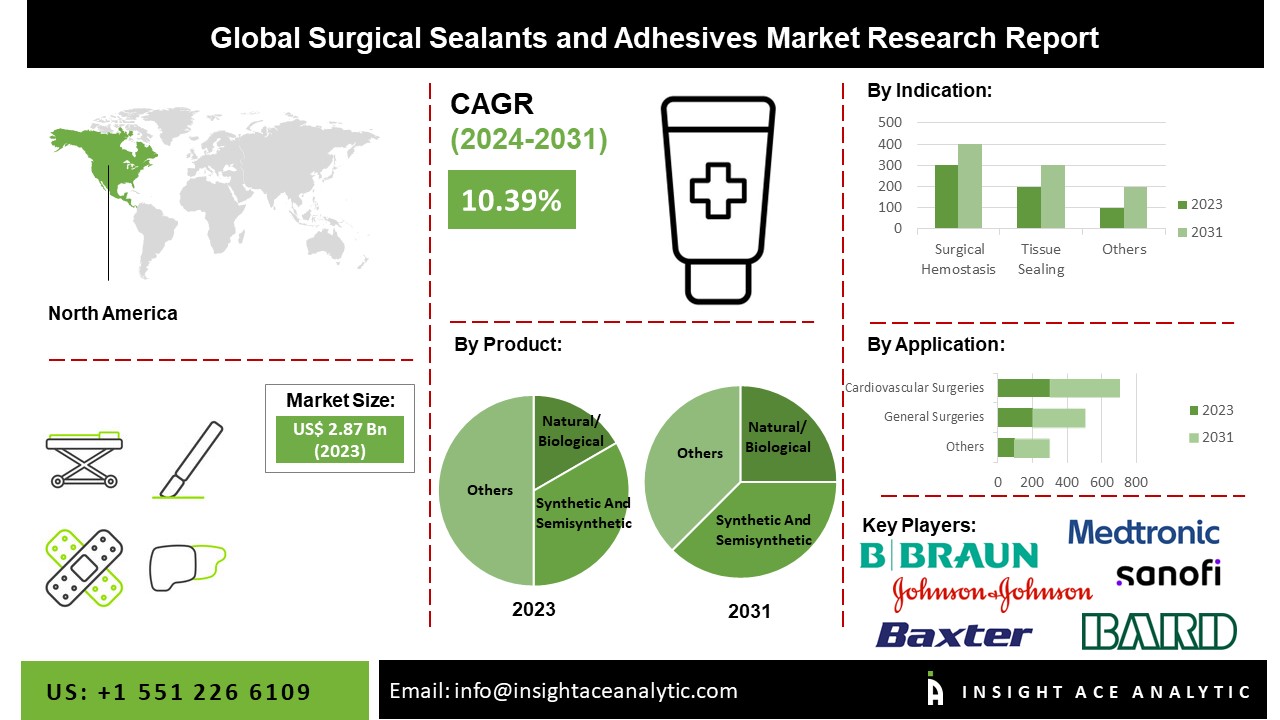

The Global Surgical Sealants and Adhesives Market Size is valued at 2.87 Billion in 2023 and is predicted to reach 6.26 Billion by the year 2031 at a 10.39 % CAGR during the forecast period for 2024-2031.

Key Industry Insights & Findings from the Report:

Surgical adhesives and sealants are substances with natural or synthetic origins that are added to sutures in order to prevent infection, repair damaged tissue boundaries, and speed healing. Given their capacity to reduce blood loss, enhance closure, and enable less painful and easier operations without the need for removal, these materials are emerging as potential substitutes for staples and sutures in many medical applications. The market for surgical sealants and adhesives is anticipated to expand as chronic health conditions like cardiovascular disease, kidney illness, neurological problems, and others are becoming more common. Another reason boosting the market for surgical sealants and adhesives is the rise in car accidents requiring urgent procedures.

The surgical sealants and adhesives market is divided into product, indication, and application. Based on product, the market is segmented into Natural/Biological Sealants and Adhesives and Synthetic and Semi-synthetic Sealants and Adhesives. Based on indication, the surgical sealants and adhesives market is segmented into Surgical Hemostasis, Tissue Sealing, Tissue Engineering. Based on application, the market is bifurcated and divided into General Surgeries, Cardiovascular Surgeries, Central Nervous System Surgeries, Orthopedic Surgeries, Urological Surgeries, and Others.

The market's leading segment is the biological segment. Fibrin, collagen, and gelatin-based sealants and adhesives are further categories for natural or biological materials because of the many medical settings in which they are used. They are useful in thoracic, cardiovascular, orthopedic, neuro, and reconstructive operations. Additionally, only fibrin and other sealants have FDA permission for usage in all three categories, namely hemostats, sealants, and adhesives.

The central nervous system (CNS) category had the highest revenue share since CNS illnesses are quite common worldwide. In CNS procedures, sealants are preferred to conventional closure techniques, including wires, sutures, and staples. Because traditional sealant techniques are challenging to use in CNS surgeries, there is an exponentially growing need for surgical sealants and adhesives for CNS.

The North American region market is expected to register the highest market share. This is majorly due to some elements, including the prevalence of chronic health conditions, an increase in age-related health problems, essential businesses engaged in manufacturing surgical sealants and adhesives, cutting-edge medical facilities, etc. One of the key elements fueling the growth of the North American surgical sealants and adhesives market is the increased frequency of chronic conditions needing surgery, notably in the United States. Besides, the Asia Pacific region is estimated to hold the largest share of the market. The aging population is propelling the surgical sealants and adhesives market, which is more likely to experience health issues, including heart disease, bone disease, eye problems, and others that call for immediate surgery.

| Report Attribute | Specifications |

| Market Size Value In 2023 | USD 2.87 Billion |

| Revenue Forecast In 2031 | USD 6.26 Billion |

| Growth Rate CAGR | CAGR of 10.39% from 2024 to 2031 |

| Quantitative Units | Representation of revenue in US$ Billion and CAGR from 2024 to 2031 |

| Historic Year | 2019 to 2023 |

| Forecast Year | 2024-2031 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Product, Indication, Application |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | R. Bard, Johnson & Johnson (UK), Baxter International, Medtronic plc (US), Braun Melsungen AG (Germany), Cohera Medical, Sanofi Group (France), Sealantis, Vivostat A/S (Denmark), Ocular Therapuetix |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Product

By Indication

By Application

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.