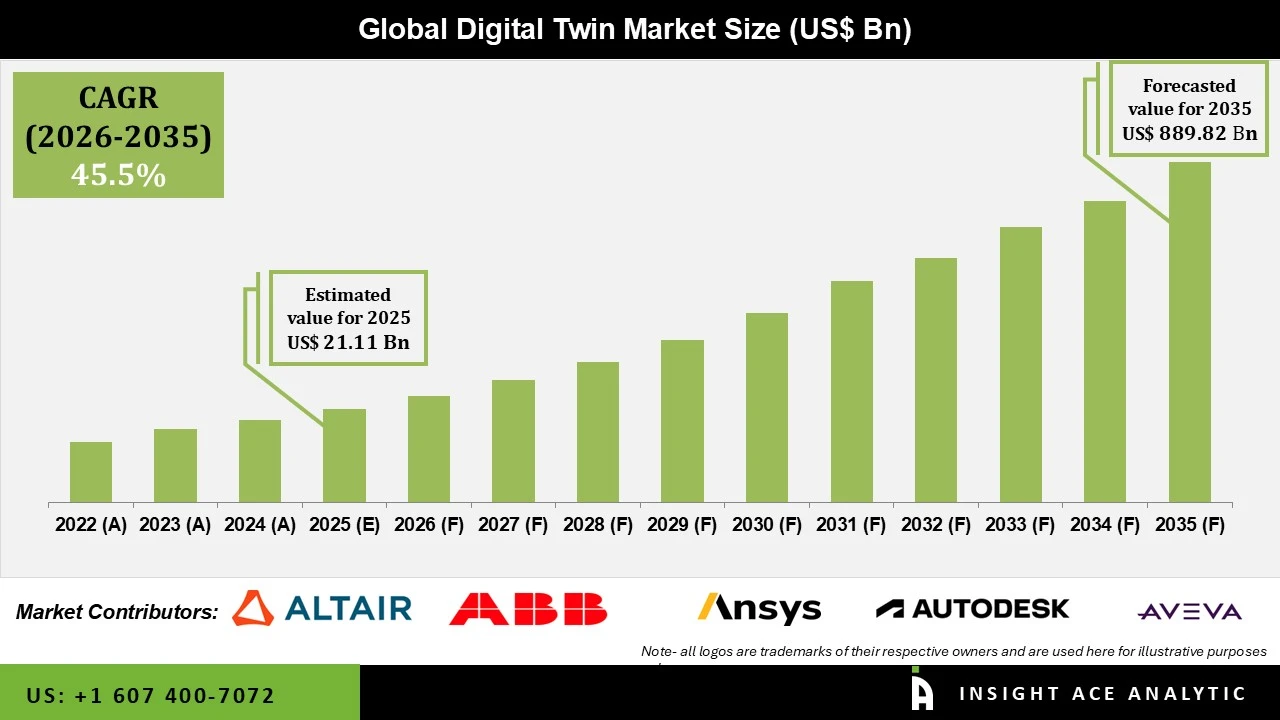

Digital Twin Market Size is valued at USD 21.11 Billion in 2025 and is predicted to reach USD 889.82 Billion by the year 2035 at a 45.5% CAGR during the forecast period for 2026 to 2035.

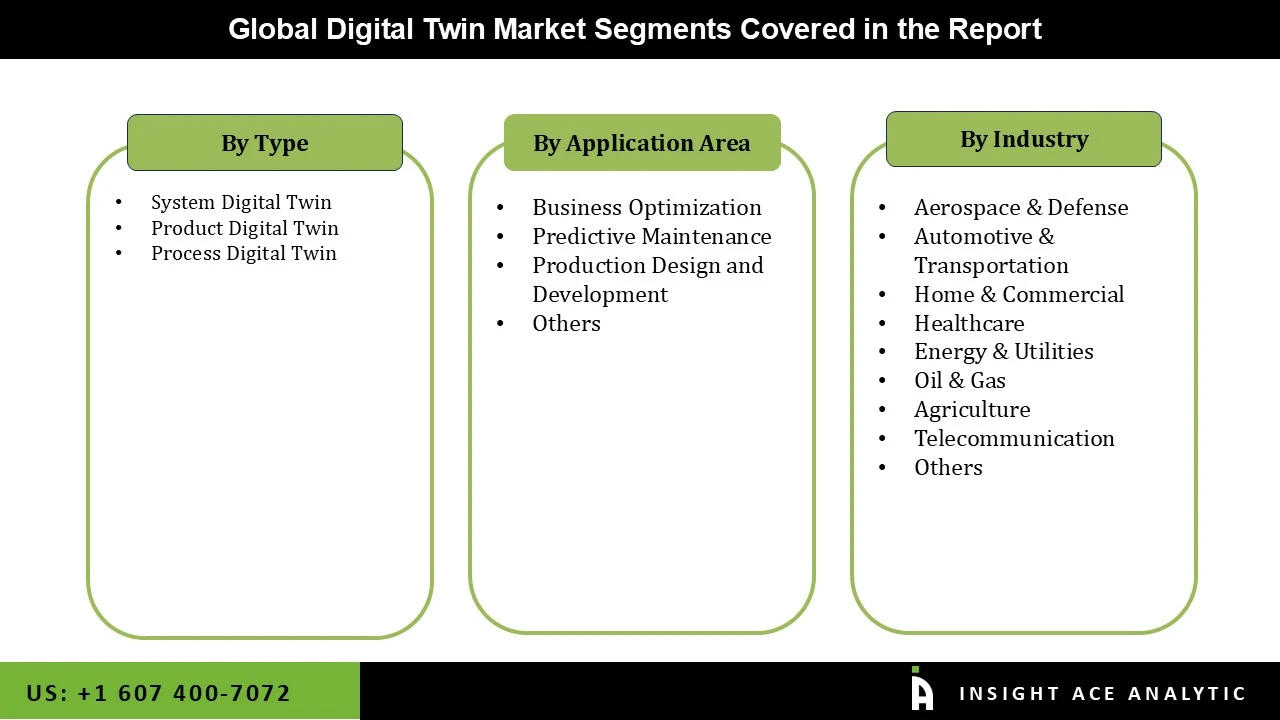

Digital Twin Market Size, Share & Trends Analysis Report By Type (System Digital Twin, Product Digital Twin, Process Digital Twin), by application area (business optimization, predictive maintenance, production design, and, development, among others) by Industry, By Region, And Segment Forecasts, 2026 to 2035

Key Industry Insights & Findings from the Report:

A digital twin is a virtual reproduction of a tangible asset, operation, or process that can ensure process and decrease outages beyond predetermined timeframes to thrive in cutthroat marketplaces. Digital twin models can now include information gathered from real-time asset monitoring technology like LiDAR (light detection and ranging) and FLIR (forward-looking infrared). As a result, in recent years, the CAGR of the global digital twin market progress has increased due to such medical conditions. The expansion results from the increased use of robotic technology like industry 4.0, robotic process automation (RPA), and others. Key companies would have the chance to provide specialized solutions to meet the needs of end customers as a result of the introduction of these technologies.

Furthermore, one of the most recent digital twin market trends is the use of twin solutions throughout the healthcare and life science industries. There are fewer physical and real-world testing or process completions since these solutions are being used more frequently by the pharmaceutical industry to estimate the end of procedures.

Additionally, these elements help healthcare professionals develop and authenticate drug candidates. IoT and cloud computing usage are growing, raising the risk of attacks and privacy and data security concerns. Privacy risks are increased when asset data must be stored online for digital twins developed on the cloud. However, the adoption of 3D simulation and 3D printing software is another driver boosting the digital twin market expansion.

The Digital Twin Market is classified into industry, type of twin, and application area. Based on the application Area, the market is categorised as business optimization, predictive maintenance, production design, and, development, among others. The market is segmented by type of twin as product twin, process twin, and system twin. The market is segmented by industry into aerospace and defense, automotive and transportation, energy and utilities, healthcare, IT and telecommunication, manufacturing, real estate, retail, and others.

The predictive category is expected to hold a significant share of the global market of digital twin. Predictive maintenance ability to enhance operational efficiency, reduce downtime, and extend the lifespan of assets. The predictive maintenance segment in the digital twin market benefits from AI-driven analytics, IoT-enabled sensors, and cloud computing. These technologies enable real-time monitoring, anomaly detection, and failure prediction, which increases operational resilience across industries like aerospace, oil & gas, and smart manufacturing.

The automotive & transportation category is expected to hold a major share of the global digital twin industry in 2022. This is due to lean manufacturing techniques, electric automobiles, and increasing simulation technology. The use of digital twin technology in the automotive industry aids engineers in obtaining psychological and technical data about the vehicle, improving automobile design and lowering costs. The usage of digital twin technology is also anticipated to rise due to future automotive themes, including public transportation, connected and self-driving automobiles, and autonomous and linked vehicles. Thus, driving the digital twin market development.

The system digital twin segment is projected to grow rapidly in the global digital twin market. The large market share is due, among other things, to the widespread use of digital twins in the development, construction, and prototyping of aerospace engines, assembly lines, communication systems, full-scale automobile models, and piping methods in the oil and gas sector. System twins are a collection of various assets that enable engineers to analyze and monitor the system's operation and synchronize its many components. Using digital twin technologies makes it easier to spot system performance and operation irregularities, which supports the digital twin market growth during the forecast period.

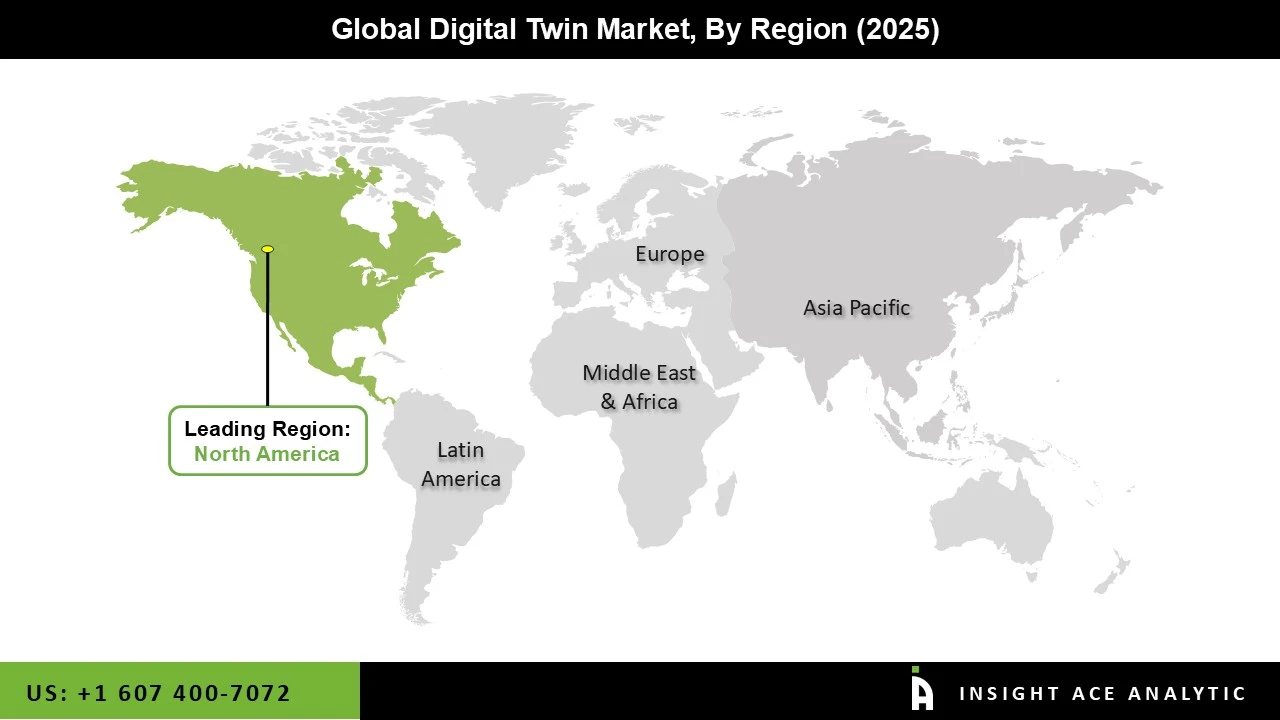

The North America digital twin market position is anticipated to register the highest market share in revenue soon. Due to the accessibility of state-of-the-art health centers, the government helps the expansion of the healthcare sector, an older society, and a rise in the prevalence of rheumatism, psoriatic arthritis, and degenerative spinal degeneration. In many technological fields, this region likewise continues to grow quickly. Organizations are increasingly adopting digital twin technologies in this region due to technical advancements in many industries and business processes. The primary drivers of market expansion are the need to use digital solutions in product development processes to reduce downtime and the increased willingness of users to invest in digital solutions to thrive in cutthroat marketplaces. In addition, Asia Pacific is projected to expand at a rapid rate in the global digital twin market. The developed production and automotive sectors in nations like China, India, Japan, and South Korea are to blame for this region's expansion. The growth of smart cities around the region and the increasing demand for consumer goods also drive the regional market.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 21.11 Billion |

| Revenue forecast in 2035 | USD 889.82 Billion |

| Growth rate CAGR | CAGR of 45.5% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Mn, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Type, Application area, Industries |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | ABB Group, ANSYS Inc., Accenture plc, Autodesk Inc, bentley systems, AVEVA Inc., bosch rexroth ag, Oracle Corporation, Siemens AG, Rockwell Automation Inc., Schneider Electric |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Digital Twin Market By Type

Digital Twin Market By Application Area: -

Digital Twin Market By Industry

Digital Twin Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.