The Global Bulk Metallic Glass Market Size is valued at 78.09 million in 2024 and is predicted to reach 456.97 million by the year 2034 at an 19.4% CAGR during the forecast period for 2025-2034.

Bulk metallic glasses (BMGs) have more exceptional mechanical characteristics, higher fracture toughness, higher elastic strain limit, decreased Elastic modulus, and are degradable without growing hydrogel. The increasing demand from ancillary sectors like electrical, electronics, and sports is anticipated to fuel the expansion of the bulk metallic glass market.

The industrialization of bulk metallic glass is being accelerated by increased research and development initiatives. From robust cell phones to personalized electronic gadgets like MP3 players and personal digital assistants, BMGs have found numerous widespread and diverse uses in the industry of electronics and electricity.The main factor driving the expansion of the entire industry is the increasing customer use of the electricity, amusement, and sports industries. Much promise exists for BMGs in biological disciplines, including sports medicine, cardiac, and even dental procedures and fillers.

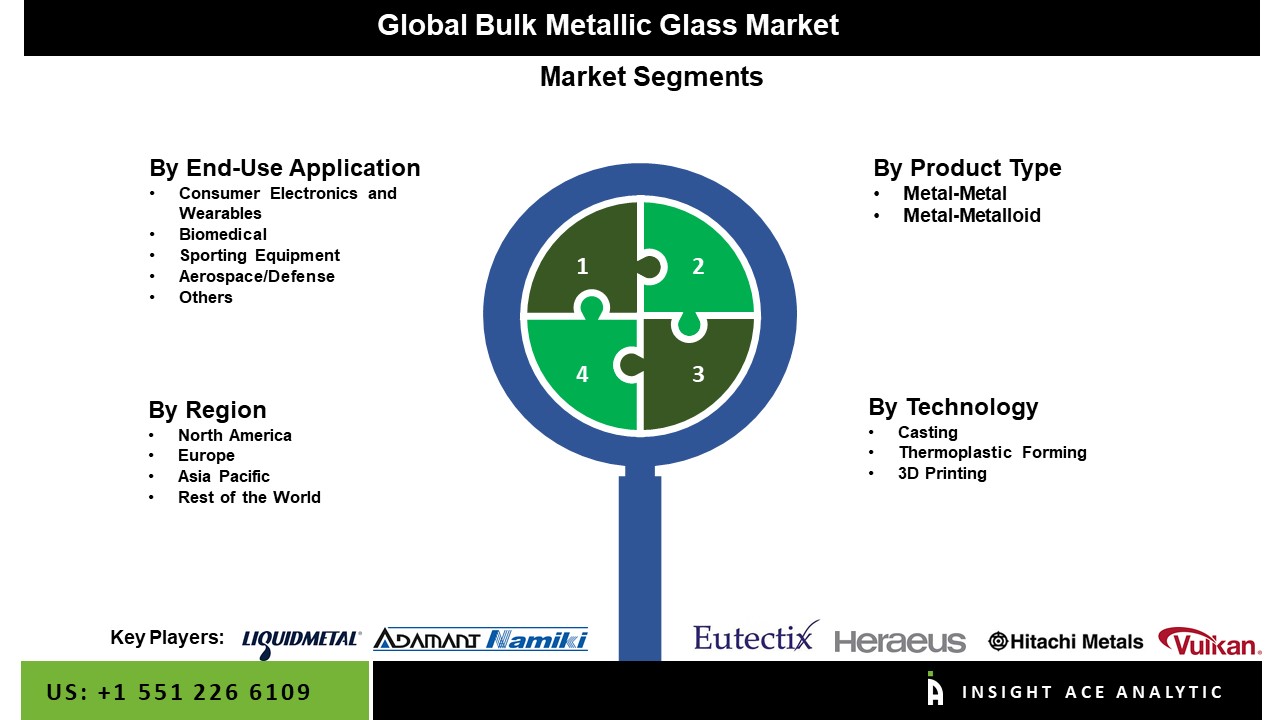

The bulk metallic glass market is segmented based on end users, products, and technology. Based on end users, the market is segmented as consumer electronics and wearables, biomedical, sporting equipment, aerospace/defense, etc. Based on product, the bulk metallic glass market is segmented as metal-metal and metal-metalloid. The market is segmented by technology into casting, thermoplastic forming and 3D printing.

The metal-metal category will hold a significant share of the global bulk metallic glass market in 2021. The metal-metal type often consists of a whole metal composition with additional metal content ranging from 9–10% to a significant amount, resulting in enhanced structural strength. The main driver propelling the metal-metal segment is growing utilization from ancillary industries, including electrical & electronics, sports, aircraft, etc. Material is now widely employed in producing electronics and parts because of advancements in circuitry and tooling. Manufacturers are increasingly incorporating metallic glass to provide efficiency and aesthetic advantages, creating an opportunity given the rising need for highly built and competent electronics.

The biomedical segment is projected to increase in the global bulk metallic glass market. The biomedical metal segment is growing significantly higher than the overall industry average, owing to the android market for orthopedic implants, cardiorespiratory implants, and others enjoying strong growth. Advances in nanomaterials significantly accelerate the progress of the therapeutic device sector., especially in countries such as the US, Germany, the UK, China, and India. [D2]

The North American bulk metallic glass market is expected to register the highest market share in revenue shortly. Manufacturers have extensively incorporated metallic glass to provide functionality and aesthetic advantage, creating an opportunity in this area due to the growing demand for highly built and capable electronics. In addition, Asia Pacific is projected to grow rapidly in the global bulk metallic glass market. China and Japan are some of the largest commercial centers for metallic glass in the Asia Pacific region. Government initiatives and policies and increased demand for electrical items have increased private and recognized players' expenditures.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 78.09 million |

| Revenue forecast in 2034 | USD 456.97 million |

| Growth rate CAGR | CAGR of 19.4% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Million, Volume in Tons and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | End-user, Products, Technology |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; Japan; Brazil; Mexico; The UK; France; Italy; Spain; Japan; India; South Korea; South East Asia |

| Competitive Landscape | Adamant Namiki Precision Jewel Co., Ltd., RS ACCIAI S.r.l., Vulkam, Heraeus Holdin, Eutectix LLC, Hitachi Metals, Ltd., Liquidmetal Technologies, Inc., Supercool Metal, Dongguan Yihao Metal Material Technology Co., Ltd., PX Grou, Glassimetal Technology, Inc, Exmet Amorphous Technology AB, Epson Atmix Corporation, Zhaojing Technology Co., Ltd and Qingdao Yunlu Advanced Materials Technology Co., Ltd. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Bulk metallic glass Market By End-Use Application

Bulk metallic glass Market By Product Type

Bulk metallic glass Market By Technology Type

Bulk metallic glass Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.