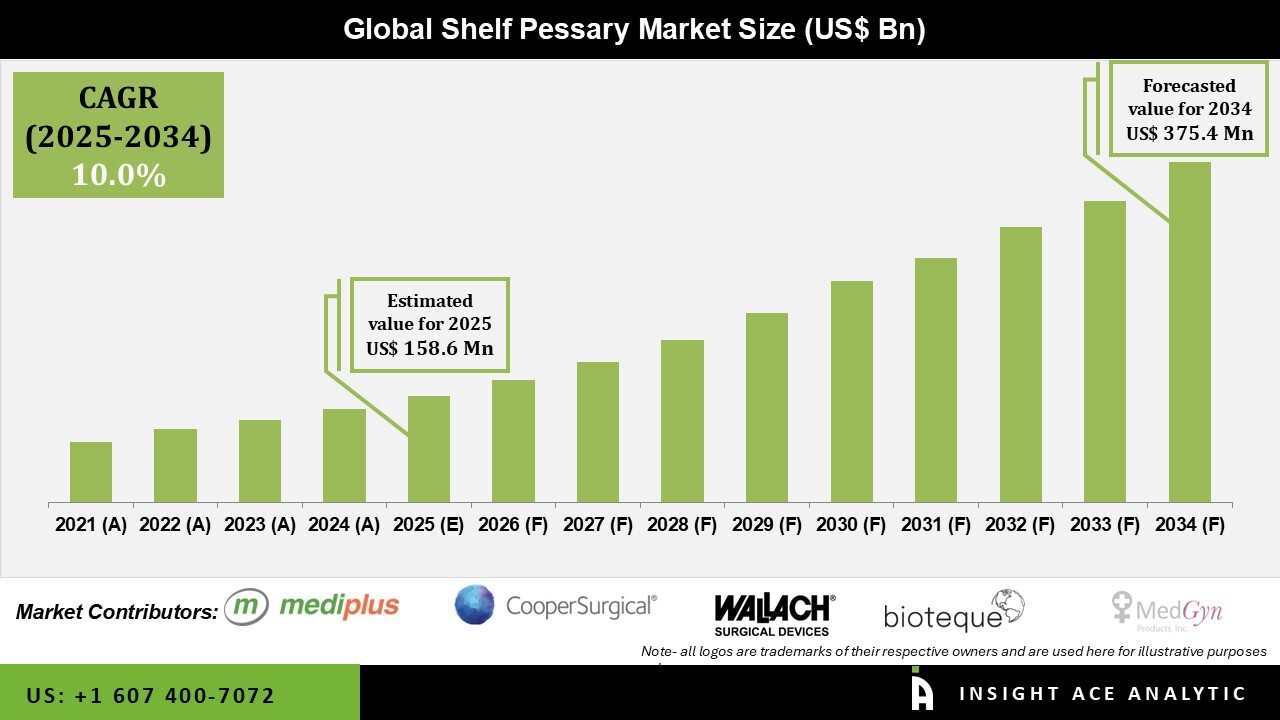

Global Shelf Pessary Market Size is valued at USD 158.6 Mn in 2024 and is predicted to reach USD 375.4 Mn by the year 2034 at a 10.0% CAGR during the forecast period for 2025 to 2034.

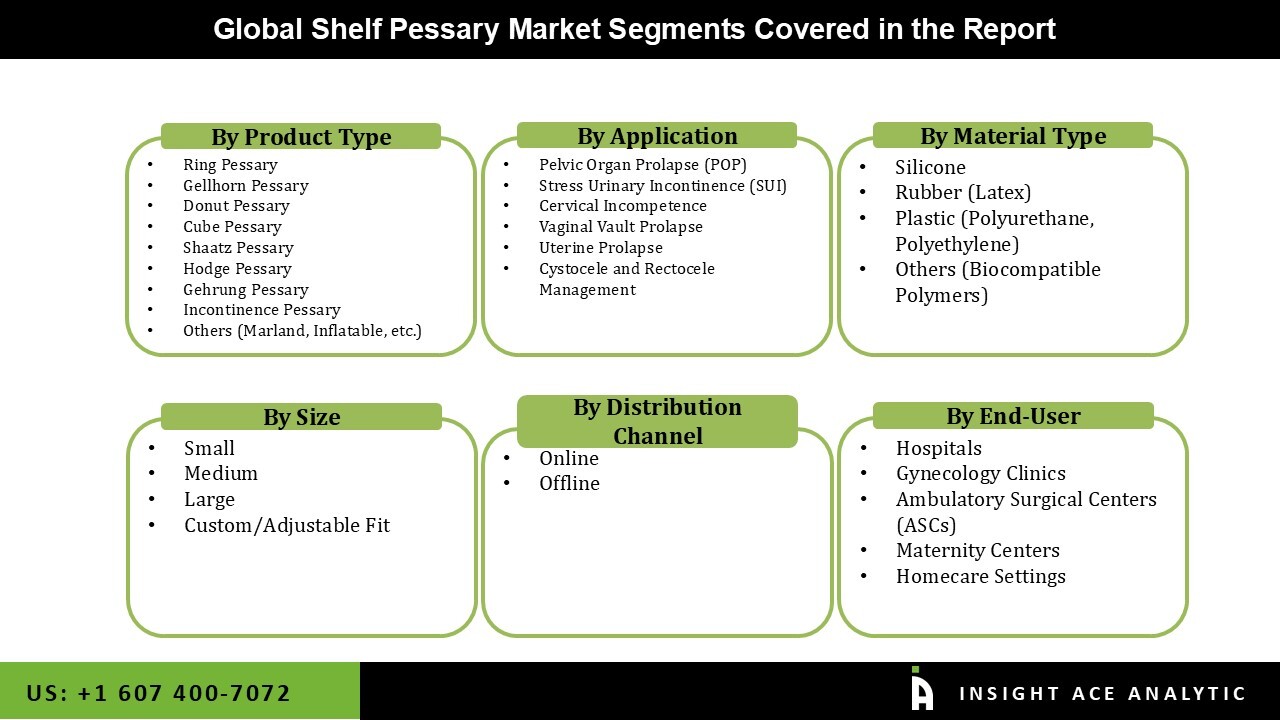

Shelf Pessary Market Size, Share & Trends Analysis Distribution by Type (Ring Pessary, Donut Pessary, Gellhorn Pessary, Cube Pessary, Hodge Pessary, Gehrung Pessary, Shaatz Pessary, Incontinence Pessary, and Others (Marland, Inflatable, etc.)), By Material (Rubber (Latex), Silicone, Plastic (Polyurethane, Polyethylene), and Others (Biocompatible Polymers)), By Size (Small, Medium, Large, and Custom/Adjustable Fit), By Application (Pelvic Organ Prolapse (POP), Cervical Incompetence, Stress Urinary Incontinence (SUI), Uterine Prolapse, Vaginal Vault Prolapse, Cystocele and Rectocele Management), By End-user (Hospitals, Gynecology Clinics, Maternity Centers, Ambulatory Surgical Centers (ASCs), and Homecare Settings), By Distribution Channel (Online and Offline), and Segment Forecasts, 2025 to 2034

A shelf pessary device is used to treat female pelvic organ prolapse (POP). POP is a disorder in which the uterus, bladder, or rectum, among other pelvic organs, falls from its usual position and presses against the vagina. Typically constructed of stiff plastic, shelf pessaries are a kind of female medical device that resembles a small, flattened disc with a bent stem on the underside. In addition to relieving POP symptoms such as pelvic pressure, vaginal bulging, urine incontinence, and difficulties emptying the bladder, it supports the pelvic organs. The growing number of elderly people who are vulnerable to pelvic organ prolapse and stress urinary incontinence, improvements in non-invasive treatment options, and improved accessibility of pessary devices through various distribution channels are some of the factors driving the shelf pessary market's growth.

The shelf pessary market is also steadily expanding because of women's increased knowledge of pelvic organ prolapse and non-surgical treatment options. Additionally, they are increasingly being recommended as first-line conservative therapy by medical professionals, particularly for patients who wish to postpone or avoid surgical procedures. Innovations in biocompatible materials that enhance patient comfort and lower the risk of infection are also helping the market. Moreover, training programs and better access to healthcare are boosting the utilization of shelf pessaries, especially in hospital and outpatient settings. With growing diagnostic capabilities and increased focus on women's pelvic health, the desire for individualized, minimally invasive surgeries is expected to grow in the future.

The prevalence of disorders like urine incontinence and pelvic organ prolapse is predicted to increase as the population ages, increasing the need for non-invasive treatment options like pessary devices. Furthermore, other factors that are anticipated to propel the market throughout the projected period include regular product launches, a significant focus on R&D by universities and industry participants, global growth by major firms, and several government initiatives.

Driver

Growing Attention to Women's Health and Rising Prevalence of Pelvic Floor Disorders

The rise in pelvic floor disorders, such as pelvic organ prolapse and urine incontinence, is the market's main growth driver for the shelf pessary market. The treatments that are minimally invasive and non-surgical have become more popular as awareness of these conditions has grown. Shelf pessaries are an easy, non-invasive, painless treatment that increases demand and adoption among patients and healthcare professionals. Additionally, the steadily rising interest in women's health and well-being is another major factor driving the growth of the shelf pessary market. As a result of vigorous advocacy for healthcare solutions with a focus on women, a lot of effort will be made to educate women about the different options available to them for addressing pelvic health issues. Consequently, there would be an increase in the use and knowledge of shelf pessaries, which would boost the shelf pessary market expansion and product development innovation.

Restrain/Challenge

Lack of Awareness and Growing Cultural Barriers

The cultural hurdles and patient ignorance continue to be major obstacles in the shelf pessary market despite increasing acceptance in professional settings. The discussions about pelvic health issues are still stigmatized in many places, which causes women to put off getting medical help for incontinence or POP symptoms. Furthermore, some patients are discouraged from adopting this option because of misunderstandings about the usage of pessaries, such as worries about discomfort, sanitation, or sexual activity. In order to overcome these obstacles and promote a more knowledgeable, transparent approach to pelvic health management, efforts by advocacy organizations, healthcare professionals, and educational campaigns are essential.

The Ring Pessary category held the largest share in the Shelf Pessary market in 2024 because it is user-friendly and comfortable for patients. Ring pessaries are adaptable and appropriate for all pelvic organ prolapse (POP) phases. Ring pessaries are used by clinicians because they are easy to insert and remove. They can be used at any stage of pelvic organ prolapse, although they work best in the early stages. Additionally, it is the kind of product that both patients and doctors use the most since it enables the patient to properly treat such problems without having surgery, thereby avoiding the complications of surgery.

In 2024, the Pelvic Organ Prolapse (POP) category dominated the Shelf Pessary market. The primary factor of this is the condition's rising prevalence, which is brought on by the world's ageing population and shifting lifestyles. POP is a disorder that results from the weakening of the tissues supporting the pelvic organs. It can be extremely painful, lead to urinary troubles, and drastically lower one's quality of life. Pessaries' effectiveness in managing POP symptoms is the primary reason they are viewed as a medication that is not just supplemental but also enhances their use.

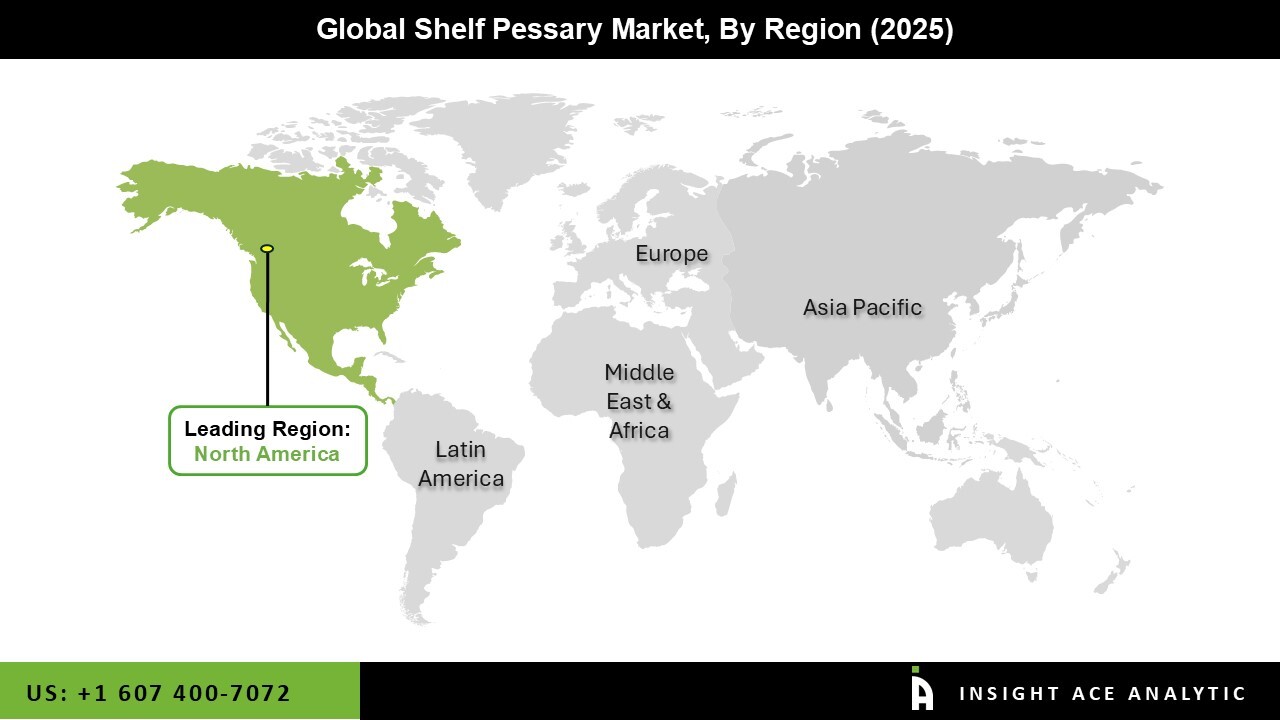

The Shelf Pessary market was dominated by the North America region in 2024 because significant medical device manufacturers are there, women's health issues are highly valued, and the region has a robust healthcare system. The United States, which accounts for the majority of the shelf pessary market in the region, is able to rely on its clear reimbursement policies and proactive government initiatives that promote advances in women's reproductive health.

Additionally, among the leading businesses are Boston Scientific, Coloplast, and Cook Medical, all of which are trailblazers and actively engaged in the creation of novel shelf pessaries that improve patient comfort and clinical efficacy. The adoption of the items is also significantly influenced by the robust research environment in U.S. clinical trials and the inclination of physicians for non-invasive treatments.

In January 2024, Mediplus Ltd announced a strategic distribution partnership with a major medical supplier in the Middle East & North Africa (MENA) region. The partnership aims to expand access to Mediplus's full range of silicone pessaries, including shelf models, in regions with growing demand for women's health and non-surgical prolapse treatments.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 158.6 Mn |

| Revenue forecast in 2034 | USD 375.4 Bn |

| Growth Rate CAGR | CAGR of 10.0% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2024 to 2034 |

| Historic Year | 2021 to 2023 |

| Forecast Year | 2025 to 2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Type, Material, Size, Application, End-user, Distribution Channel, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | CooperSurgical, MedGyn Products, Panpac Medical Corporation, Mediplus Ltd, Bioteque America, Sugar International, Wallach Surgical Devices, medesign I.C. GmbH, Dr. Arabin GmbH & Co. KG, For.me.sa srl, Meringer, Bray Group (Portia), Hallmark Surgical, Cetro Medical, and Medicare Colgate. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.