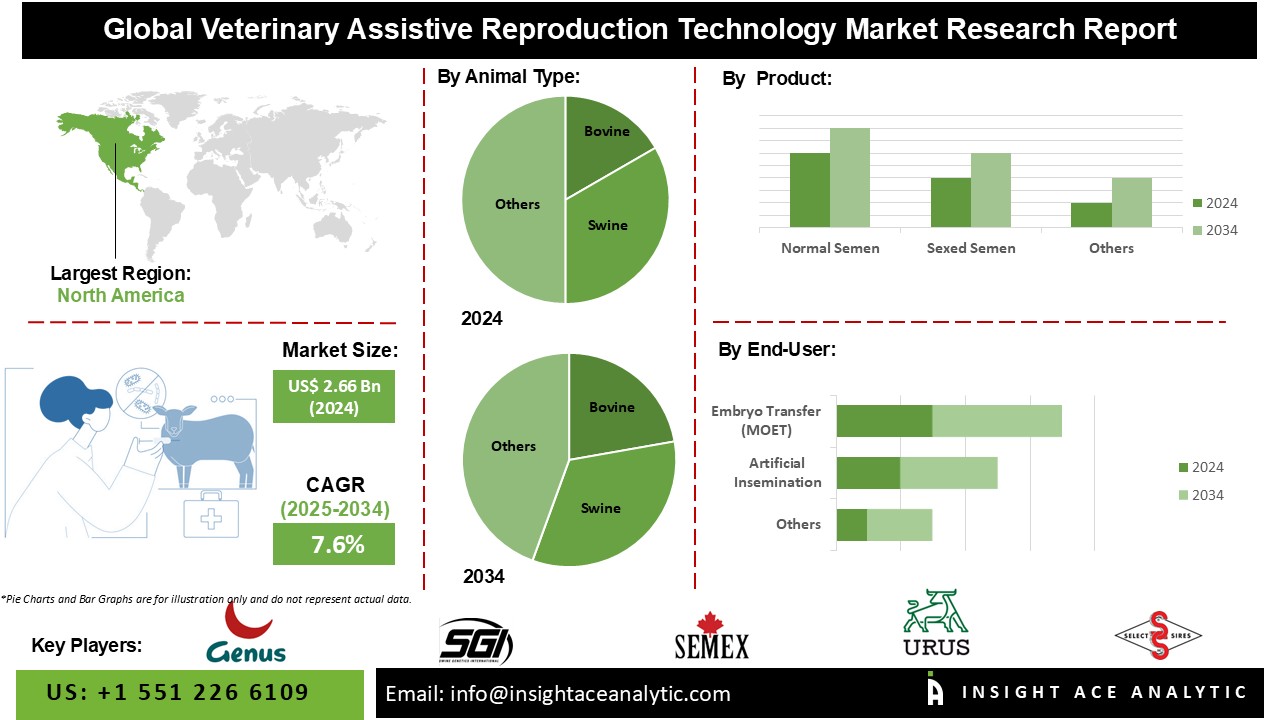

Veterinary Assistive Reproduction Technology Market Size is valued at USD 2.66 Bn in 2024 and is predicted to reach USD 5.48 Bn by the year 2034 at a 7.6% CAGR during the forecast period for 2025-2034.

Veterinary assistive reproduction technology (ART) refers to any method of treatment or procedure that alters the reproductive cycle, gametes, or embryos in some way. There have been multiple iterations of this technology designed for usage with pets. The demand for assisted reproductive treatments and products is increasing due to the rising existence of infertility among the population base, which is caused by various illnesses such as sexually transmitted infections, post-partum infections, infections after abortions, and medically iatrogenic infections. Furthermore, leading research and development initiatives aimed at improving assisted reproductive technology and substantial industry participants consistently investing in creating new, improved products are expected to boost the market's growth.

However, the market development is hampered by the high-cost criteria for the safety and health of the veterinary assistive reproduction technology market and the product's inability to prevent fog in environments with dramatic temperature fluctuations or high veterinary assistive reproduction technology, the relatively high cost of ART products, in comparison to traditional treatments, a barrier to their adoption in both developed and underdeveloped nations. The fact that insurance does not cover or reimburse these procedures is another barrier preventing the assisted reproductive technology business from growing. However, the government may initiate initiatives to enhance ART technology and technical progress to circumvent this problem. The COVID-19 epidemic hit the assisted reproductive technology industry hard because patients were afraid to travel for treatments and because of inherent safety issues. With the COVID-19 epidemic, businesses took a nosedive for medical centres focusing on in vitro fertilization. To maintain reproductive health standards, some groups have started to take action.

The veterinary assistive reproduction technology market is segmented based on animal type, product, distribution channel, and conception method. According to animal type, the market is segmented into bovine, swine, ovine, caprine, equine, and other animals. By product, the market is segmented into outlook normal semen and sexed semen. The distribution channel segment includes private and public. By conception method, the market is segmented into artificial insemination, IVF and embryo transfer (MOET).

The normal semen veterinary assistive reproduction technology market is expected to have a major global market share in 2022. Normal sperm is more affordable than sexed sperm, and the segment is very fertile. It captures a large portion of the market. Using frozen sperm, keeping bulls with high genetic value at sperm stations, and giving quality AI sperm doses all lead to better results.

The bovine industry makes up the bulk of veterinary assistive reproduction technology usage for several reasons, including efforts by both public and private entities to promote sustainable food production, advancements in bovine reproduction technology, increased demand for dairy and beef products, and other similar aspects, especially in countries like the US, Germany, the UK, China, and India.

The North American veterinary assistive reproduction technology market is expected to record the maximum market revenue share in the near future. It can be attributed to because of the rising prevalence of infertility and the increasing popularity of fertility treatments. The combination of technological advancements and rising disposable income in North America is expected to boost demand for fertility treatments, which is good news for the regional market. In addition, Asia Pacific is projected to grow rapidly in the global veterinary assistive reproduction technology market because of the large number of animals, increasing public understanding of assisted reproductive technologies, and encouraging governmental programs.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 2.66 Bn |

| Revenue Forecast In 2034 | USD 5.48 Bn |

| Growth Rate CAGR | CAGR of 7.6% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Animal Type, By Product, By Distribution Channel, By Conception Method |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Genus Plc, URUS Group LP, CRV, SEMEX, Select Sires, Inc., Swine Genetics International, National Dairy Development Board, STgenetics, VikingGenetics, Geno SA, Others |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Veterinary Assistive Reproduction Technology Market By Animal Type-

Veterinary Assistive Reproduction Technology Market By Product-

Veterinary Assistive Reproduction Technology Market By Distribution Channel-

Veterinary Assistive Reproduction Technology Market By Conception Method-

Veterinary Assistive Reproduction Technology Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.