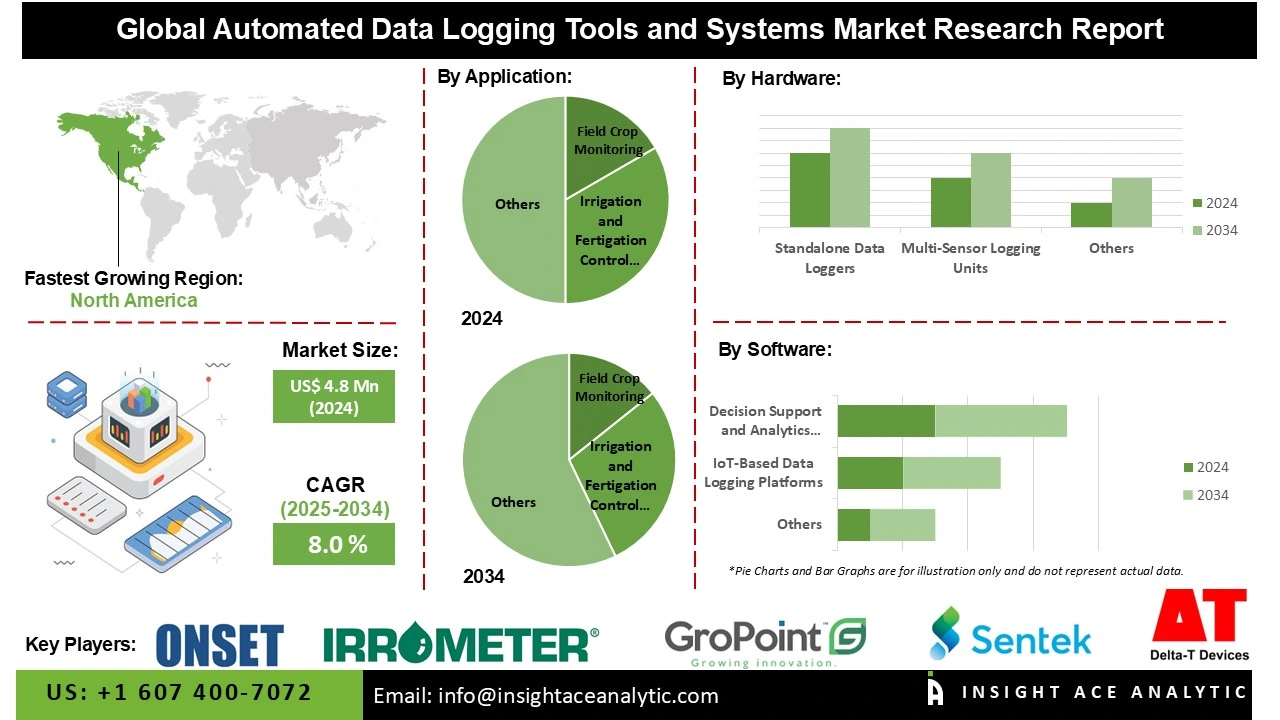

Automated Data Logging Tools and Systems Market Size is valued at US$ 4.8 Bn in 2024 and is predicted to reach US$ 10.1 Bn by the year 2034 at an 8.0% CAGR during the forecast period for 2025-2034.

Automated data logging tools and systems are technologies that continuously collect, record, and store data from sensors, instruments, or devices without manual intervention, ensuring accuracy, efficiency, real-time monitoring, and easy retrieval for analysis and decision-making. Government-backed digital agriculture initiatives are a significant driver for the automated data logging tools and systems market. These initiatives promote the adoption of precision farming technologies, smart irrigation systems, and data-driven crop management, encouraging farmers to utilize automated solutions for increased efficiency.

Subsidies, grants, and policy frameworks introduced by governments reduce financial barriers, making advanced monitoring tools more accessible to small and medium-scale farmers. Automated data logging enables accurate monitoring of soil, weather, and crop health, supporting sustainable resource use and higher yields. Additionally, integration with IoT and cloud-based platforms aligns with national goals of food security, productivity improvement, and environmental sustainability. As governments prioritize digital transformation in agriculture, the demand for reliable, automated data logging systems is expected to increase.

The deployment of IoT-enabled platforms is a significant driver in the automated data logging tools and systems market. IoT integration enables seamless connectivity between sensors, machines, and cloud systems, allowing for real-time data collection, monitoring, and analytics. These platforms enhance automation by minimizing manual intervention, reducing errors, and ensuring high accuracy in data management.

Industries such as manufacturing, energy, healthcare, and transportation are increasingly adopting IoT-enabled data logging solutions to enhance operational efficiency, facilitate predictive maintenance, and ensure regulatory compliance. In addition to this, IoT and cloud-based integration support national objectives of food security, productivity enhancement, and sustainability. As governments opt for the digitalization of agriculture, the need for robust automated logging systems is expected to increase.

Some of the Key Players in the Automated Data Logging Tools and Systems Market:

· Onset Computer Corporation (HOBO)

· Riot Technology Corporation (Gropoint)

· Gemini Data Loggers (TinyTag)

· Delta-T-Devices

· IRROMETER Company Inc.

· Sentek Technologies

· Lascar Electronics (Easylog)

· Campbell Scientific Inc.

· Munro Instruments Limited

· Spectrum Technologies Inc. (Watchdog)

· MicroEdge Instruments Inc.

· METER GROUP

· PCE INSTRUMENTS (PCE IBERICA)

· STEP Systems GmbH

· Thingslog

The automated data logging tools and systems market is segmented by application, by hardware, by software and by region. By application, the market is segmented into field crop monitoring, irrigation & fertigation control system, environmental monitoring, and others (pest & disease risk monitoring). By hardware, the market is segmented into standalone data loggers, multi-sensor logging units, sensor + telemetry modules, and automated control systems). By software, the market is segmented into IoT-based data logging platforms, and decision support and analytics platforms (AI/ML).

In 2024, the irrigation & fertigation control system held the significant market share over the projected period as it enhances precision agriculture. These technologies facilitate real-time monitoring of weather, soil moisture, and fertilizer status, enabling farmers to maximize water and fertilizer efficiency. Automated data recording enables precise and uninterrupted field data collection, reducing manual errors and labour costs. The increasing interest in green agriculture practices, along with higher yields and more efficient resource use, further boosts adoption. Supportive government initiatives and investments in smart agriculture technology are major drivers of the widespread deployment of modern farms and agribusiness enterprises.

IoT-based data logging platforms dominate the automated data logging tools and systems market due to the rising adoption of IoT and Industry 4.0 across various industries, including manufacturing, energy, healthcare, and transportation. Companies increasingly need real-time monitoring, predictive maintenance, and data-driven decision-making, which IoT-powered platforms provide by increasing operational efficiency and minimizing downtime. The more stringent regulatory demands for accuracy, traceability, and compliance with data also accelerate market growth, compelling organizations to automate logging solutions using IoT.

North America leads the market for automated data logging tools and systems owing to the region's increasing demand for precise, real-time monitoring in sectors such as healthcare, manufacturing, energy, and environmental sciences. The increasing emphasis on regulatory compliance, data transparency, and traceability fuels adoption, particularly in the pharmaceutical and food sectors.

The emergence of Industrial IoT, smart manufacturing, and predictive maintenance enhances the implementation of sophisticated logging solutions. The increasing emphasis on sustainability, energy efficiency, and environmental monitoring enhances the market's growth trajectory in North America.

Moreover, Europe's automated data logging tools and systems market is also fueled by the region’s strict regulatory frameworks, digitalization measures, and increasing Industry 4.0 adoption. Healthcare, energy, manufacturing, and environmental monitoring organizations all increasingly rely on automated logging solutions to ensure compliance, accuracy, and efficiency.

The increased emphasis on sustainability and carbon reduction compels industries to implement accurate monitoring systems for emissions and energy consumption. Alongside the trend of IoT integration, smart factories, and cloud analytics further fuel uninterrupted data acquisition and storage. Traceability, predictive maintenance, and real-time data requirements also enhance the market's growth in the technologically developed economies of Europe.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 4.8 Bn |

| Revenue Forecast In 2034 | USD 10.1 Bn |

| Growth Rate CAGR | CAGR of 8.0% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Application, By Hardware, By Software and By Region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Country Scope | U.S., Canada, Germany, The UK, France, Italy, Spain, Rest of Europe, China, Japan, India, South Korea, Southeast Asia, Rest of Asia Pacific, Brazil, Argentina, Mexico, Rest of Latin America, GCC Countries, South Africa, Rest of the Middle East and Africa |

| Competitive Landscape | Onset Computer Corporation (HOBO), Riot Technology Corporation (Gropoint), Gemini Data Loggers (TinyTag), Delta-T-Devices, IRROMETER Company Inc., Sentek Technologies, Lascar Electronics (Easylog), Campbell Scientific Inc., Munro Instruments Limited, Spectrum Technologies Inc. (Watchdog), MicroEdge Instruments Inc., METER GROUP, PCE INSTRUMENTS (PCE IBERICA), STEP Systems GmbH, and Thingslog |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Automated Data Logging Tools and Systems Market by Application-

· Field Crop Monitoring

· Irrigation and Fertigation Control System

· Environmental Monitoring

· Others (Pest and Disease Risk Monitoring)

Automated Data Logging Tools and Systems Market by Hardware-

· Standalone Data Loggers

· Multi-Sensor Logging Units

· Sensor + Telemetry Modules

· Automated Control Systems

Automated Data Logging Tools and Systems Market by Software-

· IoT-Based Data Logging Platforms

· Decision Support and Analytics Platforms (AI/ML)

Automated Data Logging Tools and Systems Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.