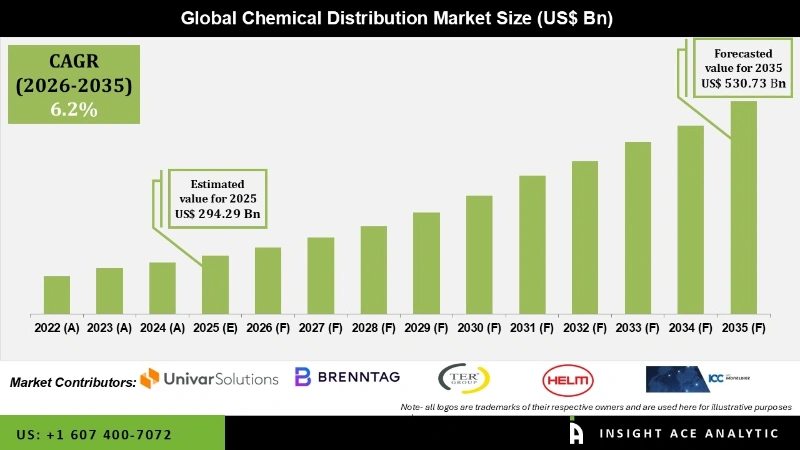

Chemical Distribution Market Size is valued at 294.29 billion in 2025 and is predicted to reach 530.73 billion by the year 2035 at a 6.2% CAGR during the forecast period for 2026 to 2035.

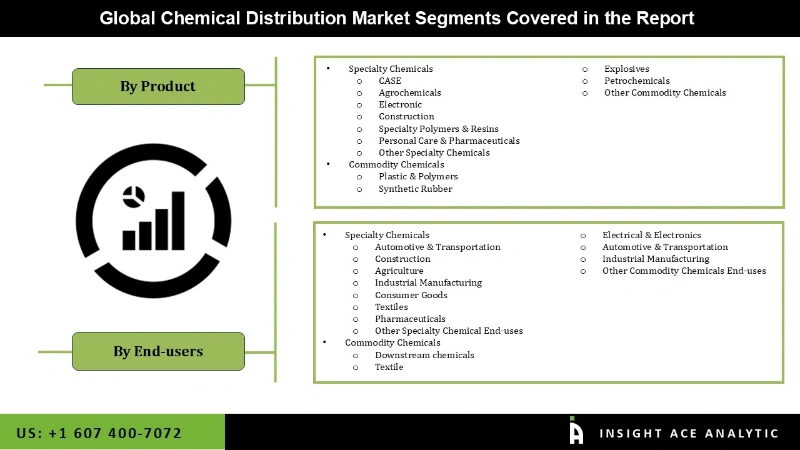

Chemical Distribution Market Size, Share & Trends Analysis Report By Product (Commodity Chemicals, Specialty Chemicals) And End-User (Agriculture, Industrial Manufacturing, Consumer Goods, Textiles, Pharmaceuticals, Downstream Chemicals, Electrical & Electronics), By Region, And Segment Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the report:

Chemical distribution solutions provide a crucial link for suppliers to connect with smaller clients in less developed areas. The chemical distributors' assistance aids the growth of the global chemical industry in assisting chemical producers in entering new markets. The market is expanding due to rising consumer demand for services (mixing, blending, and packaging) and a viable supply chain model.

With the expanding sector, increased demand from several end-use industries is also boosting market expansion. Economic turmoil and instability are allowing chemical suppliers to explore international markets and innovation in paints and coatings, which is anticipated to drive market growth throughout the projection period. Growing globalization is anticipated to drive small and large manufacturing enterprises to enter strategic partnerships with international players to achieve structurally effective cost, market share, and competitive service advantage.

The distributor of chemicals is seen as a crucial component of the operator's go-to-market plan. Chemical distributors help producers offer their goods to emerging markets at a reasonable price while reducing the distribution cost. The global chemical distribution market is expanding due to the rising usage of a greater array of chemicals in numerous different sectors.

The chemical distribution market is segmented based on product and end users. Based on product, the chemical distribution market is segmented into specialty and commodity chemicals. End users segment the market into automotive & transport, agriculture, construction, consumer goods, industrial manufacturing, textiles, pharmaceuticals, Downstream chemicals, Electrical & Electronics.

The Industrial Manufacturing category is expected to hold a major share of the global chemical distribution market in 2021. Its large utilization in manufacturing operations for creating goods, including adhesives, adhesives, residential & occupational cleaners, and high-performance thermoplastics, is responsible for its substantial market share. Factories, petrochemical industries, and heavy industrial operators use a variety of chemicals for water treatment, process treatment, and final fuel additive solutions to help them meet performance and cost goals.

These substances, which include some commodity substances, are frequently referred to as downstream substances. Today's cars also need chemistry for the paint, bumpers, and headlights, as well as for the interior seats, dashboard components, and safety measures like belts and airbags. Even some hybrid and electric vehicles' lithium polymer barriers incorporate plastic. Rising demand for these kinds of end-use industries is predicted to cause the distribution.

The specialty chemicals segment is projected to grow rapidly in the global chemical distribution market. The absence of makers of specialty chemicals mostly causes this. Specialty chemicals are utilized in various industries for specific uses and are heavily regulated by the government. Over the projection period, the growing use of specialty chemicals in the polymerization and pharmaceutical sectors is anticipated to propel the segment's expansion.

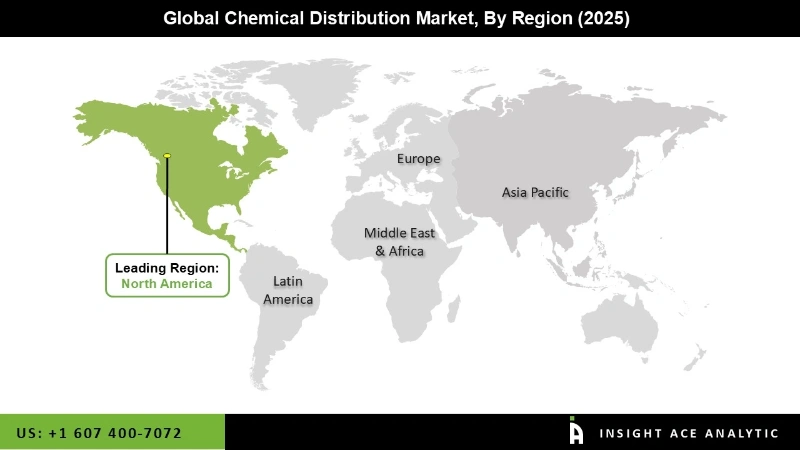

The North American chemical distribution market is expected to witness the highest market share in revenue shortly. The region's rapidly expanding construction, pharmaceutical, and automotive sectors are anticipated to fuel the expansion of North America's chemical distribution industry. In addition, the rising costs incurred by chemical businesses for expanding production facilities in North America portend a healthy development of the chemical distribution sector in the coming years.

In addition, the Asia Pacific region is anticipated to expand during the upcoming years. Because there are so many small and medium-sized chemical producers in the region, it will grow quickly during the projected period. Rising consumer spending power, increased digitalization, a growing economy, and growing end-user sectors are the main forces behind the expansion in the Asia Pacific.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 294.29 Bn |

| Revenue forecast in 2035 | USD 530.73 Bn |

| Growth rate CAGR | CAGR of 6.2% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Billion, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Product And End Users |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; Japan; Brazil; Mexico; The UK; France; Italy; Spain; Japan; India; South Korea; Southeast Asia |

| Competitive Landscape | Univar Solutions Inc.; Helm AG; Brenntag AG; Ter Group; Barents; Azalais; Safin Alan; ICC Industries, Inc., Jebsen & Jessen Pte. Ltd.; Quimidroga; Solvadis Deutschland GmbH; Ashland; Caldic B.V.; Wilbur Ellis Holdings, Inc.; Omya AG; IMCD; Biesterfeld AG; Stockmeier Group; REDA Chemicals; Manuchar. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Segmentation of Chemical Distribution Market-

Chemical Distribution Market By Product

Chemical Distribution Market By End-users

Chemical Distribution Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.