Global Specialty Fertilizers Market Size is valued at USD 26.6 Billion in 2024 and is predicted to reach USD 49.8 Billion by the year 2034 at an 6.6% CAGR during the forecast period for 2025-2034.

Fertilizers used in unique soil and plant conditions are referred to as specialty fertilizers. Specialized fertilizers are used for specialized action in plants to increase production levels. Specialty fertilizers release essential nutrients. The rising demand for high-efficiency fertilizers is a key factor anticipated to propel the growth of the specialty fertilizers market during the forecast period. The consistent application of nutrients is also projected to fuel the market for specialized fertilizers.

Moreover, it is predicted that the market for specialty fertilizers will expand more slowly due to the increased adoption of precision agricultural technology. On the other hand, it is anticipated that the development of the organic fertilizer industry will hamper the expansion of the market for specialty fertilizers.

In addition, as economies continue to advance, there may be more chances for the market for specialty fertilizers to expand in the years to come. However, the market for specialized fertilizers may face further challenges soon due to the rise in nutrient insufficiency and the growing significance of specialty nutrients.

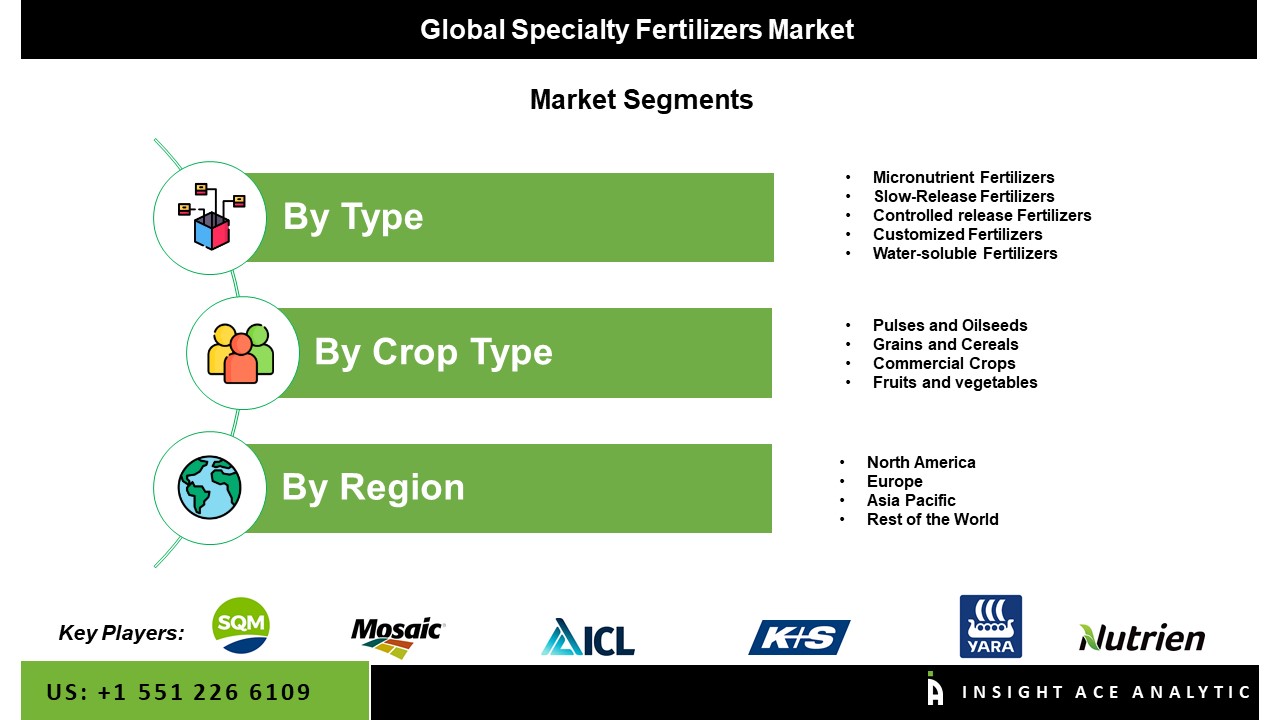

The specialty fertilizers market is segmented on the type and crop type. Based on type, the market is segmented into micronutrient fertilizers, slow-release fertilizers, controlled-release fertilizers, customized fertilizers, water-soluble fertilizers and others. Based on crop type, specialty fertilizers market is segmented into pulses and oilseeds, grains and cereals, commercial crops, fruits and vegetables and others.

The water-soluble fertilizers category grabbed the highest revenue share, and it is anticipated that they will continue to hold that position during the anticipated time. Many farmers are using water-soluble fertilizers due to their effectiveness in improving crop yields' quality and quantity. NPK, potassium nitrate, monopotassium phosphate, monoammonium phosphate, and urea phosphate are commonly used water-soluble fertilizers. Precision agriculture is aided by the growing use of water-soluble fertilizers for foliar feeding and fertigation. Due to the low salt index and high fertilizer use efficiency (almost 80–85%), there is a comparatively foremost demand for water-soluble fertilizers. Farmers are using more and more highly water-soluble fertilizers because they improve crop production and quality metrics and solve problems like nutrient fixation in soil, nutrient immobilization, and nutrient loss due to volatilization, such as nitrogen.

The grains and cereals category is anticipated to grow significantly over the forecast period. Most of the nutrients consumed by humans are thought to be obtained from cereals and grains. Cereals and grains are the main sources of calories and nutrients in many underdeveloped nations. Around the world, the production of cereals and grains has been influenced by various cultural, environmental, economic, and water supply variables. Corn, wheat, rice, barley, and sorghum are the cereals and grains that are most widely produced worldwide.

The Asia Pacific, specialty fertilizers market, is expected to register the highest market share in revenue in the near future due to the expansion of innovation in the agricultural industry. Further, it is projected that in the upcoming years, the market for speciality fertilizers in the region will expand due to the government's increased efforts to promote innovative and formulated fertilizers by providing subsidies. In addition, North America is projected to increase in the global specialty fertilizers market due to the expansion of row crops. During the anticipated term, rising grain prices will also contribute to an increase in the area's specialty fertilizer market.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 26.6 Billion |

| Revenue forecast in 2034 | USD 49.8 Billion |

| Growth rate CAGR | CAGR of 6.6% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Mn, Volume (Kiloton) and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Type, Crop Type |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Nutiren LTD, Yara International ASA, ICL Group Ltd., K+S AG, Sociedad Quimica y Minera de Chile (SQM), The Mosaic Company, EuroChem Group AG, CF Industries Holdings, Inc, Nufam and OCI Nitrogen. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Specialty Fertilizers Market By Type

Specialty Fertilizers Market By Crop Type

Specialty Fertilizers Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.