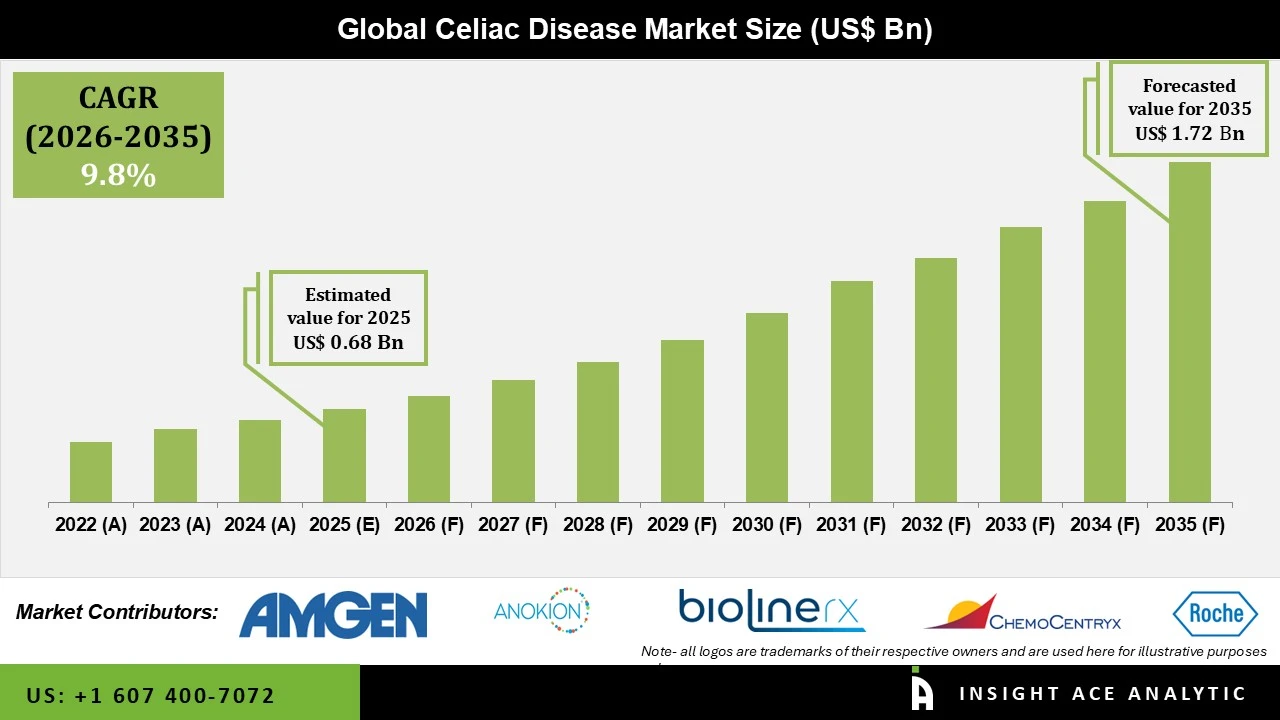

Celiac Disease Market Size is valued at USD 0.68 Bn in 2025 and is predicted to reach USD 1.72 Bn by the year 2035 at a 9.8% CAGR during the forecast period for 2026 to 2035.

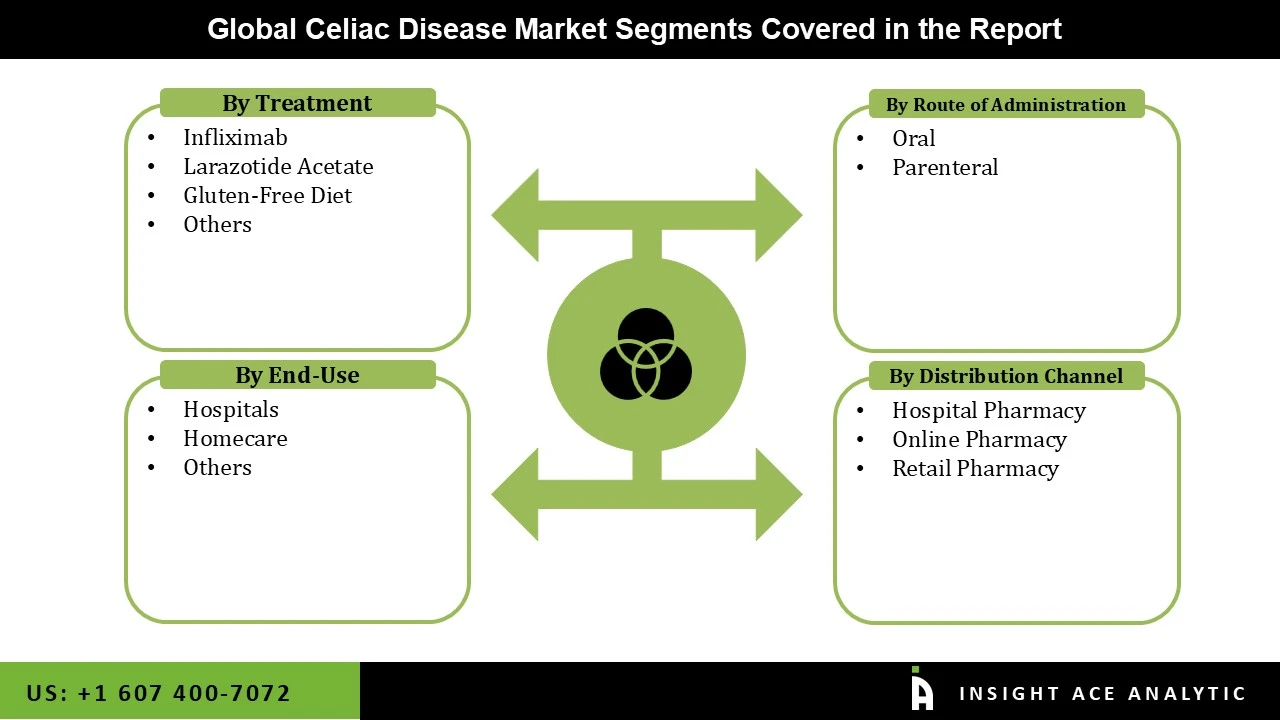

Celiac Disease Market Size, Share & Trends Analysis Report By Treatments (Infliximab, Larazotide Acetate, Gluten Free Diet), Route Of Administration (Oral And Parenteral), End-Users, And Distribution Channels, Region And Segment Forecasts, 2026 to 2035

Celiac Disease Market Key Takeaways:

|

Celiac disease is an autoimmune disorder in which gluten consumption triggers an immune response that destroys the small intestine lining. This damage limits proper nutritional absorption from meals, causing various symptoms and perhaps long-term health effects. Celiac disease symptoms include gastrointestinal problems such as stomach pain, diarrhea, and bloating, as well as non-gastrointestinal symptoms like fatigue, anemia, weight loss, and skin rashes. A number of factors influence celiac disease market trends.

First, celiac disease awareness and diagnosis have increased significantly. More people are getting the right diagnosis and seeking medical attention due to increased knowledge about the illness and its symptoms. This has helped the market for celiac disease grow overall. The rising demand for products devoid of gluten is another motivating factor. The demand for gluten-free substitutes in the food and beverage industry has surged as more people are aware of the detrimental effects gluten has on those who have celiac disease. Because of this, a wide variety of gluten-free products have been developed to satisfy the needs of people with celiac disease, such as bread, pasta, snacks, and beverages.

However, various obstacles exist in the celiac disease sector. People with celiac disease have challenges due to the shortage and high cost of gluten-free foods. Gluten-free alternatives are typically more expensive and may be difficult to locate, especially in some areas. This can create financial and logistical challenges for patients, making it difficult for them to adhere to a gluten-free diet.

The celiac disease market is segmented on the basis of treatments, route of administration, end-users, and distribution channels. Based on treatments, the market is segmented as Infliximab, larazotide acetate, gluten free diet, and others. By route of administration, the market is segmented into oral and parenteral. Based on end-users, the market is segmented as hospitals, homecare, and others. Based on distribution channels, the market is segmented as hospital pharmacy, online pharmacy, and retail pharmacy.

The gluten-free diet is the most widely used treatment for celiac disease. It is the gold standard and the only medically accepted treatment for the condition. A gluten-free diet must be closely adhered to in order to lessen symptoms, facilitate intestinal healing, and avoid long-term complications of celiac disease. While there are ongoing efforts to research alternative therapy for celiac diseases, such as the use of medications like Infliximab and Larazotide Acetate, they are not yet well-established or widely available in the market. These medications are intended to target certain aspects of the immune response triggered by gluten ingestion.

The most common way of administration for celiac disease is oral. This is mostly because the foundation of celiac disease treatment is strict adherence to a gluten-free diet, which involves avoiding gluten-containing foods and beverages. The term "oral route of administration" refers to the consumption of food and oral pharmaceuticals, including gluten-free products and prescription prescriptions or supplements.

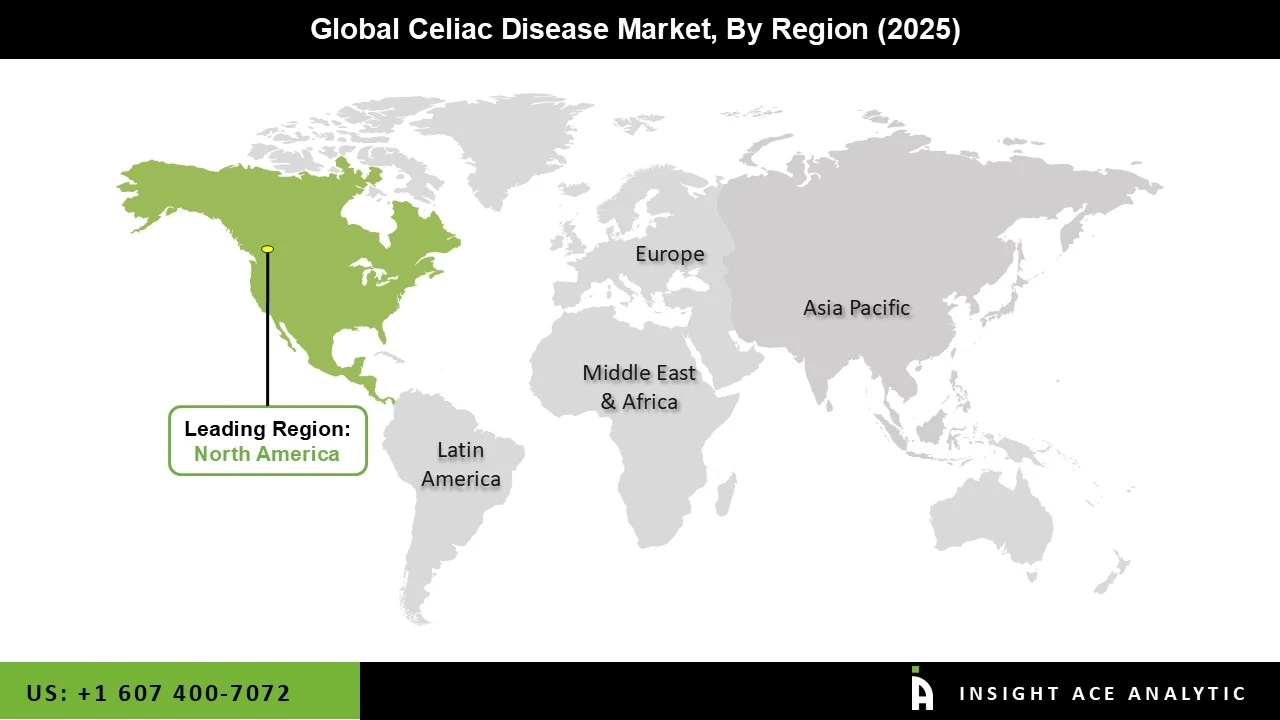

North America dominates the celiac disease market due to rising refined healthcare costs. Furthermore, increasing patient awareness and the increased incidence of celiac disease would drive the growth of the celiac disease market in the area during the forecast period. Moreover, the incidence of celiac disease varies by nation throughout Asia-Pacific. Certain countries, such as India, have lower rates of diagnosis and awareness. However, in countries such as China, Japan, and Australia, there is a growing trend of urbanization, dietary changes, and more understanding of celiac disease. This region's market is expected to grow due to rising diagnosis rates, improved healthcare infrastructure, and increased gluten-free product offerings.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 0.68 Bn |

| Revenue Forecast In 2035 | USD 1.72 Bn |

| Growth Rate CAGR | CAGR of 9.8% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Mn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026 to 2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Treatments, Route Of Administration, End-Users, And Distribution Channels |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Amgen, Anokion SA, BioLineRx Ltd, ChemoCentryx, Inc, COUR Pharmaceutical, F. Hoffmann-La Roche Ltd, ImmunogenX, LLC, Innovate Biopharmaceuticals, Takeda Pharmaceutical Company Limited, and Teva Pharmaceutical Industries Ltd. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.