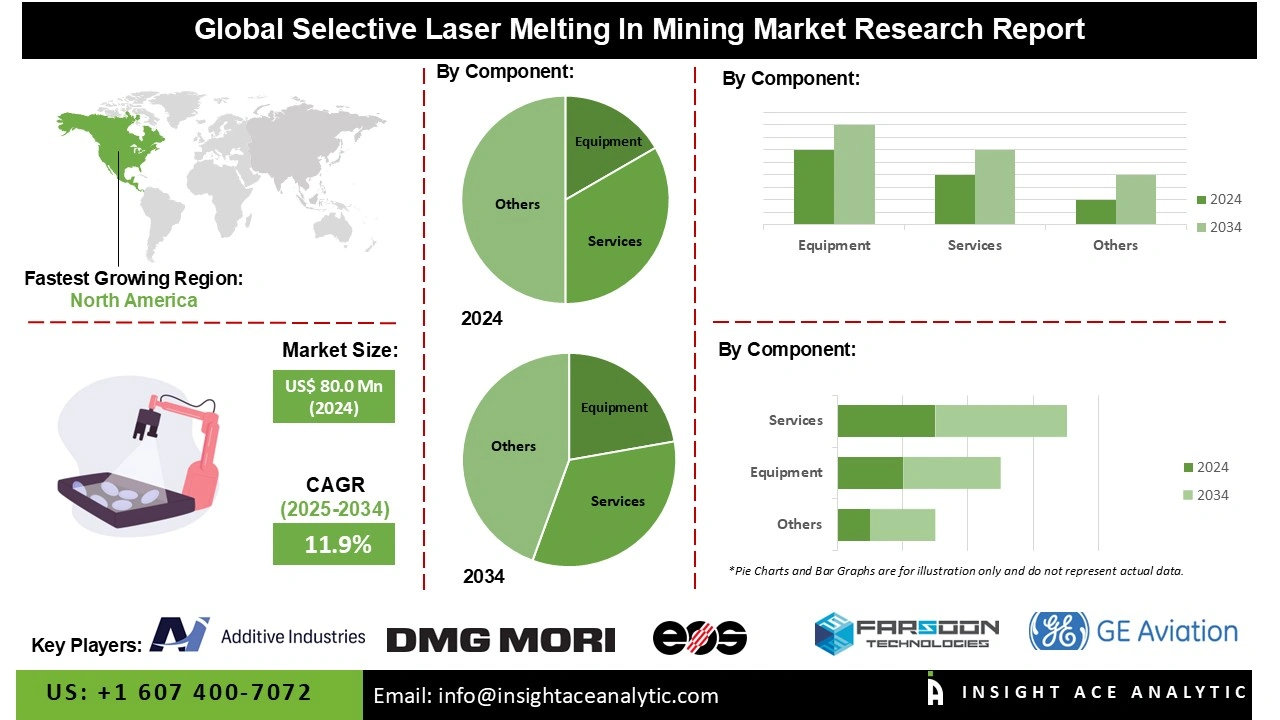

Selective Laser Melting In Mining Market Size is valued at US$ 80.0 Mn in 2024 and is predicted to reach US$ 245.1 Mn by the year 2034 at an 11.9% CAGR during the forecast period for 2025-2034.

In the mining industry, selective laser melting (SLM) is a process that creates intricate, robust, and personalized parts for mining machinery and operations using high-precision metal 3D printing technology. To make items with complex geometries that are challenging or expensive to produce using conventional machining or casting methods, a laser selectively melts layers of metal powder, such as steel, titanium, or nickel alloys. SLM enables the mining industry to rapidly produce wear-resistant tools, lightweight yet robust components, and spare parts that enhance machine performance and minimise downtime. The increasing need for rapid, efficient on-site production of essential metal components drives the growth of selective laser melting in the mining market.

Additionally, the increasing demand for additive manufacturing technologies in the mining industry is a significant factor driving the growth of the selective laser melting market in this sector. Mining businesses are increasingly using SLM to create intricate geometries and unique patterns that are not possible with standard production methods. Moreover, the ongoing technological developments in SLM machines continue to propel the expansion of the selective laser melting market in mining.

The technology's capacity to create complex, topology-optimised, and consolidated parts, replacing multi-piece assemblies with lighter, stronger single-piece components, offers fuel and energy savings, reduced maintenance costs, and operational efficiencies that appeal to mining companies looking to cut costs overall. Furthermore, the selective laser melting market in mining is greatly impacted by increased R&D expenditures in industrial technology. Both the public and private sectors are funding research and development (R&D) projects aimed at advancing additive manufacturing techniques.

Some of the Key Players in Selective Laser Melting In Mining Market:

· Trumpf GmbH + Co. KG

· 3T Additive Manufacturing

· Nikon SLM Solutions AG

· Renishaw plc

· Additive Industries

· Farsoon Technologies

· GE Additive

· DMG Mori AG

· EOS GmbH

· Wipro 3D

The selective laser melting in mining market is segmented by component. By component, the market is segmented into equipment, services, materials, and others.

In 2024, the equipment category held the largest share in the selective laser melting in mining market. The increased use of sophisticated 3D printing technologies, which enhance operating efficiency and minimise material waste, is driving the robust growth of the equipment segment. To create intricate metal components with extreme precision for drilling tools, wear-resistant parts, and specialized machinery, mining companies are using SLM technology. The ability of SLM machines to produce robust, lightweight parts that prolong the life of mining equipment and reduce maintenance costs and downtime further supports the expansion of the selective laser melting market in mining.

In 2024, the Selective Laser Melting (SLM) mining market in North America held the largest share, driven by the region's well-established mining and equipment manufacturing industries, as well as its early adoption of cutting-edge additive manufacturing technologies. The requirement for sophisticated, lightweight, high-performance metal components that enhance machine reliability and minimise downtime in challenging mining environments is a significant benefit of SLM technology, further propelling the growth of selective laser melting in the mining market.

Furthermore, the United States remains a major centre for innovation in additive manufacturing, driven by robust R&D activity, increasing investments in industrial 3D printing, and the rapid adoption of SLM machines in mining-related industries, which accelerate technology spillovers and promote regional market expansion.

Over the forecast period, the Asia Pacific region is expected to grow at the fastest rate in selective laser melting in mining, as businesses shift toward sophisticated manufacturing and domestic fabrication of intricate parts. Countries such as China, Japan, and Australia are making significant investments in additive manufacturing technology to enhance equipment supply self-sufficiency and operational efficiency. In addition, manufacturers of mining equipment are investigating SLM for creating complex components used in extraction and processing equipment, driven by the increased focus on precision engineering, reduced material waste, and energy-efficient production. Government initiatives are accelerating the integration of smart manufacturing technology across regional industries.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 80.0 Mn |

| Revenue Forecast In 2034 | USD 245.1 Mn |

| Growth Rate CAGR | CAGR of 11.9% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Component and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Trumpf GmbH + Co. KG, 3T Additive Manufacturing, Nikon SLM Solutions AG, Renishaw plc, Additive Industries, Farsoon Technologies, GE Additive, DMG Mori AG, EOS GmbH, and Wipro 3D |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Selective Laser Melting In Mining Market by Component-

· Equipment

· Services

· Materials

· Others

Selective Laser Melting In Mining Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.