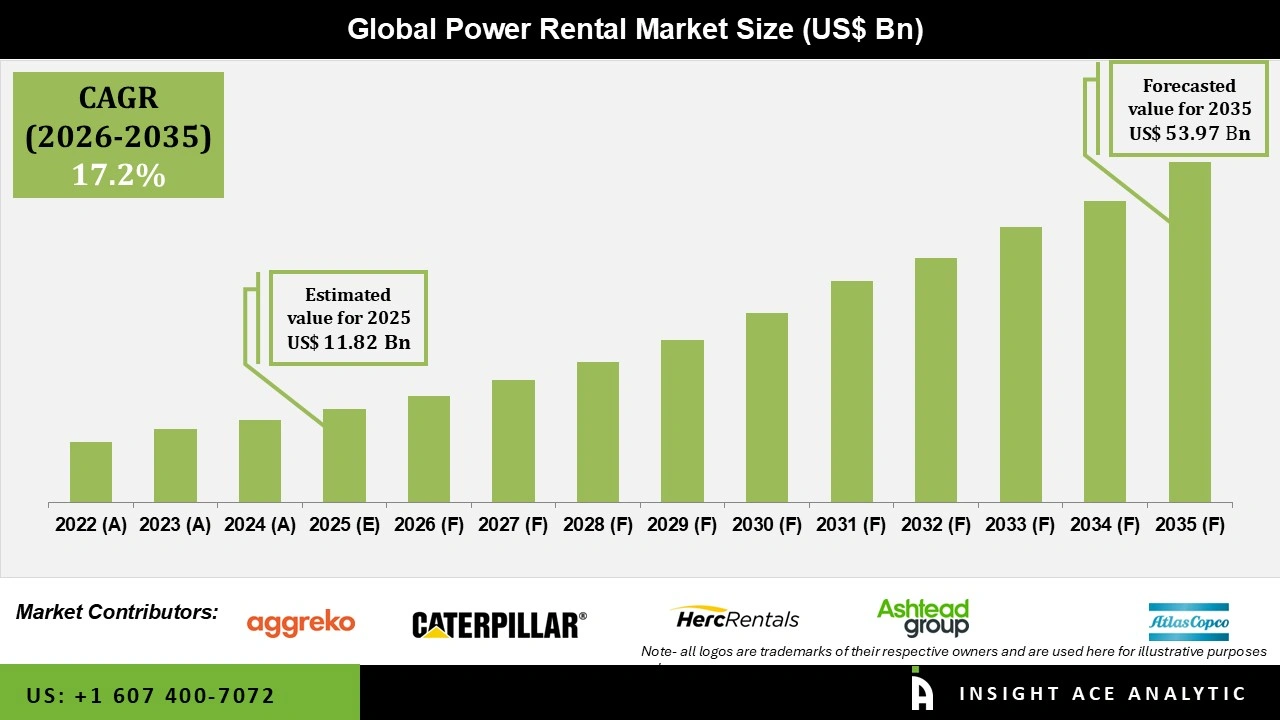

Global Power Rental Market Size is valued at USD 11.82 Bn in 2025 and is predicted to reach USD 53.97 Bn by the year 2035 at a 17.2% CAGR during the forecast period for 2026 to 2035.

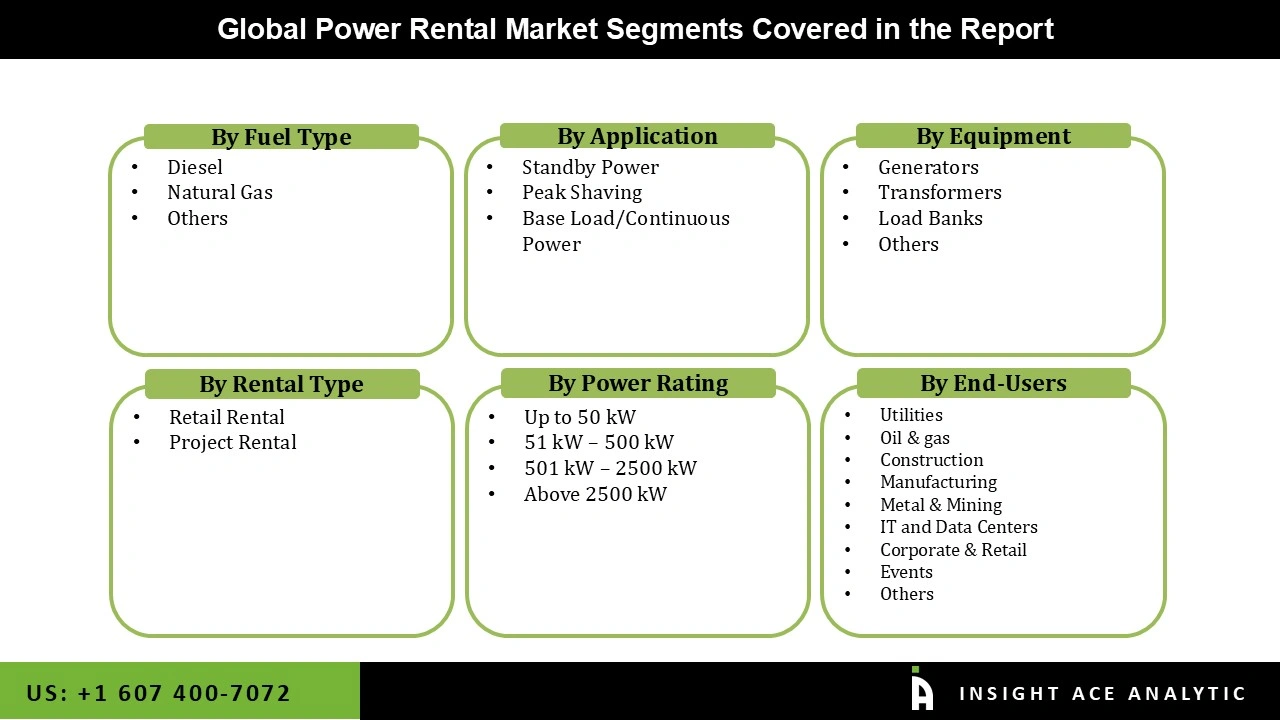

Power Rental Market Size, Share & Trends Analysis Report By Fuel Type (Diesel, Natural Gas, Others), By Application (Standby Power, Peak Shaving, Base Load/Continuous Power), By Equipment, By Rental Type, By Power Rating, By End-User, By Region, And By Segment Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the Report:

The temporary provision of power-producing equipment and services to meet immediate or temporary power needs is referred to as power renting. Renting generators, transformers, distribution panels, and related accessories from power rental firms or service providers are required. Increasing faults in transmission and distribution lines, equipment failure in power generation, unexpected grid problems, natural calamities, and a variety of other reasons are constantly disrupting power supply around the world. Various governmental and commercial agencies are quickly implementing measures to shorten the duration of power outages to allow consumers to continue with their operations.

However, the COVID-19 epidemic caused delays in building projects, industrial operations, and other industries that rely on temporary power solutions. Lockdown measures, social distance requirements, and workforce constraints resulted in project delays or temporary shutdowns, leading to lower demand for power leasing services.

The Power Rental Market is segmented on the basis of Fuel Type, Application, Equipment, Rental Type, Power Rating And End-Users. The market segmentation is as diesel, natural gas, and others based on fuel type. The application segment includes standby power, peak shaving, and base load/continuous power. By equipment, the market is segmented into generators, transforms, load banks, and others. The power Rating segment consists of Up to 50 kW, 51 kW – 500 kW, 501 kW – 2500 kW, Above 2500 kW. The end-users segment includes utilities, metal & mining, oil & gas, construction, manufacturing, IT and data centres, corporate & retail, events, etc.

The natural gas segment is expected to hold a major share of the global Power Rental Market in 2022. Natural gas powers emergency and portable generators and is regarded as an efficient nonrenewable energy source. Furthermore, gas generators are less expensive and more environmentally beneficial than diesel generators since gas minimizes hazardous air pollutants and carbon emissions when compared to diesel. Natural gas generators run on LPG, compressed gas, propane, and other fuels and come in a variety of sizes ranging from portable to industrial. These generators are less expensive and more environmentally friendly than diesel generators with less than 150 KVA capacities.

The Rental Type segment is projected to grow at a rapid rate in the global Power Rental Market. Due to the demand for power increasing over the world, the generation must increase to compensate. This demand is especially high during the day in the summer and at night in the winter. Peak demand is the instantaneous increase in the level of needed power, and it is a prevalent problem where utilities fall short of this requirement, particularly in growing nations. During peak operational hours, peak demand charges are levied. Peak shaving generators assist businesses with high electricity use lower their utility expenses during peak hours. These fees vary according to geography as well as season, with off-peak rates being the most common.

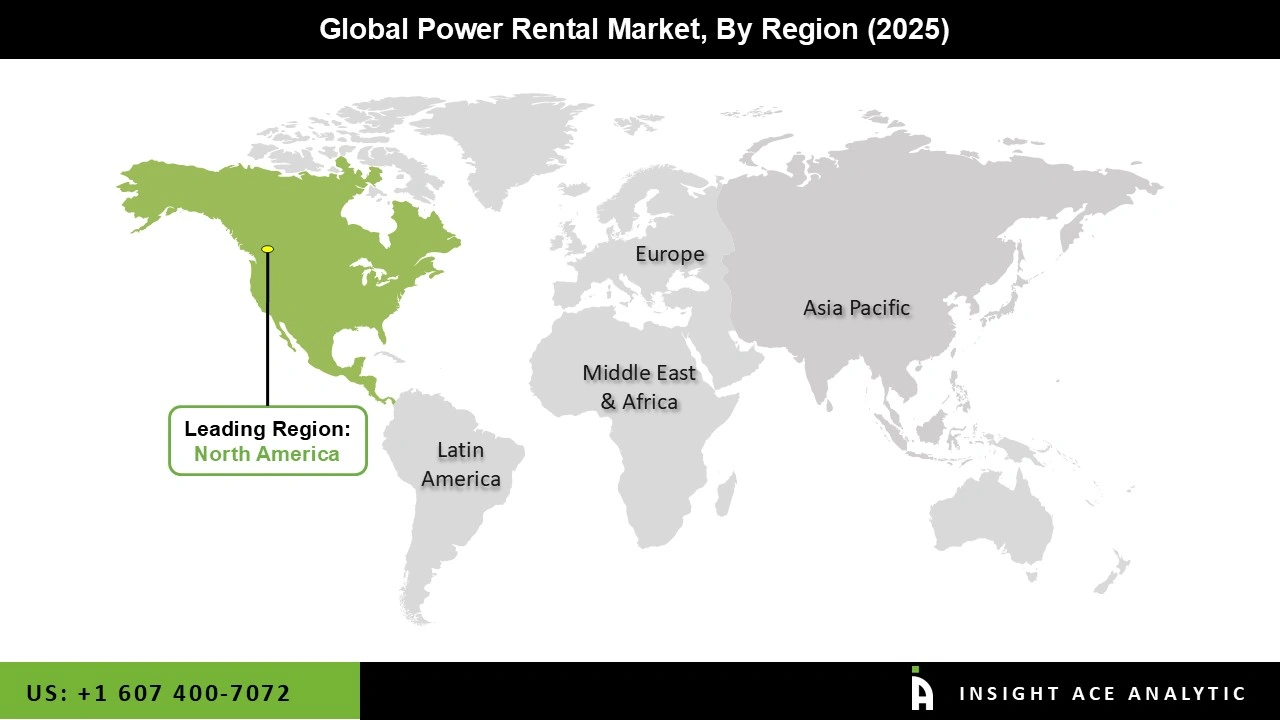

The North American, Power Rental Market, is likely to register the maximum market share in terms of revenue in the near future as a result of factors such as increased investment in the oil and gas, building, and mining industries.

The North American region's fastest-growing markets are the United States and Canada. North America has a population of about 530 million people and an economy that accounts for more than 25% of global GDP. It is one of the world's most industrialized regions. Furthermore, growing investments in mining and related exploratory activities in the region are pushing the need for power leasing equipment over the projection period.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 11.82 Bn |

| Revenue Forecast In 2035 | USD 53.97 Bn |

| Growth Rate CAGR | CAGR of 17.2% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Fuel Type, By Application, By Equipment, By Rental Type, By Power Rating, By End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Aggreko (UK), Caterpillar (US), Herc Rental (US), Ashtead Group (UK), Atlas Copco (Sweden), Cummins (US), Multiquip (US), Bredenoord (UK), Kohler (US), SoEnergy (US), Allmand Brothers (US), Wacker Neuson (Germany), Generac Power (US). |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.