Global White Spirit Market Size is valued at USD 7.6 Billion in 2024 and is predicted to reach USD 15.1 Billion by the year 2034 at an 7.2% CAGR during the forecast period for 2025-2034.

Key Industry Insights & Findings from the Report:

White spirit is water-insoluble and is used as a solvent, cleaning agent, degreaser, and solvent in aerosols, acrylics, surface coatings, coatings, and asphalt applications. The most popular solvent in the paint business is white spirit. Some elements, like the increased need for oil exploration, shifting demography, and improved global economic prospects, are projected to fuel the global white spirit market. The trend toward brand extension among consumers has helped producers enjoy higher profit margins and sales volumes.

In addition to successful marketing initiatives by businesses, the rising popularity of cocktail culture is supporting the trend toward premium products. Millennials have a pronounced shift in a preference for white spirit alcohol due to various flavours and additives. The need for oil drilling is anticipated to rise due to shifting demographics and an expected improvement in the global economy. Profitable opportunities will likely materialize shortly due to customers' growing desire for low-aromatic white spirits.

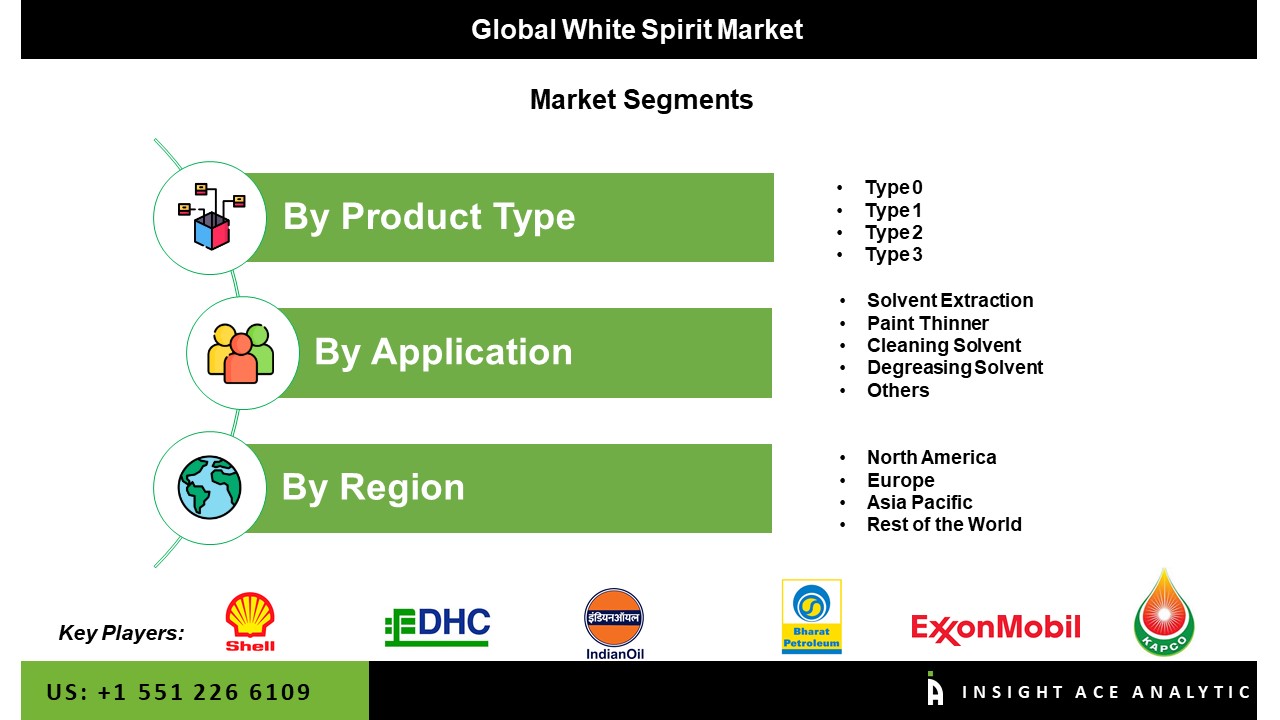

The white spirit market is segmented based on product and application. Based on product, the market is segmented as type 0, type 1, type 2, and type 3. By application, the market is segmented into solvent extraction, paint thinner, cleaning, degreasing, fuel, and disinfectant.

The type 1 category is expected to hold a major share of the global white spirit market in 2021. Type 1 white spirits are used in the petrochemical industry to remove sulfur from energy resources, and refined crude oil differs according to the type, which has a boiling range of 130-144 °C (266-291 °F).

The paint thinner segment is projected to grow rapidly in the global white spirit market. White spirits are used as diethyl ether, a paint thinner, and for cleansing brushes. Mineral spirits and white spirits are both utilized as solvents. Hence they are frequently employed in paint thinner applications. Following petroleum textile and plastisol inks, white spirits are frequently used in screen printing to clean and unclog screens. The inks used to create monoprints are also thinned using them. White spirits are frequently used in directions and gauges that contain liquid., especially in countries such as the US, Germany, the UK, China, and India.

The North America white spirit market is expected to register the highest market share in revenue shortly. Significant expansion of the North American paint and coatings market, particularly in the United States, resulted from rising demand from the automotive and transportation sectors. Population expansion, rapid urbanization, and increasing disposable incomes will significantly contribute to the industry's growth in the upcoming years. In addition, the Asia Pacific region is projected to grow rapidly in the global White Spirit market. The construction sector is rising in the area, boosting demand for painting and coatings, which is one of the main factors driving the economy's growth. The rise of the regional sector is expected to be heavily influenced by factors including increasing population, modernization, and disposable income growth in countries like China, India, and Thailand.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 7.6 Billion |

| Revenue forecast in 2034 | USD 15.1 Billion |

| Growth rate CAGR | CAGR of 7.2% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Mn, and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Product, Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Shell plc, Exxon Mobil Corporation, Bharat Petroleum Corporation Limited, Indian Oil Corporation Ltd., Neste, KAPCO Petroleum Industries FZC, DHC Solvent Chemic GmbH, Thai Oil Grou, TotalEnergies, Idemitsu Kosan Co., Ltd. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

White Spirit Market Product Type Outlook

White Spirit Market Application Outlook

White Spirit Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.