Global Artificial Intelligence Chipset Market Size is valued at USD 122.5 Billion in 2024 and is predicted to reach USD 790.44 Billion by the year 2034 at a 20.7% CAGR during the forecast period for 2025-2034.

The most widely used technology in recent years has been artificial intelligence, which is expected to hold great promise for emerging smart devices. It has been used increasingly in many facets of society and the economy. Finance, education, healthcare, logistics, and transportation are just a few of the industries where it has been extensively used since it makes it easier for services and products to be intelligent.

The physical foundation for producing applications with AI is provided by chipsets, thus including them in the development of AI apps is crucial. Autonomous vehicles, intelligent robotics, smart healthcare, smart homes, smart cities, smart finance, intelligent security, intelligent hardware, self-service stores, and intelligent education are some of the application technologies for AI.

AI technology has several facets because it is woven into applications, chipset types, computing technologies, and algorithm mechanisms. The fundamental uses of artificial intelligence are in the processing of image/video, sound and speech, natural language, device control, and large-scale computation. These edge applications can be run more easily thanks to the chipsets.

The development of semiconductor nanowire laser technology, 3D technology, and the expanding use of neural networks & deep learning technologies are key market drivers for artificial intelligence (AI) chipsets. Additionally, the increasing number of projects worldwide for smart homes, buildings, and cities is projected to increase demand for chipsets. The development of cutting-edge artificial intelligence chipsets for many applications is the focus of major players.

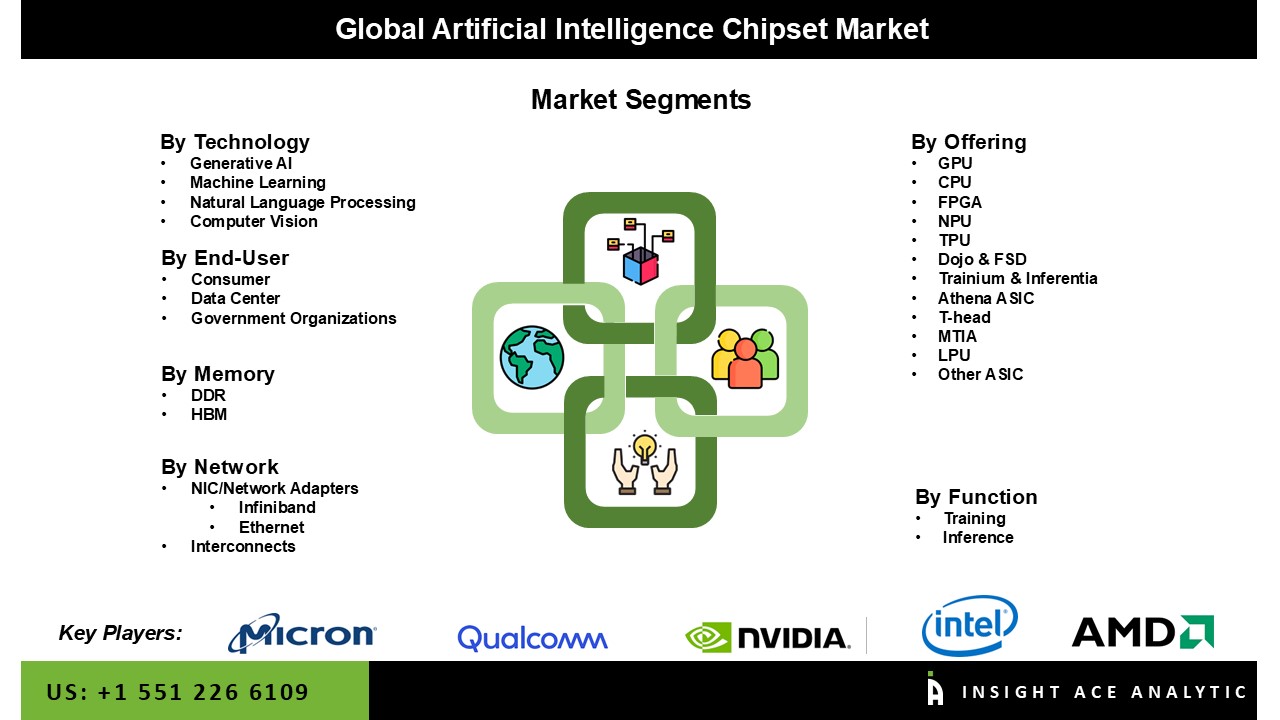

The Artificial Intelligence Chipset market is segmented by offering, technology, memory, network, function, and end user. Based on offering, the market is segmented GPU, CPU, FPGA, NPU, TPU, Dojo & FSD, trainium & inferentia, Athena ASIC, T-head, MTIA, LPU, Other ASIC. As per the memory segment is classified into DDR and HBM. The Network segment is divided into, NIC/Network Adapters, Interconnects. Memory is sub segmented into DRAM, and it is sub segmented into HBM and DDR. NIC/Network is sub segmented into adapters and InfiniBand. By Technology market is segmented into Generative AI, machine learning, natural language processing, computer vision. Generative AI is sub segmented into rule based models, statistical models, deep learning, generative adversarial networks (GANs), autoencoders, convolutional neural networks (CNNs), and transformer models. By function market is segmented into training and inference. By End-User market is segmented into consumer, data center, government organizations. Data Center is sub segmented into CSP and enterprises. Enterprises is sub segmented into healthcare, BFSI, automotive, retail & e-commerce, media & entertainment, others.

The GPU segment is set to lead the market, driven by its ability to handle intensive AI workloads through complex matrix operations. Key players like NVIDIA, Intel, and AMD continue to launch advanced GPUs for both data centers and edge applications. In November 2023, NVIDIA released the HGX H200 platform featuring the H200 Tensor Core GPU with 141 GB of HBM3e memory and 4.8 TB/s speed. Cloud giants such as AWS, Google Cloud, Microsoft Azure, and Oracle are adopting these GPUs, underscoring their critical role in AI and cloud infrastructure. Growing GPU capabilities will further accelerate market growth.

Generative AI is driving rapid growth in the Artificial Intelligence Chipset market, fueled by soaring demand for models that generate high-quality text, images, and code. As GenAI models grow increasingly complex, data center providers require Artificial Intelligence Chipsets with greater processing power and memory bandwidth. Enterprises across sectors like retail & e-commerce, BFSI, healthcare, and media & entertainment are rapidly adopting GenAI for dynamic use cases such as natural language processing, content creation, and automated design. This widespread adoption is accelerating the demand for high-performance Artificial Intelligence Chipsets, propelling strong market growth.

During the anticipated period, North America is anticipated to lead the market in terms of revenue share in the global market. The availability of established IT infrastructure and rising government R&D expenditures will probably drive market expansion in North America. The demand for AI chipsets is also increasing in the US and Canada due to the presence of significant important players like NVIDIA Corporation, Intel Corporation, Google LLC, and others. These players are concentrating on releasing cutting-edge AI chipsets to expand their product line.

The region with the fastest rate of growth is Asia Pacific in the anticipated time frame. The expansion of this industry is fueled by the region's developing economies, like South Korea, India, and others, which have strong startup ecosystems and an expanding pool of skilled labour. A council on AI ethics has also been established by the Singaporean government as part of the country's AI strategy, which calls for the deployment of AI applications across multiple industries in 2018. Due to the presence of a sizable number of AI solution providers, Europe is predicted to experience rapid growth.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 122.5 Bn |

| Revenue Forecast In 2034 | USD 790.44 Bn |

| Growth Rate CAGR | CAGR of 20.7% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Chipset Type Analysis, Function Analysis, and Industry Analysis |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; China; Japan; Brazil; Mexico; The UK; France; Italy; Spain; Japan; India; South Korea; South East Asia |

| Competitive Landscape | Intel Corporation (US), Nvidia Corporation (US), Qualcomm Technologies Inc. (US), Micron Technology, Inc. (US), Advanced Micro Devices, Inc. (US), Samsung Electronics Co., Ltd. (South Korea), Apple Inc. (US), IBM (US), Alphabet, Inc. (US), Huawei Technologies (China). |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Artificial Intelligence Chipset Market By Offering:

Artificial Intelligence Chipset Market By Memory:

Artificial Intelligence Chipset Market By Network:

Artificial Intelligence Chipset Market By Function

Artificial Intelligence Chipset Market By Technology

Artificial Intelligence Chipset Market By End-User

Artificial Intelligence Chipset Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.