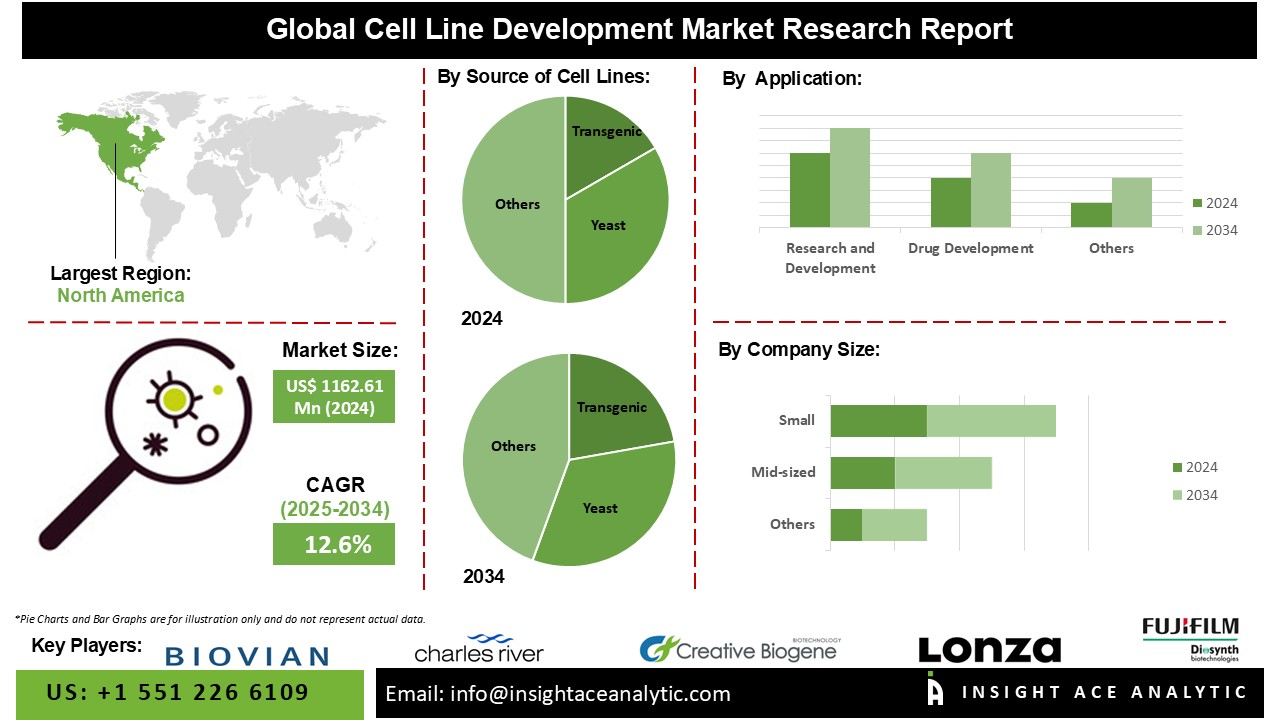

Global Cell Line Development Market Size is valued at USD 1162.61 Mn in 2024 and is predicted to reach USD 3790.05 Mn by the year 2034 at a 12.6% CAGR during the forecast period for 2025-2034.

Cell line development creates highly productive, stable cell lines required for bio-therapeutic production and manufacture. These single-celled organisms create vaccines, monoclonal antibodies, and fusion proteins. Thousands of clones are screened during the development phase to locate those producing a significant volume of bi-product while also exhibiting essential quality traits.

The features of cell lines make them more useful in synthesizing biological medicinal compounds. This raises the requirement for cell line development. As the biopharmaceutical sector grows, the cell line development (CLD) procedure is projected to be in high demand. The availability of improved methods for producing novel cell lines and an increase in demand for monoclonal antibodies and cancer medicines are expected to fuel market growth in the future years.

However, the supply chains for cell culture reagents, medium, equipment, and other vital components required in cell line creation have been hampered by worldwide lockdowns, travel restrictions, and interruptions in transportation and logistics. Many companies and research organizations have experienced delays, shortages, and cost increases as a result of these factors.

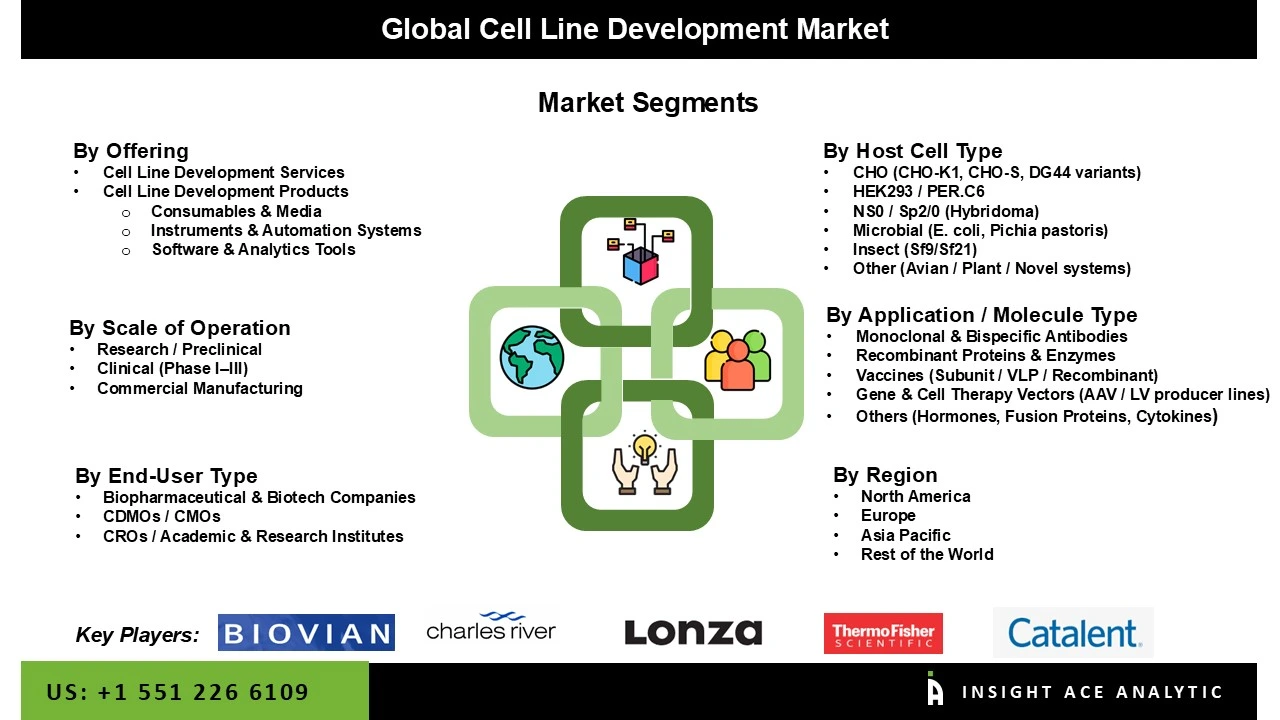

The Cell Line Development Market is segmented on the basis of source, application, company size and biologics type. As per the source, the market is segmented asTransgenic, Yeast, Bacteria, Mammalian Cells. The application segment includes Research and Development and Drug Development. By company size, the market is segmented into Very Large and Large, Mid-sized, and Small. By Biologics Type, the segment comprises Recombinant Proteins and Others

The mammalian category is expected to hold a major share in the global Cell Line Development Market in 2024. The selection of cell line sources is necessary to develop economically viable, stable cell lines. Because of their higher complex protein expression capabilities, mammalian cell lines are most commonly used to manufacture monoclonal antibodies, vaccines, and biologics. Mammalian cell culture techniques are being explored to provide vaccines for diseases such as mumps, rubella, and measles in humans, as well as foot and mouth disease in veterinary medicine. It is the fastest-growing market due to the effective manufacture of biopharmaceuticals by mammalian cell lines, which can produce complex proteins in a manner similar to humans. This is predicted to enhance mammalian cell line source revenue share in the CLD market.

The drug development segment is estimated to grow rapidly in the global Cell Line Development Market. This is attributed to increased demand for pharmaceuticals and vaccine manufacture. Bio-production technology includes the development of biologics-based therapy medications such as vaccines, therapeutic proteins, cell treatments, and gene therapies. The most prevalent applications of bio-production are biologics and vaccines, and demand is expected to rise considerably in the future due to an increase in viral and infectious diseases, particularly in poor countries.

The North America Cell Line Development Market is expected to register the highest market share in revenue in the near future. This can be attributed to the benefits connected with cell culture techniques, such as cost-effectiveness and high productivity; cell culture techniques are becoming more popular. Factors contributing to market expansion include the presence of modern healthcare infrastructure, rising demand for biologics, and increased awareness of cell therapy, as well as relatively higher healthcare expenditure levels in the region. Asia Pacific is estimated to increase significantly in the future years. Key elements influencing this rapid expansion include the presence of unexplored prospects, economic development, improved healthcare infrastructure, and favourable measures by the government and manufacturers in the biotechnology sector.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 1162.61 Mn |

| Revenue Forecast In 2034 | UUSD 3790.05 Mn |

| Growth Rate CAGR | CAGR of 12.1 % from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Offering, Host Cell Type, Application / Molecule Type, Scale of Operation and End User Type |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Biovian, Charles River Laboratories, Creative Biogene, KBI Biopharma, Lonza, ProBioGen, Syngene International, Thermo Fisher Scientific, WuXi Biologics, Advanced Instruments, LLC., AGC Biologics, Catalent, Corning Inc., Cyagen, Cytiva, Eurofins, FUJIFILM Diosynth Biotechnologies, GenScript Biotech Corporation, Horizon Discovery, Imgenex, NAEJA RGM Pharmaceuticals, Novartis, Premas Biotech, PromoCell, Rentschler Biopharma SE, Samsung Biologics, Sartorius AG, Selexis SA, Vista Biologicals, Others |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Cell Line Development Market By Offering-

Cell Line Development Market By Host Cell Type-

Cell Line Development Market By Application / Molecule Type-

Cell Line Development Market By Scale of Operation-

Cell Line Development Market By End User Type-

Cell Line Development Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.