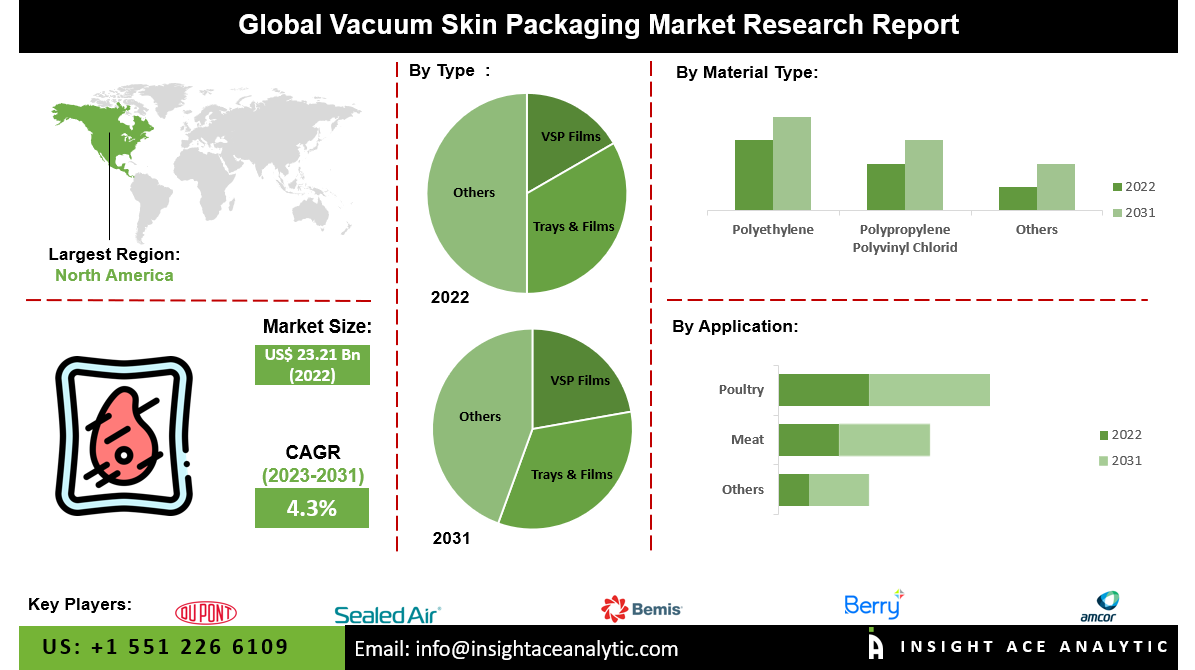

Vacuum Skin Packaging Market Size is valued at USD 23.21 Bn in 2022 and is predicted to reach USD 33.63 Bn by the year 2031 at a 4.3% CAGR during the forecast period for 2023-2031.

Key Industry Insights & Findings from the Report:

Vacuum skin packaging consists of a tray and a high-barrier film. When a package is vacuum sealed, any surplus air or moisture is sucked out before it is sealed. When applied to a product, the vacuum skin packaging film adheres to it like a second skin. The vacuum skin packaging keeps the goods fresh for a longer period by removing excess moisture. The need for vacuum skin packaging is predicted to rise in the coming years as a result of its many advantages, including its ability to prevent product spoilage, significantly enhance product presentation, result in minimal product loss, and maximize package efficiency. The rising need for food preservation methods, such as vacuum skin packaging, will likely drive the industry forward rapidly in the next years.

Furthermore, vacuum skin packaging provides an extra layer of protection compared to standard packaging methods, leading to its steady development in popularity. Market growth opportunities for vacuum skin packaging generated from renewable and natural sources have increased as society shifts toward more eco-friendly and sustainable materials. Over the course of the predicted time frame, the market should expand because of factors such as technological innovation, urbanization, industrialization, infrastructure development, and rising per capita income.

However, vacuum skin packaging is expected to slow down in the foreseen period due to the high cost of the machines and equipment used in the process and the rising availability of alternatives, such as blister packaging and shrink barrier packaging. The vacuum skin packaging business has benefited from the COVID-19 epidemic as the need for secure and dependable food and consumer goods packaging has increased significantly.

During the COVID-19 epidemic, consumers' trust in making purchases is most directly affected by packaging options and methods. As a result, a growing number of businesses are adopting vacuum skin packaging. The anticipated increase in demand for vacuum skin packaged products, particularly in the commercial sector, during the COVID-19 crisis is one of the main motives projected to fuel the growth of the vacuum skin packaging market.

The vacuum skin packaging market includes product type, material type and application. As per the product type, the market is segmented into VSP films, trays & films. The market is segmented by material type into polyethylene, polypropylene, polyvinyl chloride, and others. The application segment consists of meat, poultry, seafood, dairy products, ready meals, and others.

The polyethylene category is expected to hold a major global market share. Polyethylene's popularity is growing as a result of these desirable properties: low processing cost, robust elasticity, excellent clarity, improved sealability, high elongation, and high elongation. Composite films, including high-temperature cooking bags, tensile polypropylene, and others, often use polyethylene as the inner foundation material. Polyethylene is frequently utilized in producing zip lock bags, stretch films, and stock poly bags, among others, and is commonly regarded as a good material for food packaging. This is anticipated to boost its acceptance and, consequently, this market's revenue.

The meat segment is projected to grow rapidly in the global vacuum skin packaging market due to increased interest in extending the storage life of meat from poultry and multiple technological developments (including the advent of vacuum skin packing). Rapid urbanization, a growing population, and rising disposable expenditures, particularly in some developing nations, have made poultry the fastest-growing category, especially in countries like China, the US, Germany, the UK, and India.

The Asia Pacific vacuum skin packaging market is expected to record the maximum market share in revenue in the near future. It can be attributed to rising demand for packaged foods and the expansion of the pharmaceutical industry, two of the main factors fueling the expansion of the vacuum skin packaging market in this region. Environmental worries and sustainable development programs are being addressed alongside a burgeoning research and development sector in technology.

In addition, Europe is estimated to grow rapidly in the global vacuum skin packaging market because customers' disposable income has increased, and as a result, they are purchasing higher-grade meat, seafood, and poultry. Market expansion in this area will also be helped by rising consumer demand for protein-rich diets.

| Report Attribute | Specifications |

| Market Size Value In 2022 | USD 23.21 Bn |

| Revenue Forecast In 2031 | USD 33.63 Bn |

| Growth Rate CAGR | CAGR of 4.3% from 2023 to 2031 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2023 to 2031 |

| Historic Year | 2019 to 2022 |

| Forecast Year | 2023-2031 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product Type, Material Type, and By Application |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | DuPont, Amcor Limited, Sealed Air, Berry Global Inc., LINPAC Packaging Limited, Bemis Company Inc., G. Mondini SA, Green Packaging Material Co. Ltd., Plastopil Hazorea Company Ltd., Anuga FoodTec., and Others |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Vacuum Skin Packaging Market By Product Type -

Vacuum Skin Packaging Market By Material Type -

Vacuum Skin Packaging Market By Application -

Vacuum Skin Packaging Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

Chapter 2. Executive Summary

Chapter 3. Global Vacuum Skin Packaging Market Snapshot

Chapter 4. Global Vacuum Skin Packaging Market Variables, Trends & Scope

4.1. Market Segmentation & Scope

4.2. Drivers

4.3. Challenges

4.4. Trends

4.5. Investment and Funding Analysis

4.6. Industry Analysis – Porter’s Five Forces Analysis

4.7. Competitive Landscape & Market Share Analysis

4.8. Impact of Covid-19 Analysis

Chapter 5. Market Segmentation 1: By Type Estimates & Trend Analysis

5.1. By Type, & Market Share, 2020 & 2031

5.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2020 to 2031 for the following By Type:

5.2.1. VSP Films,

5.2.2. Trays & Films

Chapter 6. Market Segmentation 2: By Material Type Estimates & Trend Analysis

6.1. By Material Type & Market Share, 2020 & 2031

6.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2020 to 2031 for the following By Material Type:

6.2.1. Polyethylene,

6.2.2. Polypropylene,

6.2.3. Polyvinyl Chloride,

6.2.4. Others

Chapter 7. Market Segmentation 3: By Application Estimates & Trend Analysis

7.1. By Application & Market Share, 2020 & 2031

7.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2020 to 2031 for the following By Application:

7.2.1. Meat,

7.2.2. Poultry,

7.2.3. Seafood,

7.2.4. Dairy Products,

7.2.5. Ready Meals

7.2.6. Others

Chapter 8. Vacuum Skin Packaging Market Segmentation 4: Regional Estimates & Trend Analysis

8.1. North America

8.1.1. North America Vacuum Skin Packaging Market revenue (US$ Million) estimates and forecasts By Type, 2019-2031

8.1.2. North America Vacuum Skin Packaging Market revenue (US$ Million) estimates and forecasts By Material Type, 2019-2031

8.1.3. North America Vacuum Skin Packaging Market revenue (US$ Million) estimates and forecasts By Application, 2019-2031

8.1.4. North America Vacuum Skin Packaging Market revenue (US$ Million) estimates and forecasts by country, 2019-2031

8.2. Europe

8.2.1. Europe Vacuum Skin Packaging Market revenue (US$ Million) By Type, 2019-2031

8.2.2. Europe Vacuum Skin Packaging Market revenue (US$ Million) By Material Type, 2019-2031

8.2.3. Europe Vacuum Skin Packaging Market revenue (US$ Million) By Application, 2019-2031

8.2.4. Europe Vacuum Skin Packaging Market revenue (US$ Million) by country, 2019-2031

8.3. Asia Pacific

8.3.1. Asia Pacific Vacuum Skin Packaging Market revenue (US$ Million) By Type, 2019-2031

8.3.2. Asia Pacific Vacuum Skin Packaging Market revenue (US$ Million) By Material Type, 2019-2031

8.3.3. Asia Pacific Vacuum Skin Packaging Market revenue (US$ Million) By Application, 2019-2031

8.3.4. Asia Pacific Vacuum Skin Packaging Market revenue (US$ Million) by country, 2019-2031

8.4. Latin America

8.4.1. Latin America Vacuum Skin Packaging Market revenue (US$ Million) By Type, (US$ Million) 2019-2031

8.4.2. Latin America Vacuum Skin Packaging Market revenue (US$ Million) By Material Type, (US$ Million) 2019-2031

8.4.3. Latin America Vacuum Skin Packaging Market revenue (US$ Million) By Application, (US$ Million) 2019-2031

8.4.4. Latin America Vacuum Skin Packaging Market revenue (US$ Million) by country, 2019-2031

8.5. Middle East & Africa

8.5.1. Middle East & Africa Vacuum Skin Packaging Market revenue (US$ Million) By Type, (US$ Million) 2019-2031

8.5.2. Middle East & Africa Vacuum Skin Packaging Market revenue (US$ Million) By Material Type, (US$ Million) 2019-2031

8.5.3. Middle East & Africa Vacuum Skin Packaging Market revenue (US$ Million) By Application, (US$ Million) 2019-2031

8.5.4. Middle East & Africa Vacuum Skin Packaging Market revenue (US$ Million) by country, 2019-2031

Chapter 9. Competitive Landscape

9.1. Major Mergers and Acquisitions/Strategic Alliances

9.2. Company Profiles

9.2.1. DuPont

9.2.2. Amcor Limited

9.2.3. Sealed Air

9.2.4. Berry Global Inc.

9.2.5. LINPAC Packaging Limited

9.2.6. Bemis Company Inc.

9.2.7. G. Mondini SA

9.2.8. Green Packaging Material Co. Ltd.

9.2.9. Plastopil Hazorea Company Ltd.

9.2.10. Anuga FoodTec.