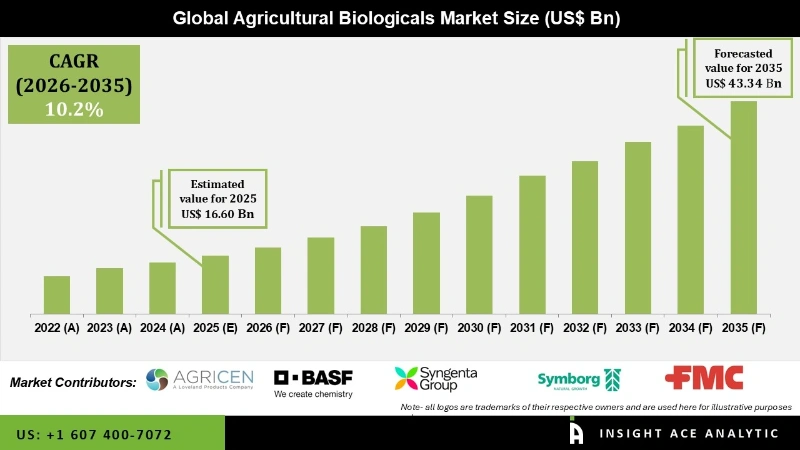

The Agricultural Biologicals Market Size is valued at USD 16.60 Bn in 2025 and is predicted to reach USD 43.34 Bn by the year 2035 at an 10.2% CAGR during the forecast period for 2026 to 2035.

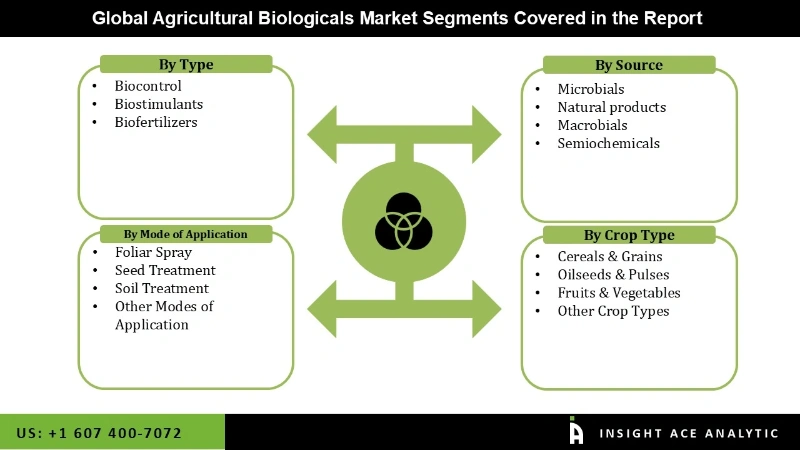

Agricultural Biologicals Market, Share & Trends Analysis Report, By Type (Biocontrol, Biostimulants, Biofertilizers), By Source (Microbials, Macrobials, Semiochemicals, Natural Products), Mode of Application (Foliar Spray, Seed Treatment, Soil Treatment), By Crop Type, By Region, and Segment Forecasts, 2026 to 2035.

The development of biological crop protection marks a significant step forward in advancing sustainable agriculture. Biologicals not only preserve and protect plant health but also help farmers meet society's growing demand for more sustainably produced food. These crop protection and seed treatment products, derived from living organisms, are referred to as biological controls in agriculture. Examples include beneficial nematodes that protect plants from insect pests and bacteria that defend against plant infections. Biologicals can be used alongside or as alternatives to traditional chemical crop protection methods, offering a more environmentally friendly approach to farming.

In 2020, the European Union (EU) implemented several laws aimed at reducing the global carbon footprint by 50%, focusing on limiting the use of chemical fertilizers and pesticides. Similarly, Japan's Ministry of Agriculture, Forestry and Fisheries (MAFF) introduced the Green Food System Strategy in August 2021, promoting the use of biostimulants and biopesticides. The global push for organic food production through sustainable farming practices is set to drive the growth of the agricultural biologicals industry. Agricultural biologics, such as biopesticides, biofertilizers, and biostimulants, are designed to reduce reliance on traditional chemical inputs. These biologics are fundamental to organic farming and sustainable agriculture, key components of the shift toward producing organic food. With growing consumer demand for sustainable farming practices and an expanding global population, the agricultural biologicals market is expected to experience significant growth in the coming years.

The Agricultural Biologicals Market is segmented based on the type, source, mode of application, and crop type. Based on the type, the market is divided into biocontrol, biostimulants, and biofertilizers. Based on the mode of application, the market is segmented into foliar spray, seed treatment, and soil treatment. Based on the source, the market is categorized into microbial, microbial, semiochemical, and natural products. Based on the crop type, the market is segmented into cereals & grains, oilseeds & pulses, fruits & vegetables, and other crop types.

Based on the type, the market is divided into biocontrol, biostimulants, and biofertilizers. Among these, the biocontrol segment tends to dominate the agricultural biologicals market. Biocontrol products, which include biopesticides derived from natural organisms such as bacteria, fungi, and beneficial insects, are widely used due to their effectiveness in pest and disease management, offering an environmentally friendly alternative to chemical pesticides. The increasing regulatory pressures to reduce synthetic pesticide usage, along with the growing demand for organic and sustainable agricultural practices, have contributed significantly to the expansion of the biocontrol market. This segment's dominance is expected to continue, driven by consumer preferences for chemical-free produce and the need for sustainable crop protection solutions. However, biostimulants and biofertilizers are also experiencing rapid growth, as they enhance plant health and soil fertility, complementing the role of biocontrol in holistic farming approaches.

Based on the source, the market is categorized into microbial, microbial, semiochemical, and natural products. Among these, Microbial, which include beneficial bacteria, fungi, and viruses, are widely used for pest control, disease management, and soil enhancement. Their versatility in both biocontrol and biofertilization makes them a key driver in the agricultural biologicals sector. Microbials are favored due to their effectiveness, ease of application, and regulatory support, as they are viewed as safer and more sustainable alternatives to traditional chemical inputs. Additionally, the market for microbial products is expanding rapidly as farmers seek environmentally friendly solutions that improve plant health and yield without causing harm to ecosystems.

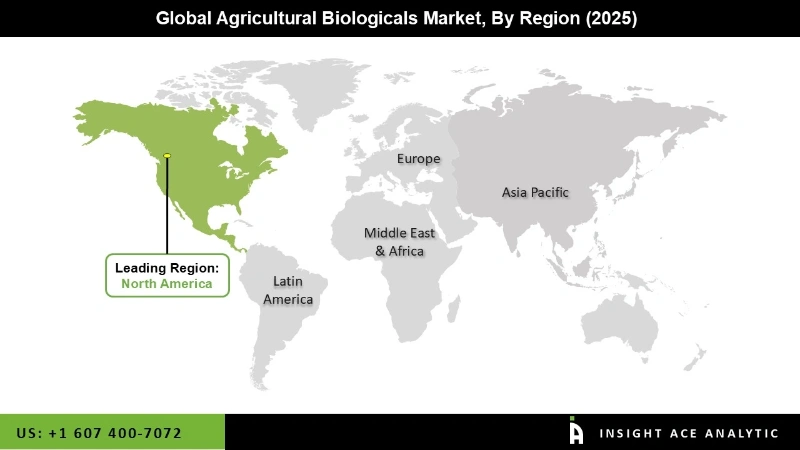

North American consumers are increasingly demanding sustainably produced food, driving the adoption of organic farming practices. Agricultural biologicals, such as biopesticides and biofertilizers, are integral to reducing the reliance on chemical inputs, which aligns with the shift toward organic and eco-friendly agriculture. The U.S. Environmental Protection Agency (EPA) and other regulatory bodies in North America have established favorable policies for the approval and use of biological products. These regulations promote the adoption of biologicals as safer alternatives to synthetic chemicals, providing a significant boost to market growth.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 16.60 Bn |

| Revenue Forecast In 2035 | USD 43.34 Bn |

| Growth Rate CAGR | CAGR of 10.2% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Type, Source, Mode of Application, Crop Type. |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Agricen, BASF SE , Syngenta Group , Symborg S.L., FMC Corporation , Corteva, CBF China Bio, Fertilizer AG, Bayer AG, UPL, Nufarm, National Fertilizers Ltd., Novozymes A/S, Lallemand Inc, Mosaic, Marrone Bio Innovations, Mapleton Agri, Biotec, PI Industries, Rovensa Next, Rizobacter, Argentina SA, Sumitomo Chemical Co., Ltd, SEIPASA, S.A., Koppert, Kiwa Bio-Tech Products Group Corporation, Gowan Company, Certis USA L.L.C., BIONEMA, Biobest Group NV, Verdesian Life Sciences, Bioceres Crop Solutions, Biotalys NV, Biomax, Sustainable Agro Solutions, S.A.U., STK Bio-AG, Vegalab SA, Andermatt Group AG, Zebra Medical Vision, Inc. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Global Agricultural Biologicals Market- By Type

Global Agricultural Biologicals Market – By Source

Global Agricultural Biologicals Market – By Mode of Application

Global Agricultural Biologicals Market – By Crop Type

Global Agricultural Biologicals Market – By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.