Global Bio Acrylic Acid Market Size is valued at USD 0.5 Bn in 2024 and is predicted to reach USD 2.2 Bn by the year 2034 at an 15.8% CAGR during the forecast period for 2025-2034.

The sectors of thermoplastics, and paints & coatings are the main consumers of bio acrylic acid as a raw ingredient. Many items must be made with bio-acrylic acid, including thin sheets, plastic extruder tubes, molded goods, paints, and other dangerous chemicals. The industry has tremendous potential in various applications, including paints, surface treatments, emulsion sealants, and sealants.

In the bio acrylic acid market, increased global manufacturing revenue growth has a substantial impact, and new product creation and innovation are creating more growth potential. Additionally, there is a rising demand for bio acrylic acid from the plastics industry throughout the projection period as a result of AEM's increased qualities, such as robustness and resistance, among others.

Furthermore, due to government restrictions, businesses are required to treat the effluent before discharging it into the oceans and oceans, which raises demand for gel electrophoresis and, in turn, positively affects the bio acrylic acid market indirectly. The market is anticipated that increasing the use of bio acrylic acid in substitution of PVA and vinyl acetate would result in lucrative market prospects.

Further, expanding need for water treatment applications is anticipated to boost market expansion. The market for bio acrylic acid has grown significantly during the analysis due to the surge in consumption of methacrylate-based polymers used to manufacture lighting fixtures, glass, vehicle rear lights, and electronic displays.

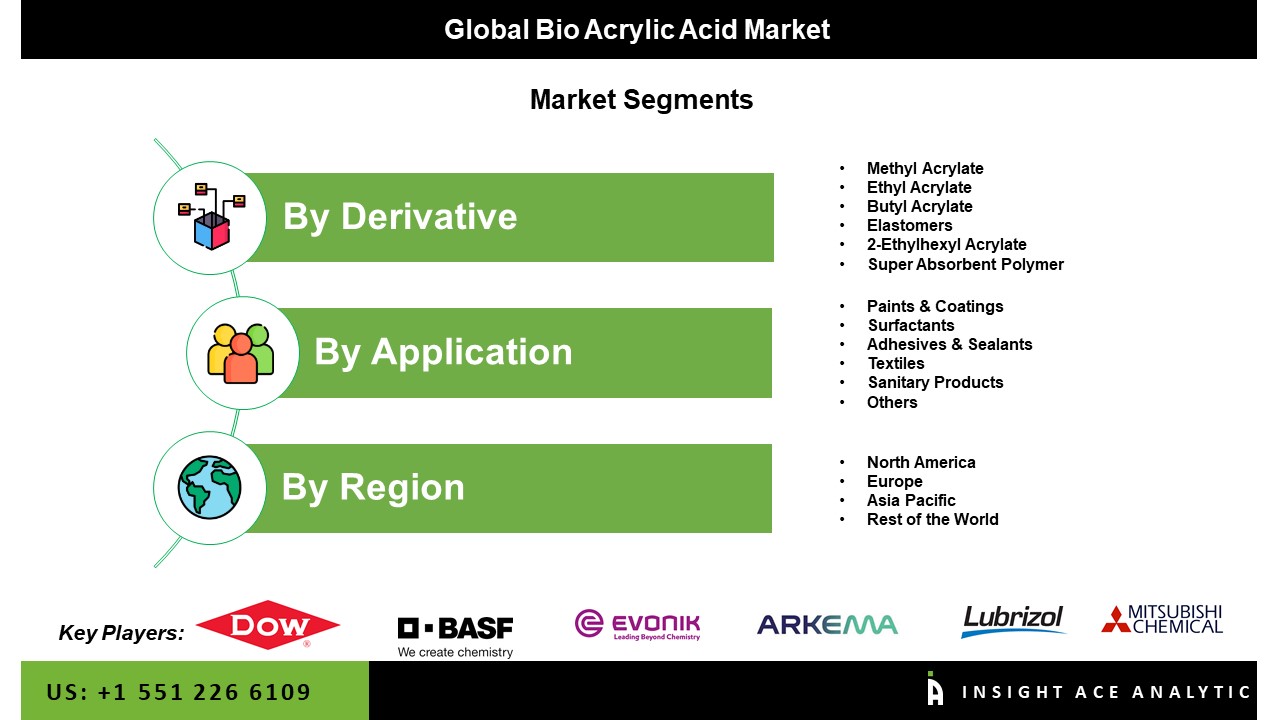

The bio acrylic acid market is segmented based on derivative products and applications. Based on derivatives, the market is segmented as methyl acrylate, butyl acrylate, ethyl acrylate, 2-Ethylhexyl acrylate, glacial acrylic acid, and super absorbent polymers. The bio acrylic acid market is segmented by application into paints and coatings, adhesives and sealants, surfactants, sanitary products, textiles, and other applications.

The butyl acrylates category will hold a major share of the global bio acrylic acid market. butyl acrylate, often known as butyl acrylate, is a liquid form of bio-acrylic acid with a distinct, spicy aroma and colorlessness. N-butyl acrylate creates all-acrylic, vinyl acrylic, and styrene acrylic copolymers. Water resistance and exceptional durability at low and high temperatures are features of n-butyl acrylate. N-butyl acrylate is used in various industrial applications, including polymer molding, building and vehicular paints and coatings, leather, textile, and glues and sealants.

The paints and coatings segment is projected to grow rapidly in the global bio acrylic acid market. For the production of long-lasting both interior and exterior paints, bio acrylic acid is widely utilized in paints and coatings. Bio acrylic acid is a chemical molecule that increases paints' and coatings' color stability and durability. Due to its superior weather and dirt resistance, bio acrylic acid is the ideal raw material for creating emulsion paints and coatings, beautifying and protecting the outside walls of structures. Leading paints and coatings manufacturers produce emulsion paints and coatings, including PPG Industries, BASF Coatings, Kansai Paint, and others. As building and infrastructure development increase, so does the consumption of defensive and durable paints, supporting the segment's revenue growth.

The North America bio acrylic acid market is expected to register the highest market share in revenue shortly. Ising derivatives consumption in surfactants, coatings, personal care goods, and adhesives is anticipated to propel regional expansion. Additionally, additional demand for bio acrylic acid is anticipated due to product innovation in organic chemicals, including bio-bio acrylic acid, bio-acrylonitrile, and bio-1,4-butanediol using renewable carbon. The demand for adult incontinence products in the United States and Canada is expected to rise, resulting in higher SAP use. In addition, Asia Pacific is projected to grow rapidly in the global bio acrylic acid market. The primary reasons supporting the revenue growth of the bio acrylic acid market in the area are the increasing employment of bio acrylic acid for domestic demand of the polymers, paints, and coating industries. Additionally, the growing use of bio acrylic acid in vehicular emulsion coatings contributes to regional revenue development.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 0.5 Bn |

| Revenue forecast in 2034 | USD 2.2 Bn |

| Growth rate CAGR | CAGR of 15.8% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Mn,, Volume (Kilotons), and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Derivative Products And Applications |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | BASF SE, China Petroleum & Chemical Corporation (SINOPEC), Arkema S.A, Mitsubishi Chemical Holdings Corporation, The Dow Chemical Company, The Lubrizol Corporation, Evonik Industries AG, PTTGC Innovation America Corporation, Formosa, Plastics Corporation and SIBUR International GmbH |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Product-

By Application-

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.