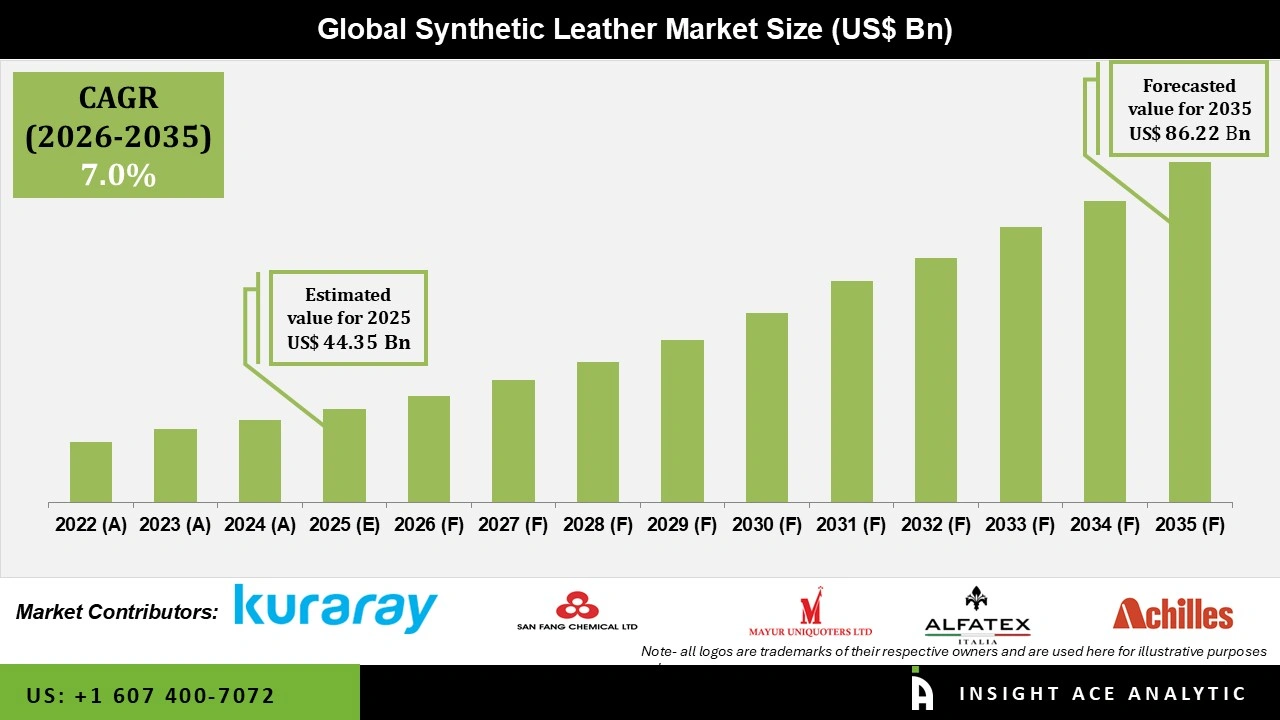

Global Synthetic Leather Market Size is valued at USD 44.35 Bn in 2025 and is predicted to reach USD 86.22 Bn by the year 2035 at a 7.0% CAGR during the forecast period for 2026 to 2035.

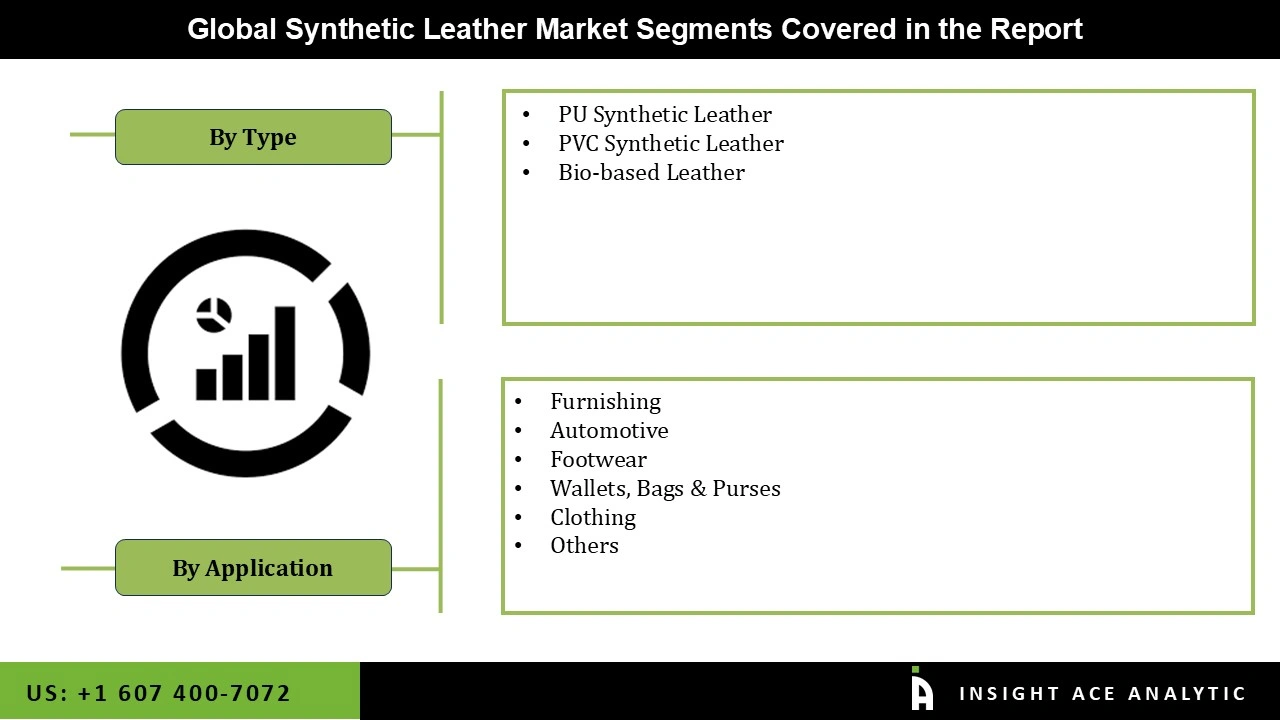

Synthetic Leather Market Size, Share & Trends Analysis Report By Type (PU, PVC, Bio-Based Leather) And Application (Furnishing, Automotive, Footwear, Wallets, Bags & Purses, Clothing), By Region, And Segment Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the Report:

Synthetic leather is a term used to describe plastic products that resemble leather due to its softness and wear resistance. Compared to natural leather, synthetic leather has a brighter appearance and a softer texture, is folding-resistant, less expensive, waterproof, and is alkali and acid resistant. Due to their chemical resistance, they can be used as boots in the chemical industry and for other industrial uses. Compared to natural leather, synthetic leather is more affordable and simpler to manufacture. The steering wheel covers, door trims, knob covers, gear boots, sun visors, hoods, roof lining, and other elements of a car are all made of synthetic leather. Automobiles, lorries, buses, motorbikes, agricultural machinery, and other vehicles all employ synthetic leather.

Synthetic leather has a high degree of flexibility, which makes it incredibly comfortable, along with resistance to alcohol, water, stains, intense heat, and cold, which increases durability and saves maintenance costs. Increased knowledge of the advantages of synthetic leather over genuine leather, as well as growing demand from the footwear industry, are driving the synthetic leather market growth globally.

Despite its advantages, synthetic leather is sometimes perceived as inferior to genuine leather. Additionally, it faces competition from other materials, such as natural fabrics, recycled materials, and other synthetic materials.

The Synthetic Leather Market is segmented based on type and application. Based on type, the market is categorized into PU synthetic leather, PVC synthetic leather and bio-based leather. Based on the application, the market is categorized into furnishing, automotive, footwear, wallets, bags & purses, clothing and others.

PVC synthetic leather is expected to dominate the synthetic leather market. PVC (polyvinyl chloride) synthetic leather is a widely used synthetic leather that offers a cost-effective and durable alternative to genuine leather. It is commonly used in applications such as automotive interiors, furniture, and consumer goods such as bags and wallets. Several factors contribute to the dominance of PVC synthetic leather in the market.

First, PVC is a widely available raw material, which makes it easier and more cost-effective to produce synthetic leather using this material. Second, PVC synthetic leather is highly versatile and can be manufactured in various colors, textures, and finishes, making it suitable for various applications. Moreover, PVC synthetic leather is known for its durability, water resistance, and low maintenance, making it a popular choice for applications where these properties are desirable. Finally, PVC synthetic leather is often less expensive than other synthetic leather materials, such as PU (polyurethane), which makes it an attractive option for manufacturers and consumers.

the footwear segment is anticipated to dominate the synthetic leather market. Synthetic leather is widely used in the footwear industry as a more cost-effective and sustainable alternative to genuine leather. It is used in various footwear applications, including athletic, casual, and dress shoes. There are several reasons why the footwear segment is expected to dominate the synthetic leather market. First, the footwear industry is one of the largest consumers of synthetic leather, with a growing global population and increasing disposable income driving demand for affordable and sustainable footwear options. Second, synthetic leather offers several advantages over genuine leather, including lower cost, greater versatility, and ease of maintenance.

Synthetic leather can be made in a wide range of colours and textures. It can be manufactured with specific properties, such as water resistance or breathability, making it suitable for various footwear applications. Finally, synthetic leather can mimic the look and feel of genuine leather, making it an attractive option for consumers who want a more sustainable and affordable alternative to genuine leather. Overall, the footwear segment is expected to continue to drive demand and growth in the synthetic leather market as manufacturers continue to innovate and develop high-quality, sustainable, and affordable synthetic leather products for use in the footwear industry.

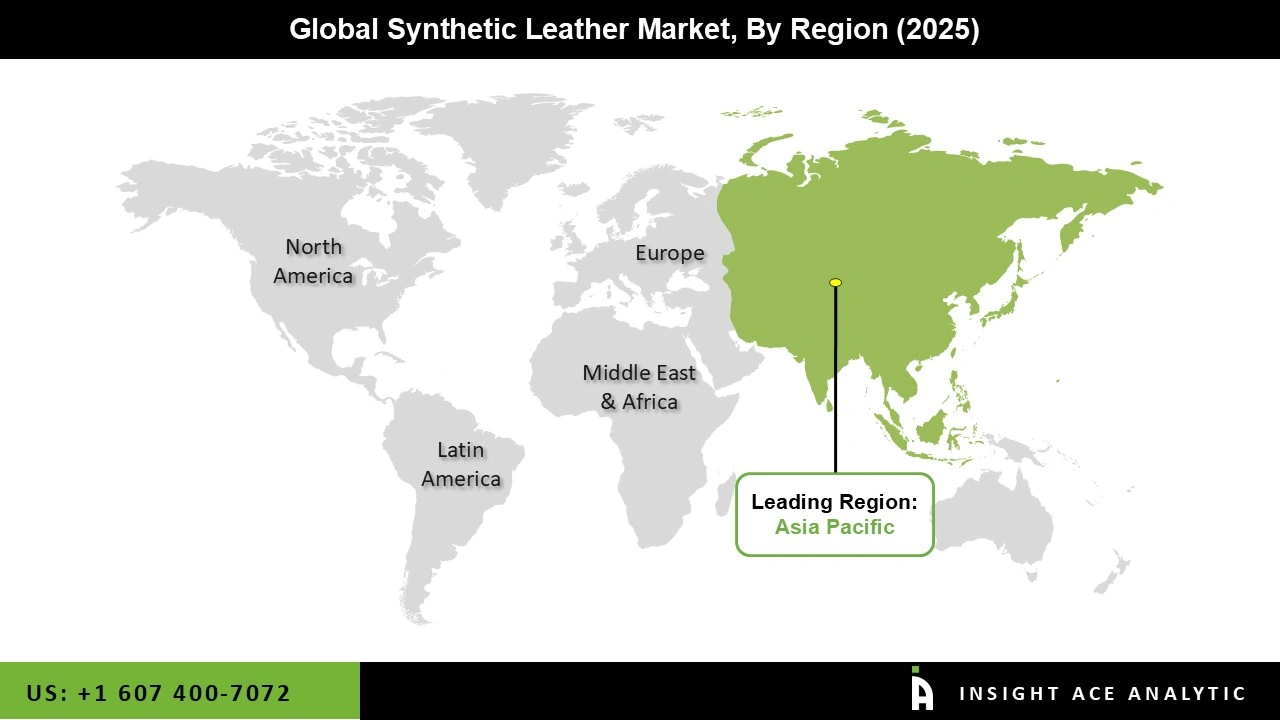

The Asia Pacific Synthetic Leather Market is expected to register the highest market share in revenue shortly. This is because many of the world's leading synthetic leather manufacturers are in Asia Pacific. These companies are investing in research and development to improve the quality and performance of their products and expand their production capacities to meet the growing demand.

The Asia Pacific region is expected to continue to play a leading role in the growth and development of the synthetic leather market, both as a producer and consumer of synthetic leather products. Besides, due to the saturation of major domestic fashion companies, the market in North America is predicted to grow slowly. Concerns from animal rights groups like PETA, WWF, and a few others have grown, which has led to growth restrictions in the leather business.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 44.35 Bn |

| Revenue forecast in 2035 | USD 86.22 Bn |

| Growth rate CAGR | CAGR of 7.0% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Bn, Volume (Million Meters) and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Type and Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Kuraray Co., Ltd.; H.R. Polycoats Pvt. Ltd.; Alfatex Italia SRL; Filwel Co., Ltd.; Yantai Wanhua Synthetic Leather Group Co., Ltd.; San Fang Chemical Industry Co., Ltd.; Mayur Uniquoters Limited; Teijin Limited and Nan Ya Plastics Corporation. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.