High-Performance Textile Market Size is valued at USD 12.5 Billion in 2024 and is predicted to reach USD 34.2 Billion by the year 2034 at an 10.7% CAGR during the forecast period for 2025-2034.

Key Industry Insights & Findings from the Report:

High-performance textiles have been designed to provide high strength, high modulus, thermal stability at high temperatures, chemical and solvent resistance, and various other characteristics for their specific end-use application. The market is projected to grow in the coming years due to the expanding manufacturing sectors worldwide. Technological developments in manufacturing technologies will drive the market in the coming years.

However, a significant element favorably influencing market growth is the high cost of completed products together with challenging manufacturing processes. The demand for durable textiles is growing due to the trend toward more materials in end-use industries. The increased emphasis on sturdy construction, quality, sturdiness, and specialized specialty materials across the globe is to blame for this. The transition is especially apparent in the aerospace and defense sectors.

Moreover, New trends, such as digital techniques in increased textiles, rising major automobile demand and the implementation of safety features in the automotive industry, new product innovations in safety gear, and rising sustainability awareness, are expected to present opportunities for the market to grow in the years to come.

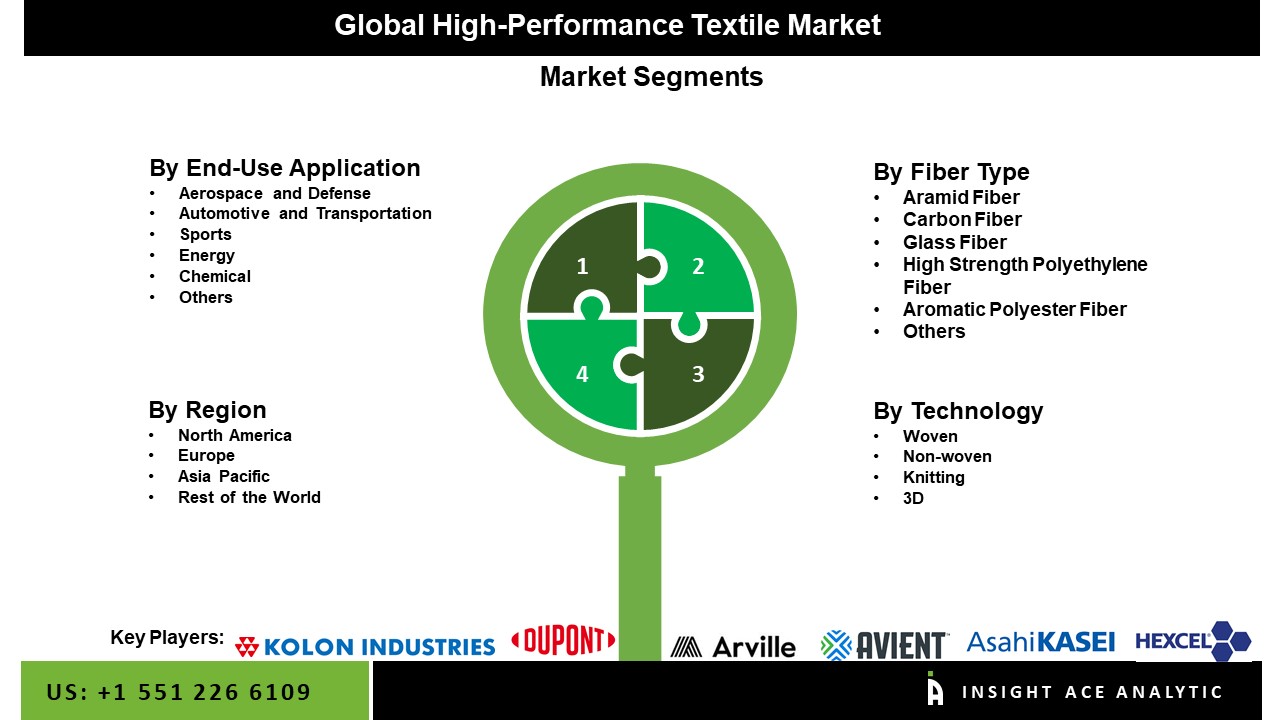

The high-performance textile market is segmented based on end-users applications, field type and technology. Based on end-user application, the market is segmented as aerospace and defense and automotive and transportation and sports and energy and chemical and other. The market is segmented by fiber type: aramid, carbon, glass, high-strength polyethylene, aromatic polyester, and others. Based on technology, the high-performance textile market is divided into woven, non-woven, knitting and 3D.

The carbon fiber category is expected to hold a major share of the global high-performance textile market in 2021 due to various aerospace sector applications, including airplanes, rockets, telescopes, and weapons. As a result of their lightweight and stiffness qualities, CFRCs are becoming increasingly prevalent in aviation components, which is another factor that is anticipated to fuel demand. Carbon fiber structures weigh about one-third and a half as much compared to aluminum and steel. CFRC consumption, however, is far more expensive than using metals. The high expense of carbon fiber has limited its use to high-performance vehicles, including aircraft like Boeing and Airbus, jet fighters, rockets, racing automobiles, sports cars, and racing yachts.

The aerospace & defense segment is projected to increase in the global high-performance textile market. The industry is shifting toward lightweight materials to increase the aircraft's budgetary performance and ecological sustainability. Therefore, aircraft production depends on high-strength, lighter, and jute structural components. In aircraft applications, aluminum alloys and structures are advantageous because they give great strength and stiffness at a decreased weight, significantly lowering fuel consumption. These materials make it possible for airplanes, particularly military aircraft, to carry greater payload and fuel, extending missions and reducing downtime.

The North America high-performance textile market is expected to register the highest market share in revenue soon on account of well-developed markets for the aerospace and defense industries. The market in this region is expanding due to factors such as increased defense spending in the United States, the use of excellent-performance fibers in the architecture, electronics, and automotive industries, and the use of high-performing fibers as an alternative to mesothelioma and steel. In addition, the Asia Pacific region is projected to grow rapidly in the global high-performance textile market. The rising demand for textile materials with high performance is driving the market in the Asia Pacific. The increased use of technical textiles in Asia is fueled by industrialization, the availability of low-cost raw materials, and growing consumer awareness of their improved functioning. There are an increasing number of manufacturers in the Asia Pacific technical textiles market.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 12.5 Billion |

| Revenue forecast in 2034 | USD 34.2 Billion |

| Growth rate CAGR | CAGR of 10.7% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Bn,Volume (KT) and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Application, Fiber Type, Technology |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Arvill, Asahi Kasei Corporation, Avient Corporation, Balte, DuPont, Freudenberg Performance Materials, Hexcel Corporatio, High Performance Textiles Pvt. Ltd., Huvis Corp, Kermel, Kolon Industries, Inc., Mitsui Chemicals, Inc, Performance Textiles, Porcher Industrie, Toray Industries, Inc, Cass Materials, Crosslink Composites, Inc., Fabiosys Innovation, High Performance Textiles GmbH, Spintex Engineering Ltd. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

High-Performance Textile Market By End-Use Application

High-Performance Textile Market By Fiber Type

High-Performance Textile Market By Technology

High-Performance Textile Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.