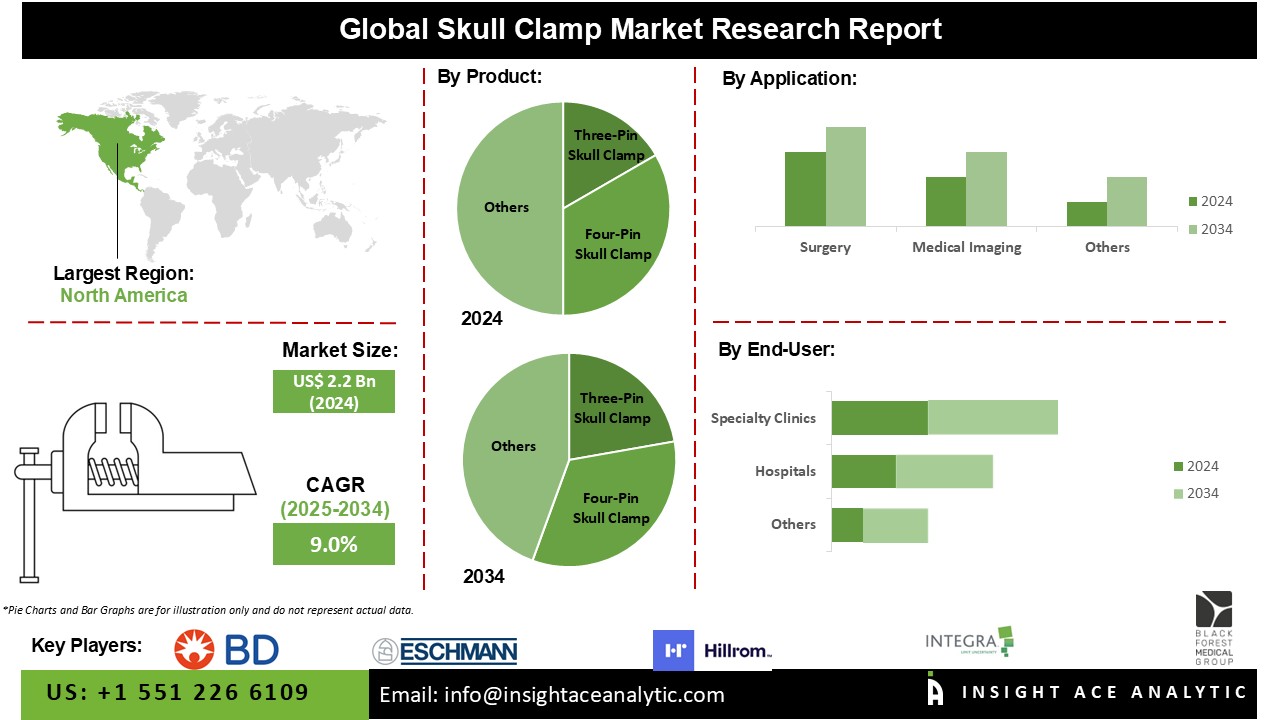

Skull Clamp Market Size is valued at USD 2.2 Bn in 2024 and is predicted to reach USD 5.2 Bn by the year 2034 at a 9.0% CAGR during the forecast period for 2025-2034.

Skull clamps, referred to as cranial fixation devices or cranial pins, are utilized in the field of neurosurgery and specific medical interventions to ensure the stability of the patient's head. These devices serve as reliable anchor points for surgical instruments, imaging devices, or for positioning the head throughout the surgical procedure.

Increased prevalence of brain traumas and neurological illnesses such as Parkinson's disease, Epilepsy, stroke, traumatic injuries, and neuroinfectious disorders are some of the factors driving market revenue growth. The American Speech-Language-Hearing Association estimates that there were roughly 27 Bn cases of traumatic brain injury in 2016, with an incidence rate of around 369 per 100,000 individuals.

Other factors driving market revenue growth include the rising frequency of brain illnesses, R&D spending by key companies, and the need for effective technologies. Cranial fixation devices are designed specifically to preserve the structural integrity of the skull and ensure the success of head or brain surgery. A skull clamp is one of the cranial fixation system's tools when firm fixation is required during spinal surgeries. Furthermore, skull clamps are required for open, critical, and percutaneous craniotomies. They are commonly used to stabilize the head and neck during neurosurgical procedures.

The Skull clamp market has been segmented based on product, application, material, accessories, and end-user. The market is segmented as three-pin skull clamp, four-pin skull clamp, and two-pin skull clump based on product. The application segment includes surgical and medical imaging. The material segment includes insulin, stainless steel, aluminium alloy, titanium, and radiolucent. By the accessories, the market is bifurcated as skull pins, headrests, and others. By end-user segment, the market is segmented as hospitals, speciality clinics, and ambulatory surgical centres.

The three-pin skull clamp category held the most market share and is expected to grow at the fastest rate during the forecast period. A three-pin skull clamp consists of a C-shaped frame that partially encircles the patient's head, with a single spring-loaded skull pin assembly situated at one end of the frame. The most popular pin-type head frame is the 3-pin skull clamp, which has a force gauge integrated into the torque screw on the side with one pin.

The surgery segment had a bigger market share. The medical imaging segment, on the other hand, is predicted to grow at a faster rate during the projection period. The skull clamps are intended to restrict patient mobility during neurosurgery procedures while still allowing for ideal patient posture for surgical access and intraoperative scans. These systems are commonly utilized in cranial neurosurgery and certain cervical operations. Furthermore, head clamps are employed in posterior cervical spine surgery to maintain a stiff, stable head posture during the treatment.

Owing to an increase in the ageing population and a rise in brain injuries, North America is likely to have the highest share. As per The Morbidity and Mortality Weekly Report 2017, 153 people die in the United States per day as a result of traumatic brain injuries. Furthermore, the region is expanding as a result of increased brain illness and injury frequencies, as well as the presence of large rivals. Other factors driving market revenue growth include increased public awareness and supported government initiatives to control brain injuries in the region.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 2.2 Bn |

| Revenue Forecast In 2034 | USD 5.2 Bn |

| Growth Rate CAGR | CAGR of 9.0% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn, volume (units) and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product, Application, Material, Accessories, End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Black Forest Medical Group, Integra LifeSciences Holdings Corp, Hill Rom Holding Inc., Eschmann Technologies Ltd., BD, TeDan Surgical Innovations, Barrfab Industria Commerce Import and Export of Hospital Equipment Ltd, Herbert Thailand Co Ltd., Media GmbH & Co KG, Micromar Industria e Com Ltd, Schaerer Medical AG, and others. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Skull Clamp Market By Product-

Skull Clamp Market By Application-

Skull Clamp Market By Material-

Skull Clamp Market By Accessories-

Skull Clamp Market By End-User-

Skull Clamp Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.