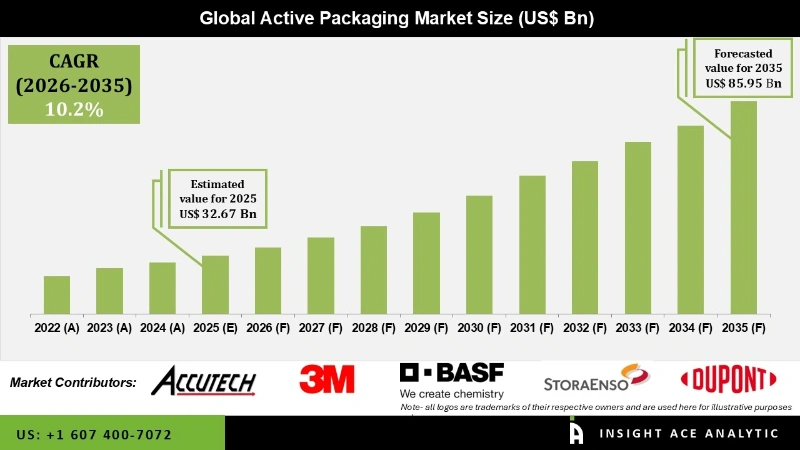

Global Active Packaging Market Size is valued at USD 32.67 Bn in 2025 and is predicted to reach USD 85.95 Bn by the year 2035 at a 10.20% CAGR during the forecast period for 2026 to 2035.

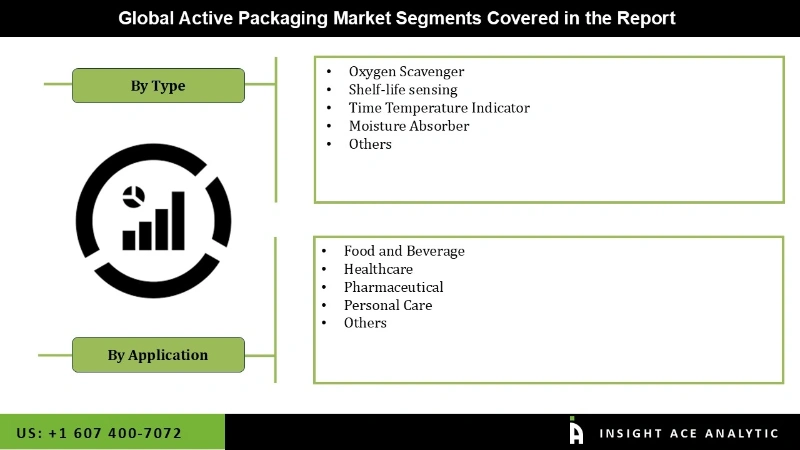

Active Packaging Market Size, Share & Trends Analysis Report By type (Oxygen Scavenger, Shelf-Life Sensing, Time Temperature Indicator, Moisture Absorber) And Application (Food And Beverage, Healthcare, Pharmaceutical, Personal Care), By Region, And Segment Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the Report:

A type of packaging called active packaging works to control the atmosphere inside the container and safeguard the goods from outside influences. It could be a products and services available type, an oxygen control type, or another type. The rising demand for food and healthcare items worldwide is crucial to this market's growth.

Active packaging is becoming more and more common in industrial items since it helps to increase life span and product quality. Food products are preserved and kept from rotting using active packaging, which is also utilized in the food business. However, the rising cost of adding active packaging elements, like sorbents, to food would likely restrain market growth over the forecast period. Since the lockdown restrictions imposed during the COVID outbreak were relaxed, there has been increased demand across internet platforms for food delivery. This element has enabled new revenues to join the global active packaging industry, together with advancements in package engineering. Because of rising urbanization, different socioeconomic, and increased disposable money, demand for packaged, frozen, and ready-to-eat meals has increased.

Increased consumption of fresh produce, meat, and frozen commodities due to expanding global trade patterns have resulted in a need for special packaging. Furthermore, an improved transportation network is projected to boost global trade, which is anticipated to be advantageous for the active packaging market expansion.

The active packaging market is segmented based on type and application. The market is segmented by type as an oxygen scavenger, shelf-life sensing, time temperature indicator, moisture absorber and others. By application, the market is segmented into food and beverage, healthcare, pharmaceutical, personal care and others.

The oxygen scavenger category will hold a major share of the global active packaging market in 2021. The primary use of oxygen scavengers, called oxygen absorbers, is to minimize or remove oxygen from various packages and the input water for steam boilers. It prevents degrading reactions caused by oxygen availability, improving the functionality of many products & processes. Oxygen scavengers used only for packaging are included in active packaging. The agricultural, beverage, and pharmaceutical industries typically utilize this packaging to respond to environmental changes. The oxygen scavenger technique aims to reduce the amount of oxygen that can result in proportional to the negative and to utilize fewer resources, such as food, metals, and pharmaceuticals.

The healthcare segment is projected to grow at a rapid rate in the global Active Packaging market. Active packaging is widely employed in the healthcare industry to preserve the product's integrity and freshness. By regulating the oxygen and moisture levels, the active packaging aids in the longer-term preservation of the product. Additionally, it prevents bacterial and fungal growth on the material. This preserves the product's authenticity and lessens the rate of product spoilage. Drugs, medical equipment, multivitamins, and items for personal hygiene are some of the popular healthcare products that use active packaging.

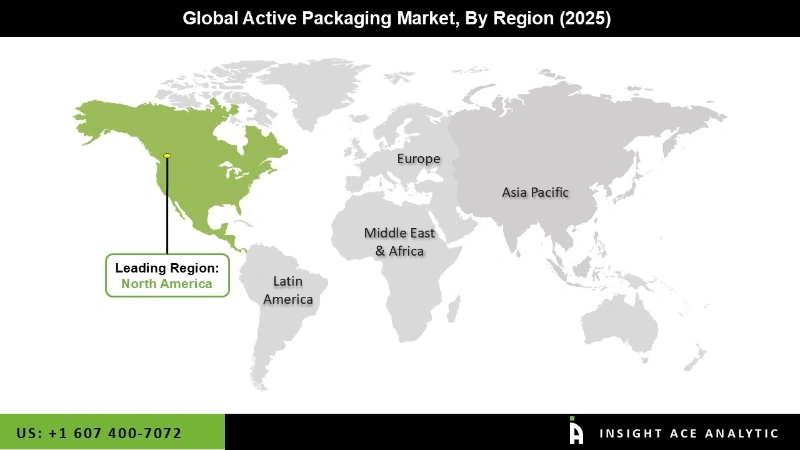

The North America active packaging market is expected to register the highest market share. Freezing, ready-to-eat, and canned foods are in more demand due to increased urban population and lifestyle changes. Another significant reason driving the market for active packaging in this region is the demand for exotic meat, flowers, and other edible frozen products worldwide.

In addition, Asia Pacific region is grow rapidly in the global active packaging market. The drivers propelling the expansion of this geographical category are changing lifestyles, growing demands for packaging solutions with extended sustainability, and rising demand for fresh & high-quality foods.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 32.67 Bn |

| Revenue forecast in 2035 | USD 85.95 Bn |

| Growth rate CAGR | CAGR of 10.20% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Bn, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Type And Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Avery Dennison, Amcor PLS,, American Thermal Instruments, Temptime Corporation, Smartrac N.V., BASF SE, Thin Film Electronics ASA, Stora Enso, International Paper, Emerson Electric Co., R.R. Donnelly & Sons (RRD) Company, Sealed Air Corporation and Smartglyph Ltd. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Active Packaging Market By Type:

Active Packaging Market By Application:

Active Packaging Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.