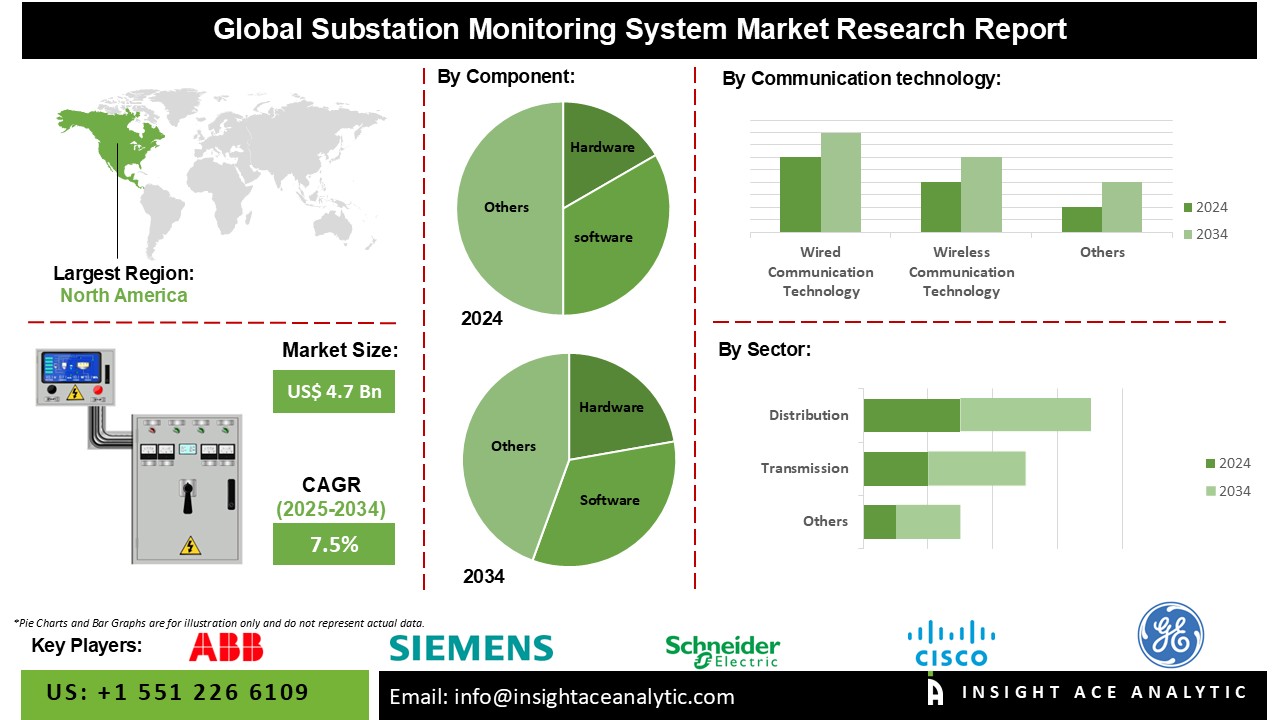

Substation Monitoring System Market Size is valued at USD 4.7 Bn in 2024 and is predicted to reach USD 9.6 Bn by the year 2034 at a 7.5% CAGR during the forecast period for 2025-2034.

A substation monitoring system is a specialized system used to monitor and manage electrical substations. Electrical substations are critical components of an electrical power grid, where electricity is transformed, controlled, and distributed to end-users. Monitoring these substations is crucial to ensure the reliability and efficiency of the electrical grid. The expansion of the substation monitoring system market is being driven by the power generating sector's efforts to address the ageing and depreciating infrastructure and enhance the IoT-based communication network.

Substation monitoring system market growth will be aided by the advantages of creating the IEC 61850 standard, which will enable interoperability between IEDs and improvements in the power ecosystem through a variety of growth strategies, including mergers and acquisitions, contracts and agreements, partnerships, expansions, and product developments. The market expansion for substation monitoring systems is predicted to be hampered by the spike in CAPEX connected with the construction of sensor networks. Other difficulties that could reduce industry demand include the dangers of malicious assaults and rising IED installation prices in substations.

The growing need for a steady and dependable supply of power distribution is the primary market driver for the world market for monitoring small stations. A small station monitoring system will become more necessary as the existing power infrastructure is updated. The expansion of the availability of energy and the quick urbanization of developing nations will fuel the demand for a small station monitoring system.

The Substation Monitoring System market is segmented on the basis of components, communication technology, and application. According to components, the market is segmented as software and hardware. The Hardware component comprises (Intelligent Electric Devices (Transformer (Voltage Instrument Transformer, Current Instrument Transformer), Relay Devices, Recloser Controllers, Circuit Breakers, Switches), Distribution Network Feeders, and Others (Smart Sensors, Microcontrollers, Cameras)).

At the same time, the Software component consists of Asset Management, Production Management, and Performance Management. The communication technology market includes wired and wireless. The wired segment is again divided into Fiber Optic (Ethernet, PROFIBUS, Others), Fieldbus, HART, and Modbus. The wireless segment comprises Wireless LAN (Wi-Fi), ZigBee, and Cellular Technology. At last, By application, the market is segmented into transportation, mining, utilities, steel, and oil and gas.

The wireless category is expected to hold a major share in the global Substation Monitoring System market. The market share that belongs to wireless is the largest. Cell phones, wireless LAN, Zigbee, and other wireless technologies are included in the wireless section. Since it is more difficult to maintain than wireless technology, wired technology is more prone to corruption. Because of this rising demand for wireless technology, the market's growth is anticipated to be at its highest level throughout the forecast period.

The Segment transportation is projected to grow at a rapid rate in the global substation monitoring system market as the increased demand for power supply in numerous linked industries. The transportation industry is anticipated to grow more quickly during the projection period. The implementation of smart grids and grid enhancement has increased the demand for solutions in this area to be monitored. An increase in project launches, such as the sponsorship of solar farm projects in the nations of the Asia Pacific and the Middle East, is fueling the development of substation monitoring systems.

In terms of revenue, the North American Substation Monitoring System market is anticipated to account for a significant market share. The substation monitoring system market in this region is growing financially as a result of, among other things, increased product launches and product expansion by significant industry players. For instance, the ARIS II Rover, an upgraded robotic substation monitoring device, was recently released by NV5 Geospatial. Due to the region's fast-accelerating industrialization, as well as the boom in the oil and gas and mining industries in its developing nations, Asia-Pacific is predicted to have tremendous growth throughout the forecast period. The rising desire for lower distribution and transmission losses in developing nations like India also drives the substation monitoring system market.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 4.7 Bn |

| Revenue forecast in 2034 | USD 9.6 Bn |

| Growth rate CAGR | CAGR of 7.5% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Million and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | By Component, Communication Technology, Sector, Industry |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | ABB, Sentient Energy, Schweitzer Engineering Laboratories, Viper Imaging, LLC, Allis Electric Co., Ltd., Allis Electric Co., Ltd., FLIR Systems, MoviTHERM, CAS, Pyrumas Software Pvt. Ltd., CAHORS, Advanced Energy, and Nortech Management Ltd., Crompton Greaves, Eaton, Emerson Electric, Honeywell, Cisco, Schneider Electric SE, General Eectric, Siemens |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Substation Monitoring System Market By Component-

Substation Monitoring System Market By Communication Technology-

Substation Monitoring System Market By Sector

Substation Monitoring System Market By Industry-

Substation Monitoring System Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.