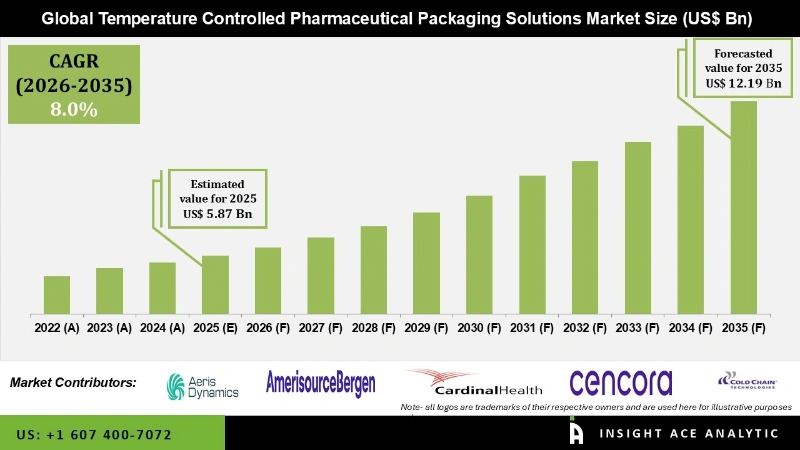

The Temperature Controlled Pharmaceutical Packaging Solutions Market Size is valued at USD 5.87 Bn in 2025 and is predicted to reach USD 12.19 Bn by the year 2035 at an 8.00% CAGR during the forecast period for 2026 to 2035.

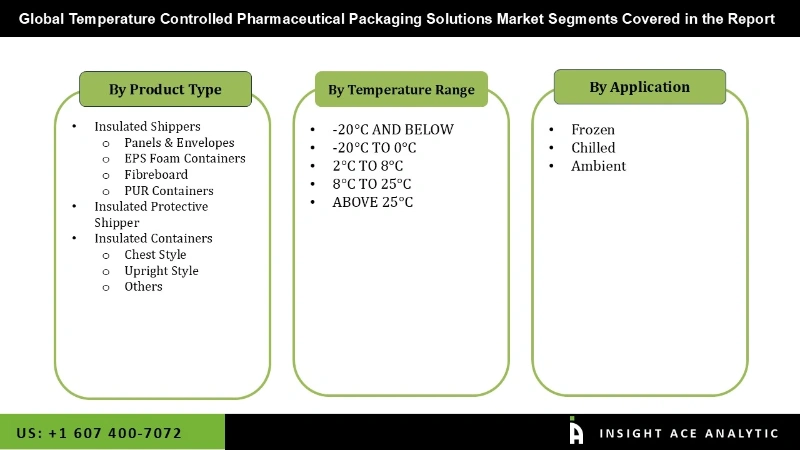

Temperature Controlled Pharmaceutical Packaging Solutions Market, Share & Trends Analysis Report By Product Type (Insulated Shippers (Panels & Envelopes, EPS Foam Containers, Fibreboard, PUR Containers) Insulated Protective Shippers, Insulated Containers (Chest Style, Upright Style)), By Application, By Region, and Segment Forecasts, 2026 to 2035.

Temperature Controlled Pharmaceutical Packaging Solutions refer to specialized packaging systems designed to maintain the required temperature range for pharmaceutical products during storage and transportation. These solutions are critical for preserving the integrity, efficacy, and safety of temperature-sensitive medications, such as vaccines, biologics, and other pharmaceutical products. They use materials with high thermal resistance to protect products from temperature fluctuations and active temperature control systems like refrigerated containers or coolers to provide a constant temperature. Electronic systems provide precise temperature control through refrigeration or heating mechanisms. These packaging solutions are essential for ensuring that pharmaceuticals remain effective from the point of manufacture to the end user, particularly in global distribution where products may encounter varying climatic conditions.

The market for temperature-controlled packaging solutions is expanding significantly due to increased demand from the food, pharmaceutical, and healthcare industries. The integrity and security of temperature-sensitive goods during storage and transportation are dependent on these businesses' use of efficient packaging solutions. Strict legal requirements for product safety and quality, new developments in insulating materials, and the growing demand for cold chain logistics are some of the main motivators. The market is expanding as a result of advancements in biodegradable materials and smart packaging technologies, which provide long-term answers to environmental issues on a worldwide scale.

The is segmented based on product type, temperature range and application, and by region. By Product type, the market is segmented into insulated shippers, insulated protective shippers, and insulated containers. Insulated Shippers segmented into panels & envelopes, EPS foam containers, fibreboard, and PUR containers. Insulated Containers are segmented into chest style, upright style, and others. Temperature Range segment includes -20°C and Below, -20°C to 0°C, 2°C to 8°C, 8°C to 25°C, and Above 25°C. By application, the market is segmented into frozen, chilled, and ambient.

Based on the product type, the market is divided into insulated shippers, insulated protective shippers, and insulated containers. Insulated Shippers segmented into panels & envelopes, EPS foam containers, fibreboard, and PUR containers. Insulated Containers are segmented into chest style, upright style, and others. Among these, The Insulated Containers segment is expected to have the highest growth rate during the forecast period. They offer significant capacity for storing and transporting pharmaceuticals, vaccines, and biologics in bulk. Used extensively in cold chain logistics for pharmaceutical distribution, especially for long-distance transport where maintaining temperature integrity is critical. The demand for insulated containers is driven by the expansion of biopharmaceuticals, vaccines, and specialty drugs that require stringent temperature control.

Based on the application, the market is categorized into frozen, chilled, and ambient. Among these, the chilled segment dominates the market. This segment caters to pharmaceutical products that require storage and transportation at temperatures typically ranging from 2°C to 8°C. Many biologics, vaccines, and specialty drugs fall into this category. The growth in biopharmaceuticals and vaccines, which often require chilled storage to maintain efficacy and safety, drives demand for sophisticated temperature-controlled packaging solutions.

The Asia Pacific region is experiencing rapid economic growth, leading to increased healthcare spending and infrastructure development. This growth supports the demand for pharmaceutical products, including biologics, vaccines, and specialty drugs that require stringent temperature control. With a growing population and rising healthcare awareness, there is a heightened demand for vaccines and biologics across Asia Pacific. These products are highly sensitive to temperature variations and require reliable temperature-controlled packaging solutions.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 5.87 Bn |

| Revenue Forecast In 2035 | USD 12.19 Bn |

| Growth Rate CAGR | CAGR of 8.00% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product type, Temperature Range, Application, |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; South East Asia |

| Competitive Landscape | Sonoco Products Company, Pelican Biothermal, Sofrigam SA Ltd., Cryopak, Cold Chain Technologies, Envirotainer Ltd., Cencora Inc., Inmark Packaging, American Aerogel Corporation |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Global Temperature Controlled Pharmaceutical Packaging Solutions Market, By Product Type

Global Temperature Controlled Pharmaceutical Packaging Solutions Market – By Temperature Range

Global Temperature Controlled Pharmaceutical Packaging Solutions Market – By Application

Global Temperature Controlled Pharmaceutical Packaging Solutions Market – By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.