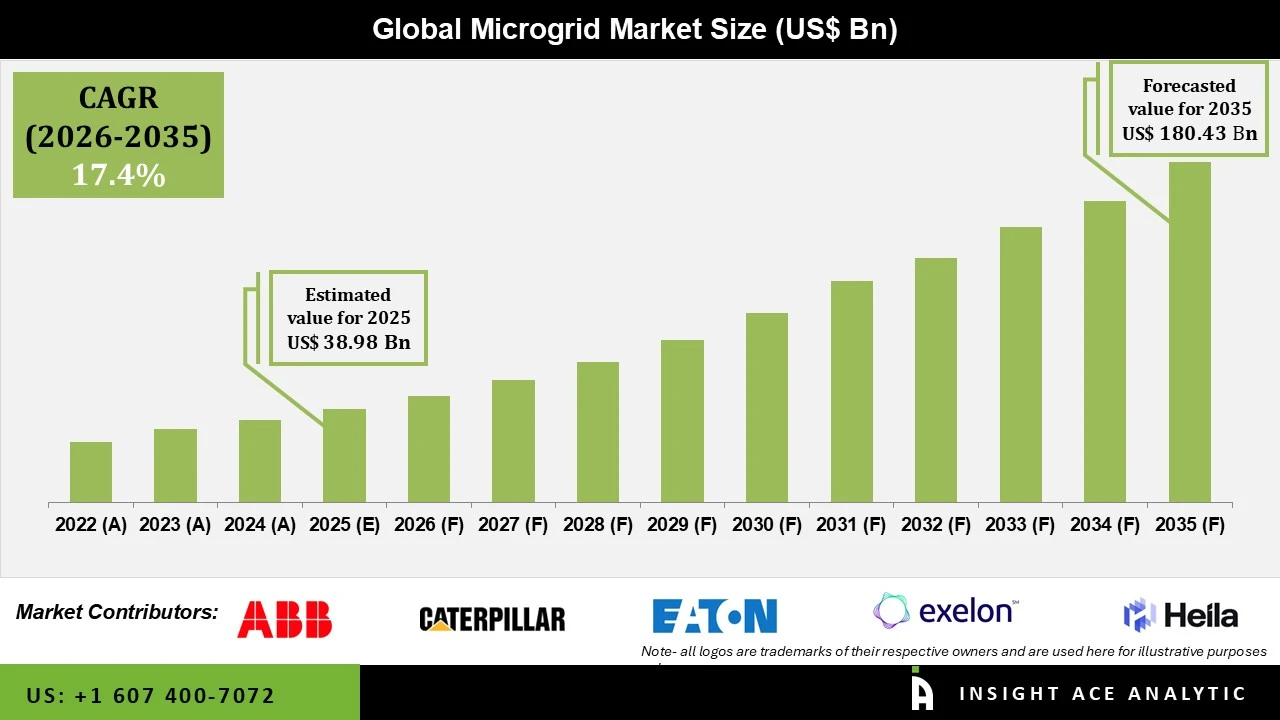

Microgrid Market Size is valued at USD 38.98 Billion in 2025 and is predicted to reach USD 180.43 Billion by the year 2035 at a 17.4% CAGR during the forecast period for 2026 to 2035

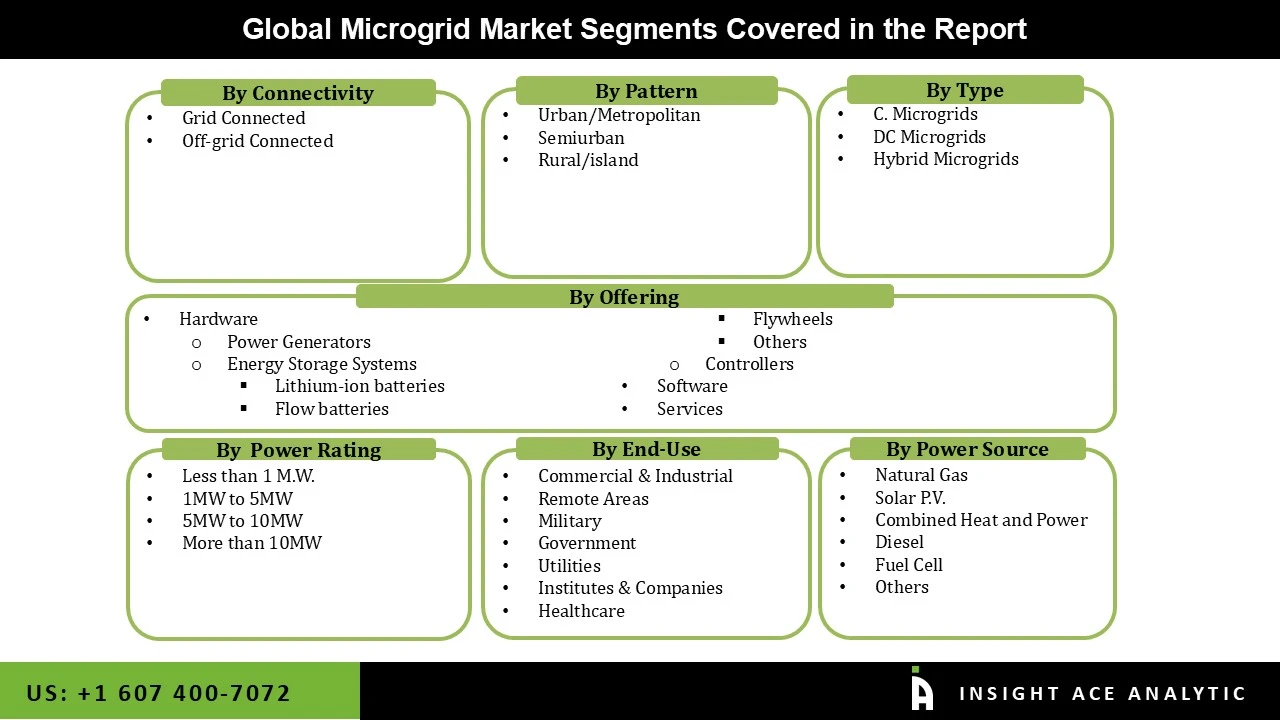

Microgrid Market Size, Share & Trends Analysis Report By Connectivity (Grid-Connected And Off-Grid Connected), Offering (Hardware (Power Generators, Energy Storage Systems, Controllers), Software, And Services), Pattern, Power Source, Types, Power Rating, And End-Use, By Region, And Segment Forecasts, 2026 to 2035

Key Industry Insights & Findings from the Report:

A microgrid is a self-sufficient energy system that supplies a particular area, such as a medical facility, college campus, or commercial district. It doesn't require the assistance of a centralized grid to function autonomously. When connected to the main grid, a smart microgrid can also operate; even when it isn't, it operates as an electrical island. By lowering harmful emissions, renewable resources are used to their full potential, efficiency is increased, and long-term energy costs are predictable.

Government attempts to reduce carbon footprint and increase demand for dependable and secure power supply in commercial and industrial sectors around the world are projected to boost the microgrid market's expansion. The market is also anticipated to grow quickly across various end-user industries, including commercial, industrial, government, and healthcare, due to software designed to monitor and regulate distributed energy resources with integrated weather and load forecasts.

The microgrid sector is anticipated to produce a modest amount of cash in the upcoming years with minimal testing, development, and research investments. But as the microgrid industry matures, it will likely only produce small profits for the major participants in the next years.

The microgrid market is segmented based on connectivity, Offering, power source, pattern, types, power rating, and end-use. Based on connectivity, the market is categorized as grid-connected and off-grid connected. Based on offering, the market is segmented as hardware (power generators, energy storage systems, controllers), software, and services.

The market is segmented by power source: natural gas, solar P.V., combined heat and power, diesel, fuel cell and others. Based on Pattern, the market is segmented as urban/metropolitan, semi-urban and rural/island. Based on the types of microgrids, the market is segmented into ac microgrids, dc microgrids, and hybrid microgrids. Based on power rating, the market is segmented as less than 1 M.W., 1MW to 5MW, 5MW to 10MW and more than 10MW. On the basis of End Use, the market is segmented into commercial & industrial, remote areas, military, government, utilities, institutes & companies and healthcare.

The grid category is expected to hold a major share of the global microgrid market. The market share of the grid connectivity segment will increase over the next several years, and the quantity of money made from this product will increase significantly. In a grid-connected system, a highly accessible power grid coupled to the main grid at a point of common coupling can act as an additional power source for a microgrid. It increases energy efficiency and offers a safe and reliable power source, which is projected to hasten the market spread of microgrids. It offers protection for electricity against disasters brought on by storms, earthquakes, and tsunamis. Microgrid deployment is increasing due to the use of artificial intelligence (Al), which enables continuous adaptation and improvement of the operation of microgrid controllers.

During the anticipated period, the commercial & industrial segment will hold the largest market share in the polymers market. The commercial and industrial sector is anticipated to expand due to ongoing developments in creative and intelligent solutions that are in line with the current product deployments. Additionally, rapid urbanization in developing countries and government reforms that facilitate the development of commercial and industrial settings would accelerate sector expansion.

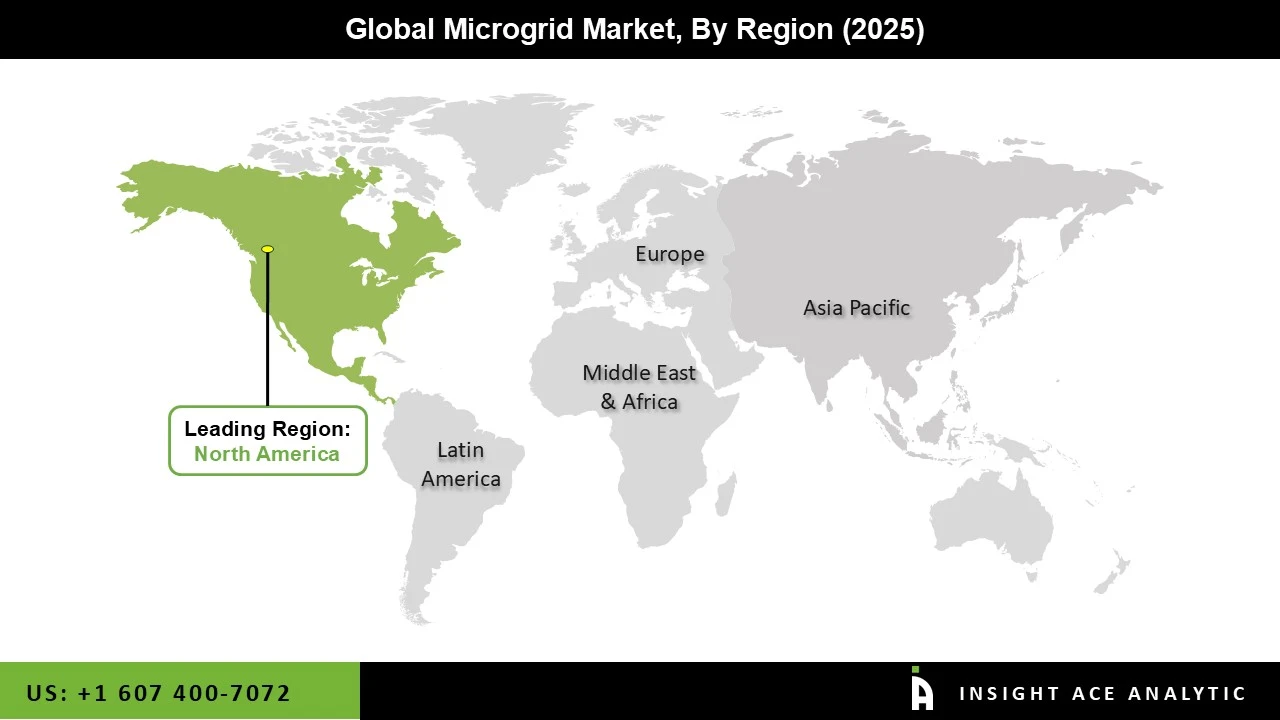

The North America Microgrid Market is expected to register the highest market share in revenue shortly. The market for microgrids globally also includes a sizable presence in North America. The United States, which has a strong legacy of energy industry innovation and a mature and well-developed energy infrastructure, dominates the region. Numerous factors, such as the rising demand for dependable and resilient energy systems, the uptake of renewable energy sources, and the implementation of beneficial laws and regulations, are fueling the expansion of the microgrid market in North America.

For instance, many states in the U.S. have developed incentive programs and set ambitious renewable energy targets to promote the implementation of microgrids. In addition, Asia Pacific will dominate the market due to the rising demand for dependable and sustainable energy sources, particularly in developing nations like India and China. This region is anticipated to account for a sizeable portion of the worldwide microgrid market. Energy demand in these nations has increased dramatically due to rising population and industrialization, which has spurred the expansion of the microgrid industry in the area. The development of the industry has also been assisted by governments in the Asia-Pacific region, implementing favorable policies and measures to support the deployment of microgrids.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 38.98 Billion |

| Revenue forecast in 2035 | USD 180.43 Billion |

| Growth rate CAGR | CAGR of 17.4% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Mn, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Connectivity, Offering, Power Source, Types, Power Rating, And End-Use |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Schneider Electric (U.S.), Eaton Corporation (U.S.), Honeywell International Inc. (U.S.), Homer Energy (U.S.), S&C Electric (U.S.), and Power Analytics (U.S.) |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Microgrid Market By Connectivity-

Microgrid Market By Offering

Microgrid Market By Power Source

Microgrid Market By Pattern

Microgrid Market By Type-

Microgrid Market By Power Rating

Microgrid Market By End-Use

Microgrid Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.