, Eastman, etc.

North America is the fastest-growing region for circular rPET flakes, driven primarily by the United States. Aggressive state-level legislation, most notably California’s SB-54, and expanding extended producer responsibility (EPR) laws in multiple states—combined with ambitious corporate pledges from Coca-Cola, PepsiCo, Danone North America, and Keurig Dr Pepper to reach 50–100 % recycled content- is creating explosive demand.

Circular rPET Flakes Market by Product Type-

· Food-Grade rPET Flakes

· Non-Food-Grade rPET Flakes

Circular rPET Flakes Market by Application-

· Bottles

· Containers

· Textiles

· Packaging

Circular rPET Flakes Market by End-Use-

· Food & Beverage

· Automotive

· Textile

· Consumer Goods

Circular rPET Flakes Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.