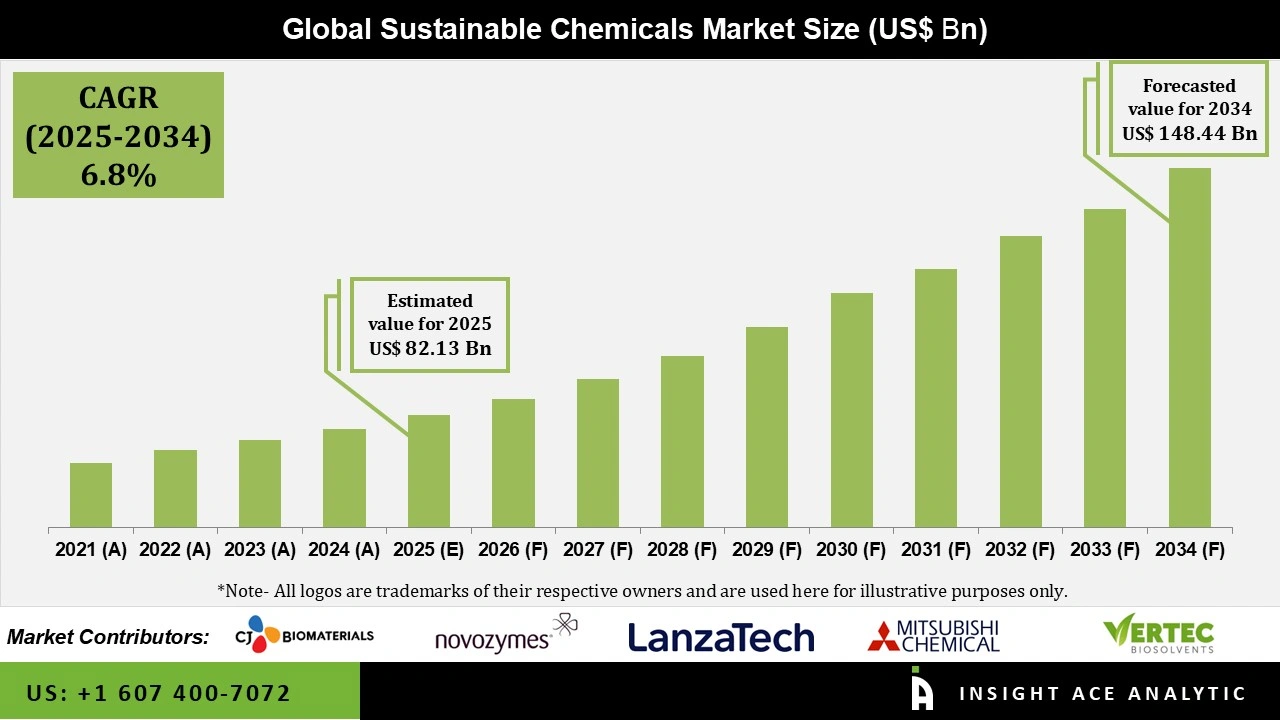

Sustainable Chemicals Market Size is valued at US$ 82.1 Bn in 2025 and is predicted to reach US$ 148.4 Bn by the year 2034 at an 6.8% CAGR during the forecast period for 2025-2034.

Sustainable chemicals are eco-friendly alternatives to traditional petroleum-based chemicals. They work just as well but create less pollution and waste. These chemicals are used in packaging, agriculture, textiles, electronics, and construction to make safer, greener products. They help create low-carbon manufacturing, cleaner detergents, and biodegradable plastics. Companies use them to reduce their environmental impact while keeping product quality high. The sustainable chemicals market is growing fast as businesses face pressure to cut carbon emissions and use safer materials.

The sustainable chemicals market is expanding rapidly due to strong global demand for greener products. Consumers want eco-friendly goods, and 78% prioritize sustainability when shopping. Major companies like BASF, Dow, and Unilever are investing billions to develop these chemicals. New technologies like bio-based ingredients and AI-designed formulas have cut production costs by 20-30%. Over 4,000 companies have pledged net-zero emissions, creating huge demand. This combination of consumer pressure, corporate commitments, and better technology drives double-digit market growth.

Government regulations are pushing the sustainable chemicals market forward. The EU's Eco-design Regulation (July 2024) requires products to be more durable, recyclable, and environmentally friendly. Similar rules in the US and China are creating global standards. However, complex regulations and supply chain tracking remain challenges. Opportunities are growing through green chemistry innovations like biorefineries and digital tracking systems. These solutions will help companies meet regulations, charge premium prices for green products, and grow the market toward $200+ billion by 2030.

Some of the Key Players in Sustainable Chemicals Market:

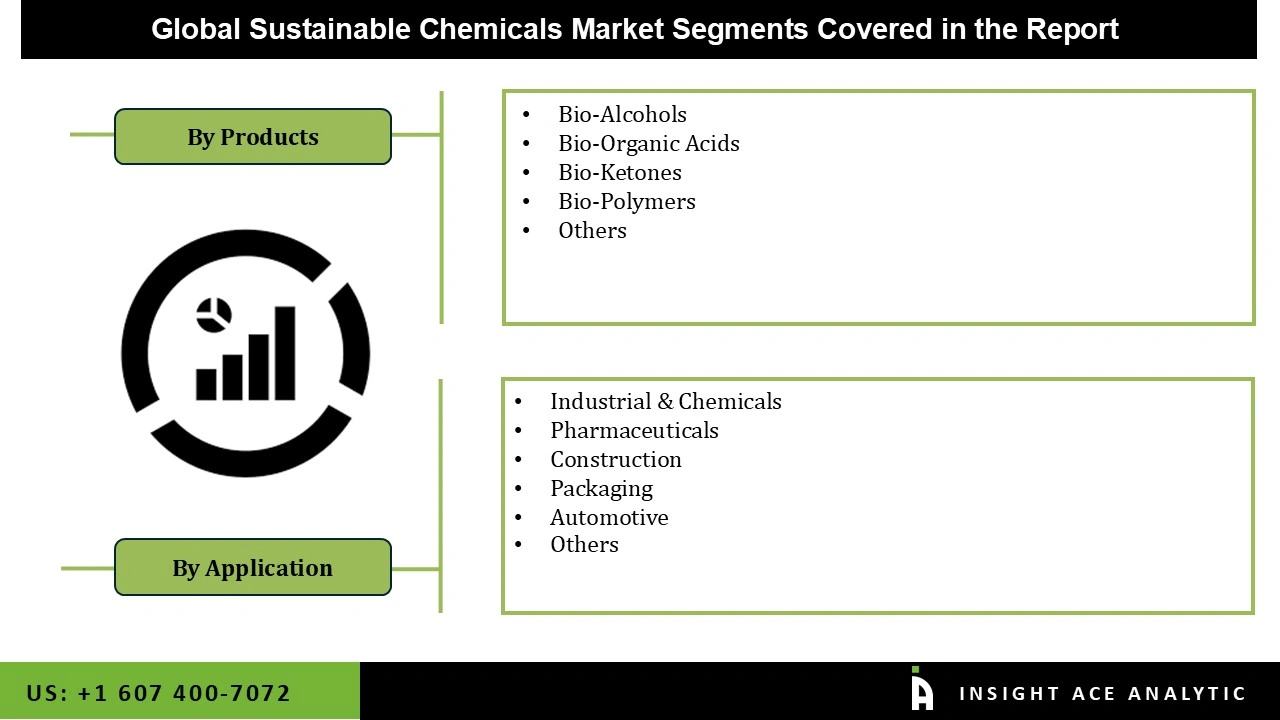

The sustainable chemicals market is segmented by products and application. By products, the market is segmented into bio-alcohols, bio-organic acids, bio-ketones, bio-polymers, and others. The segmentation by application consists of industrial & chemicals, pharmaceuticals, construction, packaging, automotive, and others.

The bio-alcohols category led the sustainable chemicals market in 2024. This convergence is fueled by large part to the increased demand for renewable and ecologically friendly chemical substitutes. These bio-alcohols significantly reduce carbon emissions when compared to petrochemical-based substitutes, aiding global efforts to reduce environmental impact. Their essential role in the shift to a more sustainable chemical industry is further reinforced by their innate adaptability as essential building blocks for a variety of sustainable products, such as bio-based solvents, as well as ongoing improvements in production processes.

The largest and fastest-growing application is industrial & chemicals, a trend is because manufacturers are under more pressure than ever to reduce waste, eliminate emissions, and replace hazardous materials in their production lines, the industrial & chemicals section of the sustainable chemicals market is expanding at the quickest rate. Because this industry consumes a lot of raw resources, even tiny changes to low-impact or bio-based chemicals have a significant positive influence on the environment. Businesses are also modernizing their procedures to satisfy international sustainability requirements and attract clients that care about the environment. The market for sustainable chemicals is growing rapidly as more businesses adopt circular practices, energy-efficient technologies, and cleaner formulations.

Europe led the sustainable chemicals market in 2024 thanks to strict rules and forward-thinking policies. The european green deal and chemicals strategy for sustainability aim to protect health and the environment while pushing for safer alternatives. The key is the REACH regulation, managed by ECHA, which forces companies to prove chemicals are safe and replace dangerous ones. Strong consumer demand for green products and big R&D investments speed up the move to a circular, toxin-free chemical industry.

The Asia-Pacific region is growing the fastest in sustainable chemicals, with the highest CAGR. Rapid industrialization, efforts to cut pollution, and higher environmental standards drive this boom. Governments enforce tougher laws and offer incentives for clean production. Abundant raw materials and heavy investment in bio-based tech further boost growth.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 82.1 Bn |

| Revenue Forecast In 2034 | USD 148.4 Bn |

| Growth Rate CAGR | CAGR of 6.8% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn, Volume (Tons) and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Products, By Application, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | CJ Biomaterials, Inc., Novozymes A/S, LanzaTech Global, Inc., Mitsubishi Chemical Corporation, TotalEnergies Corbion B.V., Vertec BioSolvents, Inc., GFBiochemicals Ltd., Eastman Chemical Company, Arkema Group, and Braskem SA |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Sustainable Chemicals Market by Products-

· Bio-Alcohols

· Bio-Organic Acids

· Bio-Ketones

· Bio-Polymers

· Others

Sustainable Chemicals Market by Application-

· Industrial & Chemicals

· Pharmaceuticals

· Construction

· Packaging

· Automotive

· Others

Sustainable Chemicals Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.