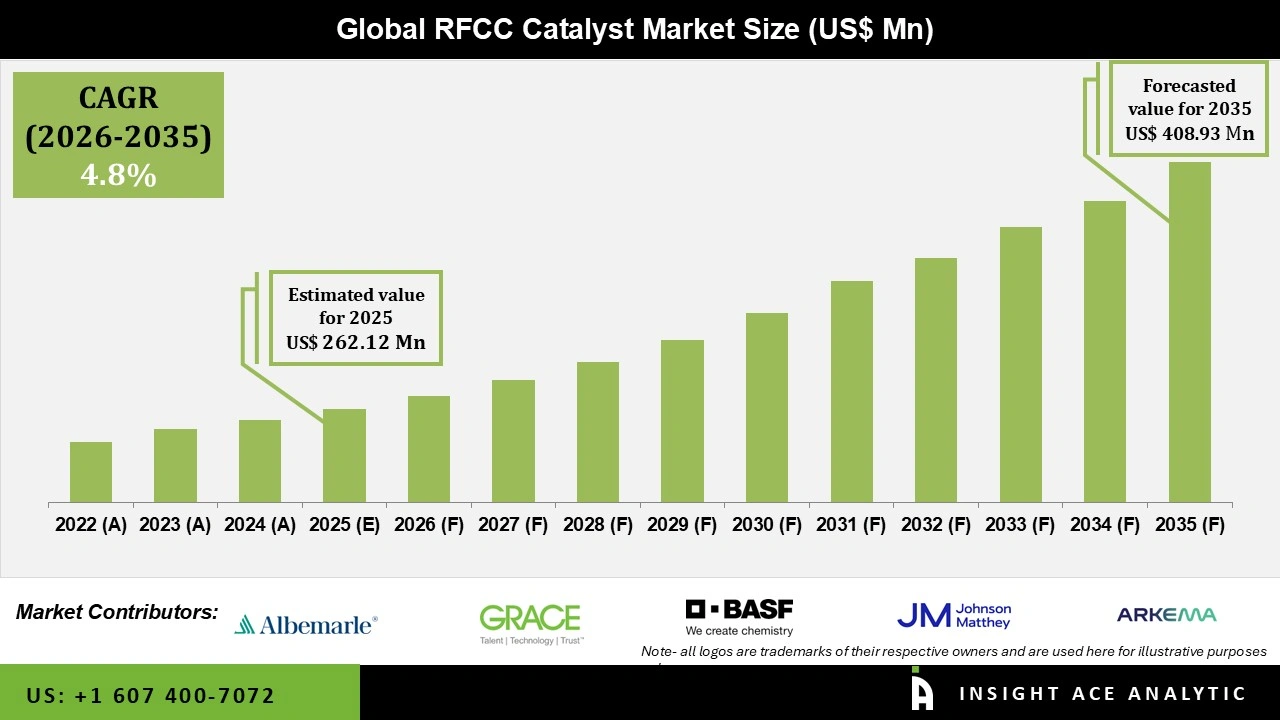

Global RFCC Catalyst Market Size is valued at USD 262.12 Mn in 2025 and is predicted to reach USD 408.93 Mn by the year 2035 at a 4.8% CAGR during the forecast period for 2026 to 2035.

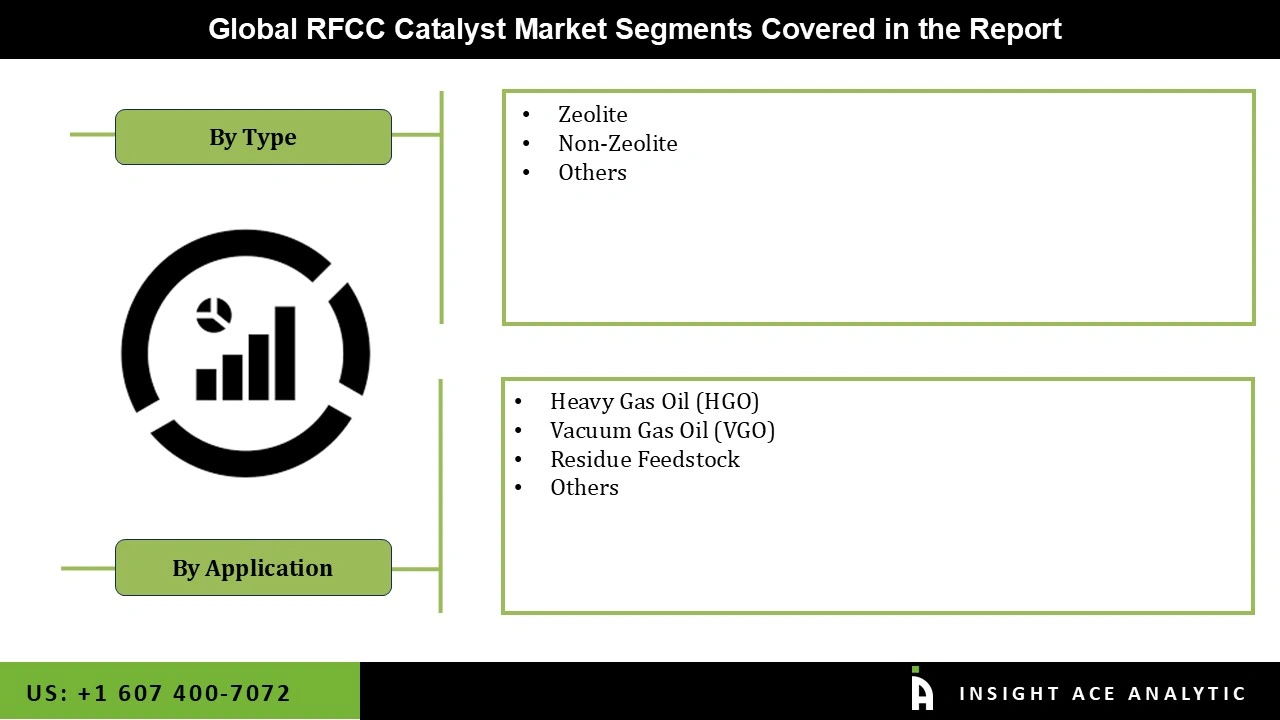

RFCC Catalyst Market Size, Share & Trends Analysis Report By Type (Zeolite, Non-Zeolite), By Application (Heavy Gas Oil (HGO), Vacuum Gas Oil (VGO), Residue Feedstock), By Region, And By Segment Forecasts, 2026 to 2035

Resid Fluid Catalytic Cracking (RFCC) catalysts are specialized catalysts used in the RFCC process, which is an advanced version of the Fluid Catalytic Cracking (FCC) process. The RFCC process is designed to convert heavy, high-molecular-weight residual oils from crude oil refining (referred to as "resid") into more valuable products such as gasoline, diesel, and lighter hydrocarbons.

Technological advancements in catalyst formulation have led to the development of more robust and efficient RFCC catalysts that can handle heavier and more challenging feedstock. The global push for energy efficiency and the increasing complexity of crude oil sources are expected to continue driving the RFCC catalyst market's growth, making it a very important component in the evolving landscape of the oil refining industry.

However, the market faces restraining factors, including the high cost of catalyst development and production, which can limit adoption, particularly among smaller refineries. Additionally, fluctuations in crude oil prices and the increasing cocentration on alternative energy sources such as electric vehicles pose challenges to the RFCC Catalyst market, potentially dampening demand. Despite these challenges, the market is likely to grow steadily, supported by ongoing research and development efforts aimed at improving catalyst performance and adapting to evolving industry needs.

The RFCC catalyst market is segmented on the basis of type and application. Based on type, the market is segmented as zeolite, non-zeolite and others. By application, the market is again segmented into heavy gas oil (HGO), vacuum gas oil (VGO), residue feedstock, and others.

The zeolite category is expected to hold a major share of the global RFCC catalyst market in 2023. This is due to their superior properties in cracking heavy hydrocarbon feedstock into valuable lighter products like gasoline and olefins. Zeolites, particularly Y-type zeolites, are highly effective because of their high surface area, strong acidity, and excellent thermal stability, which are essential for the efficient catalytic cracking process. These characteristics allow for better selectivity and higher conversion rates, making them the preferred choice for refiners aiming to maximize yield and improve process efficiency. Additionally, zeolite-based RFCC catalysts offer enhanced resistance to coke formation and metal poisoning, extending the catalyst's lifespan and reducing operational costs. Their ability to be tailored for specific feedstock compositions and product requirements further solidifies their dominance in the RFCC catalyst market.

The vacuum gas oil (VGO) segment is projected to grow at a rapid rate in the global RFCC Catalyst market due to its crucial role in enhancing gasoline yield and refining efficiency. As global fuel demand rises, particularly for cleaner fuels, refineries are increasingly adopting RFCC catalysts optimized for vacuum gas oil, driving rapid growth in this application.

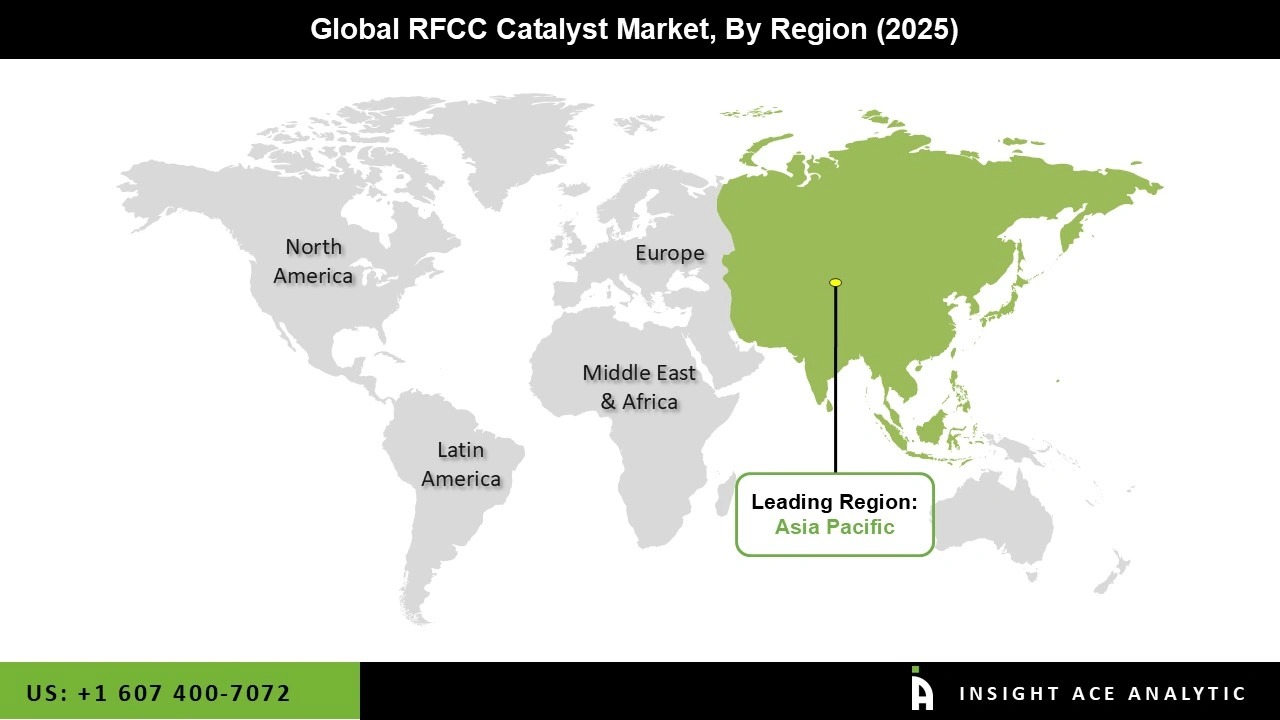

The Asia Pacific RFCC catalyst market is expected to report the largest market revenue share in the near future. This can be due to its well-established refining infrastructure and high demand for advanced refining technologies.

The region's refineries are among the largest and most sophisticated globally, driving the adoption of RFCC catalysts to enhance the efficiency and output of the refining processes. Additionally, stringent environmental regulations in Asia Pacific push refineries to use high-performance catalysts to reduce emissions and improve product yield, further boosting market dominance.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 262.12 Mn |

| Revenue Forecast In 2035 | USD 408.93 Mn |

| Growth Rate CAGR | CAGR of 4.8% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Mn, Volume (Tons) and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type And Application, |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Albemarle Corporation, W.R. Grace Company, BASF SE., Johnson Matthey, Arkema, JGC CORPORATION, Flour Corporation, Honeywell International Inc., Exxon Mobil Corporation., McDermott, and Axens, Kuwait Catalyst Company, N.E. CHEMCAT, Porocel Corporation, Yueyang Sciensun Chemical Co., Ltd., DuPont and Magma Ceramics & Catalysts |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.