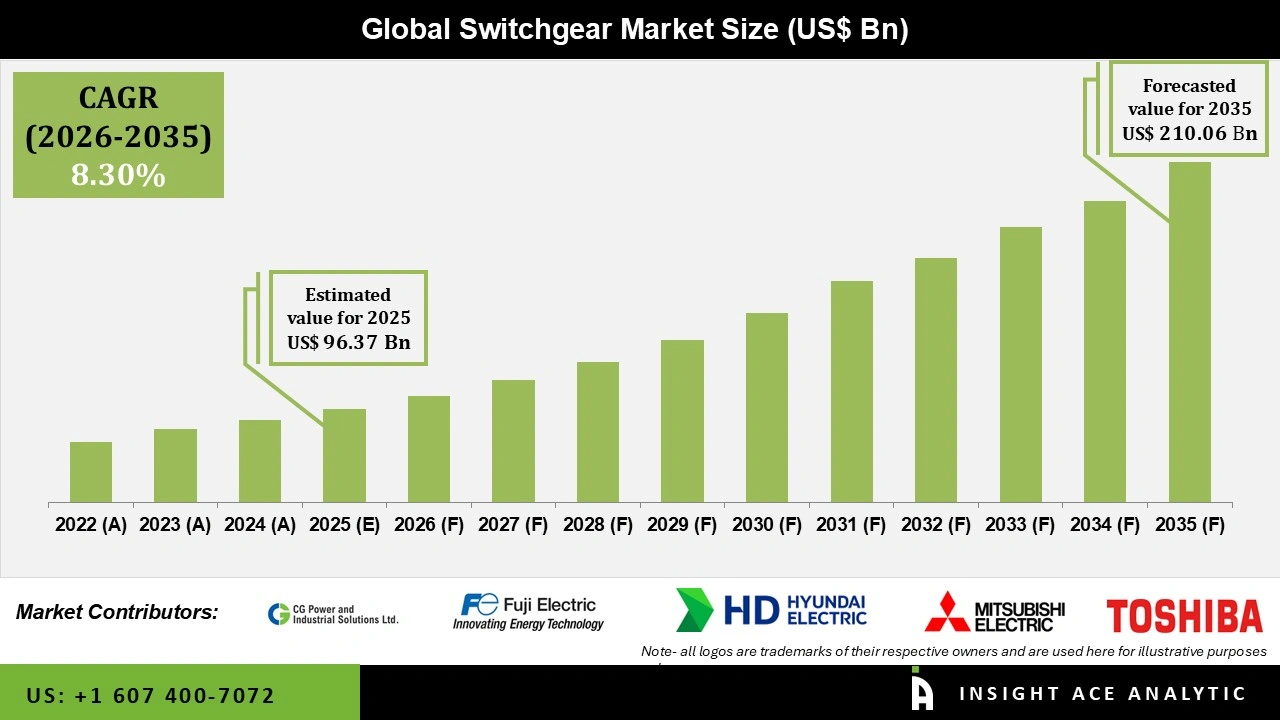

Global Switchgear Market Size is valued at USD 96.37 Billion in 2025 and is predicted to reach USD 210.06 Billion by the year 2035 at a 8.30% CAGR during the forecast period for 2026 to 2035.

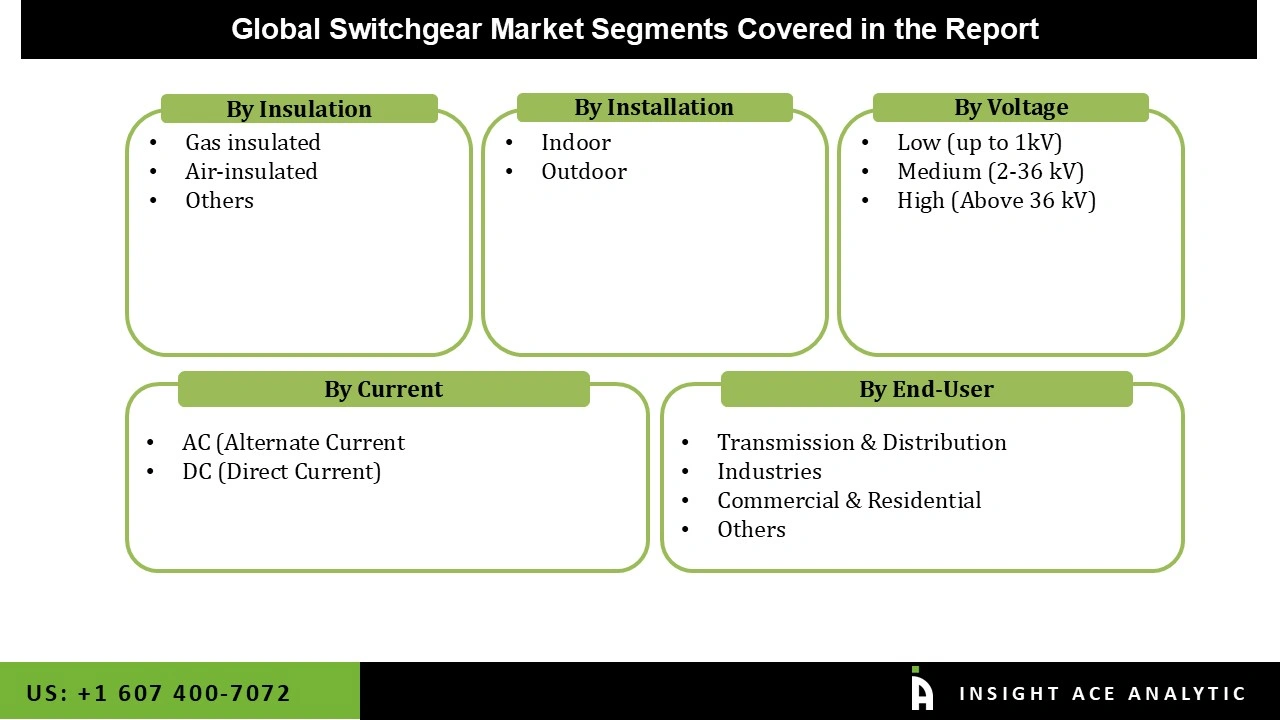

Switchgear Market Size, Share & Trends Analysis Report By Insulation (Gas-insulated Switchgears, Air-insulated Switchgears), Installation (Indoor, Outdoor), Current (AC, DC), Voltage (Low (up to 1 kV), Medium (2-36 kV), High (Above 36 kV), End User, By Region, And Segment Forecasts, 2026 to 2035.

The necessity for a wide variety of electrical equipment has increased due to the rapid growth of power in rural regions and rising energy output. Significant switchgear market trends anticipated to fuel market expansion include growing regional government aims for supplying electricity to rural areas and increased investment in this sector. It is an electrical element that controls, keeps track of, and regulates a circuit. It guarantees operating safety, cost-effectiveness, and availability in various residential, commercial, industrial, and utility applications.

Intricate electrical substations typically require switchgear technology to tolerate varying operating voltage under hazardous climatic circumstances. Building new industrial infrastructure, such as power plants for secure operations, is also predicted to spur market expansion. More government backing for the latest technology and rising investments in renewable energy development are expected to improve the business environment.

The Switchgear market is segmented on insulation, installation, voltage, current, and end-user. Based on insulation, the market is segregated as gas-insulated switchgear, air-insulated switchgear, and others. The installation segment includes indoor and outdoor. By voltage, the market is segmented into low (up to 1kV), medium (2-36kV), and high (above 36 kV). The current segment includes Ac and DC. The end-user consists of transmission & distribution utilities, industries, commercial & residential, and others.

Low voltage switchgear has a 1.1 kV AC maximum capacity. They are intended to switch and protect electrical equipment. Products for low-voltage switchgear are used by a wide range of businesses, including those in the process industry, manufacturing firms, suppliers of renewable energy, utilities, and companies that make rail equipment, particularly in the wind and solar industries. Additionally, it is anticipated that the ongoing infrastructure renovation projects will accelerate market expansion across all industries.

The fastest growth is projected for the gas-based insulation. In areas with limited space or areas exposed to high levels of pollution, gas-insulated switch gears are typically fitted. Longer life is provided by its compact design and robust structure, which guard against environmental deterioration. They are a popular option among end users because to their minimal danger of explosion and oil leakage as well as decreased running expenses.

The Kingdom of Saudi Arabia (KSA), Qatar, the United Arab Emirates (UAE), and Kuwait are anticipated to be the major drivers of market expansion. The nations of the Gulf Cooperation Council (GCC) are investing extensively in their power sectors to increase their generation capacity.

The market for switchgear in the Middle East is anticipated to benefit from the transmission and distribution segment's predicted financial growth. The KSA economy is predicted to grow quickly in a range of industries, including plastics, petrochemicals, power, and water. The quick commercial infrastructure developments are expected to lead to major growth in Qatar and the United Arab Emirates. The Egyptian switchgears market is anticipated to be supported by growing market reforms for increased efficiency and optimal investments in the power sector.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 96.37 Billion |

| Revenue forecast in 2035 | USD 210.06 Billion |

| Growth rate CAGR | CAGR of 8.30% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Billion, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026 to 2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Insulation, Installation, Voltage, Current, And End-User |

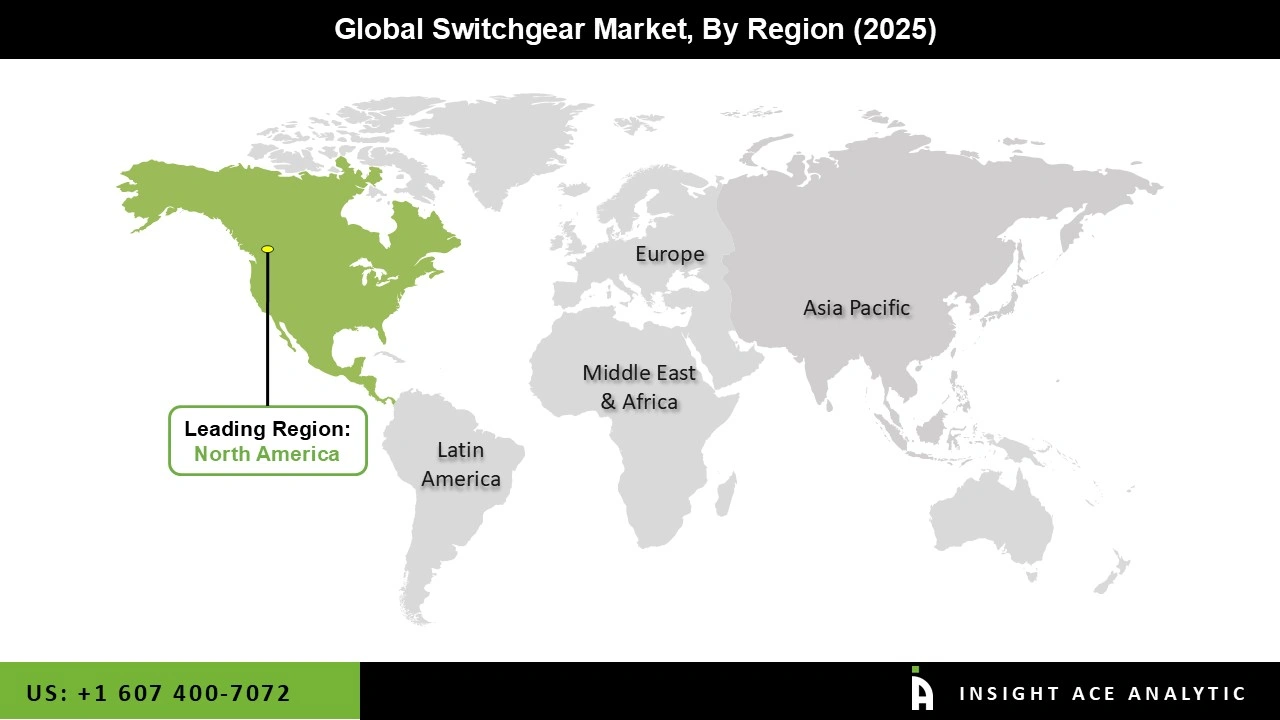

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Siemens, ABB, Schneider Electric, Mitsuibishi Electric, General Electric, Eaton, Legrand, Hitachi Hyundai Electric, Fuji Electric, and Toshiba. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.