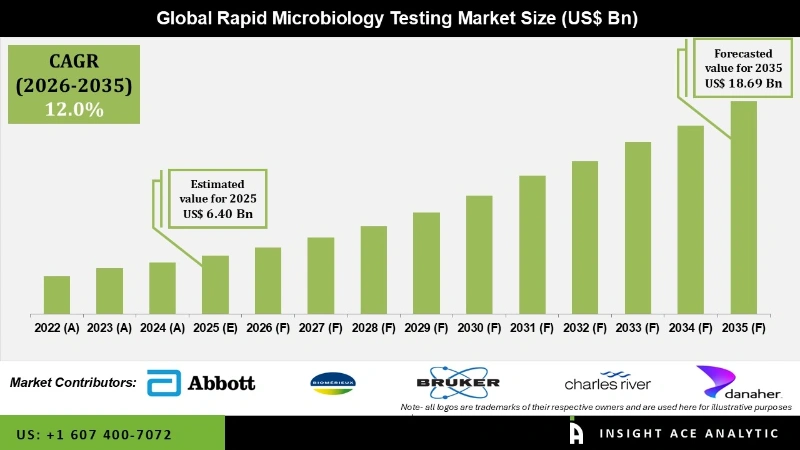

Rapid Microbiology Testing Market Size was valued at USD 6.40 Bn in 2025 and is predicted to reach USD 18.69 Bn by 2035 at a 12.0% CAGR during the forecast period for 2026 to 2035.

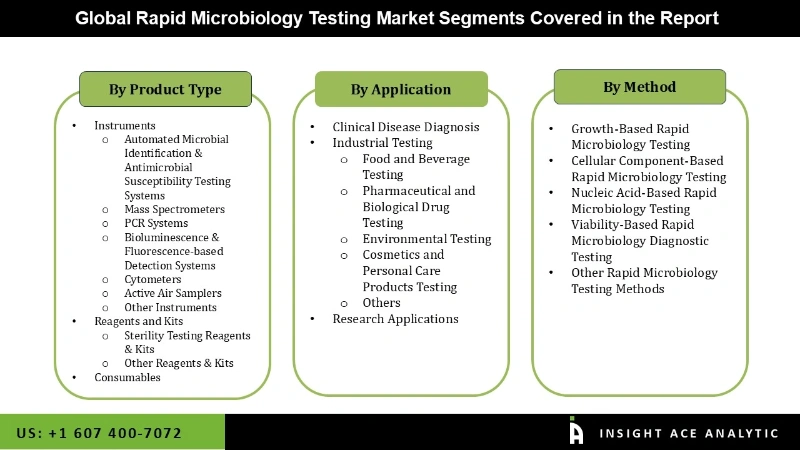

Rapid Microbiology Testing Market Size, Share & Trends Analysis Report, By Product (Instruments, Reagent& Kits, Consumables), Method (Growth, Nucleic Acid, Cellular Component, Viability and Others), Application (Clinical Disease Diagnosis, Industrial Testing, Research), By Region, Forecasts, 2026 to 2035.

The rapid microbiology testing market is experiencing rapid growth driven by technological advancements. This growth is particularly evident in industries such as pharmaceuticals, cosmetics, municipal water, and food and beverage, where microbiological testing plays a critical role in ensuring product safety and regulatory compliance. These products are cost-effective and can often lead to cost savings compared to traditional methods, a significant factor driving their uptake. Continuous technological advancements improve their sensitivity and specificity, making them more competitive. Moreover, the COVID-19 pandemic has accelerated the adoption of rapid microbiology testing solutions, with many companies developing rapid antigen tests and molecular assays for SARS-CoV-2 detection.

Potential risks include regulatory hurdles for approval, concerns regarding the accuracy and reliability of rapid tests compared to traditional methods, and the need for standardization and validation across different pathogens and sample types. Despite these challenges, the rapid microbiology testing market is poised for substantial growth, driven by technological advancements, increasing demand for faster diagnostic solutions, and the ongoing need for efficient microbial monitoring across various industries.

The rapid microbiology testing market is segmented into product, application, and method. The segmentation is based on products, including instruments, reagents and kits, and consumables. By application, the market is segmented into clinical disease diagnosis, industrial testing, and research. By method the market is segmented into growth-based rapid microbiology testing, cellular component-based rapid microbiology testing, nucleic acid-based rapid microbiology testing, viability-based rapid microbiology diagnostic testing, other rapid microbiology testing method.

The reagents and kits segment is a major contributor to the rapid microbiology testing market. These products are vital components for conducting rapid microbiology tests, providing the necessary reagents and materials for sample preparation, detection, and analysis. Reagents and kits offer convenience and efficiency, enabling laboratories and healthcare facilities to quickly perform microbial tests without the need for extensive manual preparation.

Food and beverage testing segment is experiencing rapid growth in the rapid microbiology testing market. Stringent regulations, consumer demand for safe products, and increasing awareness of foodborne illnesses drive this. Rapid microbiology tests offer quick and reliable detection of pathogens and spoilage organisms in food and beverages, ensuring product safety and quality. Additionally, technological advancements such as PCR-based methods and biosensors enhance the speed and accuracy of testing, further fueling market growth. As food safety regulations become stricter worldwide and consumer preferences shift towards healthier and safer products, the demand for rapid microbiology testing in the food and beverage industry is expected to continue rising rapidly.

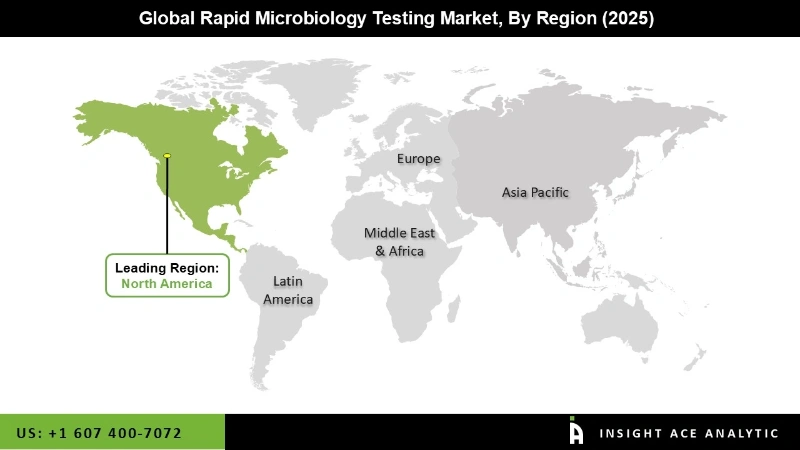

In the rapid microbiology testing market, North America stands tall, holding a significant revenue share. This is not by chance, but due to factors such as a well-established healthcare infrastructure, stringent regulatory standards, and a high prevalence of infectious diseases. The region's advanced technological capabilities and strong presence of key market players further contribute to its dominance. This stability and growth in North America's market should instill confidence in stakeholders about the market's future.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 6.40 Bn |

| Revenue Forecast In 2035 | USD 18.69 Bn |

| Growth Rate CAGR | CAGR of 12.0% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product, By Application, By Method and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Abbott, BD, BioMerieux SA, Bruker, Charles River, Danaher, Don Whitley Scientific Limited, Merck KGaA, Neogen Corporation, Quidel Corporation, Rapid Micro Biosystems, Inc., Sartorius Group, Thermo Fisher Scientific, TSI, Vivione Biosciences Inc., ERBA Diagnostics, Vedalab, Rtalabs, Shimadzu Corporation, Pall Corporation. and Mocon, Inc. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Rapid Microbiology Testing Market- By Product

Rapid Microbiology Testing Market- By Application

Rapid Microbiology Testing Market- By Method

Rapid Microbiology Testing Market- By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.