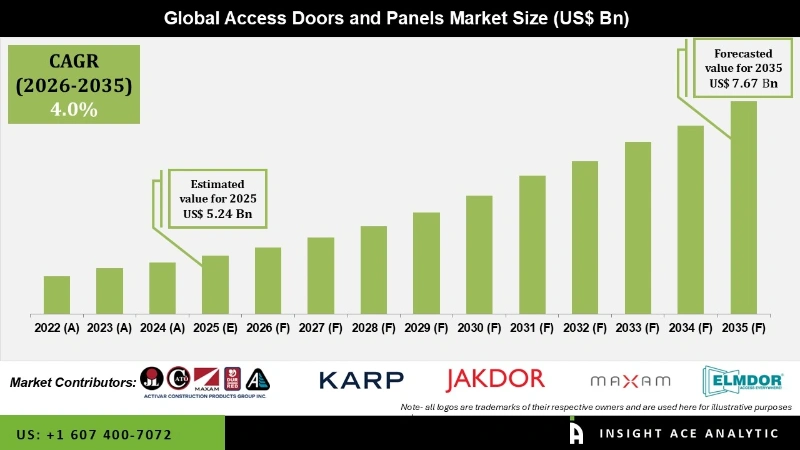

Global Access Doors and Panels Market Size is valued at USD 5.24 Bn in 2025 and is predicted to reach USD 7.67 Bn by the year 2035 at a 4.00% CAGR during the forecast period for 2026 to 2035.

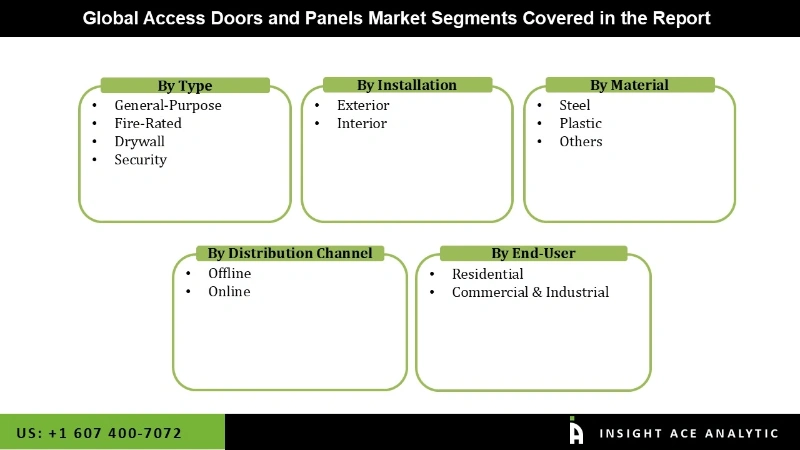

Access Doors and Panels Market Size, Share & Trends Analysis Report By Type (General-Purpose, Fire-Rated, Drywall, Security), By Installation (Exterior, Interior, By Material (Steel, Plastic), By End-user (Residential, Commercial & Industrial), By Distribution Channel (Offline, Online), By Region, And By Segment Forecasts, 2026 to 2035.

Access doors and panels are components in buildings that allow easy access to hidden areas, such as behind walls, ceilings, or floors, for maintenance, inspection, or repairs. They are used to access mechanical, electrical, and plumbing systems, and come in various types, including flush, recessed, fire-rated, and security doors.

Furthermore, there is a notable uptick in residential construction projects, particularly in the U.S., India, and China, where homeowners prioritize access doors and panels that blend seamlessly with architectural designs while maintaining aesthetic appeal. This emphasis on innovation aligns with the broader trend towards greater reliance on Internet of Things (IoT) technologies, facilitating the connectivity of smart doors. This advancement enables users to remotely monitor and manage access from diverse devices, thereby enhancing security infrastructure responsiveness and intelligence.

Additionally, economic conditions, such as fluctuations in inflation rates, currency values, and geopolitical developments, can profoundly influence the prices of essential raw materials used in manufacturing access doors and panels. The interconnected nature of global markets means that changes originating in one region can propagate, impacting material costs sourced from various parts of the world.

The market for access doors and panels is categorized into several key segments based on type, installation requirements, materials used, end-user applications, and distribution channels. In terms of type, the segments include General-Purpose doors, Fire-Rated doors, Drywall access panels, and Security doors. Based on Installation methods are divided into Exterior and Interior. Based on end users categorized into Residential and Commercial & Industrial sectors, Based on distribution channels encompass Offline and Online channels.

In 2023, the general-purpose segment held the largest market share. These access doors are designed to be versatile, serving a wide range of applications rather than being tailored to specific industries or functions. They are crafted to offer flexible solutions suitable for various use cases across commercial, industrial, institutional, and residential buildings. These general-purpose door panels are known for their ease of installation and compatibility with diverse construction environments. The renovation and retrofit market provides opportunities for access door and panel manufacturers as existing buildings undergo upgrades and enhancements.

During the forecast period, the steel segment emerged as the dominant force in the market. The demand for steel access doors is driven significantly by security considerations. Steel's inherent strength creates a sturdy barrier that enhances security in various environments, such as commercial, industrial, and institutional settings. As the market addresses the necessity for secure access solutions, steel doors are positioned as crucial elements in projects where safeguarding assets and restricted areas is paramount. Concurrently, the global demand for aluminium access doors and panels is fueled by a variety of market factors that highlight their distinctive properties and advantages. These lightweight and corrosion-resistant access solutions cater to diverse needs and contribute to their popularity in the market.

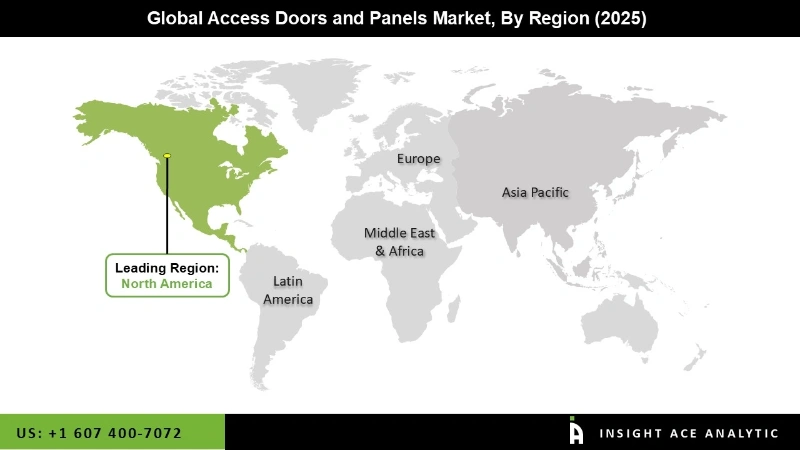

The North American access doors and the market is expected to register the highest market share in terms of revenue in the near future. The market is propelled by increasing installations in new buildings and heightened demand from door renovations and retrofit projects. Growth in the American construction sector is anticipated to be widespread, encompassing residential, non-residential, and civil engineering segments, spanning both new construction and renovation initiatives. This trend drives the expansion of the access doors and panels market in the region. Furthermore, the growth in the APAC region of the construction industry is bolstered by rising urban populations and ongoing renovation activities. Significant investments in infrastructure, particularly in Australia, China, Hong Kong, Japan, the Philippines, Singapore, Taiwan, Thailand, Myanmar, and Vietnam, highlight these countries as key potential markets for access doors and panels in the region.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 5.24 Bn |

| Revenue Forecast In 2035 | USD 7.67 Bn |

| Growth Rate CAGR | CAGR of 4.00% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, Installation Requirements, Materials Used, End-User Applications, And Distribution Channels. |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Activar Construction Products Group, Acudor Products, Elmdor, Karp Associates, Williams Brothers Corporation of America, Envisivent, Manthorpe, AirTech-UK, FlipFix, Steinberg14, Timloc, EUROPLAST and others. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Access Doors and Panels Market By Type

Access Doors and Panels Market By Installation

Access Doors and Panels Market By Material:

Access Doors and Panels Market By End-user

Access Doors and Panels Market By Distribution Channel

Access Doors and Panels Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.