The Smart Grid Storage Technologies Market Size is predicted to develop with an 11.73% CAGR during the forecast period for 2024-2031.

Smart Grid Storage Technologies refer to various energy storage systems integrated into smart grids to enhance power distribution efficiency, reliability, and flexibility. These technologies store excess energy during periods of low demand and release it when needed, balancing supply and demand and supporting the integration of renewable energy sources. The primary uses of Smart Grid Storage Technologies include grid stability, where energy storage systems quickly respond to demand or supply fluctuations to prevent power outages and maintain stability. They also aid in renewable energy integration by storing excess energy from intermittent sources like solar and wind, thus increasing the clean energy share in the grid.

Key applications of Smart Grid Storage Technologies include residential, commercial, industrial, and utility scale uses. Residential systems store solar energy, reduce bills, and provide backup power. Commercial and industrial solutions manage energy consumption, reduce demand charges, and support demand response programs. Utilities use storage for grid operations, infrastructure deferral, and services like frequency regulation and voltage support. The market growth is driven by the increasing adoption of renewable energy sources and supported by government incentives and policies promoting energy storage technology deployment to meet clean energy targets.

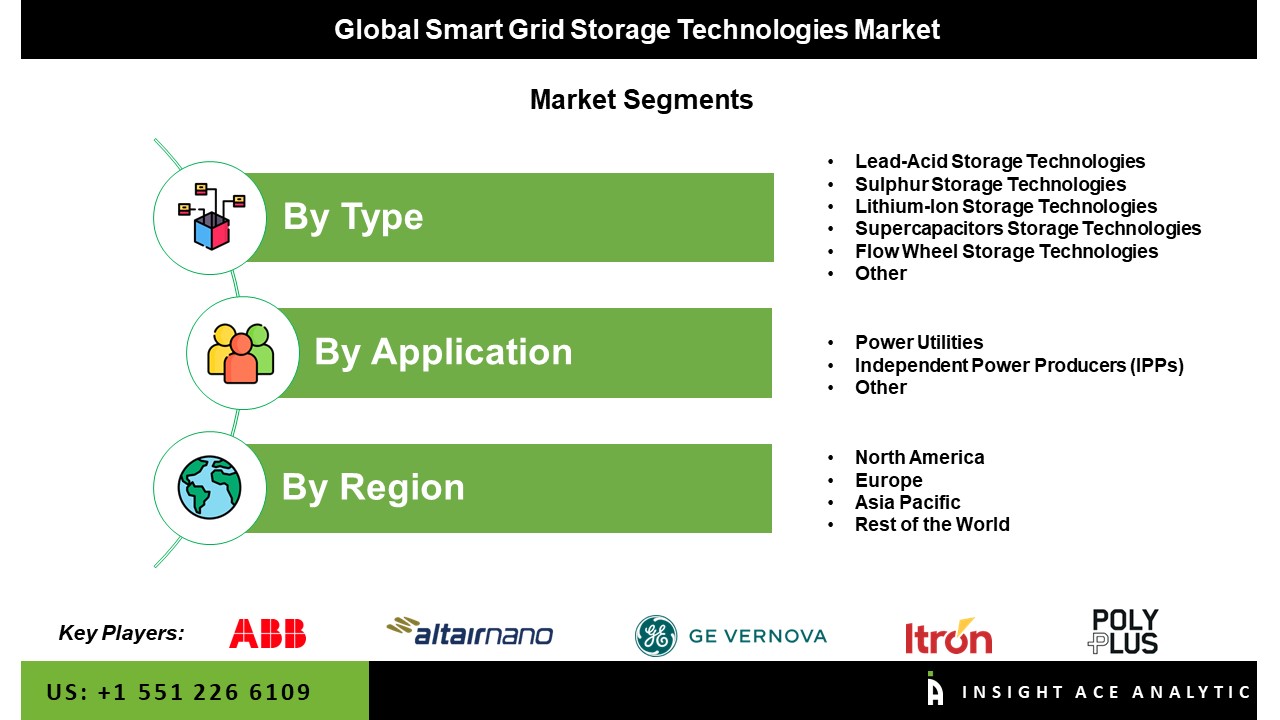

The Smart Grid Storage Technologies market is segmented by types and applications. By type the market is segmented into lead-acid storage technologies, sulphur storage technologies, lithium-ion storage technologies, supercapacitors storage technologies, flow wheel storage technologies, and others. By applications market is categorized into power utilities, independent power producers (IPPs), other.

Lithium-Ion Storage Technologies are significantly driving the Smart Grid Storage Technologies market due to their high energy density, efficiency, long cycle life, fast charging capabilities, and decreasing costs. Their compact size and efficiency make them ideal for residential and commercial energy storage, while their durability ensures cost-effectiveness over time. The rapid charging ability of lithium-ion batteries supports grid stability by providing immediate power during demand spikes or low renewable energy generation periods. As renewable energy use rises, lithium-ion batteries effectively store and release excess energy, facilitating renewable integration into the grid. Additionally, ongoing cost reductions due to technological advancements and increased manufacturing scale make lithium-ion batteries more accessible, further driving their adoption in smart grid systems.

Power utilities are increasingly adopting smart grid storage technologies to manage the intermittent nature of renewable energy sources like solar and wind, ensuring a stable power supply. These technologies enhance grid stability and resilience by managing energy supply and demand fluctuations, preventing outages, and maintaining consistent power delivery. Government policies and incentives further drive adoption by promoting renewable energy integration and energy storage investment to meet sustainability goals. Additionally, energy storage solutions enable cost savings through peak shaving and load leveling, reducing the need for additional generation capacity, lowering electricity costs, and improving operational efficiency by optimizing energy management and reducing transmission and distribution losses.

North America, especially the United States, is driving demand for smart grid storage technologies due to significant investments in renewable energy sources like solar and wind. Supportive government policies, including tax credits, grants, and Renewable Portfolio Standards (RPS), promote renewable energy integration and modernize the grid. The region's leading technology companies and research institutions continuously innovate in advanced energy storage technologies, particularly lithium-ion batteries, enhancing efficiency and reducing costs. Additionally, the growing demand for grid resilience in response to extreme weather events and natural disasters is pushing power utilities to invest in smart grid storage to ensure stable and reliable power supply during outages and peak demand periods.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 11.73 % from 2024 to 2031 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2024 to 2031 |

| Historic Year | 2019 to 2023 |

| Forecast Year | 2024-2031 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Types, Applications and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | ABB Ltd, Altairnano, Beacon Power, GE Energy Storage, Highview Power Storage, Ice Energy, Itron, PolyPlus Battery Company, Samsung SDI Energy, Schneider Electric, Siemens, Sumitomo, Xtreme Power, AES Corporation, Tesla, Inc., Saft Groupe S.A., LG Chem Ltd., BYD Company Limited |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Smart Grid Storage Technologies Market by Types -

Smart Grid Storage Technologies Market by Applications -

Smart Grid Storage Technologies Market by Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.