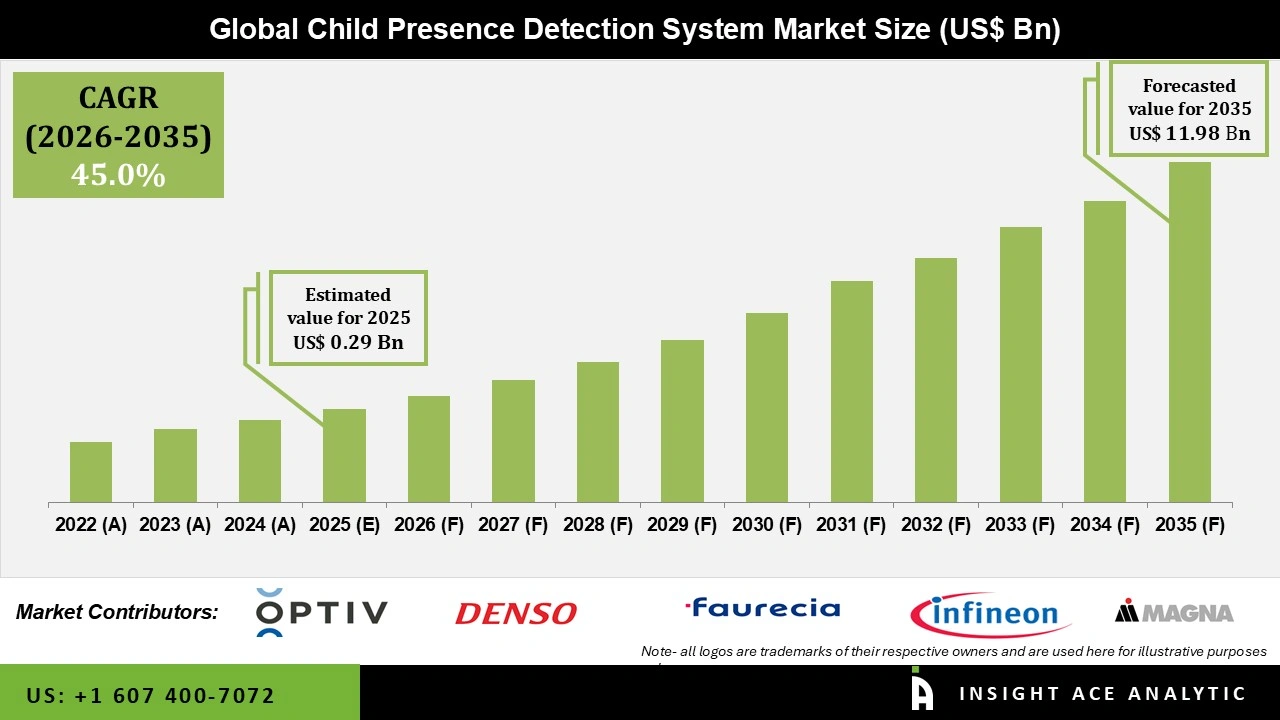

Global Child Presence Detection System Market Size was valued at USD 0.29 Bn in 2025 and is predicted to reach USD 11.98 Bn by 2035 at a 45.0% CAGR during the forecast period for 2026 to 2035.

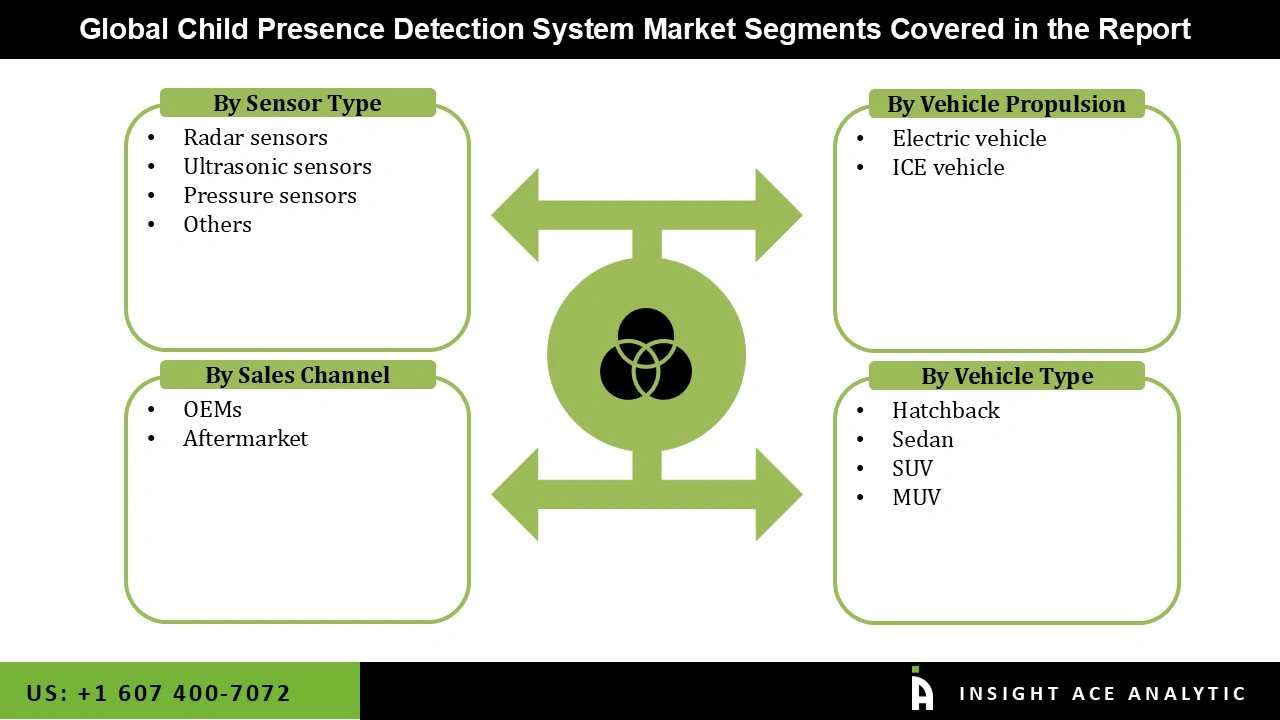

Child Presence Detection System Market Size, Share & Trends Analysis Report By Sensors (Ultrasonic Sensors, Radar Sensors, Pressure Sensors), Vehicle Propulsion (Electric Vehicle, ICE Vehicle), Sales Channel (OEMs, Aftermarket), And Vehicle Type (Hatchback, Sedan, SUV And MUV), By Region, And Segment Forecasts, 2026 to 2035

Automobile radar sensors offer an effective solution that is easy to use and priced. Various uses for sensing are intended to keep patients safe. Still, youngster detection has recently drawn much interest from automakers and consumers due to the potentially fatal consequences of leaving children alone in vehicles. So, Child Presence Detection System industry has a chance to increase as radar equipment and in-cabin detection advance. A youngster may be unsupervised in a car and danger of heatstroke.

Additionally, the kid presence detection system resolves this issue. If a child is left unsupervised in the automobile, the alarm and communication systems will cause alert notifications to be sent out, alerting the caregiver or bystanders. This is frequently an incredibly accurate and trustworthy radar technology designed to find even a newborn baby's sleeping vital signs.

Furthermore, the primary issue driving the market for child presence detection systems is the rising frequency of child fatalities from being trapped in hot cars. In addition, it is anticipated that rising sales of luxury SUVs and daily birth rates will fuel of child presence detection system market development.

The child presence detection system market based on sensors, vehicle propulsion, sales channel, and vehicle type. Based on sensors, the market is segmented as Ultrasonic Sensors, Radar Sensors, Pressure Sensors. By vehicle propulsion type, the market is segmented into electric vehicle and ICE vehicle. Based on sales channel type, market is segmented as OEMs and aftermarket. Based on vehicle type, market is segmented as hatchback, sedan, SUV and MUV.

The OEM category will hold a major share of the global Child Presence Detection System market in 2021. Child surveillance and cabin sensors feature production, acquisition, and installation are some of the tasks carried out in the OEM market. Several automakers are working to provide safety and comfort to comply with current and emerging child presence detector technologies globally. OEM is the original equipment manufacturer, giving the automaker greater credibility and authenticity. General Motors is one of the major OEMs that offer child presence detection systems on its passenger automobiles.

The radar sensors segment is projected to grow rapidly in the global child presence detection system market. Radar sensors are a useful piece of equipment for spotting kids. The commercial needs are met by radar while reducing privacy concerns compared to other smart sensors like webcams. Radar is poised to replace other sensors as the standard for left-out child monitoring and cabin tracking because of its many advantages.

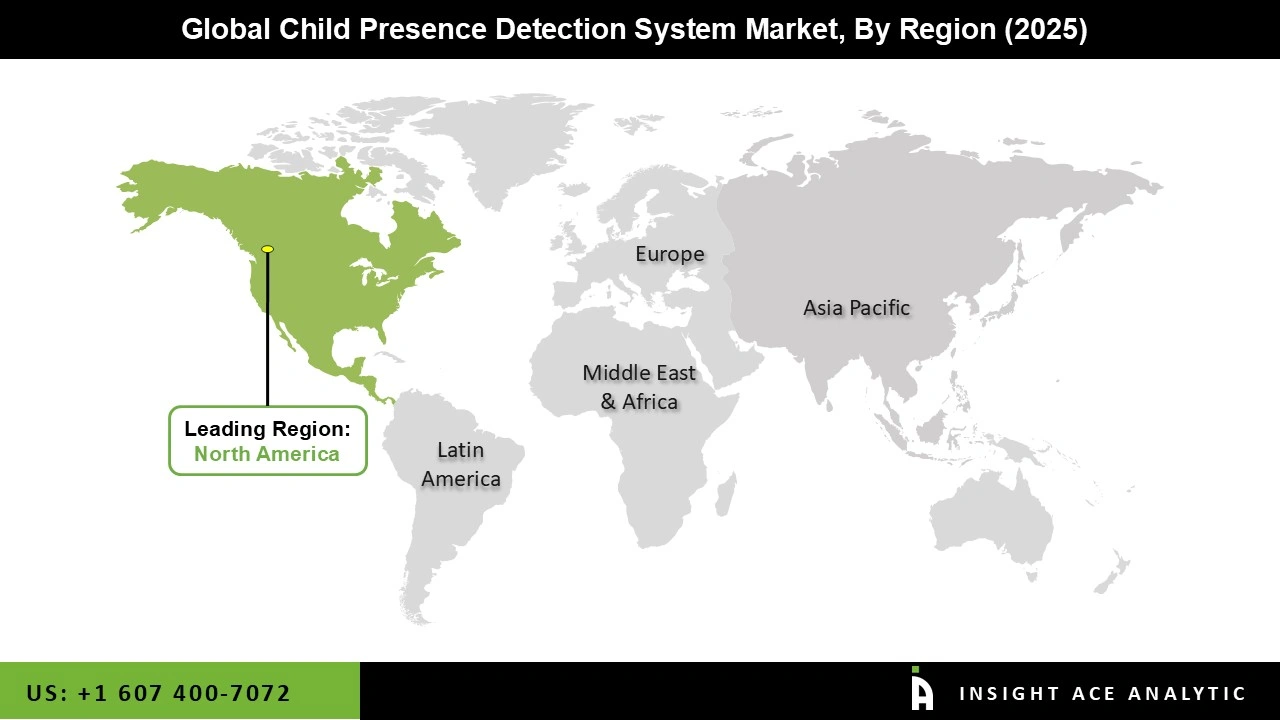

The North America child presence detection system market position is expected to register the highest market share in revenue soon. The market growth for design safety enhancements in the automotive industry, which has considerably fueled the expansion of the kid location detection system market, is the main driver of the region's market.

The dangers of heatstroke in cars are also becoming more well-known, which will spur market expansion during the projection period. Some significant firms in North America are investing in new technology to enhance their operations. The region anticipates significant growth potential throughout the projected period since it has quickly adopted new technologies in the automotive sector. In addition, Europe is projected to grow rapidly in the global child presence detection system market. This is because commercial companies are increasingly implementing sophisticated sensors, recognition, radar, and photography technology.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 0.29 Bn |

| Revenue Forecast In 2035 | USD 11.98 Bn |

| Growth rate CAGR | CAGR of 45.0% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Billion, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026 to 2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Sensors, Vehicle Propulsion, Sales Channel, And Vehicle Type |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Aptiv PLC, Continental AG, Denso Corporation, Faurecia, Infineon Technologies AG, Magna International AG, Robert Bosch GmbH, ZF Friedrichshafen AG, Valero and Visteon Corporation. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.