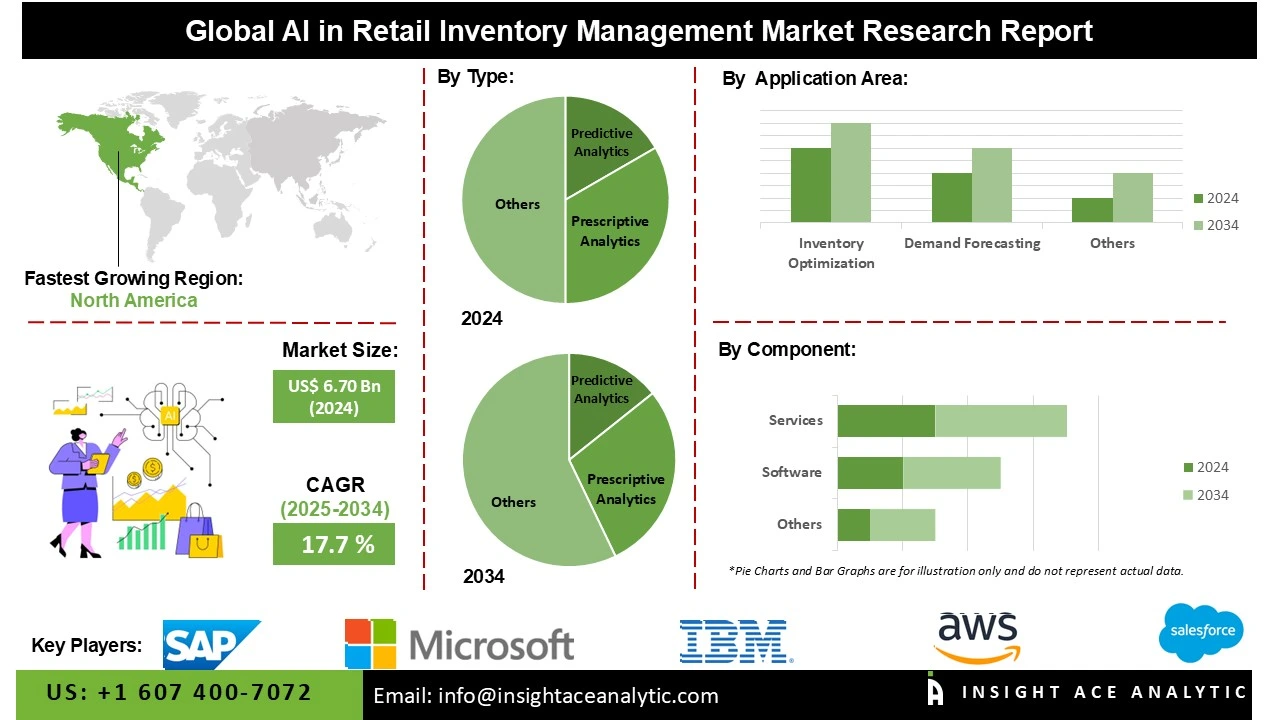

AI in Retail Inventory Management Market Size is valued at US$ 6.70 Bn in 2024 and is predicted to reach US$ 33.60 Bn by the year 2034 at an 17.7% CAGR during the forecast period for 2025-2034.

AI in Retail Inventory Management Market Size, Share & Trends Analysis Distribution by Type (Predictive Analytics, Prescriptive Analytics, Cognitive Analytics, Machine Learning, and Deep Learning), By Application (Inventory Optimization, Demand Forecasting, Stock Replenishment, Price & Promotion Management, and Supply Chain Planning), By Component (Software and Services), By Deployment (Cloud-Based and On-Premises), By Organization Size, By End-User Industry, By Technology, and Segment Forecasts, 2025-2034.

Artificial Intelligence (AI) is transforming retail inventory management by generating superior ordering recommendations and streamlining warehouse operations through deep analysis of sales trends. The core value of the market lies in delivering solutions that reduce operational costs, enhance customer satisfaction, and ensure consistent product availability. By leveraging AI-driven tools, retailers automate repetitive tasks, achieve unprecedented accuracy, and gain data-driven insights that facilitate strategic planning and expedite decision-making.

The global market for AI in retail inventory management is expanding, driven by the critical need for accurate demand forecasting, the minimization of costly stockouts, and the optimization of supply chain efficiency. This growth is further propelled by the intensifying focus on predictive accuracy and inventory reliability. A robust retail environment underpins this demand; for instance, the National Association of Convenience Stores reported in January 2024 that the number of convenience stores in the U.S. grew 1.5% to over 152,000, highlighting the scale of the potential market.

Despite this momentum, the sector's growth is tempered by challenges such as high implementation costs and complex integration with legacy systems. However, significant opportunities are emerging from the relentless expansion of e-commerce and continuous advancements in AI analytics, which are creating a fertile ground for innovative and scalable inventory management solutions.

Some of the Key Players in AI in Retail Inventory Management Market:

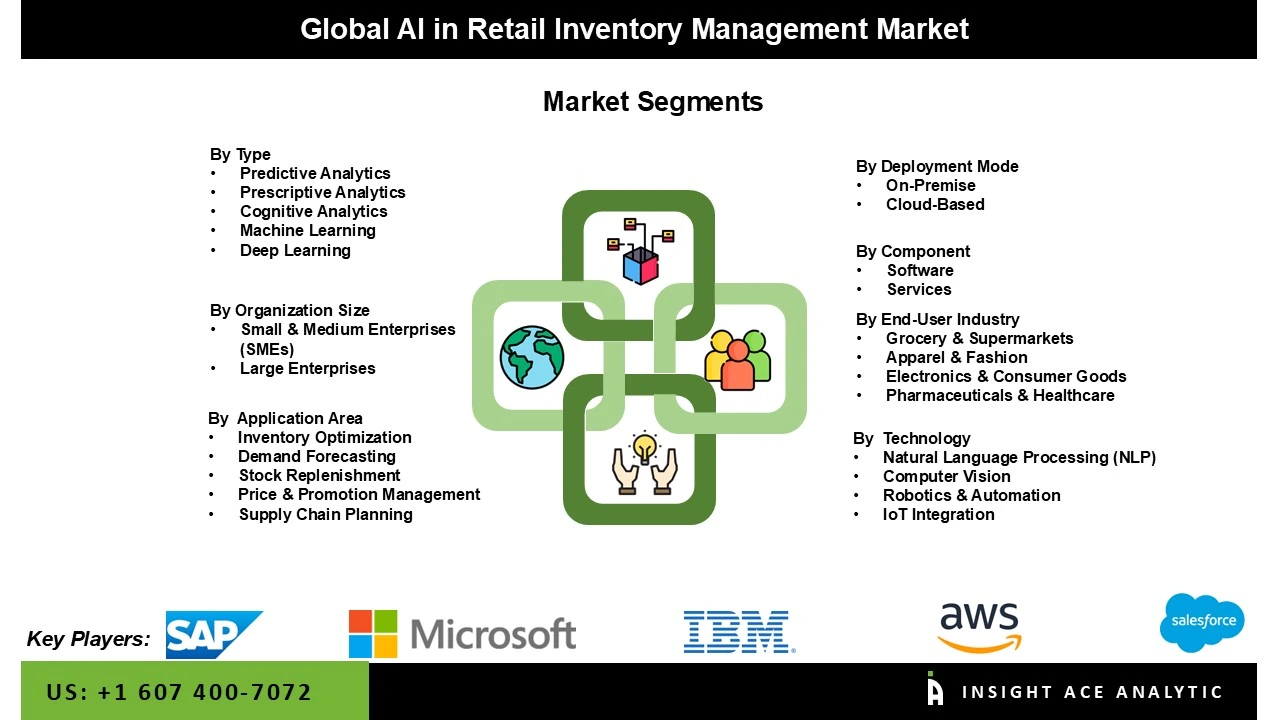

The AI in Retail Inventory Management market is segmented by Type, Application, Component, Deployment, Organization Size, End-User Industry, and Technology. By Type, the market is segmented into Predictive Analytics, Prescriptive Analytics, Cognitive Analytics, Machine Learning, and Deep Learning. By Application, the market is segmented into Inventory Optimization, Demand Forecasting, Stock Replenishment, Price & Promotion Management, and Supply Chain Planning. By Component, the market is segmented into Software and Services. By Deployment, the market is segmented into Cloud-Based and On-Premises. By Organization Size, the market is segmented into Small & Medium Enterprises (SMEs) and Large Enterprises. By End-User Industry, the market is segmented into Grocery & Supermarkets, Apparel & Fashion, Electronics & Consumer Goods, Pharmaceuticals & Healthcare. By Technology, the market is segmented into Natural Language Processing (NLP), Computer Vision, Robotics & Automation and IoT Integration.

The Predictive Analytics category led the AI in Retail Inventory Management market in 2024. This convergence is because it helps retailers better predict demand and prevent expensive stockouts or overstock situations. These solutions allow for more intelligent inventory planning and purchasing by examining past sales data, seasonal patterns, and consumer behavior. Predictive analytics is crucial for large companies like Amazon and Walmart to maximize facilities and stores. Its appeal stems from the fact that it is comparatively simpler to deploy than more complex forms of AI, and it yields a quantifiable and quick return on investment.

The largest and fastest-growing application is inventory optimization, a trend is because it directly addresses one of the main issues facing retailers—balancing stock levels. While too little inventory results in missed revenue, too much inventory ties up capital. AI facilitates real-time warehouse storage optimization, order adjustments, and demand prediction. There have been noticeable advantages for retailers like Target and Kroger, including decreased waste and quicker refilling. Inventory optimization is the preferred use case for AI adoption in retail due to its obvious financial benefit and simplicity in proving return on investment.

North America dominated the AI in Retail Inventory Management market in 2024. The United States is at the forefront of this expansion. This is due to its robust IT infrastructure and early adoption of AI-driven solutions, North America now owns the greatest share of the worldwide AI in retail inventory management market. To increase stock accuracy and customer satisfaction, big retailers like Walmart, Amazon, and Target make significant investments in automation and predictive analytics. The area has a significant advantage due to its sophisticated logistics networks, availability of cloud computing, and solid alliances with AI pioneers.

Due in large part to retailers' quick adoption of digital and automated technologies to meet the growing demand for e-commerce is common in the Asia-Pacific area, the AI in Retail Inventory Management market is expanding at the strongest and fastest rate in this region. Nations like China, India, and Japan are making significant investments in smart retail platforms and AI-driven logistics. Strong smartphone use, the region's growing middle class, and government encouragement of AI innovation are all contributing factors to this expansion.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 6.70 Bn |

| Revenue Forecast In 2034 | USD 33.60 Bn |

| Growth Rate CAGR | CAGR of 17.7% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, By Application, By Component, By Deployment, By Organization Size, By End-User Industry, By Technology, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Oracle, SAP, IBM, Microsoft, Salesforce, Amazon Web Services (AWS), Google (Google Cloud), Intel, Nvidia, Honeywell, Symphony, RetailAl, Blue Yonder, ToolsGroup, and RELEX Solutions |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

AI in Retail Inventory Management Market by Type-

· Predictive Analytics

· Prescriptive Analytics

· Cognitive Analytics

· Machine Learning

· Deep Learning

AI in Retail Inventory Management Market by Application-

· Inventory Optimization

· Demand Forecasting

· Stock Replenishment

· Price & Promotion Management

· Supply Chain Planning

AI in Retail Inventory Management Market by Component-

· Software

· Services

AI in Retail Inventory Management Market by Deployment-

· Cloud-Based

· On-Premises

AI in Retail Inventory Management Market by Organization Size-

· Small & Medium Enterprises (SMEs)

· Large Enterprises

AI in Retail Inventory Management Market by End-User Industry-

· Grocery & Supermarkets

· Apparel & Fashion

· Electronics & Consumer Goods

· Pharmaceuticals & Healthcare

AI in Retail Inventory Management Market by Technology-

· Natural Language Processing (NLP)

· Computer Vision

· Robotics & Automation

· IoT Integration

AI in Retail Inventory Management Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.