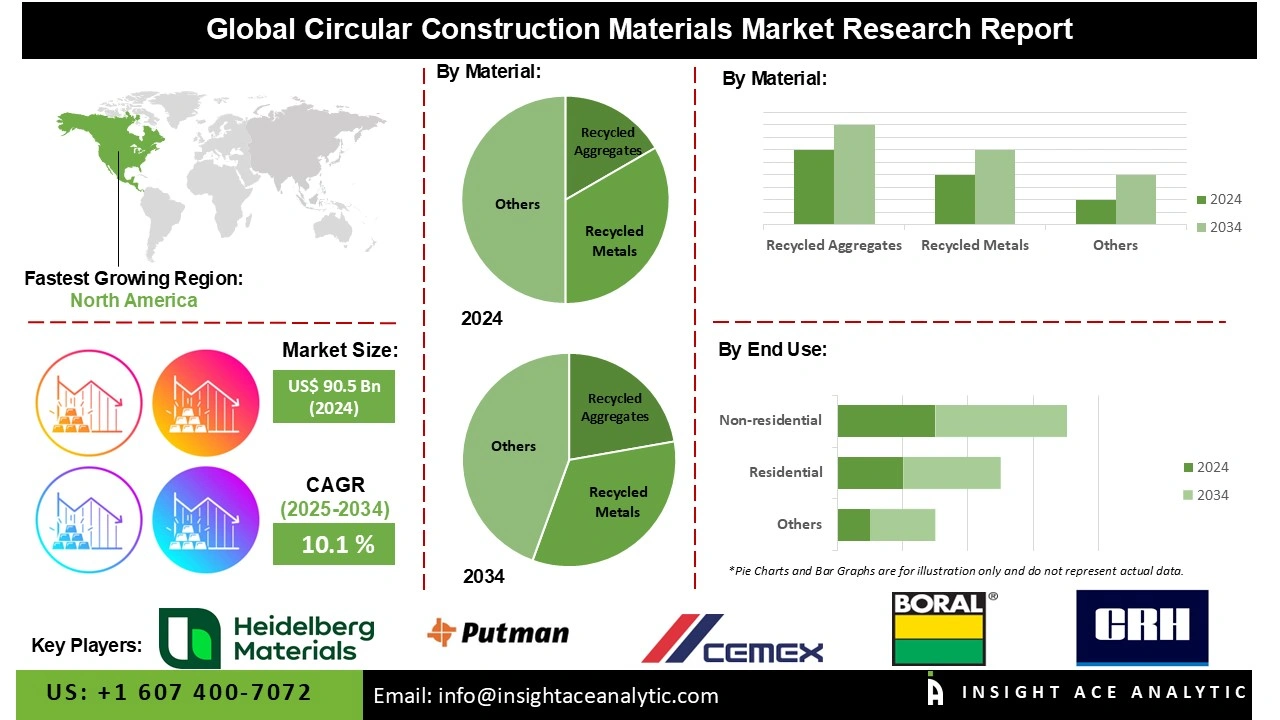

Global Circular Construction Materials Market is valued at US$ 90.50 Bn in 2024 and it is expected to reach US$ 234.69 Bn by 2034, with a CAGR of 10.1% during the forecast period of 2025-2034.

Circular construction materials represent a transformative approach to building design and resource management, fundamentally reimagining how materials flow through the construction lifecycle. Unlike conventional linear models, where materials are discarded after use, circular materials are engineered for continuous reuse, recycling, and regeneration. This paradigm shift positions buildings as "material banks" that store valuable resources for future projects, creating a closed-loop system that minimizes waste, reduces environmental impact, and enhances long-term resource security.

These materials encompass a diverse range of products and strategies, including high-value reclaimed timber and structural steel, concrete incorporating recycled aggregates, modular building components designed for disassembly, and innovative bio-based composites. The core objective is to maximize material longevity and utility while drastically reducing the extraction of virgin resources. This approach not only addresses the construction industry's significant waste generation and carbon emissions but also creates new economic opportunities through material marketplaces and advanced recycling technologies.

The adoption of circular construction materials is accelerating globally, supported by evolving regulatory frameworks, green building certification systems, and growing stakeholder demand for sustainable development practices. This movement represents a fundamental restructuring of construction value chains, establishing a new standard for responsible resource management in the built environment while maintaining structural integrity and aesthetic possibilities. As the industry continues to innovate in material science and digital tracking systems, circular construction materials are increasingly becoming the benchmark for forward-thinking, resilient, and environmentally conscious construction practices worldwide.

Some of the Key Players in the Circular Construction Materials Market:

The circular construction materials market is segmented by material and end-use. By material, the market is segmented into reclaimed wood, recycled plastics, recycled aggregates, recycled metals, and others. By end-use, the market is segmented into residential and non-residential.

In 2024, the recycled aggregates category held the largest share in the circular construction materials market. Their cost-effectiveness and compatibility with current construction methods are the reasons for their extensive use. When building roads and infrastructure, when a lot of material is needed, the use of recycled aggregates is especially noticeable. Additionally, this supremacy has been reinforced by their mechanical strength, comparable performance to virgin aggregates, and suitability for cement-based applications. Moreover, the adoption of circular economy ideas and green building certifications has also increased in both public and private infrastructure projects due to government initiatives.

In 2024, the residential segment had the highest market share in the circular construction materials market, driven by rising demand for eco-friendly urban infrastructure and affordable, sustainable housing options. Homebuilders are increasingly incorporating reclaimed wood, low-carbon concrete, and recycled aggregates to meet consumer demand for green living spaces and sustainability goals. Moreover, governments have promoted the use of circular materials by providing tax breaks and subsidies for the construction of sustainable homes. The dominance of the residential sector has also been reinforced by the use of recycled materials in the rehabilitation and retrofit of older housing units.

In 2024, North America sustained its leadership position in the global circular construction materials market, driven by robust regulatory frameworks, well-established recycling infrastructure, and widespread adoption of green building certifications. These regions are supported by robust corporate sustainability initiatives, substantial private investment in material innovation, and standardized systems for material reuse and monitoring that have been established over the past decade.

Meanwhile, the Asia-Pacific region possesses the highest development potential in circular construction materials. This expansion is mostly propelled by remarkable urban development, significant government-led sustainable infrastructure projects, and a rising influx of foreign investment in green building technologies. Major economies such as China, Singapore, and Australia are adopting comprehensive national circular economy strategies and advancing large-scale eco-city initiatives that systematically integrate recycled and bio-based materials, thereby generating significant market opportunities for both domestic and international suppliers.

Circular Construction Materials Market by Material-

· Reclaimed Wood

· Recycled Plastics

· Recycled Aggregates

· Recycled Metals

· Others

Circular Construction Materials Market by End-use-

· Residential

· Non-residential

Circular Construction Materials Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.