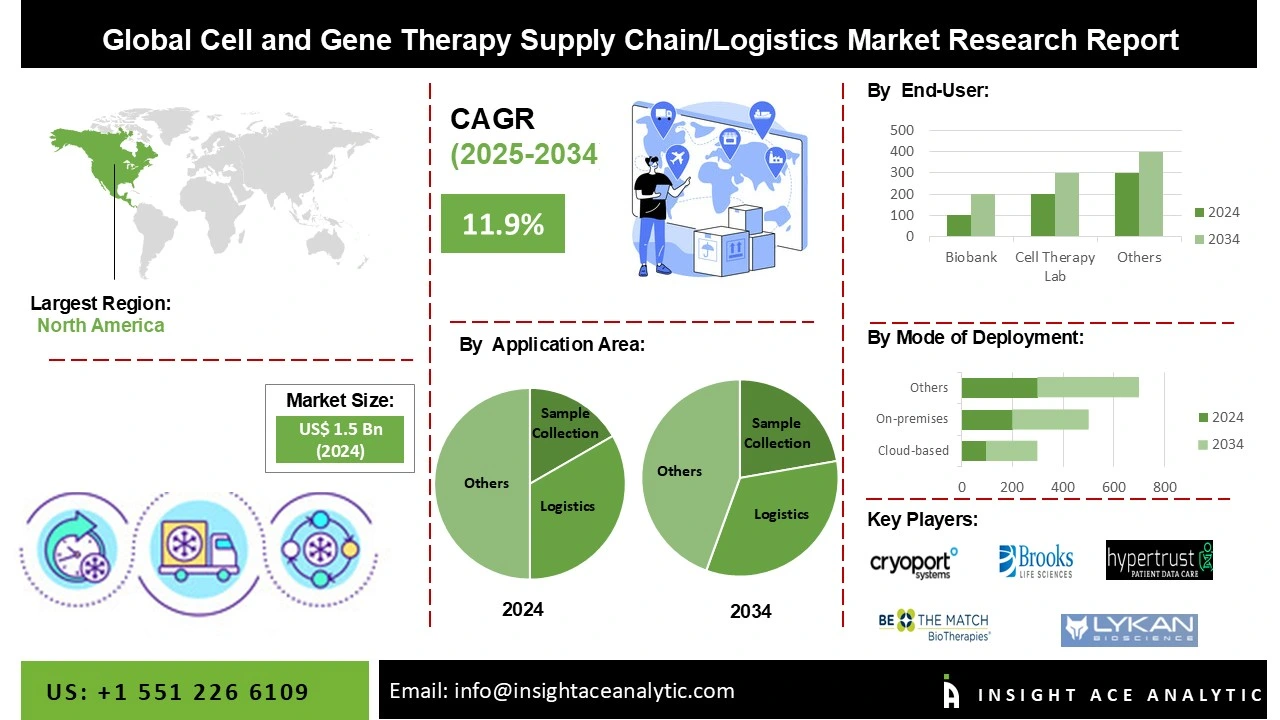

Cell and Gene Therapy Supply Chain/Logistics Market Size is valued at 1.5 Billion in 2024 and is predicted to reach 4.4 Billion by the year 2034 at a 11.9 % CAGR during the forecast period for 2025-2034.

Global Cell and Gene Therapy Supply Chain/Logistics provides customizable services to support any stage of the supply chain, from the point of patient identification through cell harvest, therapeutic intervention, and long-term outcomes data collection. Cell and gene therapies are spearheading a new era in medicine, offering treatments specifically designed to target individual patients' needs. As therapies become more personalized, the need for robust and adaptable supply chain services is skyrocketing. From the procurement of patient-specific materials to the delivery of customized treatments, supply chain services are adapting to ensure seamless coordination of these complex processes. Providing personalized therapeutics along with smart packaging is a key challenge in this market.

1. Marken, a UPS Company

2. World Courier, a Cencora Company

3. DHL Global Forwarding / DHL Life Sciences & Healthcare

4. Kuehne + Nagel International AG (QuickSTAT)

5. Cryoport Systems, Inc.

6. UPS Healthcare (United Parcel Service, Inc.)

7. FedEx Express / FedEx Healthcare

8. Vineti, Inc.

9. TrakCel Ltd.

10. SAP SE

The challenges and needs of cell and gene therapy supply chains increase the need for more advanced IT systems. Most pharmaceutical companies are collaborating with IT companies to make services automated and less complex. Modern technology platforms for supply chain data management can help you control, manage, and monitor your supply chains in just a few clicks. For instance, Marken is developing technologies designed to address complex logistics and provide optimal supply chain solutions for the fast-growing cell and gene therapies market. The constant improvements in the cell and gene therapy (CGT) supply chain management services are expected to propel the Cell and Gene Therapy Supply Chain/Logistics market growth over the forecast period.

The increasing need for cell and gene therapies, developments in the real-time supply chain operations, and the rising number of clinical trials is likely to evolve the Cell and Gene Therapy Supply Chain/Logistics market at a considerable rate in the next few years. Furthermore, advanced medical technologies, increasing customizable facilities, improving quality and efficacy of CGT supply chain services, and novel supply chain service innovations by pharmaceutical companies enhance the market growth. However, the high investment cost required for CGT supply chain services, lack of standard therapy protocols, and complex procedures hinder the market growth.

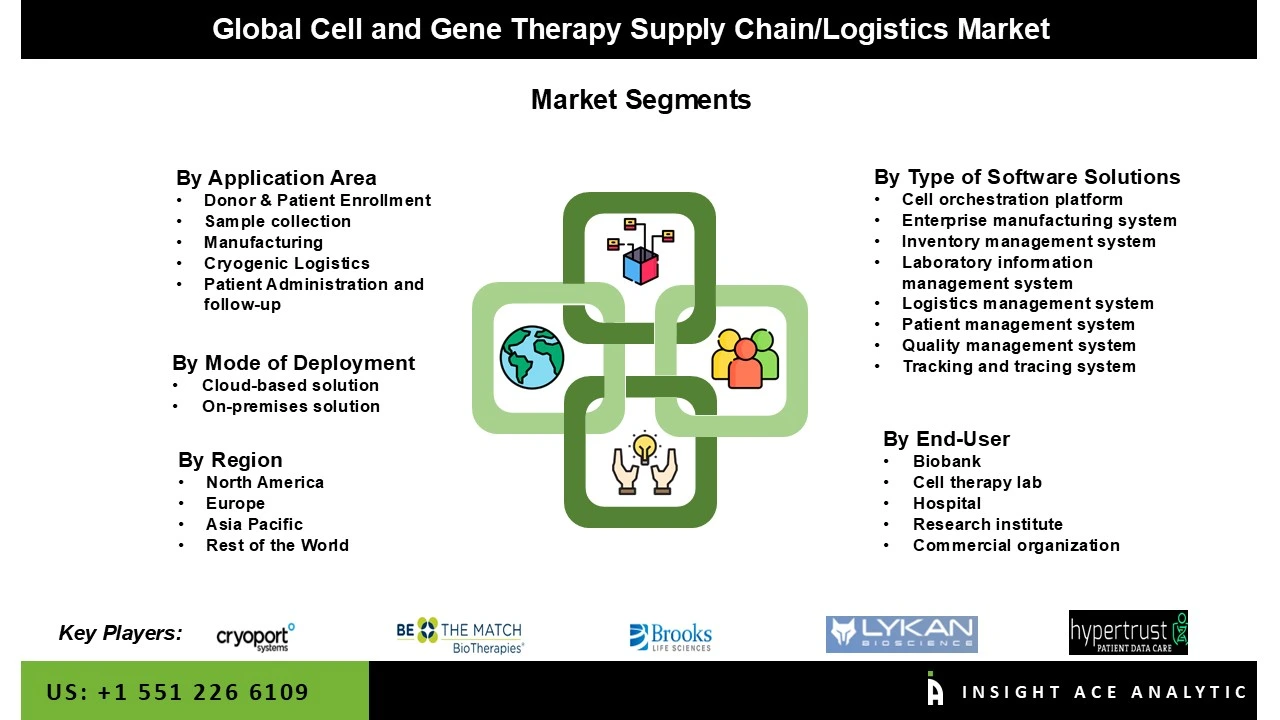

Segmentation of Cell and Gene Therapy Supply Chain/Logistics market includes Application area (Donor eligibility assessment, Sample collection, Manufacturing, Logistics, Patient verification and treatment follow-up), Type of software solution (Cell orchestration platform, Enterprise manufacturing system, Inventory management system, Laboratory information management system, Logistics management system, Patient management system, Quality management system, Tracking and tracing system), Mode of Deployment (Cloud-based solution, On-premises solution), End-user (Biobank, Cell therapy lab, Hospital, Research institute, Commercial organization). Regionally, the Cell and Gene Therapy Supply Chain/Logistics market can be divided into North America, Europe, Latin America, Asia-Pacific, and the Middle East and Africa. North America, followed by Europe, holds the maximum share of this market due to increased research and development expenditure, improved CGT supply chain services efficiency, and the fast adoption of advanced technologies.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 1.5 Billion |

| Revenue Forecast In 2034 | USD 4.4 Billion |

| Growth Rate CAGR | CAGR of 11.9 % from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Billion and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Application area, Type of software solution, Mode of Deployment, End-user, Scale of operation |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Be The Match BioTherapies, MAK-SYSTEM, Cryoport, Brooks Life Sciences, Lykan Bioscience, Clarkston Consulting, SAP, Hypertrust Patient Data Care, Haemonetics, MasterControl, TraceLink, SAVSU Technologies, TrakCel, Title21 Health Solutions, sedApta Group, Vineti, Stafa Cellular Therapy, Thermo Fisher Scientific(Patheon), McKesson, Biocair, Marken(UPS Company), Modality Solutions, Almac, Arvato Supply Chain Solutions SE, Catalent, Inc, BioLife Solutions, Inc, Biostor Ltd, Yourway Biopharma Services Company, Atelerix Ltd |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2025 to 2034 based on Application Area

· Donor & Patient Enrollment

· Sample Collection & Processing

· Manufacturing & Quality Operations

· Cryogenic Logistics & Distribution

· Patient Administration & Follow-Up

· Data Integration & Regulatory Compliance

Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2025 to 2034 based on Type of Software Solution

· Cell Orchestration Platforms (COI/COC)

· Manufacturing Execution Systems (MES)

· Inventory & Material Management Systems

· Laboratory Information Management Systems (LIMS)

· Logistics & Supply Chain Management Platforms

· Patient & Donor Management Systems

· Quality & Compliance Management Systems (QMS)

· Tracking, Traceability & Analytics Platforms

· Integrated Data / Interoperability Layers

Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2025 to 2034 based on End-User

· Biobanks & Repository Operators

· Cell Therapy Manufacturing Facilities

· Hospitals & Transplant Centers

· Research Institutes / Academic Medical Centers

· Biopharma & CGT Developers

· CDMOs / CROs

Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2025 to 2034 based on Scale of Operation

Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2025 to 2034 based on Type of Deployment

· Cloud-Based

· On-Premises

· Hybrid

· SaaS Subscription

Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2025 to 2034 based on Region

North America Cell and Gene Therapy Supply Chain/Logistics market revenue (US$ Million) by Country, 2025 to 2034

Europe Cell and Gene Therapy Supply Chain/Logistics market revenue (US$ Million) by Country, 2025 to 2034

Asia Pacific Cell and Gene Therapy Supply Chain/Logistics market revenue (US$ Million) by Country, 2025 to 2034

Latin America Cell and Gene Therapy Supply Chain/Logistics market revenue (US$ Million) by Country, 2025 to 2034

Middle East & Africa Cell and Gene Therapy Supply Chain/Logistics market revenue (US$ Million) by Country, 2025 to 2034

Competitive Landscape

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.