Spider Silk Market Size is valued at 2.42 billion in 2024 and is predicted to reach 5.83 billion by the year 2034 at an 9.3% CAGR during the forecast period for 2025-2034

Key Industry Insights & Findings from the Report:

Spider silk is formed of joined and unjoined strands of liquid protein, and its chemical makeup varies depending on the spider's intended function. Numerous research and development projects are being conducted on the material to alter its tensile strength and flexibility to realize its full potential. The demand for high-resilience synthetic fibers has sharply increased in several industries, including aerospace, defense, and others. For instance, scientists at Purdue University's Air Force Research Laboratory in Indiana are testing the development of a functional fiber that can be woven into big, flexible fabrics using the methods already used in the textile industry.

Rising demand for these textile goods from the defense, automotive, and healthcare sectors is predicted to fuel spider silk market revenue development. People now choose biodegradable materials over synthetic polymers due to growing awareness of the adverse consequences of plastic waste.

Spider silk can assist in reducing the number of toxins and pollutants used in the methods required to produce current petroleum-based fibers and polymers because it is biodegradable and biocompatible. This is anticipated to boost the spider silk market expansion, as a result, support market revenue growth throughout the projected year.

However, due to high manufacturing costs, the global market for spider silk has had poor revenue development. Additionally, due to their cannibalistic and territorial natures, it isn't easy to farm spiders for the commercial manufacture of fabric. The limited amount of silk that spiders can produce is another barrier to its commercial manufacturing.

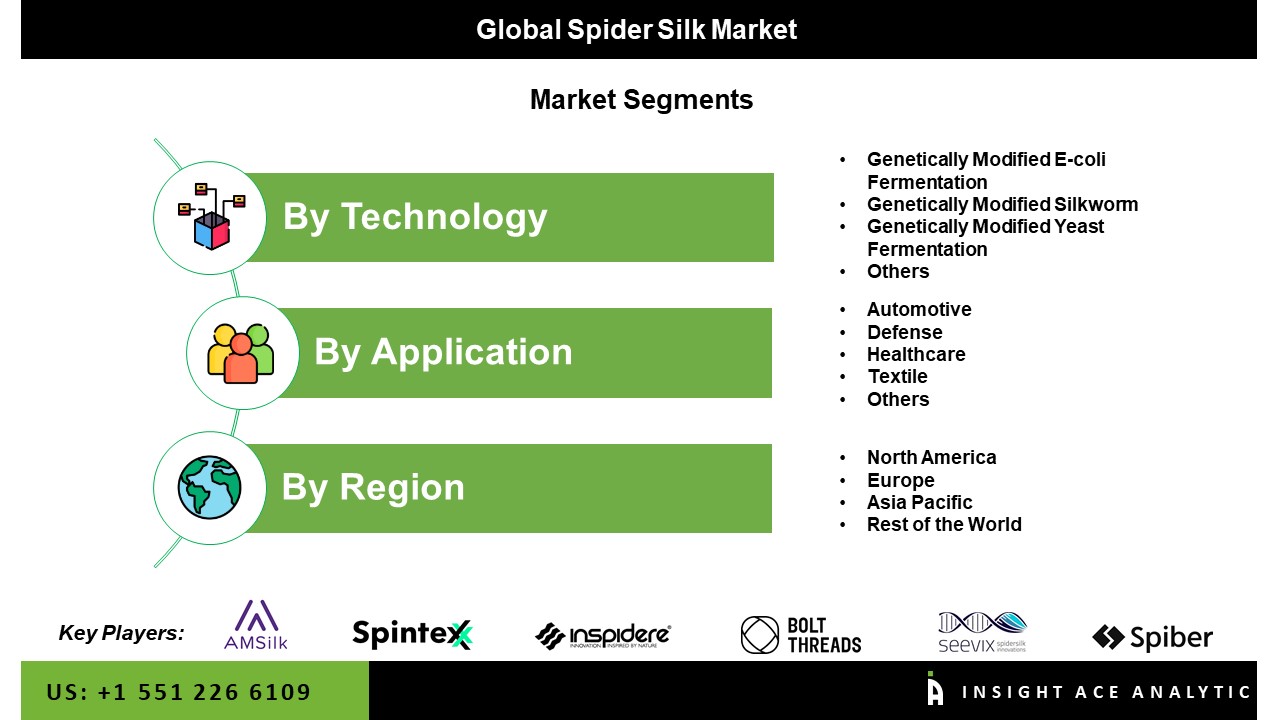

The spider silk market is segmented on technology and application. Based on technology, the market is segmented into genetically modified e-coil fermentation, genetically modified silkworm, genetically modified yeast fermentation and others. Based on application, the market is segmented into automotive, defense, healthcare, textile and others.

The genetically modified e-coli category grabbed the highest revenue share, and it is anticipated that it will continue to hold that position during the anticipated time. Numerous creatures have had their genetic makeup altered due to the rising need for highly robust synthetic fiber and the quick development of bio-engineering. Large-scale production of the spidroin proteins, which are present in dragline silk made by spiders, is being done by businesses using genetically modified bacteria and protein purification technology. Spidiroin is produced by selecting a portion of the gene sequence used to express it. A bioreactor is used to grow E. coli bacteria that have had the gene sequence cloned into them. Spider silk is used in cardiology, coronary tissue regeneration, bone restoration, skin cell proliferation, and vaccinations. During the forecast period, rising demand for the genetically modified E. coli fermentation method is anticipated to fuel segment revenue growth.

The automotive category is anticipated to grow significantly over the forecast period. Spider silk strands and proteins can create incredibly robust and lightweight automotive components, which will aid the transportation sector in increasing vehicle weight-to-fuel efficiency. Vehicles with lower weights require less fuel to operate, which greatly reduces air pollution. This is anticipated to enhance the need for spider silk in the automotive sector, resulting in increased revenue for this market.

The Asia Pacific spider silk market is expected to register the highest market share in revenue in the near future. The demand for alternate sources of highly resilient biodegradable fabrics is anticipated to rise as textile goods in the automotive, defense, and healthcare sectors grow in popularity in the region's nations. During the forecast period, this is likely to contribute to an increase in market revenue.

In addition, North America is projected to grow rapidly in the global spider silk market because there are many significant businesses in the region, and more people are investing in academic research. Publicly sponsored research has increased due to expanding government and large university collaborations. Another important element anticipated to boost market revenue growth is the region's governments' rising defense spending to supply militaries with cutting-edge facilities.

| Report Attribute | Specifications |

| Market size value in 2023 | USD 2.50 Bn |

| Revenue forecast in 2031 | USD 9.49 Bn |

| Growth rate CAGR | CAGR of 18.29% from 2024 to 2031 |

| Quantitative units | Representation of revenue in US$ Million, and CAGR from 2024 to 2031 |

| Historic Year | 2019 to 2023 |

| Forecast Year | 2024-2031 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Technology And Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Krag Biocraft Laboratories, Inc., Amsilk GmbH, Bolt Threads, Inc, Spiber, Inc, Seevix Material Sciences Ltd., Inspidere BV, Technology Holdings LLC, Spintex Engineering Ltd., Spiber Technologies AB, Spidey Tek, Inc and Xampla Ltd. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Spider Silk Market By Technology

Spider Silk Market By Application

Spider Silk Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.