Global Wound Electrical Stimulation Devices Market Size is valued at US$ 209.9 Mn in 2024 and is predicted to reach US$ 443.8 Mn by the year 2034 at an 8.0% CAGR during the forecast period for 2025-2034.

Wearable sweat sensors are non-invasive patches or bands that analyze sweat in real-time to monitor health biomarkers like electrolytes, glucose, and hormones. They provide immediate insights into hydration, athletic performance, and medical conditions by wirelessly transmitting data to a smartphone.

The wound electrical stimulation devices market is experiencing significant growth, firstly driven by the increasing demand for non-invasive therapies. Patients and physicians are both resorting to pain-free therapies that reduce the risk of infection, promote faster recovery without surgery, and heal tissues faster. Electrical stimulation heals tissues faster, promotes circulation, reduces inflammation and is therefore the first choice for chronic wounds, burns, and ulcers. The rise in diabetic wounds and pressure ulcers also drives adoption. The demand for cost-effective, home-care solutions and the evolution of portable device technology also accelerate the rate at which the market expands globally.

The wound electrical stimulation devices market is expanding due to technological innovation in electrical stimulation improves the efficacy of treatments and patient outcomes. Modern devices are able to provide more accurate, adjustable currents, enhancing rates of wound healing for chronic ulcers, pressure sores, and post-operative wounds.

Compatibility with intelligent monitoring systems enables real-time feedback and improved treatment optimization. Miniaturization and portability increase ease of use in home healthcare, supporting compliance. In addition, advancements in electrode technology and wireless communication minimize discomfort and enhance user-friendliness, rendering electrical stimulation a more predictable, non-surgical alternative to traditional wound care therapy.

Some of the Key Players in the Wound Electrical Stimulation Devices Market:

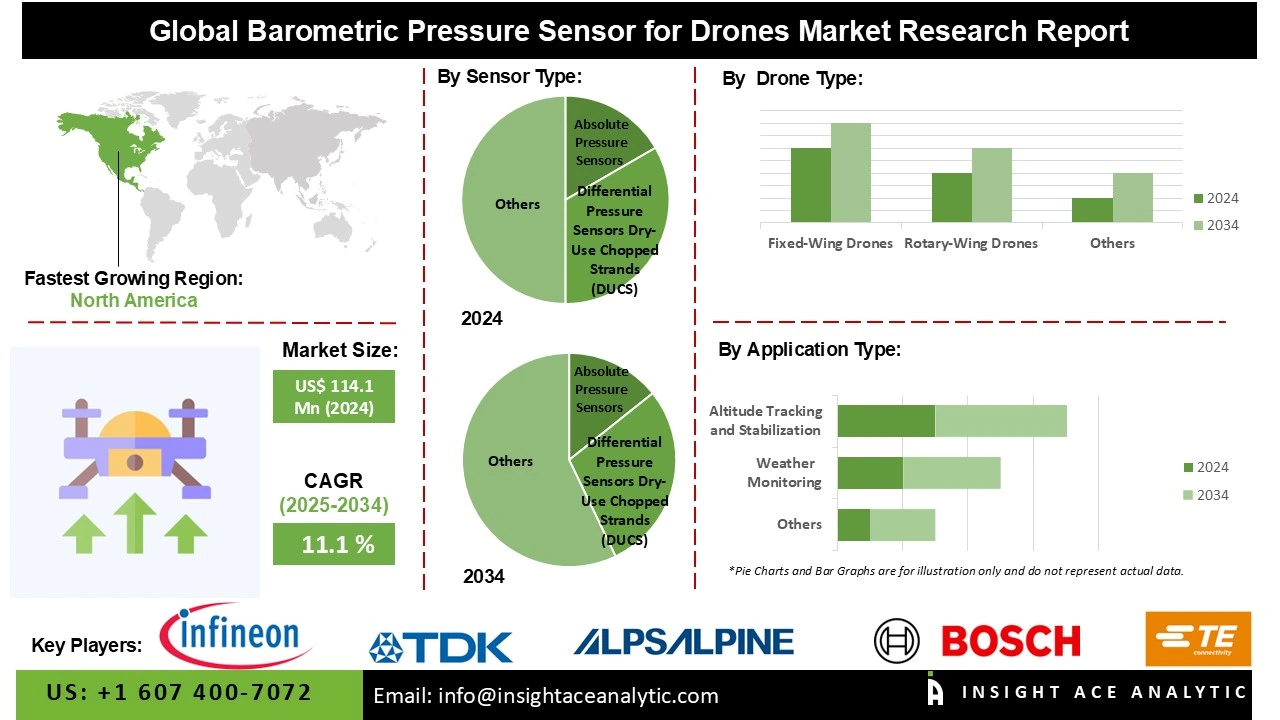

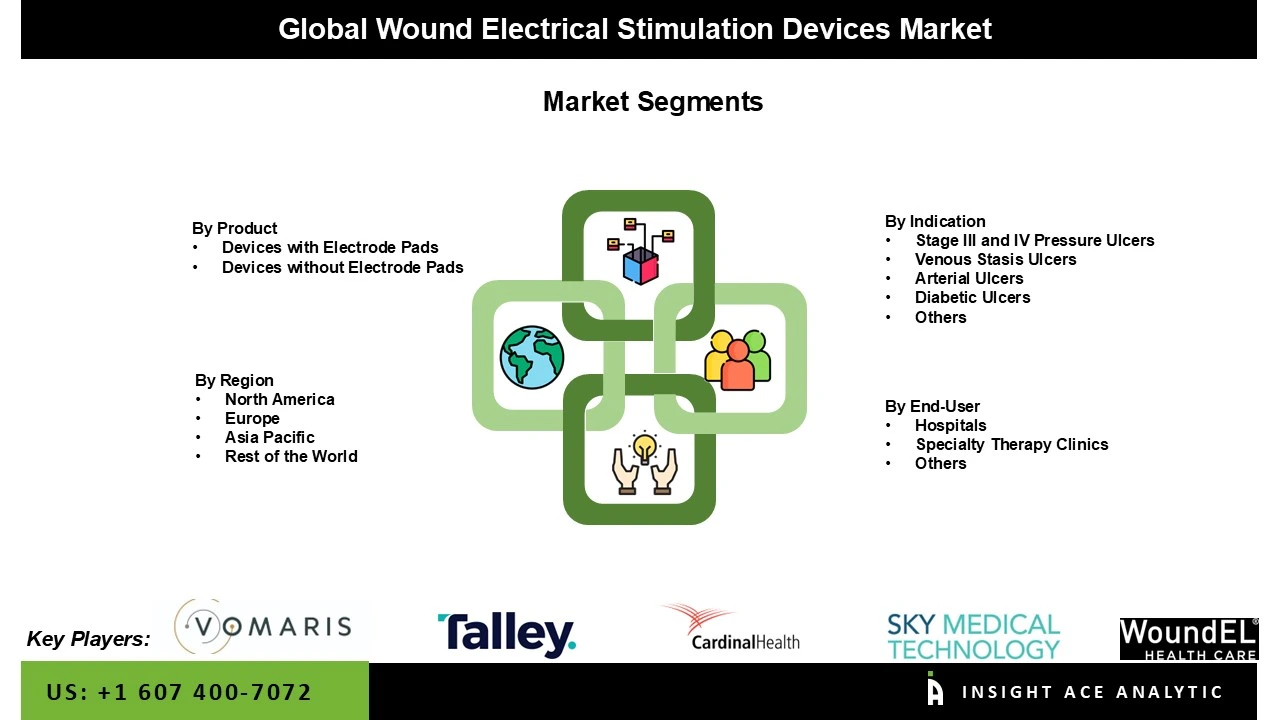

The wound electrical stimulation devices market is categorized through multiple segmentation criteria. These include product type (distinguished as devices with electrode pads and those without), clinical indication (covering stage III and IV pressure ulcers, venous stasis ulcers, arterial ulcers, and diabetic ulcers, among others), and end-user (primarily hospitals and specialty therapy clinics). Additionally, the market is analyzed geographically through regional segmentation.

In 2024, the devices with electrode pads segment held the major market share in the wound electrical stimulation devices market. This is due to the growing incidence of chronic wounds like pressure ulcers, diabetic foot ulcers, and venous leg ulcers. Electrode pad-based devices provide accurate electrical stimulation, increasing blood flow, stimulating cell migration, and speeding up wound healing. Increasing geriatric population, rising incidence of diabetes, and need for cost-effective, non-invasive therapies for wound management are major drivers. Portable, easy-to-use electrode pad device technology innovations further accelerate adoption in home care and clinical settings.

The wound electrical stimulation devices market is dominated by hospitals due to the rising demand for advanced wound care solutions. Hospitals are increasingly adopting these devices to treat chronic wounds such as pressure ulcers, diabetic foot ulcers, and venous leg ulcers, which are prevalent among ageing and diabetic populations. Electrical stimulation accelerates healing, reduces infection risks, and shortens hospital stays, making it a cost-effective option. Growing clinical evidence supporting efficacy and hospital investments in modern wound management technologies further drives adoption.

North America dominates the market for wound electrical stimulation devices due to the region’s rising prevalence of chronic wounds. The region’s high burden of diabetes and obesity increases demand for advanced wound care solutions. Growing awareness of faster healing benefits, supportive reimbursement policies, and technological advancements in electrotherapy devices further boost adoption. Additionally, the existence of strong healthcare infrastructure and increasing investments in innovative wound care technologies fuel market expansion.

In addition, Europe is the second-largest region in the market for wound electrical stimulation devices. This is attributed to actively increasing prevalence of chronic wounds, like pressure ulcers, diabetic foot ulcers, and venous leg ulcers, due to an aging population and rising diabetes cases. The growing need for cutting-edge, non-invasive therapies that accelerate wound healing and reduce infection risk supports adoption. Moreover, supportive reimbursement policies, strong clinical research, and rising investments in healthcare innovation encourage the use of electrical stimulation devices across hospitals and homecare settings.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 209.9 Mn |

| Revenue Forecast In 2034 | USD 443.8 Mn |

| Growth Rate CAGR | CAGR of 8.0% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Mn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product, By Indication, By End-User and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Accel-Heal Technologies Limited, Vomaris Innovations, Inc., WoundEL Health Care, Diapulse Corporation, Sky Medical Technology Ltd., Cardinal Health, Inc., Talley Group Limited, Convatec Limited, DeRoyal Industries, Inc., Devon Medical, Inc. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Wound Electrical Stimulation Devices Market by Product-

· Devices with Electrode Pads

· Devices without Electrode Pads

Wound Electrical Stimulation Devices Market by Indication -

· Stage III and IV Pressure Ulcers

· Venous Stasis Ulcers

· Arterial Ulcers

· Diabetic Ulcers

· Others

Wound Electrical Stimulation Devices Market by End-User-

· Hospitals

· Specialty Therapy Clinics

· Others

Wound Electrical Stimulation Devices Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.