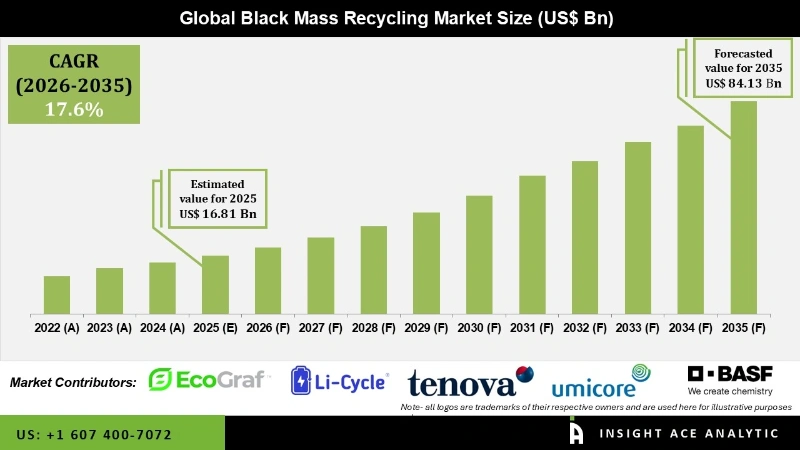

Global Black Mass Recycling Market Size is valued at USD 16.81 Billion in 2025 and is predicted to reach USD 84.13 Billion by the year 2035 at a 17.6% CAGR during the forecast period for 2026 to 2035.

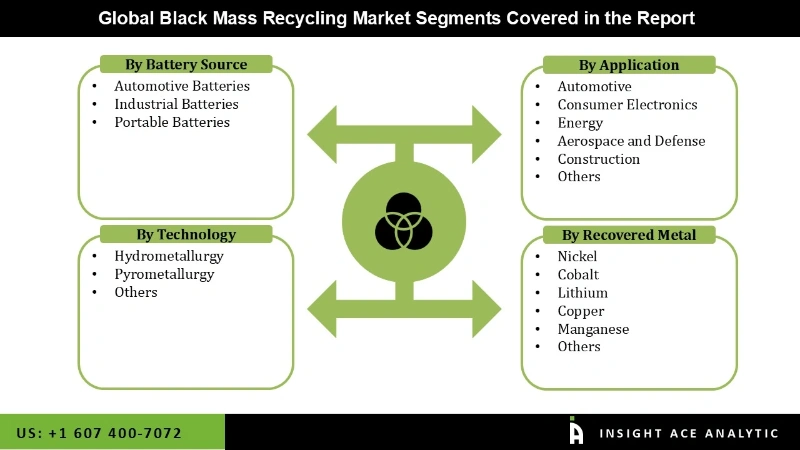

Black Mass Recycling Market Size, Share & Trends Analysis Report By Battery Source (Automotive, Industrial, And Portable Batteries), Technology (Hydrometallurgy, Pyrometallurgy), Recovered Metal (Nickel, Cobalt, Lithium, Copper, Manganese), And Application, By Region, And Segment Forecasts, 2026 to 2035.

The black mass recycling market is expected to bolster shortly, mainly due to growing concern for battery waste disposal and increased battery adoption across the industrial sector. Rising investments in recycling technologies, increased traction of second-life batteries, changes in company business models due to climate action, rising demand for raw materials and lithium-ion batteries across the value chain, and the development of economic and environmental technologies are all expected to provide opportunities for the market to grow in the coming years.

It also has a huge impact on end-use sectors since it delivers a variety of benefits that can boost efficiency, cut costs, and provide a steady source of critical metals. With a greater global emphasis on circular economic principles and advancements in recycling technologies for the recovery of high-performance metals, there is a growing shift toward the consumption and demand of lithium-ion batteries in end-use industries, resulting in a demand for black mass powder.

However, the COVID-19 outbreak has paradoxically impacted the black mass recycling industry. On the one hand, the epidemic has made it more difficult to recycle outdated lithium-ion batteries by disrupting the global delivery network. Despite this, the epidemic has increased the usage of electric vehicles, increasing the need for key metals and opening up new markets for the black mass recycling business.

The black mass recycling market is segmented on the basis of battery source, technology, recovered metal, and application. Based on battery source, the market is segmented as automotive, industrial, and portable batteries. The technology segment includes hydrometallurgy, pyrometallurgy, and others. By recovering metal, the market is segmented into nickel, cobalt, lithium, copper, manganese, and others. The applications segment includes automotive, consumer electronics, energy, aerospace and defense, construction, and others.

The hydrometallurgy category is expected to hold a major share of the global black mass recycling market in 2022. In general, mechanical treatment, hydrometallurgical treatment, thermal pre-treatment combined with hydrometallurgical procedures, or pyrometallurgical treatment are used in the recycling of used lithium batteries. In the hydrometallurgical processes, the metals from the black matter are dissolved in water solutions, including reagents, following mechanical/physical processing (usually acids). The resulting metal-rich solution is then processed to recover the metals using ion exchange, solvent extraction, or precipitation.

Also, The Pyrometallurgy technique has lately grown in prominence, especially in the automotive (EV) and renewable energy industries. Falling prices and favorable chemistry steered the technological demand. A lithium battery has a life expectancy of three to four years, after which time users can recycle it and replace it with a new one.

The automotive segment is projected to grow at a rapid rate in the global black mass recycling market owing to attributable to the rising sales of electric automobiles across the globe. It outperforms traditional cars in terms of fuel economy, low carbon emission and maintenance, home charging convenience, smoother drive, and reduced engine sound. There is a growing shift towards the demand and consumption of lithium-ion batteries in the end-use industries, which is creating demand for black mass powder. This shift is due to an increased focus on circular economic principles globally and advancements in recycling technologies for the recovery of high-performance metals.

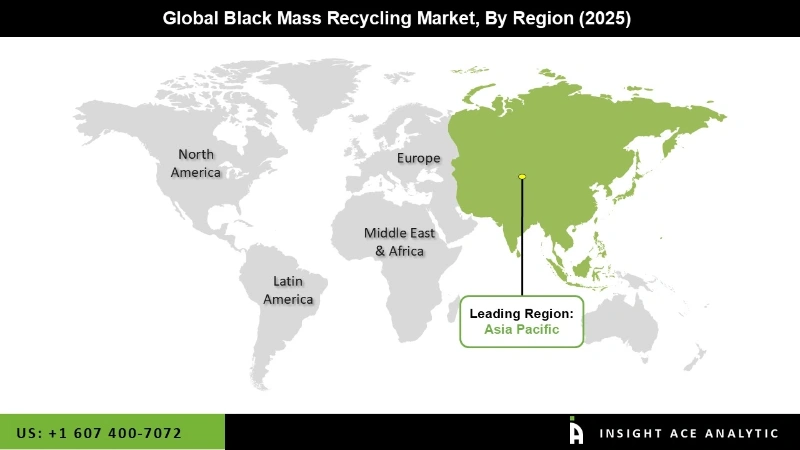

Asia Pacific's black mass recycling market is expected to register the highest market share in revenue in the near future. Due to its massive electric vehicle industry, top suppliers throughout the supply chain, and quickly developing economy, China presently owns most of the global black mass recycling market. With the burgeoning start-ups in battery recycling, the European region's battery recycling industry has recently seen steady expansion. Other major drivers for the battery recycling industry are the region's developing electric vehicle sector and energy storage initiatives.

According to the International Energy Agency, new electric car registrations in Europe will quadruple to 1.4 million in 2020, representing a 10% sales share. The batteries are also being manufactured for renewable-plus-storage projects in the area. Europe has acknowledged that a circular economy is required to satisfy environmental goals under such an energy transition scenario.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 16.81 Billion |

| Revenue forecast in 2035 | USD 84.13 Billion |

| Growth rate CAGR | CAGR of 17.6% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Mn, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Battery Source, Technology, Recovered Metal, And Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | BASF SE, Umicore, Tenova S.p.A., Li–Cycle Corp., Lithion Recycling, AKKUSER, Duesenfeld, ELECTRA, ROYALBEES, RUBAMIN, Aqua Metals Inc., HYDROVOLT AS, SungEel Hi-Tech. Co., Ltd., ECOGRAF, Fortum, Redux GmbH, Green Li-ion Pte Ltd., TATA Chemicals Ltd., ATTERO, and Exigo Recycling Pvt. Ltd. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Black Mass Recycling Market By Battery Source-

Black Mass Recycling Market By Technology-

Black Mass Recycling Market By Recovered Metal-

Black Mass Recycling Market By Application-

Black Mass Recycling Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.