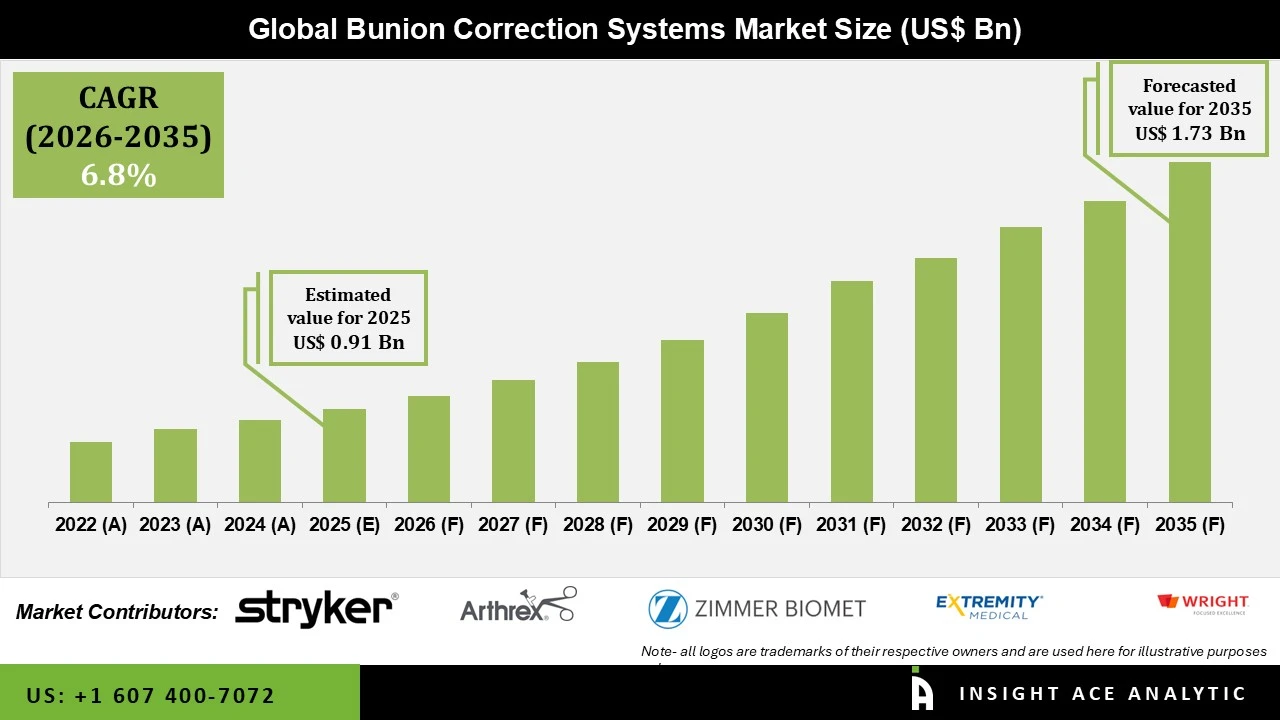

Bunion Correction Systems Market Size is valued at USD 0.91 billion in 2025 and is predicted to reach USD 1.73 billion by the year 2035 at an 6.8% CAGR during the forecast period for 2026 to 2035.

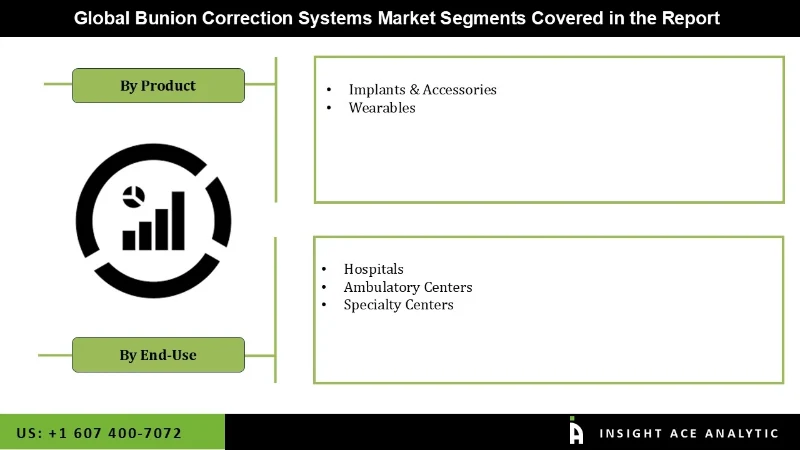

Bunion Correction Systems Market Size, Share & Trends Analysis Report By Product (Implants & Accessories And Wearables) And End-Use (Hospitals, Specialty Clinics And Others), By Region, And Segment Forecasts, 2026 to 2035

Key Industry Insights & Findings from the Report:

With one in three Americans suffering from the ailment, bunions or hallux valgus is a common foot disorder among adults. The condition is most frequently brought on by wearing uncomfortable, narrow shoes for an extended period, foot injuries, and genetic foot issues. The producers of the fixation systems are focusing on the introduction of cutting-edge products that will support the market's revenue growth.

Additionally, both illnesses' symptoms include swelling and problems with joint movement, which are predicted to aid in the market's expansion. One important reason projected to drive the market demand is the availability of a wide range of surgical and non-surgical procedures to manage the problem, such as PROstep MIS, a non-invasive process. In general, orthopedic implants, bunion pads and tapings, painkillers, surgery, injections, and physical therapy are used to treat bunions.

The condition's increasing prevalence of treatment methods is anticipated to increase. The increasing number of techniques used to treat the illness is anticipated to accelerate market growth rate. Leading hospitals and toe fixation system manufacturers are working together to expand the market for these products.

Some major Bunion Correction Systems Market Players are:

The bunion correction systems market is segmented on the product and end-use. Based on product, the bunion correction systems market is segmented into implants & accessories and wearables. Based on end-use, the bunion correction systems market is segmented into hospitals, specialty clinics and others.

The market's leading segment is wearable. One important reason that is anticipated to boost the market is the increasing occurrence of bunions. Additionally, it is anticipated that the availability of wearables for various demographics, including the adult, pediatric, and geriatric populations, will further propel the segment's growth. In general, the wearables are used to support the joint to stop malpositioning and to control pain. The wearables do not, however, address bunions.

Hospitals grabbed the highest revenue share, and it is anticipated that they will continue to hold that position during the anticipated time. The increase in patients having corrective procedures at the hospitals greatly impacts the market development. Additionally, the advent of less invasive surgery solutions for the illness is anticipated throughout the projection period to support sector growth further. Surgical methods typically entail removing the swollen tissue to realign and straighten the foot's bones and alleviate pain and swelling.

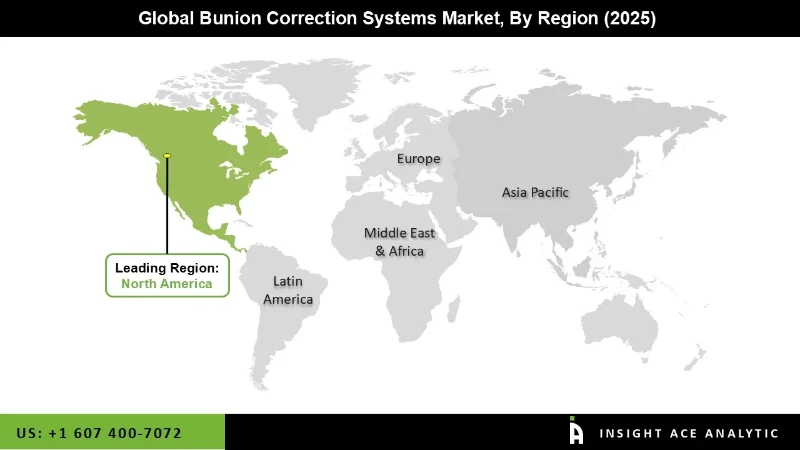

The North American bunion correction systems market is expected to register the highest market share in revenue shortly. The increasing number of people having corrective procedures to treat the issue is one factor that is accounted to have a beneficial impact on the segment's growth. The availability of minimally invasive implants that treat the bunion's underlying cause is anticipated to be a major driver of the segment's growth.

In addition, Asia Pacific is projected to grow rapidly in the global bunion correction systems market. Increased activity, including acquisitions and mergers made by important regional industry operators, is the primary driver of market progress.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 0.91 Bn |

| Revenue forecast in 2035 | USD 1.73 Bn |

| Growth rate CAGR | CAGR of 6.8% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Million, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026 to 2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Product And End-Use |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Stryker Corporation; Arthrex, Inc.; Zimmer Biomet Holdings, Inc.; Wright Medical Technology, Inc.; Extremity Medical, LLC.; Acumed, LLC.; De Puy Synthes, Biomet, Inc.; CrossRoads Extremity Systems; BioPro, Inc.; Orthofix Holdings Inc.; OrthoHelix Surgical Designs |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Bunion Correction Systems Market By Product

Bunion Correction Systems Market By End-use

Bunion Correction Systems Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.