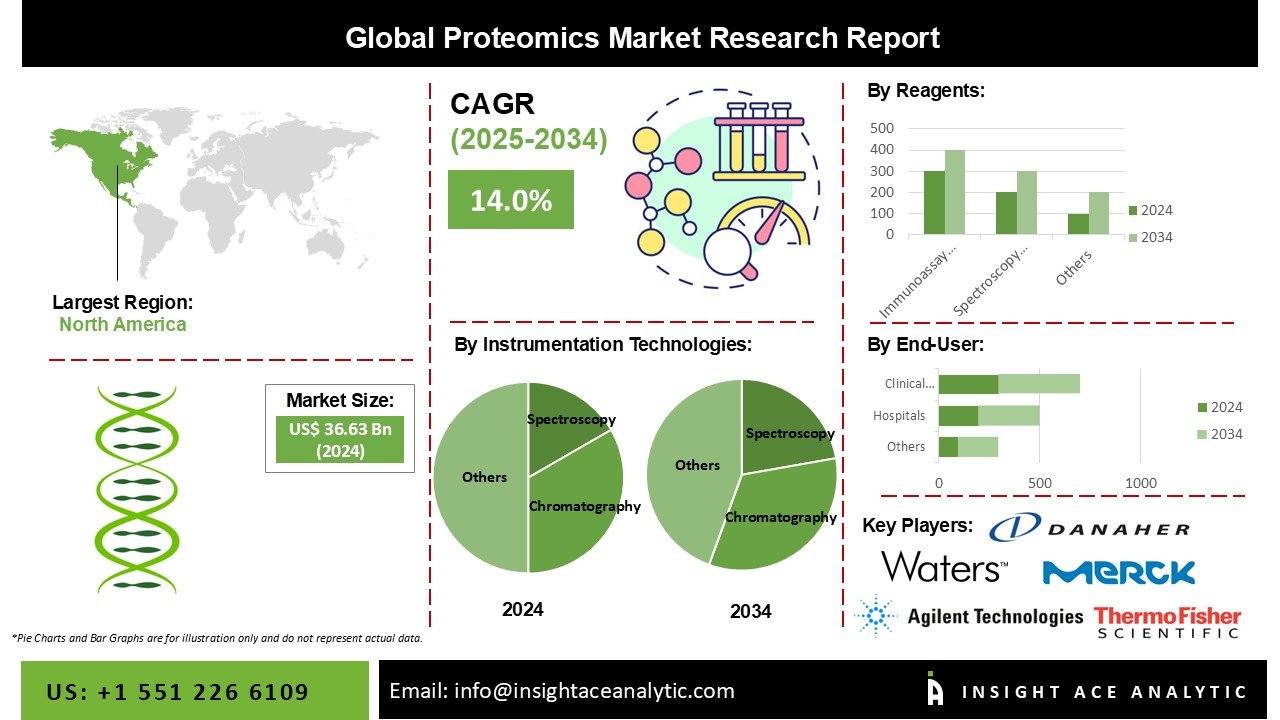

Proteomics Market Size is valued at 36.63 billion in 2024 and is predicted to reach 132.74 billion by the year 2034 at a 14.0% CAGR during the forecast period for 2025-2034.

Proteomics is the most advanced area of disease diagnostics, which is changing quickly. Proteomics is utilized to identify the proteins present in a specific disease and aids in comprehending both their expression and function. Due to the rising rapid market growth in the amount of technical and financial effort put into research and development activities, numerous new technologies are anticipated to be introduced into proteomics.

The need for proteomics is anticipated to develop dramatically in the upcoming years due to the recent rise in cancer cases and the huge increase in the prevalence of genetic disorders. The development of biomarkers, clinical diagnostics, and an increased focus on product features in drug design will all contribute to market expansion.

Moreover, the protein research being done to treat COVID-19 patients is fueling market expansion. In addition, a study in Nature Chemical Biology found that tiny proteins can prevent virus entry into human cells and group virus particles collectively to lessen the virus's capacity for infection. Additionally, the COVID-19 pandemic is anticipated to spur an increase in peptide therapeutic research, which will benefit the industry. Additionally, market expansion over the anticipated period is being driven by increased public and private funding for proteome research.

The proteomics market is segmented based on product and application. Based on product, the proteomics market is segmented as spectrometry, chromatography, electrophoresis, x-ray crystallography, surface plasmon resonance, x-ray crystallography, protein fractionation systems, etc. By reagents, the market is segmented into immunoassay reagents, spectroscopy reagents, chromatography reagents, protein microarray reagents, x-ray crystallography reagents, electrophoresis reagents and protein fractionation reagents. By software & services, the market is segmented as core proteomics services and bioinformatics software & services. The market is segmented by application as diagnostic, drug discovery & development, and others. End users segment the market as hospitals, labs and biopharma.

The spectroscopy category will hold a major share of the global Proteomics market 2022. The market will expand due to the widespread use of this technology in most processes and its significant applications in the production of medications, foreign illness analysis, pharmaceutical analysis, and proteomics metabolomics. The most widely popular method in the world and has had substantial growth in recent years since it helps synthesize medications through various procedures.

The clinical diagnosis segment is projected to grow rapidly in the global Proteomics market. Researchers and doctors frequently employ protein analysis to find disease biomarkers for early detection and identifying specific risk factors. New opportunities for illness early identification and prevention should result from this. Proteomics-based diagnostics, which supports the segment's expansion, makes it possible to uncover potential biomarkers and protein transcriptional regulation that may be used to recognize and predict cancers and assess their prognosis.

In the upcoming years, the early diagnosis of numerous diseases will be a significant opportunity for developing this approach. The use of proteomics can be used to understand biomarkers. Additionally, it aids in the recognition and categorization of tumors.

The North America Proteomics market is expected to register the highest market share. Antibody-drug conjugates and protein therapies are important in treating and diagnosing diseases in North America. This subject is constantly developing, and there has been a substantial study on cutting-edge, revolutionary next-generation treatments. More than a hundred modified therapeutic proteins have been approved for clinical application. Several protein therapies are undergoing clinical trials to treat cancer, immunological disorders, infections, age-related diseases, and numerous other ailments.

Additionally, proteomics research is most active in nations like the United States. In addition, the Europe regional market is projected to grow rapidly in the global proteomics market. This market will expand due to ongoing field research and development and the utilization of top-notch instruments for research. There will be a massive increase in the demand for proteomics due to the rising demand for customized medicines or treatments. Ongoing partnerships and collaborations among the various market participants will also assist the market's expansion.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 36.63 Bn |

| Revenue Forecast In 2034 | USD 132.74 Bn |

| Growth Rate CAGR | CAGR of 14.0% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Type Of Technology, Product, Application, And End User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Thermo Fisher Scientific, Inc. (US), Danaher Corporation (US), Merck KGaA (Germany), Agilent Technologies, Inc. (US), and Waters Corporation (US). |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Segmentation of Proteomics Market-

Proteomics Market By Product-

Proteomics Market By Regents

Proteomics Market By Software & Services

Proteomics Market By Application-

Proteomics Market By End users

Proteomics Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.