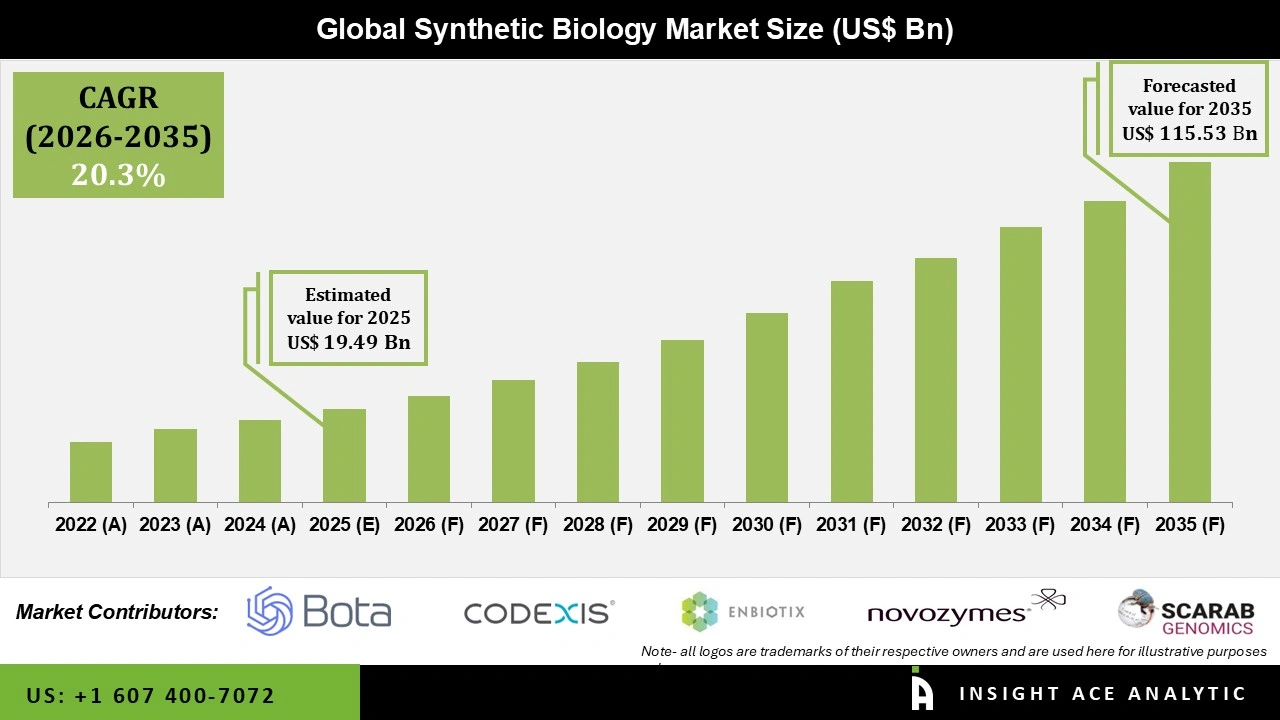

Global Synthetic Biology Market Size is valued at USD 19.49 Bn in 2025 and is predicted to reach USD 115.53 Bn by the year 2035 at an 20.30% CAGR during the forecast period for 2026 to 2035.

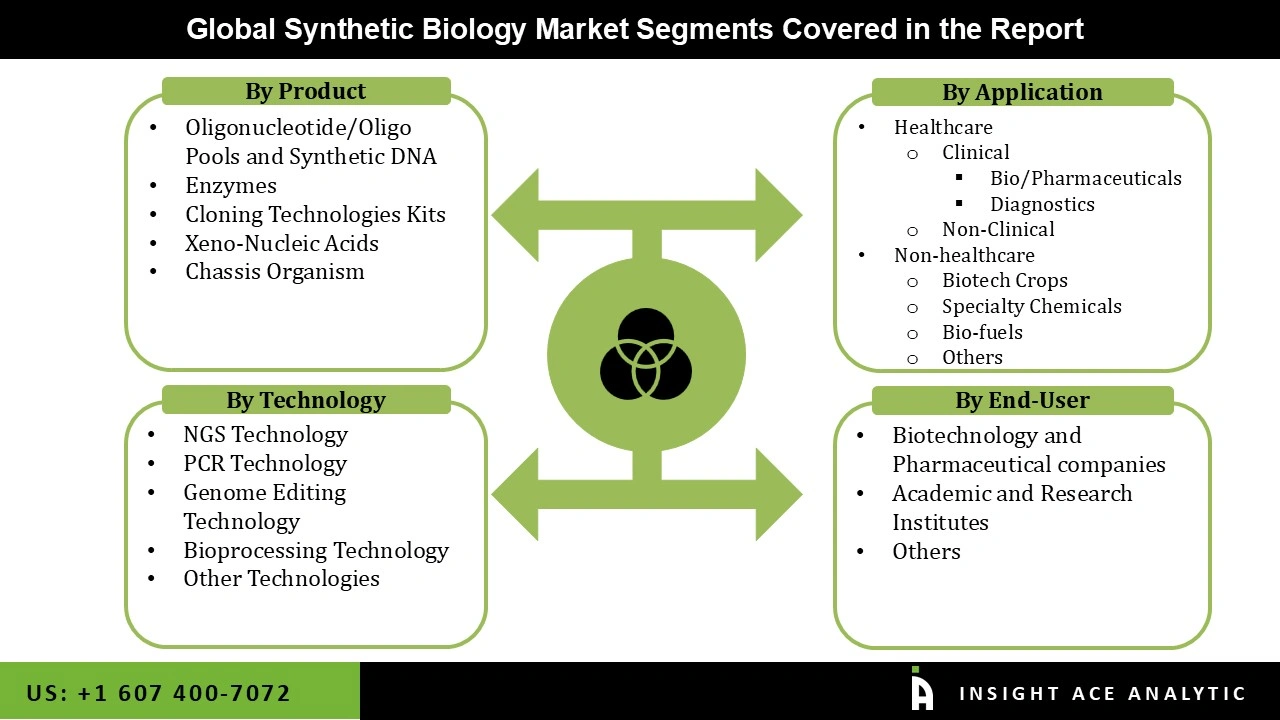

Synthetic Biology Market Share & Trends Analysis Report, By Product (Oligonucleotide/Oligo Pools and Synthetic DNA, Enzymes, Cloning Technologies Kits, Xeno-Nucleic Acids, Chassis Organism), By Technology (NGS Technology, PCR Technology, Genome Editing Technology, Bioprocessing Technology, Other Technologies), By Application, By End Use, By Region, and Segment Forecasts, 2026 to 2035.

Synthetic biology is a rapidly advancing scientific discipline focused on repurposing organisms to give them new capabilities. It allows researchers and businesses worldwide to tackle critical issues in manufacturing, agriculture, and medicine by harnessing nature’s power. Although synthetic biology is relatively new, its progress has been greatly accelerated by technological DNA sequencing and synthesis breakthroughs. This field enables the development of gene-edited crops with improved drought resistance, nutrient utilization, pest resistance, and enhanced nutritional value, offering new potential in agricultural resilience and food security. Additionally, synthetic biology is instrumental in the production of renewable biofuels, as engineered microorganisms can convert biomass into fuels like ethanol, butanol, and biodiesel, thereby providing sustainable alternatives to fossil fuels and reducing the carbon footprint of energy production.

Synthetic biology is driving the sustainable production of valuable chemicals, materials, and pharmaceuticals by enabling engineered microorganisms to produce biofuels, such as ethanol and biodiesel, from renewable resources. This advancement aligns with the growing demand for alternative energy sources, driven by climate change concerns and the depletion of traditional resources, positioning biofuels as a key area in the synthetic biology market. Increased funding and research are expected as synthetic biology provides effective ways to engineer microbes for more efficient biofuel production. Additionally, gene editing technologies like CRISPR/Cas9 are transforming the field, allowing precise DNA modifications that enable new treatments for genetic diseases, enhanced crop yields, and engineered organisms with novel characteristics. This revolution in gene editing is garnering significant attention in gene therapy and genetic engineering, paving the way for synthetic biology to reshape biotechnology and medicine fundamentally.

The Synthetic Biology Market is segmented based on product, technology, application, and end user. Based on the product, the market is divided into oligonucleotide/oligo pools and synthetic DNA, enzymes, cloning technologies kits, Xeno-nucleic acids, and chassis organisms. Based on the technology, the market is divided into NGS technology, PCR technology, genome editing technology, bioprocessing technology, and other technologies. Based on the application, the market is divided into healthcare, clinical, bio/pharmaceuticals, diagnostics, non-clinical, non-healthcare, biotech crops, specialty chemicals, biofuels, and others. Based on the end-user, the market is divided into biotechnology and pharmaceutical companies, academic and research institutes, and others.

Based on the product, the market is divided into oligonucleotide/oligo pools and synthetic DNA, enzymes, cloning technologies kits, Xeno-nucleic acids, and chassis organisms. Among these, the oligonucleotide/oligo pools and synthetic DNA segment are expected to have the highest growth rate during the forecast period. Oligonucleotide pools and synthetic DNA are essential for gene editing tools like CRISPR, which require precise DNA sequences for applications in gene therapy, disease modeling, and agricultural advancements. As gene editing technology continues to grow, so does the demand for high-quality synthetic DNA. With advancements in personalized medicine and the development of gene therapies, there is a greater need for custom DNA sequences. Synthetic DNA enables tailored therapeutic solutions that can be designed to match an individual’s genetic profile, supporting a surge in synthetic biology applications in healthcare. Rising investments and strategic partnerships in synthetic biology, supported by both private and governmental organizations, are fueling research and development in synthetic DNA. These investments support the scaling of synthetic DNA production, expanding its applications and accelerating its growth.

Based on the technology, the market is divided into NGS technology, PCR technology, genome editing technology, bioprocessing technology, and other technologies. Among these, the genome editing technology segment dominates the market. Genome editing facilitates the creation of microorganisms or plants that can produce valuable chemicals, biofuels, and pharmaceuticals more efficiently and sustainably. Genome editing is enabling faster product development, from genetically modified organisms (GMOs) to synthetic therapeutics. This acceleration in product commercialization leads to faster return on investment for companies, which further propels the growth of the genome editing market. As genome editing technology matures, regulatory frameworks and ethical guidelines are evolving to support its use in human therapies, agricultural innovations, and environmental applications. This provides an environment conducive to continued growth in the market.

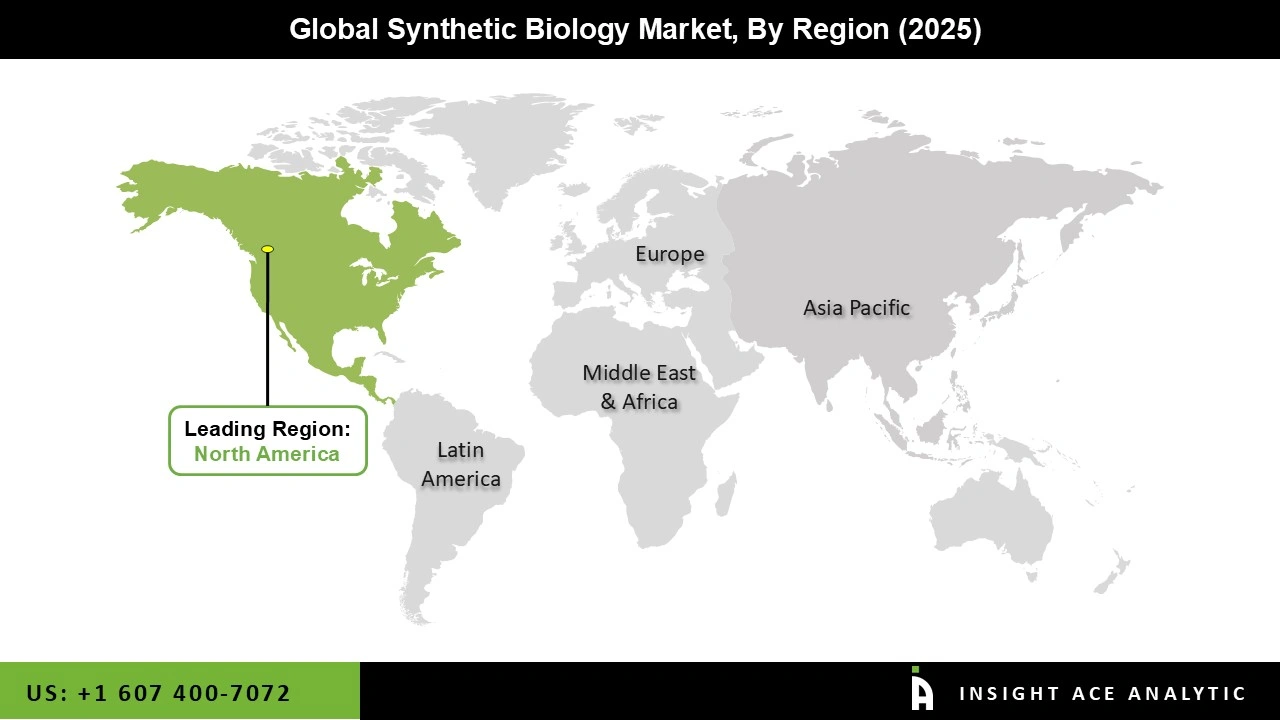

North America, particularly the United States, has a robust biotechnology ecosystem with significant investments in research and development (R&D). This includes funding from both the public and private sectors, driving advancements in synthetic biology. The U.S. is home to leading biotech companies and universities that push the boundaries of synthetic biology applications in medicine, agriculture, and industry.

The U.S. has a dominant biotechnology and pharmaceutical industry, which heavily utilizes synthetic biology technologies. Applications such as gene editing, gene therapy, and drug discovery are expanding rapidly, supported by favorable regulations and high demand for innovative treatments. Companies in North America are also leading in synthetic biology-based product development, including genetically engineered organisms and bio-manufactured chemicals.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 19.49 Bn |

| Revenue Forecast In 2035 | USD 115.53 Bn |

| Growth Rate CAGR | CAGR of 20.30% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026 to 2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive Market structure, growth prospects, and trends |

| Segments Covered | By Product, Technology, Application and End User. |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Bota Biosciences Inc., Codexis, Inc., Creative Biogene., Creative Enzymes., Enbiotix, Inc., Illumina, Inc., Merck Kgaa, New England Biolabs Eurofins Scientific, Novozymes, Pareto Bio, Inc., Scarab Genomics, Llc, Synthego, Synthetic Genomics Inc., Thermo Fisher Scientific, Inc., Agilent Technologies, Inc., Twist Bioscience, BioBricks Foundation, DIYbio, Amyris, Cyrus Biotechnology, TeselaGen |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.