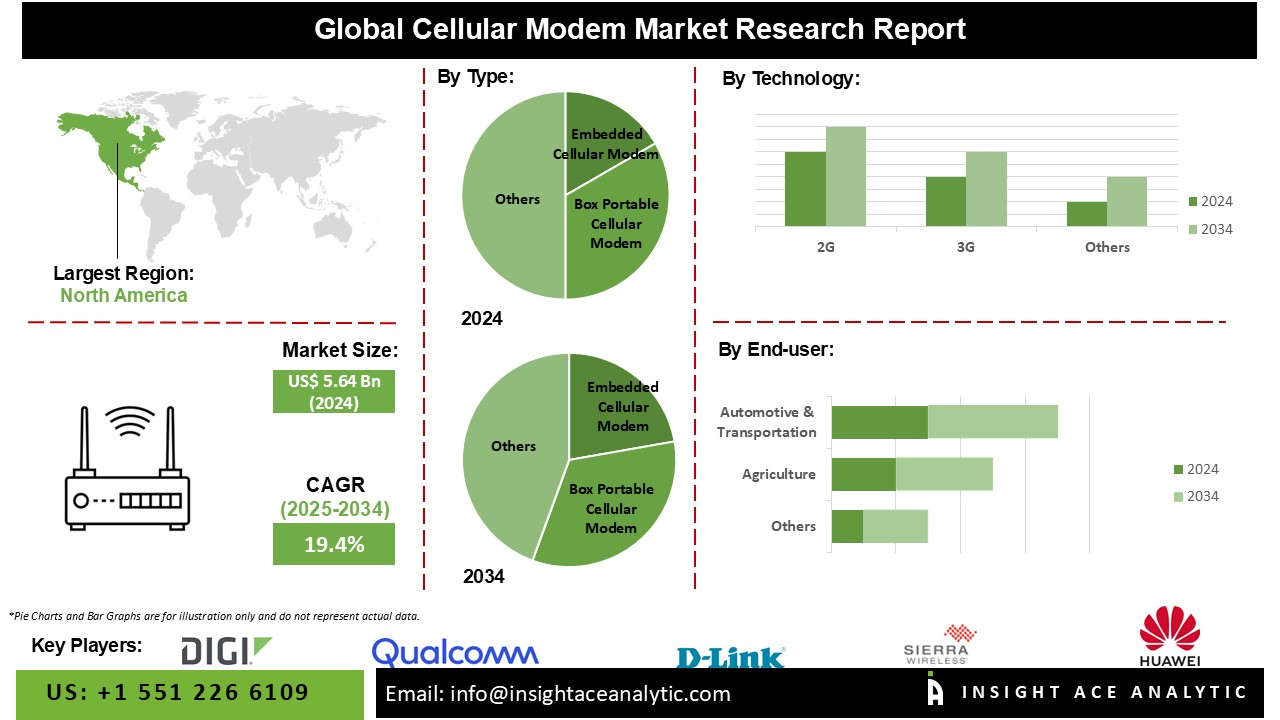

Cellular Modem Market Size is valued at USD 5.64 Billion in 2024 and is predicted to reach USD 32.84 Billion by the year 2034 at a 19.4% CAGR during the forecast period for 2025-2034.

A cellular modem enables electronic devices to access the Internet using cellular networks. This gadget uses the cellular network architecture to transmit data and communicate between the device and the network. These provide dependable and high-speed internet connectivity to various devices and systems, including smartphones, tablets, laptops, IoT devices, industrial machinery, automotive systems, and more. 5G cellular modems are in great demand due to the revolutionary changes in communication brought about by the advent of 5G technology in the past few years. Furthermore, the broad usage of telemedicine and other types of remote healthcare, as well as the increasing number of digital payments in the financial technology sector, are two aspects that present opportunities for the market to expand.

However, the market growth is hampered by the strict regulatory criteria for the safety and health of the cellular modem market and the product's inability to prevent fog in environments with dramatic temperature fluctuations or high cellular modems. Businesses and organizations installing IoT devices face significant difficulty in places with poor cellular network coverage, such as distant or rural areas.

The low population density and potentially difficult topography make it economically impracticable for telecommunication firms to construct cellular network infrastructure in these places. COVID-19 has become a major health issue on a global scale. As the virus spread rapidly, the government instituted lockdowns, quarantines, border restrictions, and the suspension of economic activities. The raw materials supply to multiple countries was negatively impacted as a consequence of the disruptions in the supply chain. Multiple annoyances have resulted from the numerous limitations, including quarantine protocols, border closures, and lockdowns.

The cellular modem market is segmented based on type, technology, and verticality. Based on type, the market is segmented into embedded cellular modems and box portable cellular modems. By technology, the market is segmented into 2G, 3 G,4G,5G, NB-IoT, and LTE-M. By vertical, the market is segmented into agriculture, automotive & transportation, smart cities, and healthcare.

The portable box cellular modem market is expected to hold a major global market share in 2022. Portable cellular modem inboxes are becoming more popular as the need for fast and dependable internet connections grows in many sectors and applications. These modems are a great option when looking for reliable internet connectivity but want to avoid dealing with complicated installations or a lot of wire. The rising popularity of online learning, telemedicine, and remote work has magnified the demand for reliable and fast Internet connections. Because of their plug-and-play feature, box portable cellular modems are ideal for short-term installations, outlying areas, and companies seeking simple ways to go online.

The healthcare industry makes up most of cellular modem usage because cellular modems are most commonly used for telemedicine and RPM. Patients in far-flung areas or those with long-term health issues can monitor their heart rate, blood pressure, and glucose levels using medical equipment with cellular modems. Patients benefit from better outcomes and fewer hospital readmissions since the data is sent to healthcare providers in real-time, especially in countries like the US, Germany, the UK, China, and India.

The North American cellular modem market is expected to record the maximum market revenue share in the near future. It can be attributed to the rapid development of the Internet of Things (IoT) and smart gadgets like smartphones, tablets, and wearables, which are becoming increasingly popular. In addition, Asia Pacific is estimated to grow rapidly in the global cellular modem market because of the proliferation of internet users and the fast growth of urban areas, particularly in areas where wired broadband connections are scarce.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 5.64 Billion |

| Revenue Forecast In 2034 | USD 32.84 Billion |

| Growth Rate CAGR | CAGR of 19.4% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type. Technology, Vertical |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Digi International Inc. (US), Sierra Wireless (Canada), Qualcomm Technologies, Inc. (US), D-Link Corporation (Taiwan); Huawei Device Co., Ltd. (China); TP-Link Corporation Limited. (China); Xiamen Technology Baima Co., Ltd (China); NETGEAR (US); Advantech Co., Ltd. (Taiwan); Cisco Systems, Inc. (US); Moxa Inc. (Taiwan); Multi-Tech Systems, Inc. (US); Belkin (US); Peplink (US); Robustel (China); LANTRONIX, INC. (US); InHand Networks (US); Motorola Mobility LLC (US); Bentek Systems (Canada); Campbell Scientific, Inc.(US); Red Lion (US); Shenzhen Wlink Technology Co., LTD. (China); Jinan USR IOT Technology Limited (China); Bivocom (China); Airgain, Inc.(US), CalAmp, Wlink Technology, and Others |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Segmentation of Cellular Modem Market-

Cellular Modem Market By Type-

Cellular Modem Market By Technology-

Cellular Modem Market By Vertical-

Cellular Modem Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.