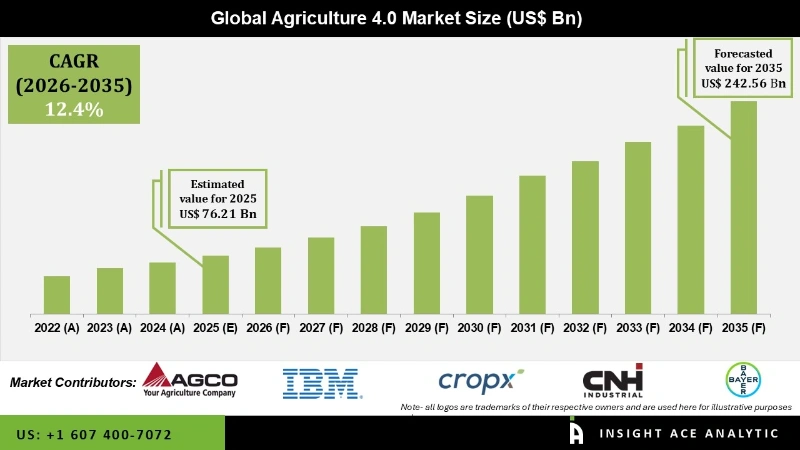

Global Agriculture 4.0 Market Size is valued at USD 76.21 Bn in 2025 and is predicted to reach USD 242.56 Bn by the year 2035 at a 12.4% CAGR during the forecast period for 2026 to 2035.

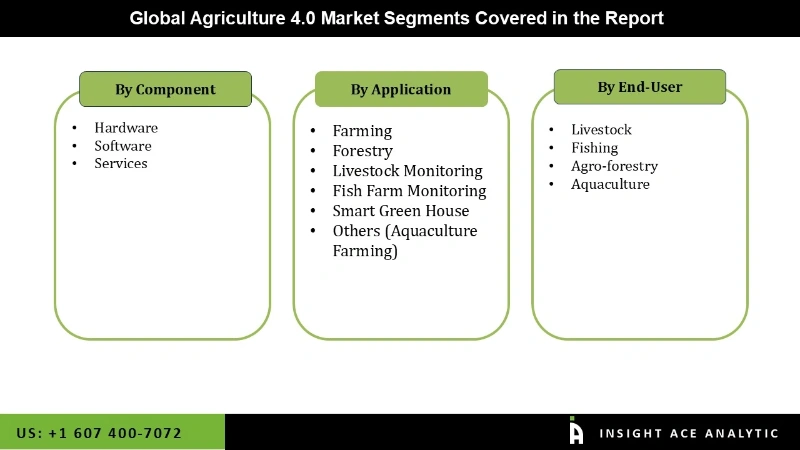

Agriculture 4.0 Market Size, Share & Trends Analysis Report By Component ( Hardware ( Livestock Monitoring Hardware, Agriculture Hardware, Forestry Hardware, Fish Farm Hardware, Greenhouse Farming Hardware ) Software, Services ) By Application ( Farming, Forestry, Livestock Monitoring, Fish Farm Monitoring, Smart Green House, Others (Aquaculture Farming), by Region, And by Segment Forecasts, 2026 to 2035.

A revolutionary shift in farming is being represented by Agriculture 4.0, which incorporates cutting-edge technologies such as artificial intelligence (AI), the Internet of Things (IoT), big data, automation, and robotics. This shift will improve efficiency, sustainability, and production. Utilizing precision equipment such as drones, IoT-enabled sensors, and autonomous machinery, this smart farming strategy optimizes resource utilization, minimizes waste, and enhances yields.

The market's growth is primarily driven by the increasing demand for high-quality food products among the population, the steadily declining availability of arable land, and the impact of flooding. The UN FAO projects that by 2050, there will be 9.1 billion people on the planet, which is almost 34% more people than there are now. Consequently, food production needs to rise by 70% in order to feed this growing population. Additionally, the market will be driven in the upcoming years by numerous government initiatives to promote modern farming methods, such as the use of robots in farming, as well as the introduction of cutting-edge technologies, including blockchain, drones, and big data, throughout the agricultural sector in crop production.

Furthermore, other significant variables that are anticipated to support market expansion include rising investments in agricultural technology, the growing popularity of greenhouses and indoor farming, and the decline in agricultural output resulting from droughts and floods. Therefore, it is projected that the demand for Agriculture 4.0 will increase dramatically, leading to a surge in the global market and generating profits for industry leaders in the years to come.

Some Major Key Players In The Agriculture 4.0 Market:

The Agriculture 4.0 market is segmented based on component, application, indication, and end-user. As per the component, the market is segmented into Hardware [Livestock Monitoring Hardware (RFID Tags and Readers, Sensors, Control Systems, GPS, Others (Drones)), Forestry Hardware (Harvesters & Forwarders, UAVs/ Drones, GPS, Cameras, RFID and Sensors, Variable Rate Controllers, Others), Agriculture Hardware (Automation and Control Systems, Sensing and Monitoring Devices), Fish Farm Hardware (GPS/ GNSS, Sensors, Others), Greenhouse Farming Hardware (Combined Heat and Power Systems (CHPs), Cooling Systems, Automated Irrigation Systems, pH Sensors)], Software, and Services. By application, the market is segmented into Farming (Crop Health Assessment, Crop Monitoring and Spraying, Planting, Soil and Field Analysis, Field Mapping, Weather Tracking and Forecasting, Irrigation Management, Inventory Management, Farm Labor Management, Financial Management), Livestock Monitoring (Heat Stress & Fertility Management, Milk Harvesting Management, Feeding Management, Animal Health & Comfort Management, Behavior Monitoring Management, Others), Forestry (Genetics and Nurseries, Silviculture and Fire Management, Harvesting Management, Inventory and Logistics Management), Fish Farm Monitoring (Tracking and Fleet Navigation, Feeding Management, Water Quality Management, Others), Smart Green House (HVAC Management, Yield Monitoring, Water and Fertilizer Management, Lighting Management), and Others (Aquaculture Farming). By end-user, the market is segmented into Livestock, Fishing, Agro-forestry, and Aquaculture.

The hardware category is expected to hold a major global market share in 2024. The hardware category includes a range of tools and apparatus utilized in agriculture 4.0, such as sensors, drones, automated equipment, and Internet of Things devices. These technologies conduct jobs, gather data, and keep an eye on circumstances to improve farming efficiency. The demand for sophisticated hardware solutions that allow for real-time monitoring and automation of farming activities is being driven by the growing requirement for precision agriculture. Additionally, farmers may now more easily access these instruments, allowing for their widespread adoption, thanks to improvements in sensor technology and the declining costs of drones and IoT devices.

The main application area for agriculture 4.0 technologies is farming, where they are used for yield optimization, crop monitoring, and precision agriculture. By combining sensors, IoT devices, and AI-driven analytics, farmers can collect data on crop performance, weather, and soil health in real-time, which helps them make better decisions. The growing need for food around the world pushes farmers to use precision farming methods in order to increase yields while using the fewest resources possible. Technological developments also make farming solutions more accessible.

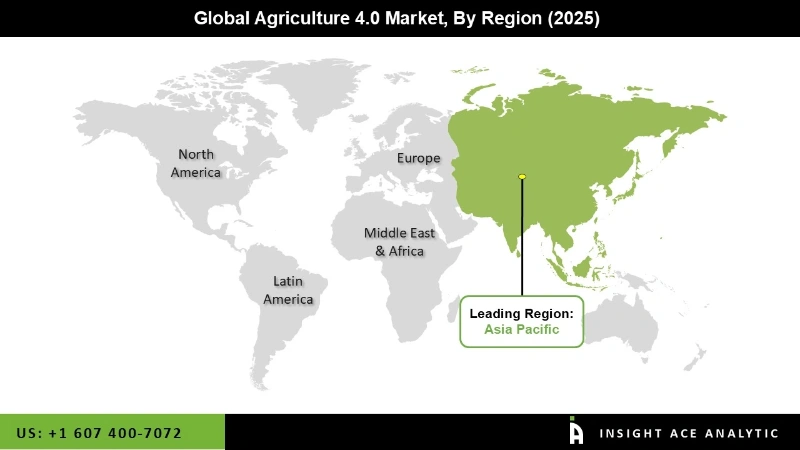

Asia Pacific Agriculture 4.0 market is expected to register the highest market share in revenue in the near future. The primary driver of its domination is its sizable population and the resulting need for more food production. Additionally, the demand for improved agricultural technologies is being driven by a large agricultural sector, a fast-expanding population, and rising urbanization. China and India are leading the way in implementing agriculture 4.0 solutions due to their vast agricultural land areas and varied farming methods. In addition, North America is projected to grow rapidly in the global Agriculture 4.0 market. The region is encouraging the adoption of creative solutions because of its concentration on sustainable agriculture and sophisticated technology skills. Leading the way in the adoption of robotics, smart farming, and precision agriculture in their agricultural sectors are nations like the. A conducive environment for the development of Agriculture 4.0 technologies is being created by the region's robust infrastructure for research and development, as well as encouraging government regulations.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 76.21 Bn |

| Revenue Forecast In 2035 | USD 242.56 Bn |

| Growth Rate CAGR | CAGR of 12.4% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Component, Application, Indication, And End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | AGCO Corporation, Kubota Corporation, Saga Robotics AS, Syngenta Crop Protection AG, Bayer AG, Deere & Company, IBM, CNH Industrial, Corteva Agriscience, CropX inc., Trimble Inc., and Yara International |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Segmentation of Agriculture 4.0 Market-

Agriculture 4.0 Market By Component-

Agriculture 4.0 Market By Application-

Agriculture 4.0 Market By End-User-

Agriculture 4.0 Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.