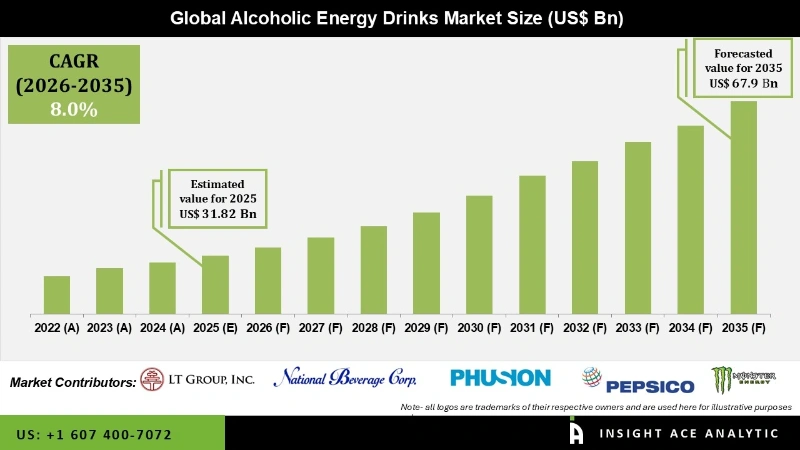

Global Alcoholic Energy Drinks Market Size is valued at USD 31.82 Billion in 2025 and is predicted to reach USD 67.9 Billion by the year 2035 at a 8.0% CAGR during the forecast period for 2026 to 2035.

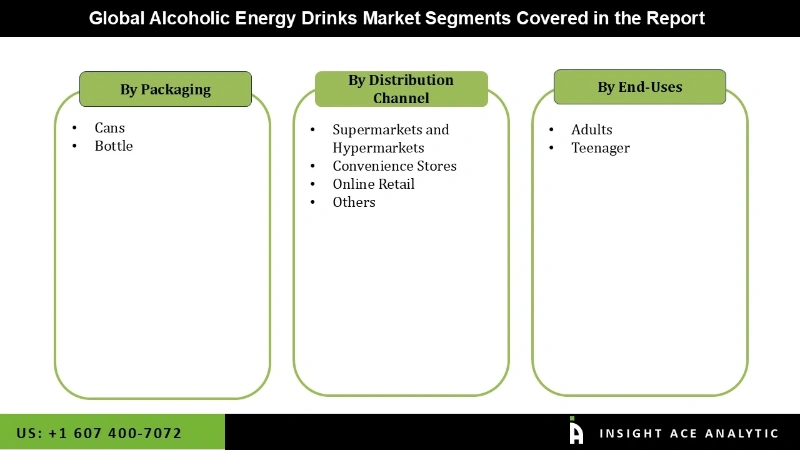

Alcoholic Energy Drinks Market Size, Share & Trends Analysis Report By Packaging (Cans And Bottles), End Users (Adults And Teenagers), And Distributional Channel (Supermarkets And Hypermarkets, Convenience Stores, Online Retail And Others), By Region, And Segment Forecasts, 2026 to 2035.

Alcoholic Energy Drinks Market Key Takeaways:

|

Key Industry Insights & Findings from the Report:

Alcoholic energy drinks are alcoholic drinks that also contain caffeine or other stimulants. Most of these beverages are offered in cans and bottles. Alcoholic energy drinks are more palatable and healthier than alcohol. Using a variety of packaging in various sizes and forms and is accessible for both residential and commercial use in places like hotels, restaurants, and cafés (HoReCa).

In recent times, These alcoholic energy drinks are also becoming more popular since they are used as mixers in well-known alcoholic drinks. These drinks also include pyridoxine acid, which helps alleviate allergies, skin conditions, tension, and anxiety. The sector for alcoholic energy drinks has expanded dramatically due to the rise in riboflavin content, which helps alleviate blood conditions and muscle cramps. These factors account for the constant need for alcoholic energy drinks in the healthcare industry. Moreover, urban development and the resulting lifestyle shift push the demand for alcoholic energy drinks nationwide. Additionally, advertisements for alcoholic energy drinks claim that they can boost cognitive function, revitalize the body, and increase performance and stamina.

Some of the major key players in the Alcoholic energy drinks market are amway, Arizona Beverages USA

The alcoholic energy drinks market is segmented on the packaging, end users, and distributional channel. Based on packaging, the market is segmented as cans and bottles. By end users, the alcoholic energy drinks market is segmented into adults and teenagers. By distributional channel, the market is segmented into supermarkets and hypermarkets, convenience stores, online retail and others.

The cans category is expected to hold a significant share of the global alcoholic energy drinks market in 2021. Customers are more frequently choosing these drinks over canned wine and other alcoholic beverages due to their increasingly sophisticated taste and choice. Young consumers prefer aluminum cans since they are more mobile and do not break like glass. The demand for the product in cans has considerably increased. It is anticipated to keep growing throughout the projected period due to the coronavirus pandemic forcing the closure of taverns, pubs, and restaurants. Some customers are looking for useful alcoholic energy drinks, many of which are offered in cans. As a result, the producers have been attempting to enter this market by launching additional products in this format.

The supermarkets and hypermarkets segment is projected to grow rapidly in the global alcoholic energy drinks market. Due to an increase in disposable income, the trend of shopping at supermarkets and hypermarkets will likely pick up quickly soon. Many individuals shop at supermarkets and hypermarkets in urban areas to fulfil everyday needs. The market is fueled by factors like expanding energy drink consumption, rising demand for items that deliver quick energy, and rising numbers of athletes who use these products to raise their energy and performance., especially in countries such as the US, Germany, the UK, China, and India.

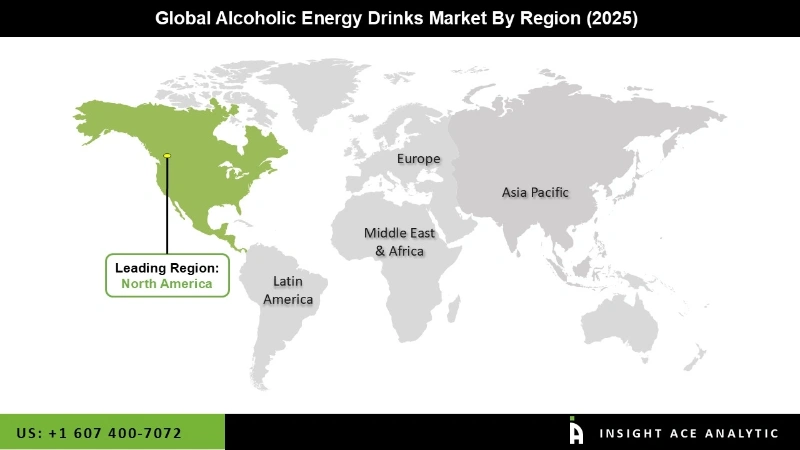

The North American, alcoholic energy drinks market is expected to register the highest market share in revenue soon. This can be attributed to the region's strong focus on the environment, with the increasing adoption of Alcoholic energy drinks in different industries, including food & beverages, personal care, packaging, automotive, and others. In addition, the chemical industry in the region is focusing on the production of alcoholic energy drinks to develop sustainable and environmental-friendly solutions. Growing demand for bio-based components across industries and widespread adoption of alcoholic energy drinks in the production of intermediate chemicals in the region are factors increasing the growth of the target market in the region. Additionally, Asia-Pacific is anticipated to develop rapidly in the global market for alcoholic energy drinks. In China, India, and Japan, the market is predicted to witness considerable expansion as a result of customers' willingness to sample new flavours and the strong demand from immigrants residing in the country who are interested in a wide range of beverages. Demand for items in the region has been boosted by promotional events designed to target and appeal to a wide variety of consumers.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 31.82 Billion |

| Revenue forecast in 2035 | USD 67.9 Billion |

| Growth rate CAGR | CAGR of 8.0% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Mn, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Packaging, End Users and Distributional Channel |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Arizona Beverages USA, LT Group, Inc., Monster Beverage Corp, National Beverages Corp., Pepsi CO., Phushion Projects, Steelbrew, suntory holdings limited, United Brands Beverages Innovation. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Packaging

By End-Users

By Distribution Channel

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.