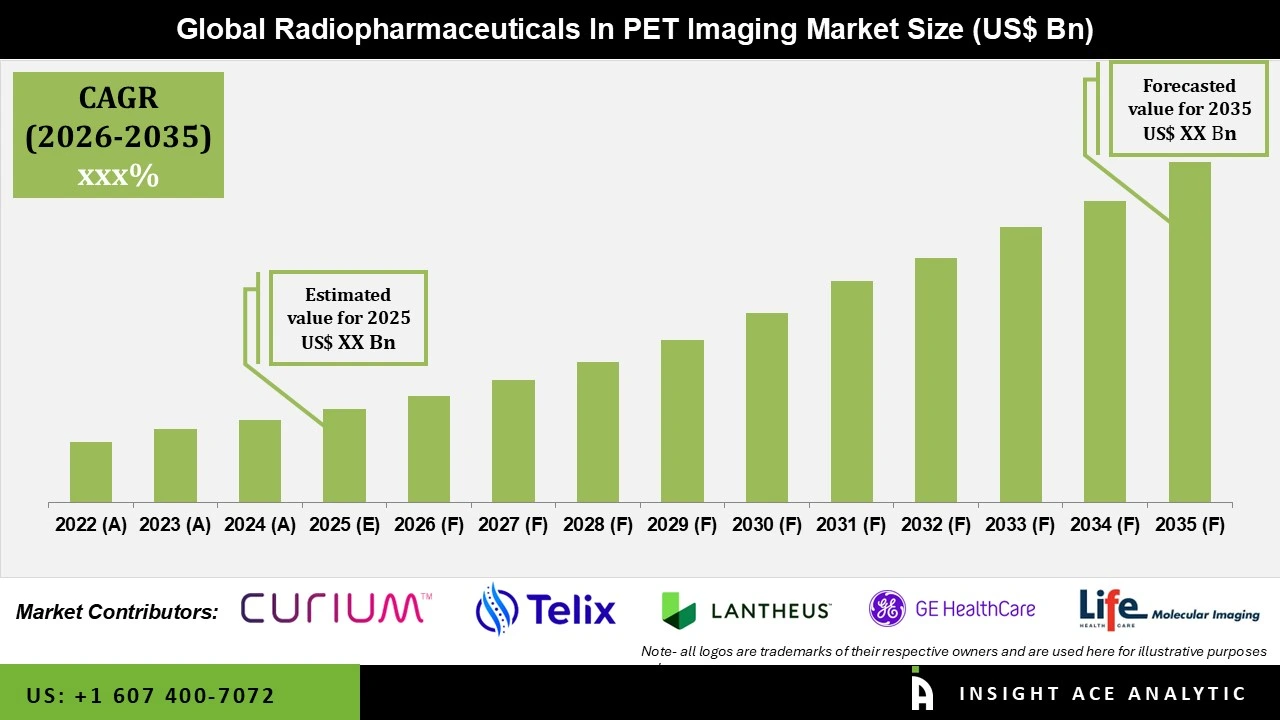

Global Radiopharmaceuticals in PET Imaging Market Size is valued at USD 1.56 Bn in 2024 and is predicted to reach USD 3.02 Bn by the year 2034 at a 7.1% CAGR during the forecast period for 2025 to 2034.

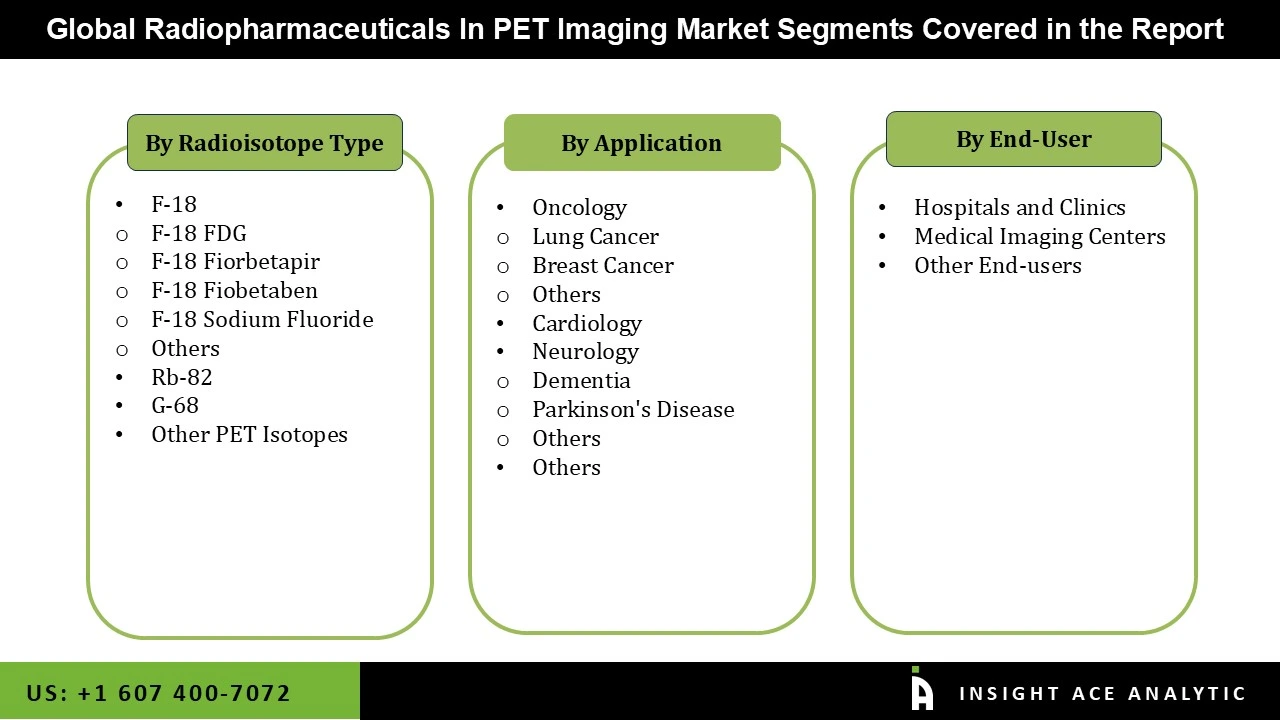

Radiopharmaceuticals in PET Imaging Market Size, Share & Trends Analysis Report By Radioisotope Type (F-18 FDG, F-18 Fiorbetapir, F-18 Fiobetaben, F-18 Sodium Fluoride), By Application (Oncology (Lung Cancer, Breast Cancer), Cardiology, Neurology (Dementia, Parkinson's Disease), Others), By End-User (Hospitals and Clinics, Medical Imaging Centers), By Region, And By Segment Forecasts, 2025 to 2034.

In medical imaging, Positron Emission Tomography (PET) has emerged as a key technique for the diagnosis and treatment of a number of illnesses, most notably cancer, neurological disorders, and cardiovascular ailments. Radiopharmaceuticals, which are radioactive substances used as tracers to see biological processes in vivo, are essential to the success of PET imaging. The market for these goods is expanding quickly because of developments in PET technology and the creation of novel radiopharmaceuticals.

The growing need for early illness detection, especially for cancer and neurological disorders, is fueling the global market for radiopharmaceuticals in PET imaging. Radiopharmaceuticals aid in tumour detection, therapy effectiveness monitoring, and organ metabolic function evaluation. The market for radiopharmaceuticals in PET imaging is poised for substantial development due to ongoing technical advancements, rising healthcare spending, and growing precision medicine applications.

In addition, to visualize brain activity and identify neurological conditions, including epilepsy, Parkinson's disease, and Alzheimer's disease, radiopharmaceuticals are crucial. The radiopharmaceuticals in the PET imaging market is expanding because of the growing need for neurological PET imaging and the ageing population.

The Radiopharmaceuticals in PET Imaging market is segmented based on Radioisotope Type, Application, and End-user. Based on radioisotope type, the market is segmented into F-18 (F-18 FDG, F-18 Fiorbetapir, F-18 Fiobetaben, F-18 Sodium Fluoride, and Others), Rb-82, G-68, and Other PET Isotopes. The applicaiton segment comprises Oncology (Lung Cancer, Breast Cancer, Others), Cardiology, Neurology (Dementia, Parkinson's Disease, Others), and Others. By end-user, the segmentation includes Hospitals and Clinics, Medical Imaging Centers, and Other End-users.

The F-18 Sodium Fluoride category is expected to hold a major global market share in 2021 driven by its growing use in cancer and bone scanning applications. When compared to traditional technetium-based bone scans, F-18 NaF is a highly effective PET radiotracer for detecting bone metastases, providing better imaging quality and faster uptake. The market for F-18 NaF has increased as a result of the increased demand for more accurate diagnostic tools brought on by the rising incidence of cancer, especially breast and prostate cancer. Developments in technology and growing provider awareness of the advantages of early and precise bone disease detection are also accelerating PET/CT use.

The increasing global existance of cancer and the growing need for accurate and early tumour identification are driving the expansion of the oncology sector in the market for radiopharmaceuticals for PET imaging. F-18 Fluorodeoxyglucose (FDG) and F-18 Sodium Fluoride (NaF) are two examples of PET radiopharmaceuticals that are essential for cancer diagnosis, staging, treatment planning, and therapy response monitoring. Technological developments have significantly improved the precision and therapeutic usefulness of PET imaging in oncology in hybrid imaging systems.

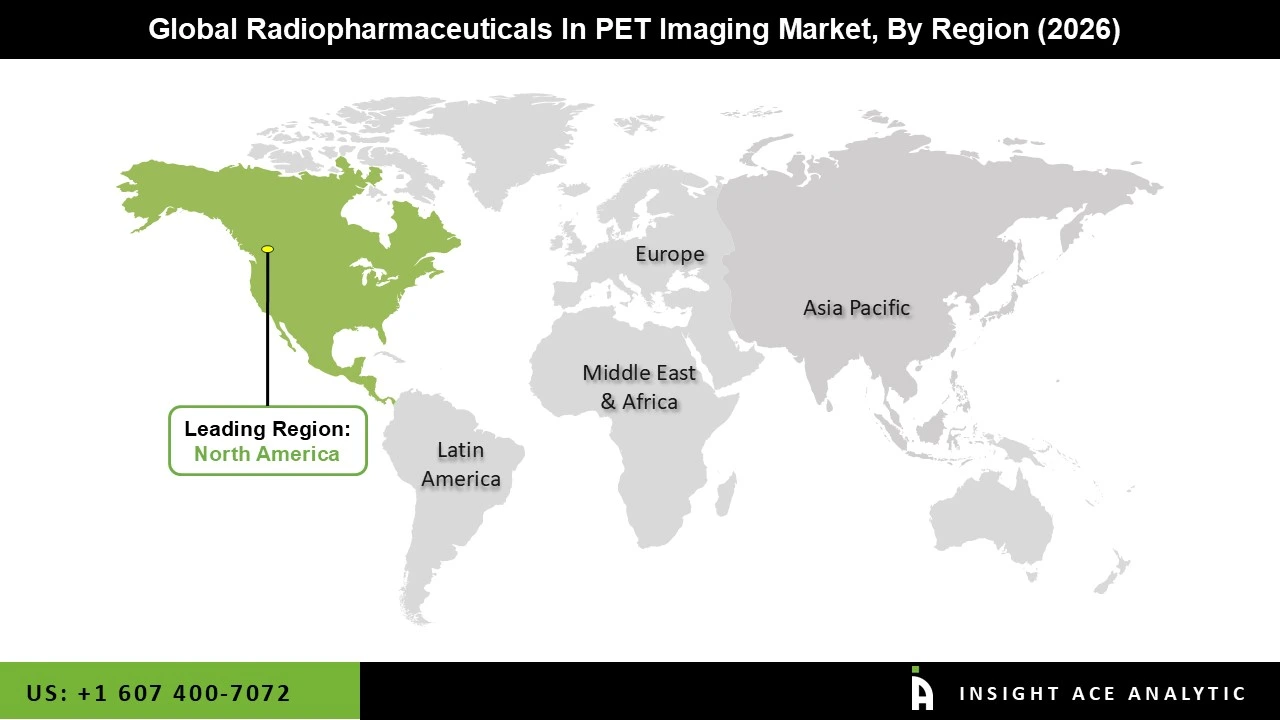

The North American Radiopharmaceuticals in PET Imaging market is expected to register the highest market share in revenue in the near future. In North America, cancer and neurological conditions, including Parkinson's, Alzheimer's, and other dementias, are becoming more common. In neurology and cancer, PET imaging is an essential tool, especially for continuing monitoring, therapy planning, and early discovery.

This tendency is anticipated to continue as the population ages, increasing the need for radiopharmaceuticals in PET. In addition, Europe is projected to grow rapidly in the global Radiopharmaceuticals in PET Imaging market.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 1.54 Bn |

| Market Size Value in 2034 | USD 3.02 Bn |

| Growth Rate CAGR | CAGR of 7.1% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Mn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2024-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Radioisotope Type, Application, and End-user |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia |

| Competitive Landscape | Curium, Telix Pharmaceuticals, Lantheus Holdings, Inc., GE Healthcare, Life Molecular Imaging, Siemens Healthineers, Avid Radiopharmaceuticals, Cardinal Health, Eckert & Ziegler. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

North America-

• The US

• Canada

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Mexico

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.