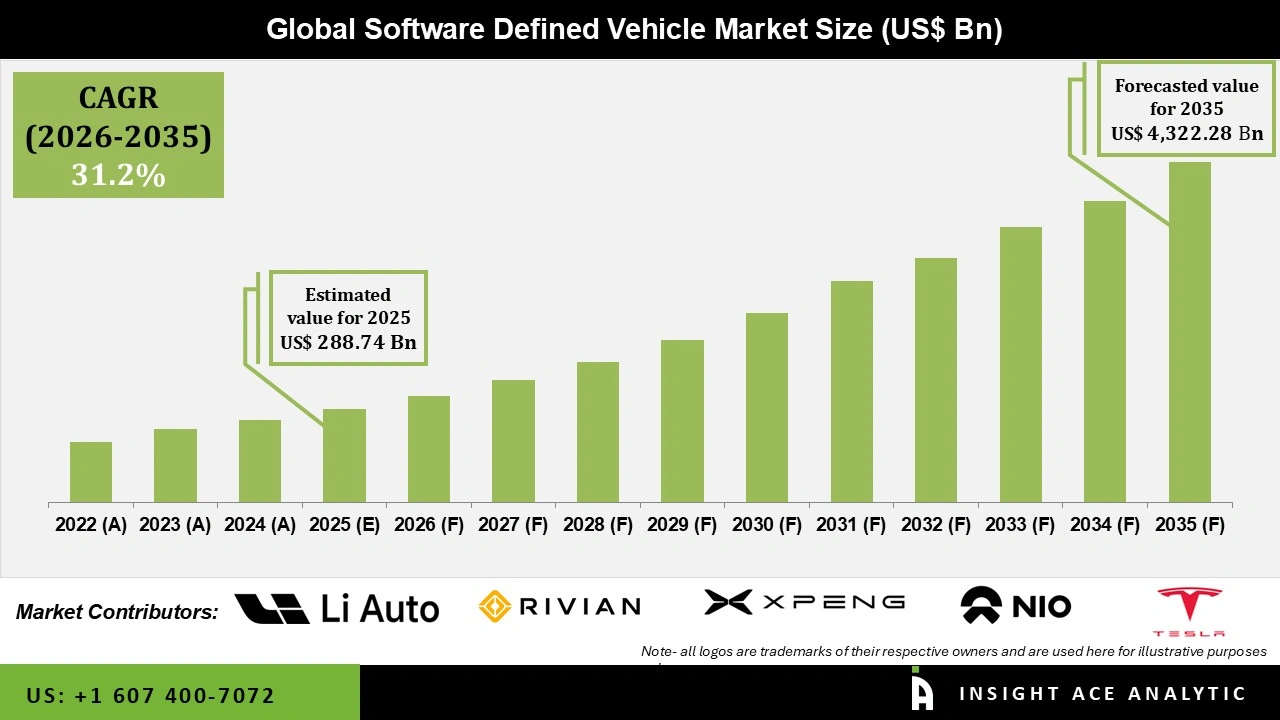

Global Software Defined Vehicle Market Size is valued at USD 288.74 Bn in 2025 and is predicted to reach USD 4,322.28 Bn by the year 2035 at an 31.20% CAGR during the forecast period for 2026 to 2035.

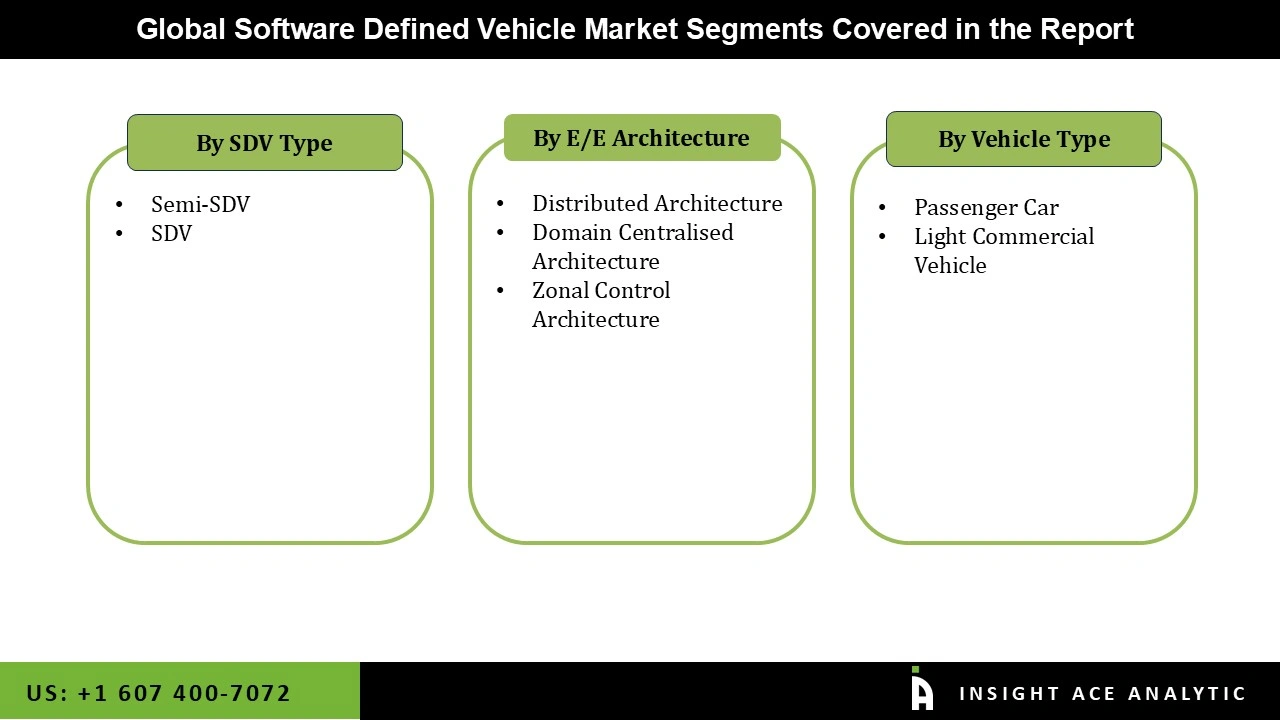

Software Defined Vehicle Market, Share & Trends Analysis Report, By SDV Type (Semi-SDV. SDV), E/E Architecture (Distributed, Domain Centralised, Zonal Control), Vehicle Type (Passenger Car and Light Commercial Vehicle), By Region, and Segment Forecasts, 2026 to 2035.

The automobile industry is beginning to follow a developmental path similar to that of the computer and smartphone industries due to the increased standardization of hardware and technology. The automobile industry is undergoing a transformation led by Software Defined Vehicles (SDVs). Previously, the industry relied on discrete hardware for various applications.

SDVs separate network tasks from proprietary hardware appliances by managing functionality and features mostly through software. This change enables the growth of automobiles both physically and digitally, with software being a key differentiator. The development and maintenance of automobiles have undergone a substantial evolution with the commercialization of software, which also optimizes the vehicle's lifecycle and value cycle.

For instance, In Sept 2023, The Automotive in the Software-Driven Era initiative was started by the World Economic Forum and BCG to get ready for the rise of software-defined vehicles. The objective of this effort is to enhance safety, inclusivity, sustainability, and overall system resilience in the automobile industry by leveraging the possibilities of cross-industry and public-private collaboration. Over thirty of the top businesses in the tech, automotive, and new mobility sectors have joined the campaign thus far.

The Software Defined Vehicle Market is segmented based on the by SDV type, E/ E architecture, and vehicle type. Based on the SDV type, the market is segmented into semi-SDV, and SDV. Based on the E/E Architecture, the market is segmented into distributed, domain centralised, and zonal control. Based on the vehicle type, passenger car, and light commercial vehicle.

Based on the SDV type, the market is segmented into semi-SDV, and SDV. Based on the E/E architecture. Among these, the SDV segment is expected to have the highest growth rate during the forecast period. SDVs utilize software to control and manage a wide range of vehicle functions, including driving dynamics, infotainment systems, and advanced driver-assistance systems (ADAS). SDVs support advanced functionalities such as autonomous driving capabilities, improved connectivity, and sophisticated driver assistance systems. These features are highly sought after in the market and drive the demand for SDVs.

Based on the E/E Architecture, the market is segmented into distributed, domain centralised, zonal control. Among these, the zonal control segment dominates the market. Zonal control reduces complexity by centralizing management in fewer units, leading to more efficient data processing and reduced wiring. It supports the scalability required for advanced features and functionalities in Full SDVs, including those related to autonomous driving and advanced connectivity. The efficiency, scalability, and cost benefits of Zonal Control contribute to its dominance in the SDV market.

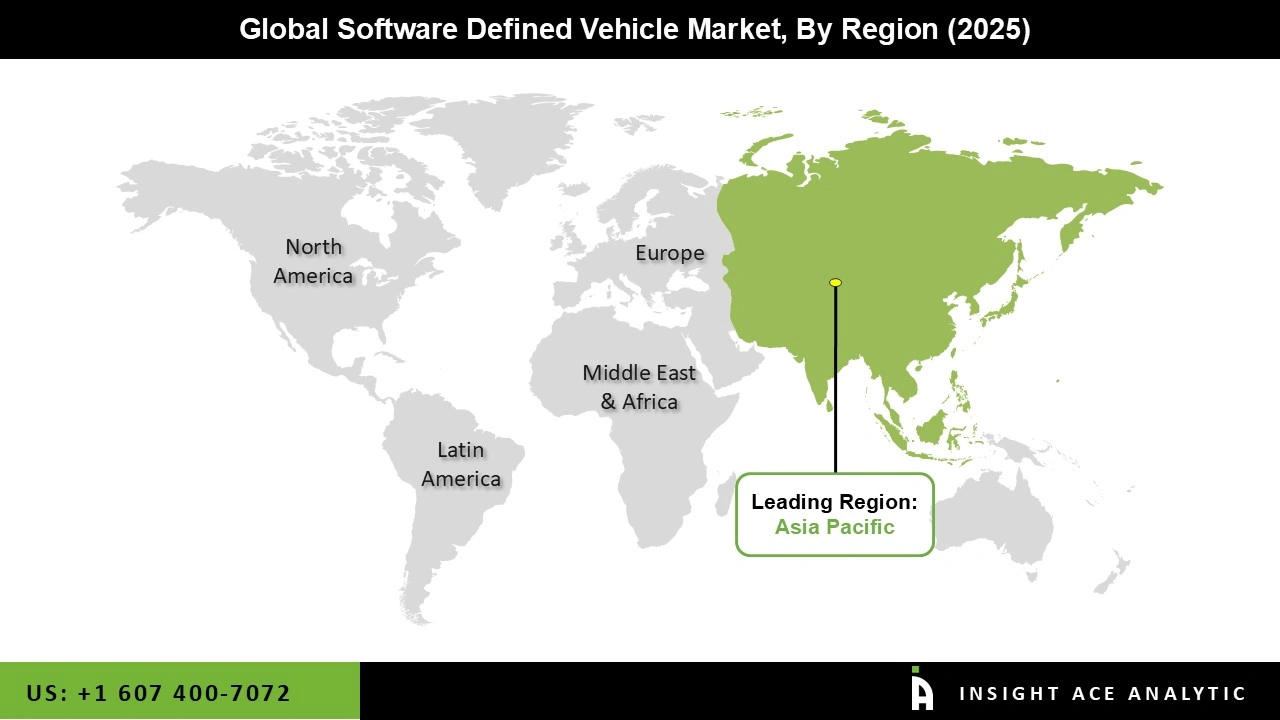

Asia Pacific is a hub for technological innovation and development. The region has a strong presence of tech companies specializing in automotive software and electronics, contributing to the growth of SDVs.

The region has well-established manufacturing capabilities and a robust supply chain, enabling the efficient production and integration of SDV technologies. The rising demand for advanced vehicle features, such as connectivity, automation, and enhanced safety, is driving the adoption of SDVs. Consumers in Asia Pacific are increasingly seeking innovative automotive technologies.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 288.74 Bn |

| Revenue Forecast In 2035 | USD 4,322.28 Bn |

| Growth Rate CAGR | CAGR of 31.20% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Mn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By SDV type, E/ E Architecture, Vehicle type |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; South East Asia |

| Competitive Landscape | Tesla Inc., Li Auto Inc., NIO Inc., Rivian Automotive, Inc., XPENG Inc., ZEEKR Automotive Technology Co., Aptiv PLC, Continental AG, Mobileye (an Intel company), NVIDIA Corporation, Robert Bosch GmbH, Waymo LLC, Volkswagen AG, Hyundai Motor Company, Ford Motor Company, Renault Group, Toyota Motor Corporation, Stellantis N.V., Mercedes-Benz AG, BYD Company Ltd., BMW AG, Sonatus Inc., NXP Semiconductors, KPIT Technologies, Excelfore Inc., Applied Intuition Inc., Marelli Holdings Co., Ltd., Qualcomm Technologies, Inc., Vector Informatik GmbH, Tata Elxsi Ltd., Harman International (Samsung), Zhejiang Geely Holding Group, Audi AG, Daimler Truck AG, Valeo SA, Infineon Technologies AG, Microchip Technology Inc., Denso Corporation, Magna International Inc., Autoliv Inc. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.