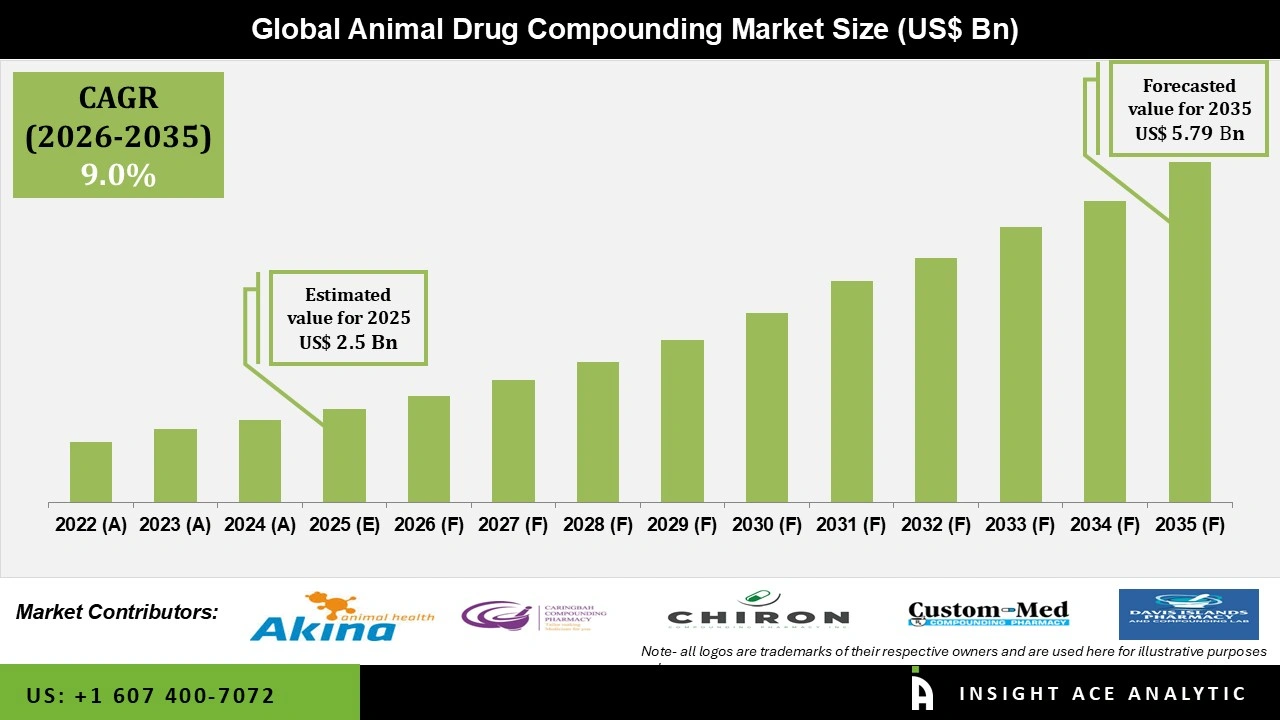

Global Animal Drug Compounding Market Size is valued at USD 2.50 Billion in 2025 and is predicted to reach USD 5.79 Billion by the year 2035 at an 9.0% CAGR during the forecast period for 2026 to 2034.

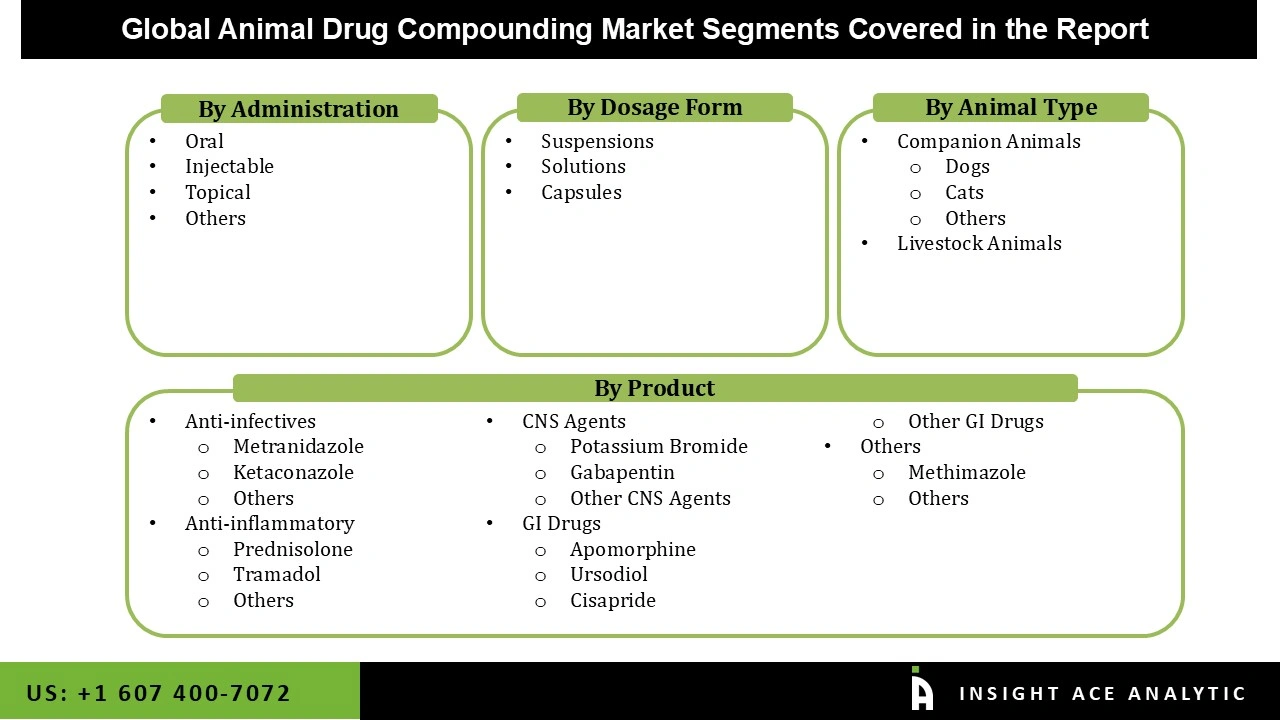

Animal Drug Compounding Market Size, Share & Trends Analysis Report By Animal Type (Companion Animals, Livestock Animals), By Product (Anti-infective Agents, Anti-inflammatory Agents, Hormones & Substitutes, CNS Agents, GI Drugs), By Route of Administration, By Dosage Form, By Region, And Segment Forecasts, 2026 to 2035.

Animal Drug Compounding Market Key Takeaways:

|

As more pet parents learn about the benefits of compounded drugs, which is projected to inspire more people to adopt them, the market will expand. The industry has also seen potential due to the rising need for individualized and specialized medications for companion animals and the expanding animal population and longer life spans. Furthermore, a rise in the prescriptions for animal-compounded medicines is anticipated to fuel market expansion. The FDA reports that 6.3 million prescriptions for compounded animal medications are written by veterinarians each year in the United States.

Like many other global businesses, the COVID-19 pandemic had a detrimental effect on the market for animal medication compounding in 2020. According to reports, supply chain interruptions, a decline in sales, a decrease in demand, and operational difficulties brought on by changing regulations and policies are the most critical effects of COVID-19 on the veterinary healthcare system. Due to widespread lockdowns and limitations on the movement of persons and commodities, manufacturing companies, pharmacies, and veterinary service providers were severely impacted. For instance, the American Veterinary Medical Association reports that the coronavirus outbreak caused the cancellation or delay of around 60% of veterinary services in April 2020. By July 2020, the number had fallen to roughly 30%.

The Animal Drug Compounding market is segmented based on animal type, product, route of administration, and dosage form. Based on animal type, the market is segmented as Companion Animals, Dogs, Cats, Others, and Livestock Animals. The product segment includes Anti-infective Agents, Anti-inflammatory Agents, Hormones & Substitutes, CNS Agents, and others. By route of administration, the market is segmented into Oral, Injectable, Topical, and Others. The dosage form segment includes Suspensions, Solutions, and Capsules.

By animal type, the companion animal market accounted for the highest proportion of the global animal medication compounding market in 2022. Similarly, it is anticipated that over the next few years, the companion animal segment will expand at the fastest rate, exceeding 8%. This market is developing as a result of factors like an increase in the number of companion animals, rising pet care costs, increased knowledge of animal medicine compounding among pet owners and veterinarians, and the many advantages it offers companion animals.

While CNS agents are the most frequently prescribed treatment for treating neurological problems such as a change in behaviour, blindness, seizures, etc., in pets, these sectors dominated the global market for animal drug compounding. In veterinary medicine, a variety of pharmacological classes are employed as CNS or psychotropic drugs. Among them are anxiolytics, anticonvulsants, tranquillizers, analgesics, sedatives, antidepressants, antipsychotics, and others. Several CNS agents are available from businesses like Wedgewood Pharmacy that are formulated for particular medical conditions.

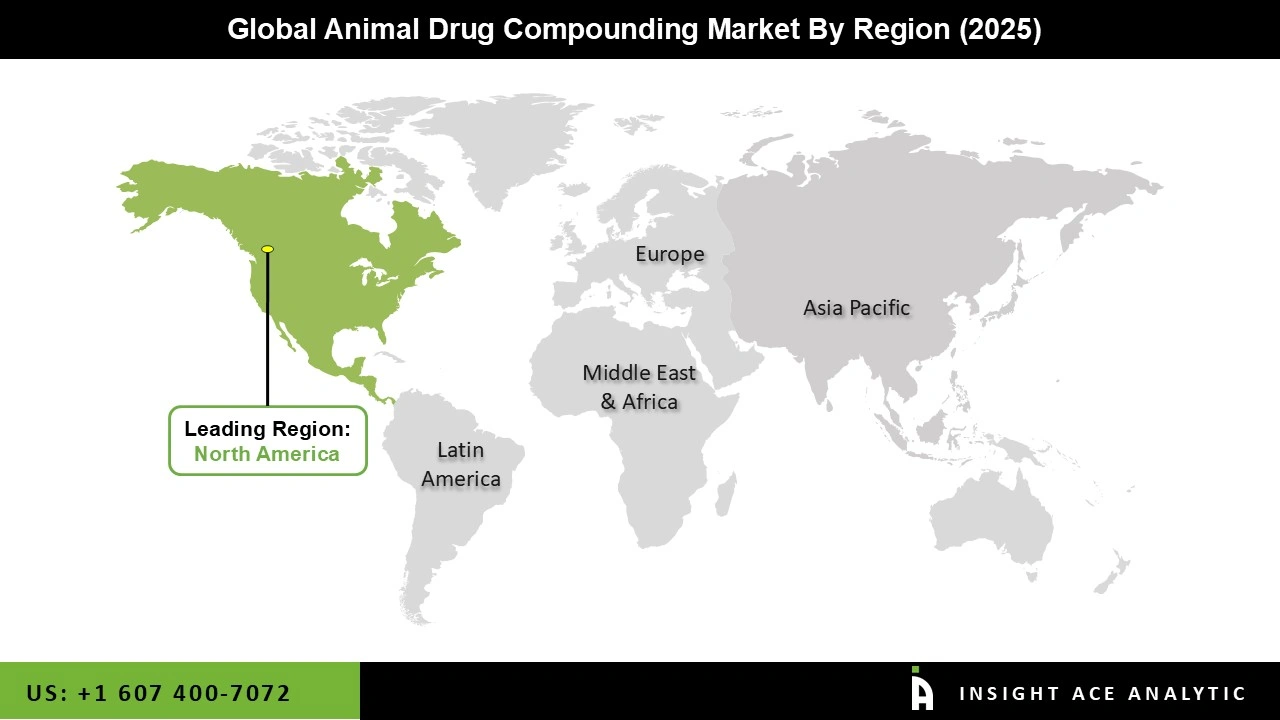

During the forecast period, Asia Pacific is anticipated to have the fastest CAGR. The rise in pet humanization, rising costs for veterinary treatment, and the accessibility of affordable animal compounded pharmaceuticals are the leading causes of the expansion.

A surge in demand for compounded veterinary pharmaceuticals, notably for pets and non-food-producing animals in the region, as well as increased investment by international players to enhance their presence in this region, are also projected to fuel the market's expansion.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 2.50 Billion |

| Revenue forecast in 2035 | USD 5.79 Billion |

| Growth rate CAGR | CAGR of 9.00% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Billion, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Animal Type, Product, Route Of Administration, And Dosage Form |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Wedgewood Pharmacy; Vimian; Pharmaca; Akina Animal Health; Triangle Compounding; Davis Islands Pharmacy and Compounding Lab; Custom Med Compounding Pharmacy; Central Compounding Center South; Wellness Pharmacy of Cary; Miller's Pharmacy. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.