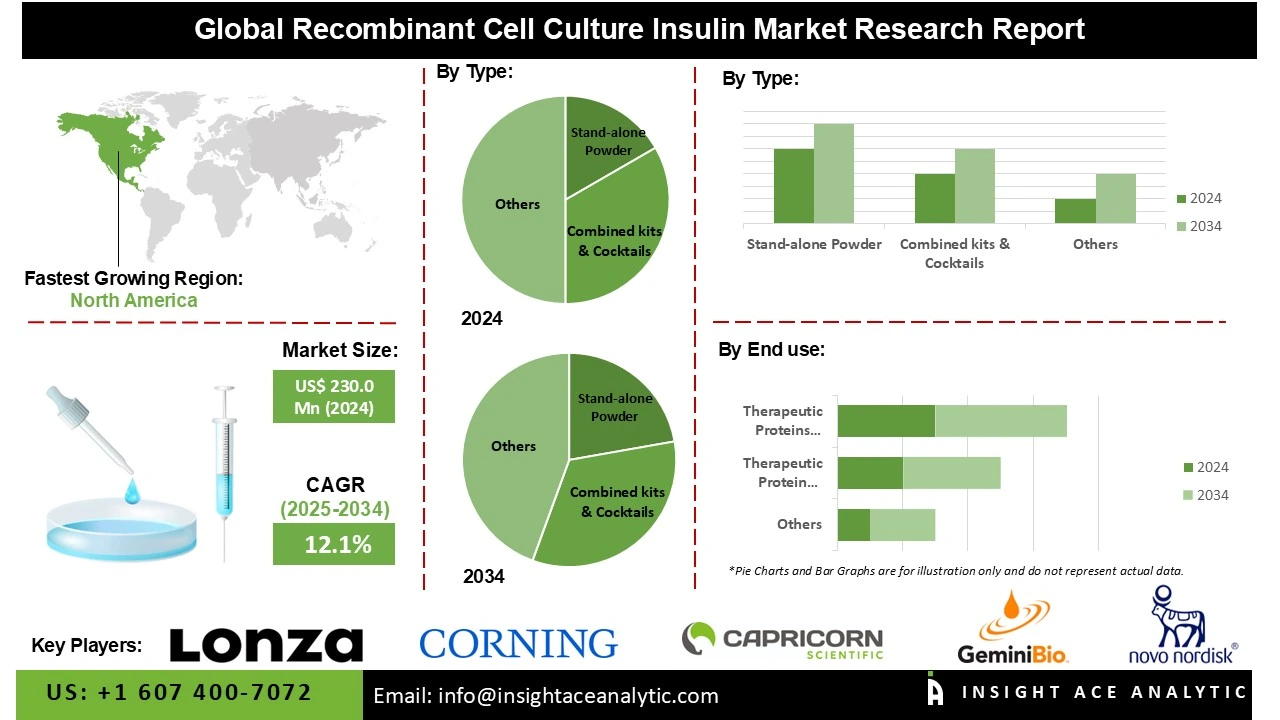

Global Recombinant Cell Culture Insulin Market is valued at US$ 230.0 Mn in 2024 and it is expected to reach US$ 714.2 Mn by 2034, with a CAGR of 12.1% during the forecast period of 2025 to 2034.

Recombinant Cell Culture Insulin Market Size, Share & Trends Analysis Distribution by Type (Stand-alone Powder, Combined kits & Cocktails, and Liquid Insulin), By End use (Therapeutic Protein Originators, Therapeutic Proteins Biosimilars, Vaccine Manufacturers, Regenerative Medicine, Academic Research Institutes, Cell Culture Media Manufacturers, CMOs & CROs, and CDMO), and Segment Forecasts, 2025 to 2034

Recombinant cell culture Insulin is a genetically engineered variant of human insulin that plays essential dual functions in biotechnology and medicine. Produced via microbial systems such as E. coli and yeast, it has transformed diabetes management by offering a safe, dependable, and consistently accessible alternative to traditional animal-derived insulin.

Concurrently, in biomanufacturing, it serves as a vital growth supplement in serum-free media, promoting cell proliferation and productivity across various industrial cell lines. By activating insulin/AKT signaling pathways, it substantially enhances the yields of therapeutic proteins, viral vectors, and vaccines, rendering it essential in the manufacturing of advanced biologics. This dual application, which addresses both global healthcare requirements and biopharmaceutical manufacturing, highlights its essential role in contemporary medicine and biotechnology.

The market for recombinant cell-culture insulin continues to expand, supported by several key factors. The biopharmaceutical industry's shift toward chemically defined, serum-free media has established insulin as an essential cell culture component. Concurrently, the growing diabetes prevalence worldwide maintains a strong demand for therapeutic insulin. While the market faces challenges, including price regulation and cold chain requirements, ongoing transitions toward animal-component-free bioprocessing and continued biomanufacturing innovation present significant growth opportunities for this established yet evolving sector.

Some of the Key Players in the Recombinant Cell Culture Insulin Market:

The recombinant cell culture insulin market is segmented by type and end-use. By type, the market is segmented into stand-alone powder, combined kits & cocktails, and liquid insulin. By end-use, the market is segmented into therapeutic protein originators, therapeutic proteins biosimilars, vaccine manufacturers, regenerative medicine, academic research institutes, cell culture media manufacturers, CMOS & CROS, and CDMO.

The combined kits & cocktails category led the recombinant cell culture insulin market in 2024. This convergence is fueled by its ease of use, ready-to-use formulas, and cell culture performance enhancement. To cut down on preparation time and minimize human variations, these kits frequently include a pre-formulated combination of insulin with other essential nutrients and growth hormones. The market for combined Kits and cocktails is anticipated to rise steadily as the biotechnology and pharmaceutical industries search for effective, scalable, and standardized solutions for cell culture applications.

The largest and fastest-growing end-use is therapeutic protein originators, a trend because key players are well-established, their brands are well-known, and their recombinant insulin medicines are widely used in significant markets. Their continuous revenue domination in the global market is a result of their robust r&d pipelines, wide distribution networks, and excellent manufacturing standards.

In 2024, North America, led by the united states, maintained its dominant position in the recombinant cell culture insulin market. The region's leadership is anchored by its advanced healthcare infrastructure, the presence of major biopharmaceutical companies, and sophisticated biomanufacturing capabilities. This established ecosystem, combined with a strong and growing demand for high-quality recombinant proteins for both therapeutics and cell culture processes, sustains its market prominence. Further growth is fueled by robust biomanufacturing activity and a widespread industry shift toward chemically defined, animal origin-free media.

The Asia-Pacific region is projected to be the fastest-growing market for recombinant cell culture insulin. This accelerated expansion is driven by significant improvements in healthcare infrastructure, increasing investment in biopharmaceutical research and development, and government initiatives supporting local drug manufacturing. China, in particular, is emerging as a high-growth market, largely due to a rapidly increasing demand for innovative biologics, including cell and gene therapies, which rely heavily on recombinant insulin in their production processes.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 230.0 Mn |

| Revenue Forecast In 2034 | USD 714.2 Mn |

| Growth Rate CAGR | CAGR of 12.1% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Mn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, By End-use, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Lonza, Corning Incorporated, GeminiBio LLC., Elabascience, Capricorn Scientific GmbH, Novo Nordisk A/S, Eli Lilly And Company, Sanofi S.A., Biocon Ltd, Bioton S.A., Gan & Lee Pharmaceuticals, Julphar Gulf Pharmaceutical Industries, Zhuhai United Laboratories Co., Ltd., Tonghua Dongbao Pharmaceutical, and Wockhardt Ltd |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Recombinant Cell Culture Insulin Market by Type-

· Stand-alone Powder

· Combined kits & Cocktails

· Liquid Insulin

Recombinant Cell Culture Insulin Market by End use-

· Therapeutic Protein Originators

· Therapeutic Proteins Biosimilars

· Vaccine Manufacturers

· Regenerative Medicine

· Academic Research Institutes

· Cell Culture Media Manufacturers

· CMOs & CROs

· CDMO

Recombinant Cell Culture Insulin Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.